March saw the Spring Budget, which sadly was a total damp squib for the property market and meant, that when the Bank of England monetary committee met a few days later, interest rates were held again for the fifth consecutive month, although the Governor of the Bank of England, Andrew Bailey, did promise that interest rate drops were on the way! But nobody knows when that might be and with the economy falling back into recession, this might not be as soon as well all hoped.

On a more positive note, the clocks hopped forward, so at least it is lighter a bit later into the evening. We have to be grateful for small mercies at the moment!

So, what does all that mean for the property market nationally and more importantly in SK8 and SK3?

It is fair to say that despite slightly conflicting reports from the Nationwide and Zoopla, March was a fairly subdued month for market, although there remained some green shoots to cling on too.

Let’s start with a look at what the major indices are saying before we break down the local data in more granular detail.

House price growth was "subdued" last month as higher mortgage rates affected affordability

Property prices rose 1.6% on average from March 2023, but fell 0.2% compared with the February, the UK's largest building society said.

While mortgage rates have fallen from peaks seen last summer, they remain well above the low levels seen in the wake of the coronavirus pandemic.

The Nationwide said affordability was still stretched but was improving.

Robert Gardner, the building society's chief economist, stated that affordability pressures on buyers were "weighing down" on activity in the housing market and price growth.

For someone on an average wage of about £35,000 per year buying a typical home, mortgage payments currently take up nearly 40% of their take home pay.

"That's well above the 30% which is the long-run average," Mr Gardner said.

In Northern Ireland and the North of England house price growth was stronger than other areas, rising 4.6% and 1.7% respectively compared with last year.

This was mainly due to house prices in those regions being less expensive compared with other places in the UK and more affordable for buyers, leading to higher demand.

Interest rates predicted to come down later in the year

The annual house price increase of 1.6% was the fastest rise since December 2022, although it was a smaller increase than economists had been expecting.

Prices fell by 0.2% in March alone, the first drop since December 2023, after a 0.7% increase the month before.

In a statement, Nationwide said mortgage approvals in January were 15% lower than before the Covid pandemic, reflecting the impact of higher interest rates, which are at a 16-year high.

However, Mr Gardner said income rises were outpacing the house price increases, gradually making houses more affordable.

"But it's going to take time to make a big difference," he warned.

Mr Gardner said many people were expecting the Bank of England to lower interest rates this year, which would have a knock-on effect of lower mortgage rates. Financial markets are predicting a first cut in June or August, with rates forecast to drop to around 4.5% by the end of the year.

The number of mortgage approvals rose in February to the highest level since the month the mini budget was delivered under former prime minister Liz Truss.

More than 60,380 mortgage approvals were recorded, the highest figure since more than 65,340 deals got the go-ahead in September 2022, according to Bank of England figures.

It is very important to remember that all these companies use very different data points In compiling their figures. Nationwide looks at its own mortgage lending and does not include cash buyers or buy-to-let deals. Cash buyers account for about a third of housing sales.

House prices firming with no sign of faster growth

The average house price in the UK is £263,900 as of February 2024 (published in March 2024) according to the property portal Zoopla.

Property prices have risen by £200 compared to the previous month and fallen by £900 (-0.3%) compared to a year ago.

There’s a clear divide across the UK in terms of house price growth. Prices continue to fall in southern regions. On the other hand, house prices are rising the most in the Northern Regions and Scotland.

All parts of the country are recording higher house price inflation than 6 months ago. Sales volumes are recovering and pricing levels are firming up across the UK housing market.

Zoopla expects these trends to continue into the second half of 2024 as house prices continue to adjust to higher mortgage rates and reduced buying power.

Housing market activity continues to improve at the start of 2024

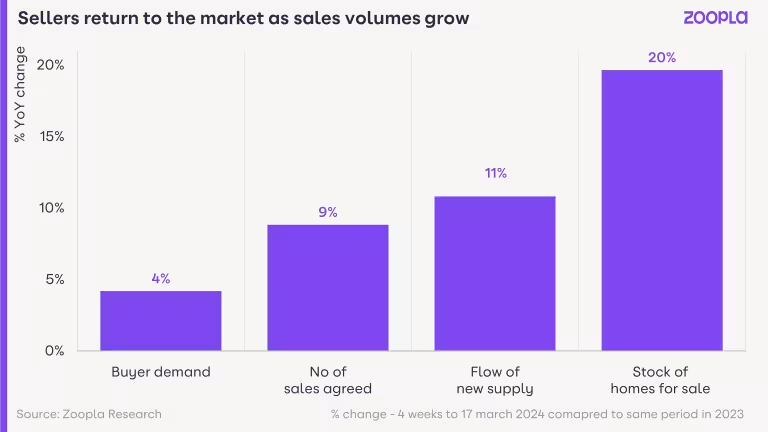

The Zoopla House Price Index shows that all primary measures of housing market activity have positive momentum in March 2024.

The number of sales agreed is currently +9% higher than a year ago. Over the first 3 months of 2024, there were +7% more sales compared to the same period in 2023.

The strongest growth in sales is in housing markets with more affordable house prices, including the Northwest (+13%) and Yorkshire and Humber (+11%).

A fifth more homes for sale than last year

The rise in agreed sales could be one reason more sellers are putting their home on the market.

The average estate agent had +11% more properties on the market in the last 4 weeks than they did this time last year.

Overall, there are a fifth more homes for sale compared to a year ago, which is something we can concur with here in Cheadle and will look at later.

Why is there more activity in the housing market?

There is improving sentiment in the UK housing market and it’s down to faster real wage growth and a healthy jobs market, both of which are boosting consumer confidence.

The latest GfK Consumer Confidence survey found that confidence about personal finances has hit the highest level for more than 2 years.

At the same time, the average mortgage rate for a 75% loan-to-value ratio on a 5-year fixed rate has fallen to 4.4%. That’s more than 1 full percentage point down from a high of 5.8% in June 2023.

41% of sales agreed are at least 5% below asking price

Despite rising confidence and market activity, buyers remain price sensitive and continue to negotiate prices.

Two-fifths (41%) of sales agreed in March 2024 were at least 5% below the asking price.

Back in the last 3 months of 2023, this figure was closer to half of all sales - but it remains high by historical standards. This reinforces my view that house price inflation will remain broadly static during 2024.

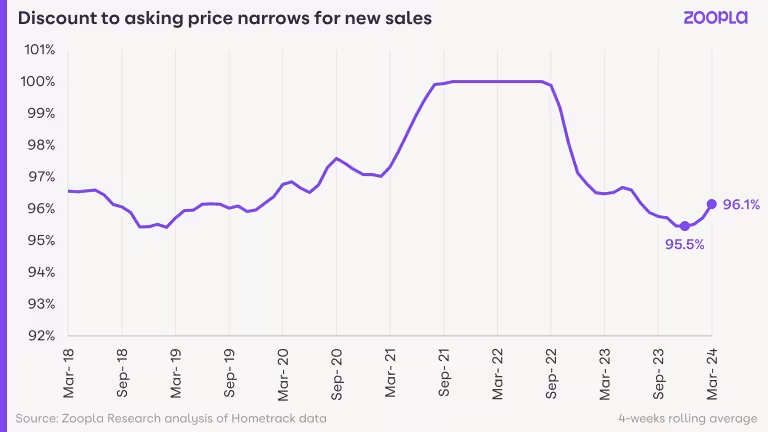

Discounts on asking prices return to pre-pandemic average

The difference between asking price and agreed sale price is continuing to narrow in further evidence of improving market conditions.

The average (median) discount was 4.5% in November 2023 - from initial asking price to agreed sale price. This equated to £14,250 in monetary terms.

According to our March 2024 House Price Index, the average discount is now 3.9% or £10,000. This is the lowest since July 2023 and in line with the pre-pandemic average.

Smaller discounts reflect a combination of greater realism from sellers on where to set their asking price, along with growing buyer confidence.

Zoopla are seeing this trend across the UK housing market, but discounts remain larger across London and the Southeast, with discounts of 4.3% on average. This is where house prices are higher and posting annual price falls. Across the rest of the country, the average discount to the asking price is 3.4%.

Greater choice for buyers keeps house prices in check

Zoopla’s opinion is that a greater availability of homes for sale will also keep house price rises in check.

In the first 3 months of 2024, the average estate agent had almost 30 homes for sale - a return to the pre-pandemic average. This gives buyers choice and room to negotiate, especially if homes fail to attract interest quickly.

Zoopla data shows that a third of homes for sale have been on the market for more than 3 months and are still listed at the initial asking price.

This is evidence that sellers need to remain realistic on where they set their asking price if they are to take advantage of improving market conditions and sell their home in 2024.

The homes sat on the market for more than 3 months are potential candidates for a price reduction. It could help attract more buyer interest, although it will depend on what price the seller needs to unlock their next move.

What impact will lower mortgage interest rates have in 2024?

Zoopla expects rising disposable incomes to be the main driver of better housing affordability over 2024. Disposable incomes are projected to increase by +3.5% over the year but they expect house prices to remain flat.

The timing and scale of interest rate falls - and the subsequent impact on mortgage rates - is another key factor that could boost market sentiment.

Fixed rate mortgages today are already priced around expectations of a drop to interest rates, but a further reduction would likely result in further falls to mortgage rates. It depends on how low money markets see the Bank Rate falling.

Economists currently predict the Bank Rate to fall to 3.5% by the end of 2025. If accurate, it’s expected that mortgage rates will stay around the 4%+ range.

This would support sales volumes but would require incomes to continue to rise faster than house prices to help reset housing affordability.

Now that we have reviewed the National picture, lets take a look closer to home, at what has happened in March.

What has been happening and where is the SK8 and SK3 property market?

After a particularly good month in February, the number of new listings dropped back in March.

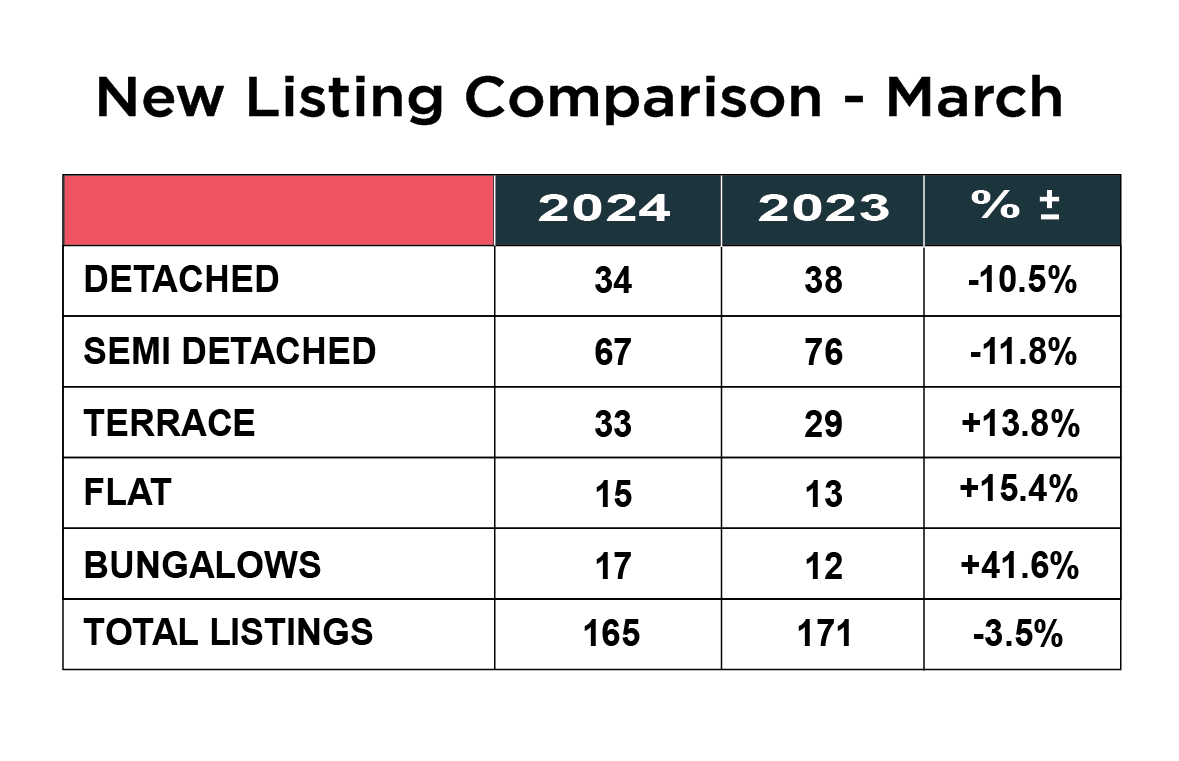

After seeing a huge influx of new properties coming onto the market in both January and February, the total number of listings for March was down 3.5% from the previous year, from 171 to 165.

Breaking the figures down by property type, the biggest increase was in the number of bungalow’s - which might just be one of those occasional anomalies we see, up from 12 to 17, an increase of 41.6%. There was also an increase in the number of flats, up 15.4% and terraced houses, up 13.8%, but a drop in the number of detached and semi detached homes, down 10.5% and 11.8% respectively.

A slowing down of the rate at which new homes are coming onto the market may also keep the pressure up on house prices, or at least prevent them falling significantly.

Buyer interest remains subdued despite the Spring Market

Perhaps the biggest concern, and this was something picked up by both Zoopla and the Nationwide, is that buyer apathy hasn’t changed much now for almost a year.

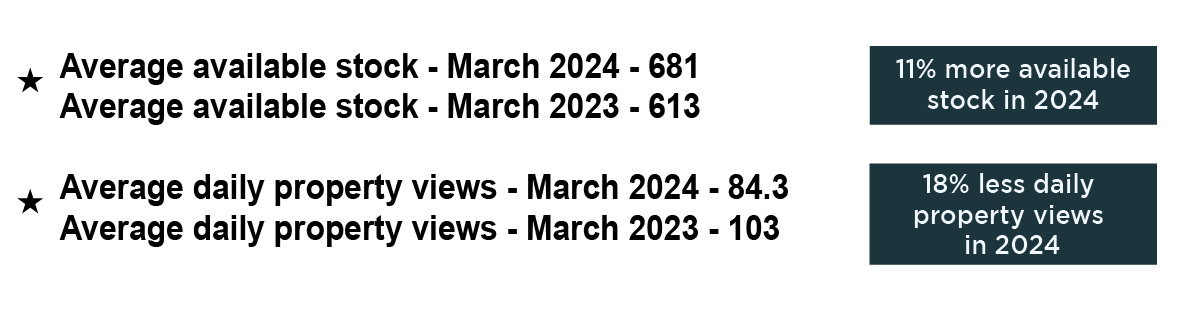

The number of available properties in SK8 and SK3 rose from 673 last month, to 681 in March, which was up overall 11% from a year ago, at 613.

The number of daily property views on Rightmove was a disappointing 84.3, which is 18% lower than a year ago and down a massive 56.8% from March 2022, when we were seeing 195 average daily property views. This is compelling evidence that the local property market is still not in a great place and the number of high calibre and serious buyers is extremely low and impacting on the market.

How are individual house types performing in SK8

The average price of a house in SK8 now stands at £361,872. Those of you who follow our monthly house price blog will realise that is down £1,393 or 0.38% from last month, when the figure was £363,265.

When we break it down by property type, detached homes now stand at £515,651 which is up 4.8% on twelve months ago. Semi-detached homes are now an average of £366,341 down 0.9% on a year ago. Terraced houses now average £312,786, which is up 5.8% on the previous twelve months, but a drop of just over £8,000 from the previous month. Flats are actually down 2.0% year on year and now stand at an average of £177,448. Prices are clearly remaining resilient but are certainly not going up.

What is happening with SK3 House Prices currently?

The average price of a property in SK3 currently stands at £243, 851 which is up 6.9% on the same period a year ago. Prices bounced back a little in March and seem to be holding firmer than SK8, which is probably a reflection of them being a little cheaper generally.

Detached homes now stand at an average value of £378,533, which is up a healthy 7.9% on last year and up just over £5,000 on last month. Semi-detached homes now average £271,407, which is up 3.8% year on year and £4,000 up on February. Terraced houses are now an average of £214,793, up 5.9% from this time in March 2023 – but interestingly, down £2,000 from February. And flats now average £174,523, which is up 9.7% on the same period last year and an increase of over £5,000 on February.

Sales drop in March as market stagnates

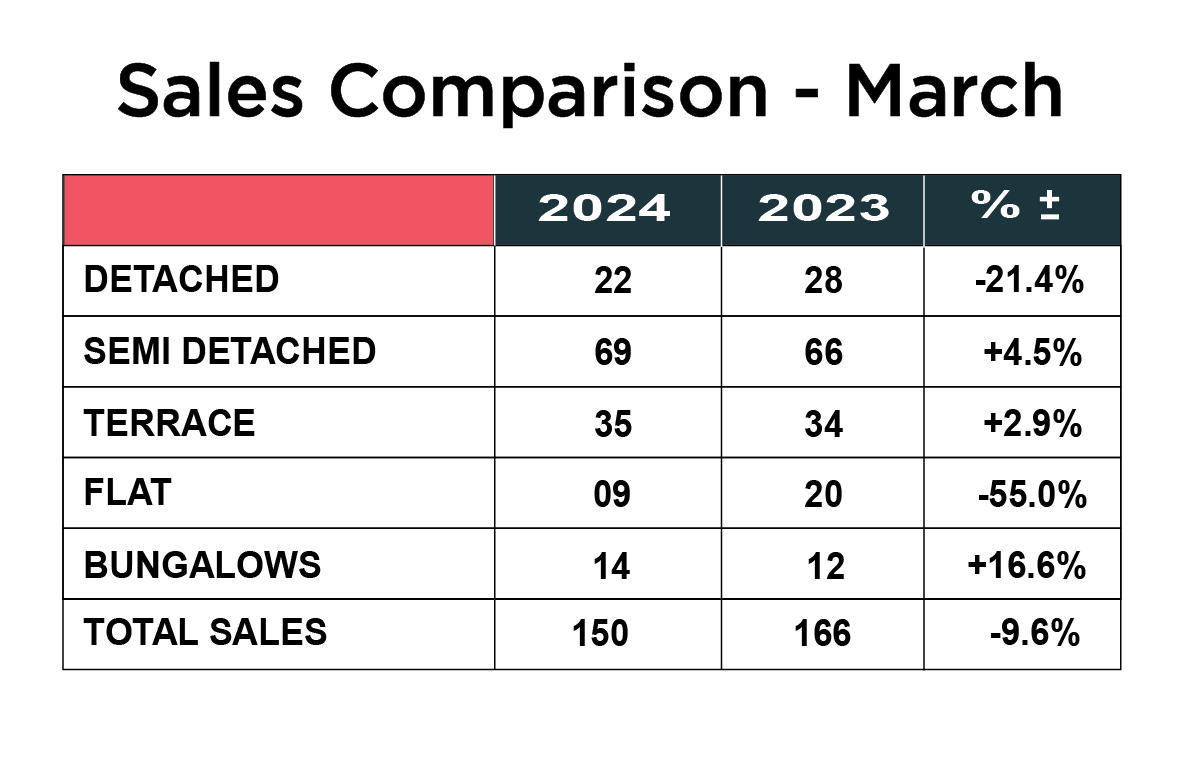

After two months of the number of sales increasing at the start of 2024, and despite the number of available homes rising – the number of sales dropped almost 10% in March 2024 over the same period in 2023.

When we look at the individual breakdown of property types, it was a bit of a mixed bag. There was an increase in the number of bungalows sold, up 16.6% from 12 to 14 and a modest increase in the number of semi-detached and terraced homes sold. However, there was a significant drop in the number of flats sold, down 55% from 20 in 2023 to 9 in 2024 and the number of detached house sales, dropped from 28 to 22 or down 21.4% over the same period last year.

Buyer sentiment and confidence clearly remains subdued.

Renting in SK8 and SK3

The lack of rental stock in SK8 and SK3 remains the biggest issue and is keeping upward pressure on rental prices.

In SK8 rents have flat lined year on year in overall increases, but the average yield is a still a very healthy 5.00%. The average rent for a house is £1516 and for a flat it is £948 per calendar month.

In SK3 rents are up 6.9% year on year and average yields are a healthy 5.50%. The average rent for a house in SK3 is £1089 and £845 per calendar month for a flat.

If you are a landlord with a property to rent out, we would love to hear from you, as we have a huge database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees.

Summary

After the euphoria of the start to the year, February was a bit of a damp squib and March has continued in the same vein, proving that despite there being more properties to choose from, buyers remain unenthusiastic and selective, which of course means sellers still need to sensible and realistic with their pricing when they market their homes.

The lack of innovation in the Budget and the many lenders increasing interest rates for new products, despite the Bank of England holding firm with the base rate is still causing many would be buyers to hold back on their plans.

Whilst major stakeholders such as the Nationwide, Halifax, Zoopla and Rightmove are still trying to talk the market up. The reality is somewhat different, especially in SK8 and SK3 currently.

March was definitely quieter for us than February and January, with the number of viewings down, despite some great new listings. There were a couple of Bank Holidays, which may have skewered the stats a little, but overall, it just doesn’t feel quite as busy as it normally would be in the Spring market. So, for those sellers who have been “testing the market” and aren’t in any hurry to sell will need to review their strategy if they are not receiving any offers. Those that have been on the market 6-8 weeks or longer, without any positive interest, need to review the price, to ensure the property remains competitive, along with the marketing strategy, to attract more eyeballs. If you want to talk to us about your options and how you can change up your marketing without any obligation, please call 0161 428 3663.

At the risk of sounding like the proverbial gramophone record, our advice to home sellers remains the same. Price your home to reflect the current market from the outset. The longer a property sits there without selling, the more money it will cost you. All the metrics show that the market is resilient but subdued and prices are certainly not going up. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same. We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and money in the long run.

It is also so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Online agents such as Strike and Purple Bricks are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or good practice.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has ahead of a move in 2024 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.