Welcome to the Cheadle Property Market Update for February 2025, the most comprehensive and in depth look at the local property market and also what is happening nationally.

February has been a mixed bag, with the property marketing remaining pretty resilient, despite the continuing gloomy outlook for the UK economy and the increased uncertainty around the world following Donald Trump’s election as President of the United States for a second term.

Stock levels continue to rise, which is keeping pressure on house price inflation, with the number of price reductions at its highest level for several years, but there definitely appears to be some cautious optimism amongst first time buyers and even buy to let investors, which is reflected in the rising sales figures, despite the concerns about the upcoming Renters rights bill in May.

So, as we always do, we like to take a look at the national picture, to see how the SK8 and SK3 markets are performing and seeing if the trends we are seeing locally are mirroring the national picture.

Let’s start with our usual look at the headlines from the Nationwide February Property Index.

House price growth remains solid in February

Annual rate of house price growth remained broadly stable in February at 3.9%, compared with 4.1% in January

House prices go up 0.4% month on month

Recovery in housing market transactions in 2024

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“The price of a typical UK home rose by 3.9% year on year in February, similar to the annual pace of growth seen in January. House prices increased by 0.4% month on month, after taking account of seasonal effects - the sixth consecutive monthly gain.

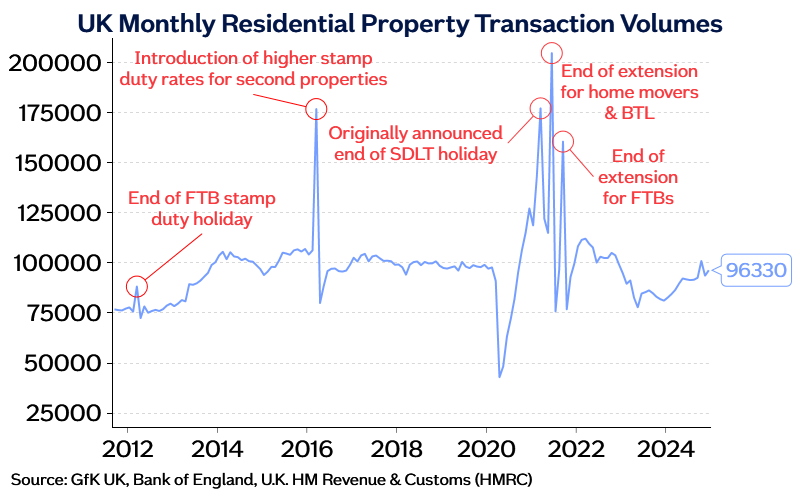

“Housing market activity has also remained resilient in recent months, despite ongoing affordability challenges. Indeed, the second half of 2024 saw a noticeable pick up in total housing transactions, which were up 14% compared with the same period in 2023.

However, taking 2024 as a whole, transactions were still modestly (6%) lower than the levels prevailing before the pandemic struck in 2019.

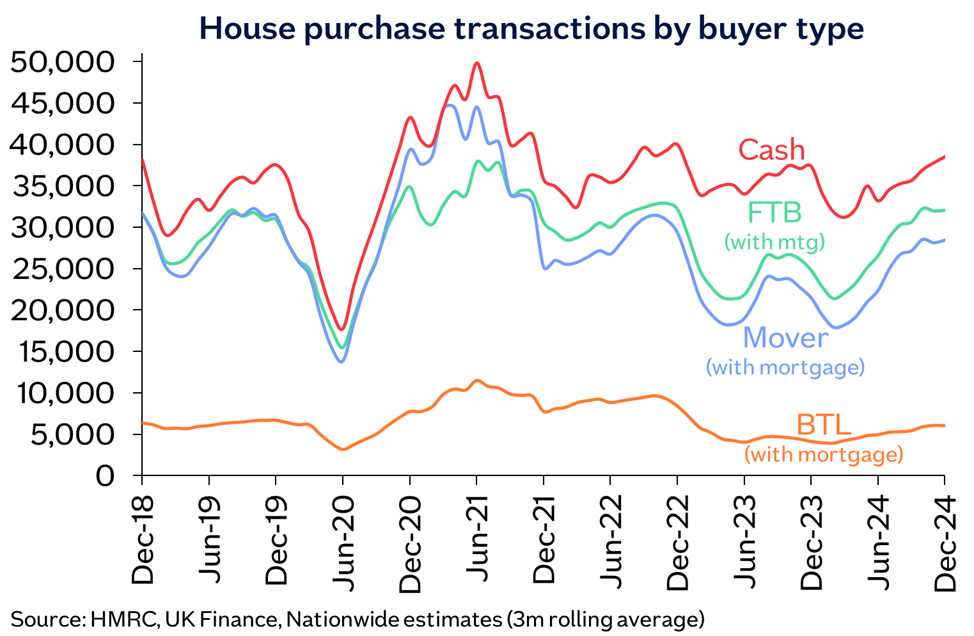

“In terms of the pattern of transactions, it is notable that first-time buyer activity continued to recover, with mortgage completions in 2024 just 5% below 2019 levels. This represents a solid performance, given the interest rate environment – for example, five-year fixed mortgage rates are currently around 4.4% (for borrowers with a 25% deposit) compared to 2% in 2019.

“Cash transactions remained particularly robust, with activity 2% above pre-pandemic levels.

“The last 12 months have seen a gradual increase in the number of buy to let purchases involving a mortgage, with rental increases and an easing in buy to let mortgage rates improving the ability to raise finance. Nonetheless, activity remains quite subdued compared to historic levels.

“However, it is important to note that some cash purchases are also undertaken by landlords and that activity in this space appears to have remained more buoyant. However, higher transaction costs, as a result of recent and upcoming stamp duty changes and uncertainty relating to the regulatory environment, also appear to be having a cooling effect on this segment of the market.

“Looking ahead, the changes to stamp duty at the start of April are likely to generate volatility in transactions in the near term, as buyers bring forward their purchases to avoid the additional tax. This will likely lead to a jump in transactions in March, and a corresponding period of weakness in the following months, as occurred in the wake of previous stamp duty changes.”

So, now let’s take a look at the Zoopla February 2025 Property Index and see how their forecast and outlook compare with the Nationwide.

Key takeaways

Sales agreed are up 10% year-on-year, as 11% more homes come to market

House price inflation ticks lower to 1.9% in response to higher mortgage rates and rising buying costs from April

There's a rapid growth in the number of flats for sale: with 14% more flats coming to market versus 5% more houses

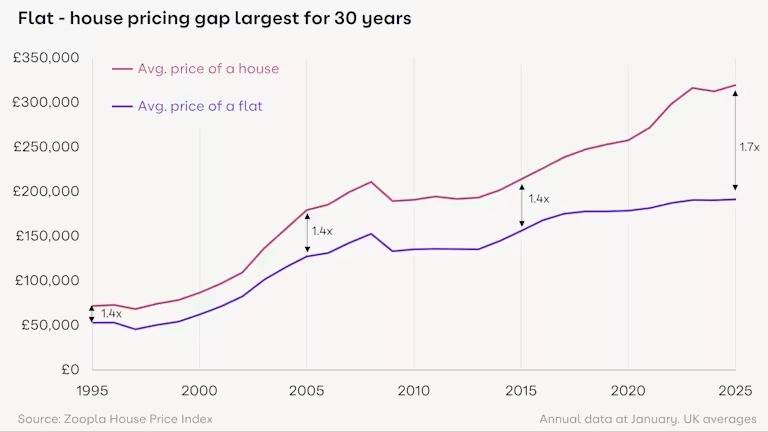

The value of houses has increased 24% over the last 5 years, that's 3 times faster than the value of flats, which has seen 7% growth

The price gap between houses and flats is now at a 30-year high (with houses worth nearly twice the price of flats)

Buyers are still prioritising houses, despite the lower prices of flats

Mortgage repayments for a flat are currently 43% lower than rental costs

Strong earnings growth is supporting activity, but a greater supply of homes for sale is expected to keep price inflation in check

Key figures

The average house price in the UK is £267,200 as of January 2025 (published in February 2025).

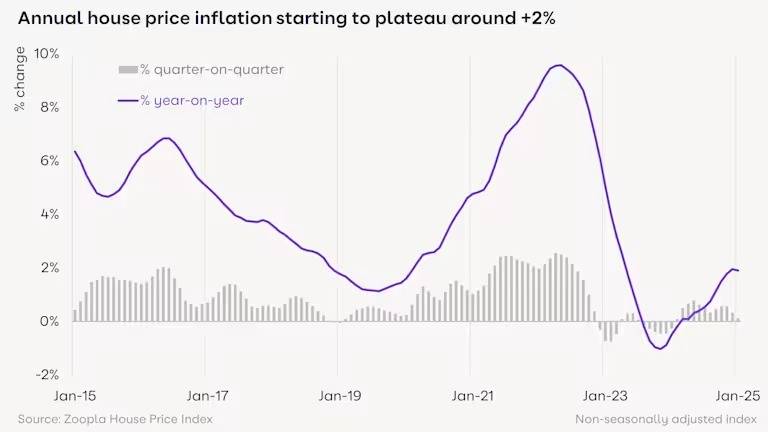

Property prices are now at +1.9% inflation compared to a year ago and the average UK house price is set to rise by 2.5% by the end of the year.

Sales activity higher but rate of house price inflation dips

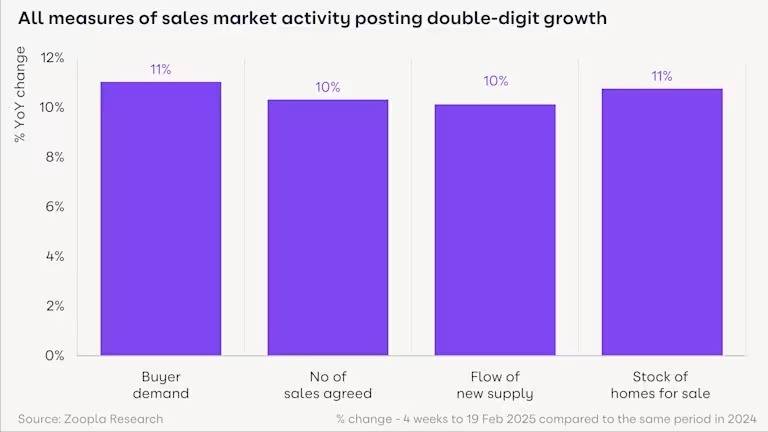

The sales market continues to register positive momentum, with all key measures of market activity running 10-11% higher than a year ago. The number of sales agreed is 10% higher, and the number of homes for sale is up 11% compared to a year ago, meaning there are now more buyers in the market.

Increased levels of housing market activity mirror other measurefs of economic activity, including robust earnings growth, higher retail sales and signs that consumer confidence is on the rise.

But while market activity continues to increase, the annual rate of house price inflation is edging lower. It increased +1.9% in the 12 months to January 2025, down from +2.0% in December 2024.

House price inflation continues to follow a north-south divide. Average prices are 7.2% higher in Northern Ireland and 3% higher in the North West. However, house prices across London and southern England have only risen by 1% to 1.2% over the last year.

House price inflation slowed across most regions of the UK in January. This reflects the sharp dip in consumer confidence in the wake of the Autumn 2024 Budget, and mortgage rates rising by 0.5% since September 2024.

Stamp duty impact starts to feed through

The moderation in house price inflation may also reflect buyers starting to factor in higher stamp duty rates.

From April 2025, half of homeowners will have to pay an extra £2,500 per purchase, while another third will pay up to this level.

40% of first-time buyers will also pay more stamp duty, up from 20% today.

Home buyers will expect to reflect this extra cost in their offers, typically looking to split the cost with the seller.

In monetary terms the differences are not large, but the overall impact of these stamp duty changes will keep house price inflation in check over 2025.

Surge in number of flats listed for sale

One notable trend emerging during the early weeks of 2025 is a double-digit increase (14%) in the number of flats on the market, compared to a more modest increase (5%) in the number of houses for sale.

A return to price increases for flats in 2024 has brought more supply to the market, with flats accounting for 1 in 4 homes currently for sale.

This increase in the number of flats for sale is running well ahead of the growth in new sales agreed (4%) and buyer demand for this property type, which is currently 1% of all buyers.

In contrast, the demand for houses is 16% higher than a year ago, while available supply of this property type is just 5% higher.

This mismatch in supply and demand explains why the value of an average flat has risen by just 0.5% in the last year, compared to house values, which have risen 2.2%. That said, we don’t expect house values to rise faster, given the greater choice of homes for sale and the extra stamp duty costs for many buyers.

In most cases, flat-owners coming to market are facing smaller capital gains than house-owners.

Two in every 5 flats for sale (40%) have an asking price of less than £20,000 above the last purchase price, compared to just 6% of houses.

Gains, even small, are not guaranteed though, with 15% of flats priced lower than they were previously purchased .

Gap between price of houses and flats reaches 30-year high

The search for space over the pandemic boosted demand for houses, while concerns over the running costs of flats (e.g. service charges and ground rents) has acted as a drag on flat prices. Building safety is another factor impacting demand for some recently built flats.The average price of a flat has increased by just 7% over the last 5 years, compared to house prices increasing by nearly a quarter (24%).

Looking at data from a longer period, the gap between the price of houses and flats is at a 30-year high. The average price of a house (£319,500) is 67% higher than the average price of a flat (£191,300).

Growing preference for houses a missed opportunity?

While flats are looking like better value for money, buyers (especially first-time buyers) are still prioritising houses.

Zoopla data shows that in 2017, over 2 in 5 (44%) first-time buyers who were looking to buy outside London wanted a 3-bed house. This increased to over a half (52%) by the end of 2024.

However, demand for 1 and 2-bed flats has declined from 25% to 17% over the same period.

It’s surprising that more buyers aren’t looking at flats as an option for home ownership, given the pricing differential to houses and the cost of buying vs renting.

Among major UK cities, we calculate that the monthly mortgage repayments on a flat are 43% lower than the cost of renting, while mortgage costs for a house are 22% higher.

The market for flats is diverse and, in an affordability-constrained market, it seems that there are opportunities for canny buyers prepared to do their homework and weigh up the purchase of a flat rather than potentially waiting longer to buy a house.

The outlook for prices, future salability and running costs are all important factors.

Housing market outlook for 2025

The housing market remains resilient with more people looking to move home in 2025 and 2026 than this time last year. Average earnings growth of 6% over the last year, well ahead of inflation, is supporting buyer confidence and helping to reset affordability.

There has been a sizable increase in the number of homes for sale in the early weeks of the year, which is giving buyers greater choice and stronger negotiating power.

Alongside higher stamp duty costs coming in for many from April, we expect house price inflation to be kept in check at 2-2.5%, with above-average growth in more affordable markets outside southern England.

So it would appear that both the Nationwide and Zoopla are seeing some signs that the market is holding firm, with more buyers being tempted by the wider choice of properties available, but this is of course keeping house price inflation extremely modest.

Now it is time to take a look at how the local SK8 and SK3 markets have been performing and whether we are mirroring the national picture or seeing something totally different.

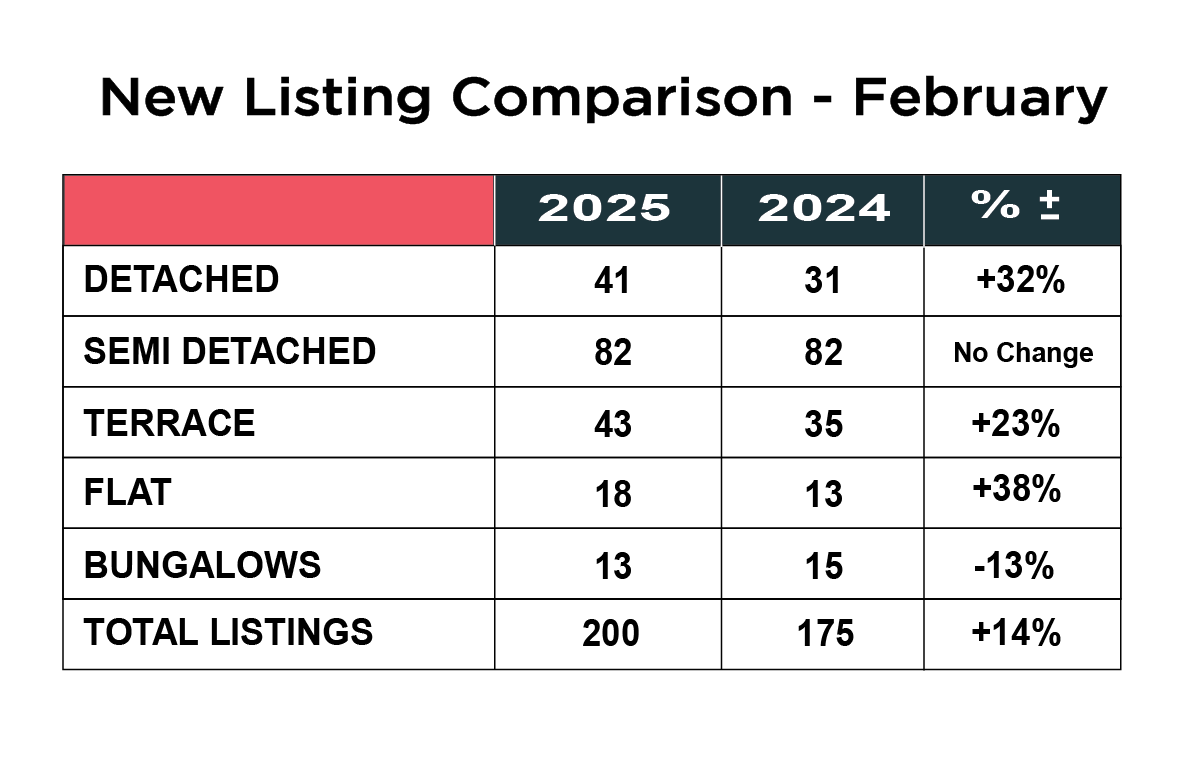

Listings show significant increase in February 2025

The number of new properties which came to the market in February showed a mark increase over the same period in 2024, with there being an uplift of 14% from 175 to 200 in the month.

We saw an increase in the number of new instructions in 3 of the 5 categories, with the biggest increase in the number of flats for sale, up from 13 to 18, a jump of 38%, second was the number of detached homes which came onto the market, up from 31 in 2024 to 41 in 2025, which is an increase of 32%, followed by a rise in the number of terraced homes, up from 35 to 43, an increase of 23%. There was no change in the number of semi-detached homes which came onto the market, remarkably 82 this year and last! And the only category where the numbers were down was bungalows, down 13% from 15 last year to 13 in 2025.

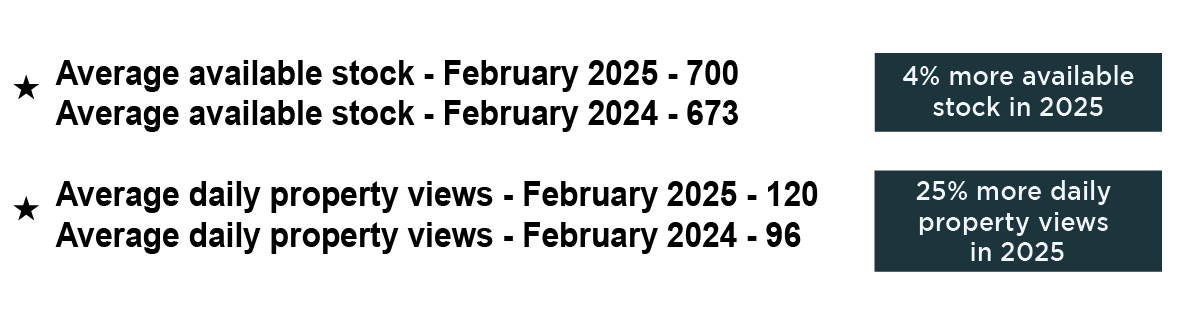

Stock levels on the rise again keeping pressure on prices

After January, when for the first time in 14 months the average stock available came down in SK8 and SK3, we saw a 4% increase on last year up from 673 to 700 in February 2025 and up 7% on last month alone.

What was encouraging was that the average number of daily property views rose from 96 last February, to 120 in 2025, an increase of 25%. This could be because there is more stock to choose from, a last-minute rush from prospective buyers hoping to buy before the stamp duty changes at the end of March, or perhaps just a sign of more confidence generally as suggested by both the Nationwide and Zoopla.

What’s hot and what’s not in SK8

The average price of a property in SK8 now stands at £359,887, which is 2.5% lower than the same period in 2024, but up slightly on January 2025.

When we look at the individual property types, detached homes are 2.6% cheaper than they were 12 months ago, standing at an average of £503,857, which is actually up £6,000 on January. Semi-detached homes are now an average price of £372,683, up 2.5% from a year ago.

Terraced homes are the only style of property, where prices have come down a little, down 6% on last February and now stand at £289,273, which is up £500 on January, so virtually no change there. Flats continue to have seen the largest uplift in prices, up an impressive 11.7% on February 2024 and now average out at £194,493.

What’s happening in the SK3 property scene

The average price of a property in SK3 currently stands at £245,006 which is 4.1% up year on year, so prices generally in the area are doing pretty well and up £7,000 from January 2025.

Detached homes now stand at an average value of £388,367, which has shown some significant fluctuation in recent months but is still a very impressive 22% up year on year. Semi-detached homes now average £265,553, which is down £5,000 from the end of 2024, but still up 1.1% over the last 12 months. Terraced houses now average £219,989 which is up 5.2% year on year and £5,000 more than January this year.

Flats now average £160,618, which have now levelled out with prices towards the end of 2024.

Sales figures up 26% in February

Sales were up a very healthy 26% in February from 131 last year to 165 in February 2025. As mentioned previously in the blog, some of this can probably be attributed to a flurry of late activity to try and beat the stamp duty increase deadline and some to the fact there are just a lot more houses to choose from.

When we break it down by individual property types, there was a huge uplift in the number of sales of detached homes – up from 18 in 2024 to 34 in 2025, which is a whopping increase of 89%.

There was also a rise of 78% in the number of bungalows sold at 16, up from 9 last year. Semi-detached home sales were up a healthy 20% from 55 to 66, but the number of flats and terraced homes sold were down 8.3% and 8% respectively.

What is the latest in the SK8 and SK3 rental market?

As the new Renters Rights Bill works it way through parliament and will become law from May, many landlords and tenants continue to consider the potential impact of the changes.

We have certainly seen an increase in the number of our landlord clients offloading some or all of their rental portfolio as they worry about what effect the law changes will have, but this of course impacts on supply and keeps the upward pressure on rents, which is the complete opposite to the sales market.

The average rental price for a house in SK8 is now £1615 and for a flat it is £990. The yield is a very healthy 7.16%, which despite landlords fears about the new legislation, still make renting a property out financially attractive, particularly if the property doesn’t have a buy to let mortgage on it!

In SK3 rents are 4.1% over a 12-month period. The yield is a healthy 6.00%. There is a strange anomaly this month, where the average price of a flat exceeds those of houses, but that is likely to be a rogue month, rather than the norm.

If you are a landlord with a property to rent out, we would love to hear from you, as we have a pre-qualified database of high calibre tenants waiting for the right home. Call Patrick, Josh or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website Check out our Landlord Services and Fees or if you have any questions or concerns about the Renters Rights Bill and how it might affect you.

Summary and outlook for the rest of 2025

The housing market has started the year very steadily and showing tremendous resilience. We feel that Q1 will see an increase in the number of sales and completion, but that is likely to drop back in Q2 after the current stamp duty window closes at the end of March. After that it remains to be seen what happens with the economy, interest rates and geo politics in the second half of 2025, but we don’t expect to see any significant improvement, until Q3 at the earliest.

We do not expect there to be a significant rises in house prices, as stock levels continue to rise and the existing stock sees more and more price reductions, but hopefully a period of stability and consistency will give the market chance to recalibrate and we should have a clearer picture of the direction of travel after Q2 2025.

What will remain more important than ever for Cheadle home sellers is choosing the right estate agent to sell their home in a more difficult and competitive market.

A well-established, experienced local agent who has operated in challenging markets before with the widest possible marketing mix both online and offline, to reach the serious buyers is essential. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to the widest market. Exclusively online or personal brand agents are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or just plain good practice.

We can demonstrate a successful strategy to help you move, that puts more money in your pocket at the end of the transaction.

Pricing your property correctly from the outset has never been more important. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same, but that is how we get the market moving.

We appreciate that nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and ultimately money. There is no mileage in putting your house on the market with the mindset “ We aren’t in any hurry and happy to sit and wait to get our price” It is not an effective strategy in the current market and the longer a property sits on the market unsold, the less likely it is to sell and certainly not for the best price, as buyers start to question what might be wrong with the property.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2025, please contact Josh, Patrick or Maurice to arrange for a FREE marketing advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.