As summer turns to autumn – where did the summer go? it seems to have passed us by in the blink of an eye! and the political party conference season starts, with the Conservatives in Manchester, it looks like a tough winter ahead for beleaguered home sellers and buyers across the country, although there have been one or two tiny green shoots of optimism in recent days, that we haven’t previously been able to report over the last twelve months or so, that we will analyses throughout this property market update.

These include a freeze in interest rate hikes by the Bank of England, a number of the fixed rate mortgage products coming down a little. Food prices dropped a little, with the price of an average food basket dropping 0.1% – the first drop in two years according to the British Retail Consortium, all of which helped the overall UK inflation rate drop to 6.70% compared to 6.80% the previous month and 9.90% last year. This is still a far cry from the government target of around 2-3%, but anything moving in a positive direction must be welcomed.

UK house prices now £14,500 lower than a year ago says Nationwide.

UK house prices fell by 5.3% in the year to September, with drops in price in every region of the country as rising interest rates continue to squeeze the property market.

The house price index from the Nationwide, the biggest British building society, showed that seasonally adjusted prices stalled over the month in September, after a 0.8% drop in August. The price of an average home was £257,808 in September, nearly £14,500 lower than a year earlier.

The housing market in Britain has slowed dramatically in many regions of the country in recent months as the Bank of England has raised interest rates sharply to combat a surge in inflation triggered by coronavirus pandemic disruption after Russia’s invasion of Ukraine, which sent energy prices soaring.

The Bank responded with a series of interest rate rises that remained unbroken until last month. The September meeting of the Bank’s monetary policy committee was the first time in almost two years that it was left unchanged, giving hope for an end to further rises in borrowing costs.

However, the effect of the rate rises remains clear in the housing market. Only 45,400 mortgages were approved for house purchase in August, according to the latest data available from the Bank of England. Nationwide said that figure was about 30% below the monthly average in 2019 before the start of the pandemic and the consequent volatile period in the housing market.

Robert Gardner, Nationwide’s chief economist, said: “This relatively subdued picture is not surprising given the more challenging picture for affordability. For example, someone earning an average income and purchasing the typical first-time buyer home with a 20% deposit would spend 38% of their take home pay on their monthly mortgage payment – well above the long-run average of 29%.”

Gardner said the Bank’s pause had helped to push down longer-term interest rates, which could ease prices for mortgages. Yet the prospect of a return to the record low rates of the pre-pandemic period – unprecedented in history – was distant, he said.

He expected the housing market to remain “fairly subdued” in the next few months, after declines in price in every region of the country during the July to September quarter of 2023. The biggest decline was evident in the south-west of England, where prices dropped by 6.3% in the quarter, and six out of 13 regions experienced drops of more than 5%. The smallest drop was in Northern Ireland, down by just 1.8%.

UK house sellers increasingly cutting prices to secure a sale.

UK house sellers are increasingly cutting prices to secure deals even as the normally busy autumn selling season gets under way, according to data from property platform Zoopla.

Discounts have increased to 4.2 per cent from the original asking price over the past four weeks, representing an average of £12,125, the highest level since March 2019. The evidence that more sellers are cracking on pricing comes a week after the Bank of England paused its long series of interest rate increases. Stable borrowing costs will be a relief to the property market, but analysts said the likelihood that rates would stay high for a prolonged period meant further falls in house prices would be required before market activity recovered.

Mortgage lenders cut their rates over the summer, easing the affordability crunch for buyers. The average five-year fixed mortgage rate stands at 5.54 per cent, according to Rightmove. Capital Economics, a consultancy, projects that borrowing costs will remain at relatively high levels and house prices will keep falling until mid-2024, dropping about 10 per cent in total from their peak in August 2022. House prices fell 4.6 per cent in the year to August this year, the largest drop since 2009, according to Halifax.

“It certainly remains a buyer’s market,” said Richard Donnell, research director at Zoopla. “The asking price isn’t the value of the home. It’s the starting point. In today’s market, buyers are negotiating a bigger discount.” A third of homes that sold had their prices cut, of which one in 10 dropped by more than 10 per cent before finding a buyer, Donnell said.

Zoopla also forecasts that the UK house price-to-earnings ratio will fall back into line with the 20-year average by the end of this year, at 6.3%.

What is the outlook for the SK3 and SK3 property market?

Now that we have the overview of the picture nationally, it is time to go into granular detail for the local market and see what shifts and trends are happening that will affect home sellers, buyers, landlords and tenants.

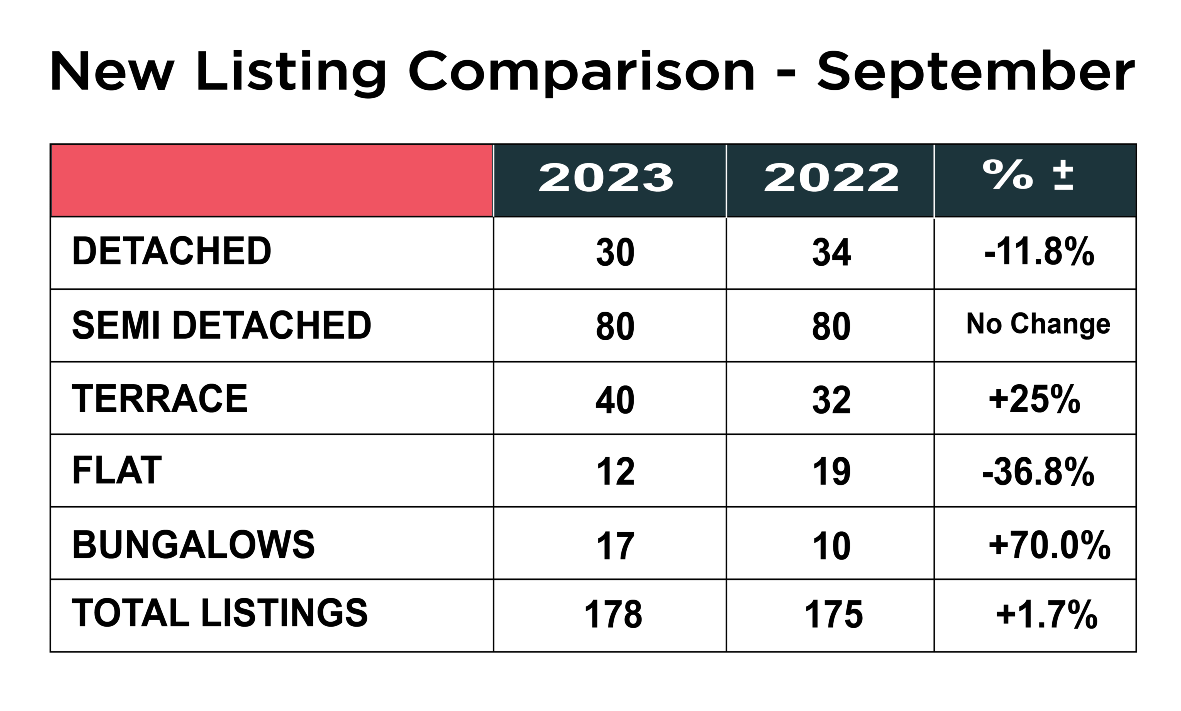

As always, the first graphic shows the comparison between September 2023 and September 2022 for how many houses came on the market in total and by individual property type.

The number of new properties coming onto the market in September was very similar to the number of new listings over the same period last year, up just 1.7% from 175 to 178.

To be honest, we thought the numbers might be higher, but we suspect that the continual negativity in the mainstream press and media is maybe forcing people to delay their decision in the hope that the market settles. But this could be a very risky strategy and we will explain more on this later.

What stood out in the September 2023 figures was the jump in the number of bungalows for sale. We appreciate it is a relatively small sample size, but a 70% uplift is significant and something we will continue to monitor over the coming months. There was exactly the same number of semi-detached homes listed in 2023 as in 2022 at 80 new listings and a 25% increase in the number of terraced houses for sale year on year. The biggest drop was in the number of flats coming on the market, down 36.8% from 19 to 12 and detached homes down from 34 to 30, a drop of 11.8%

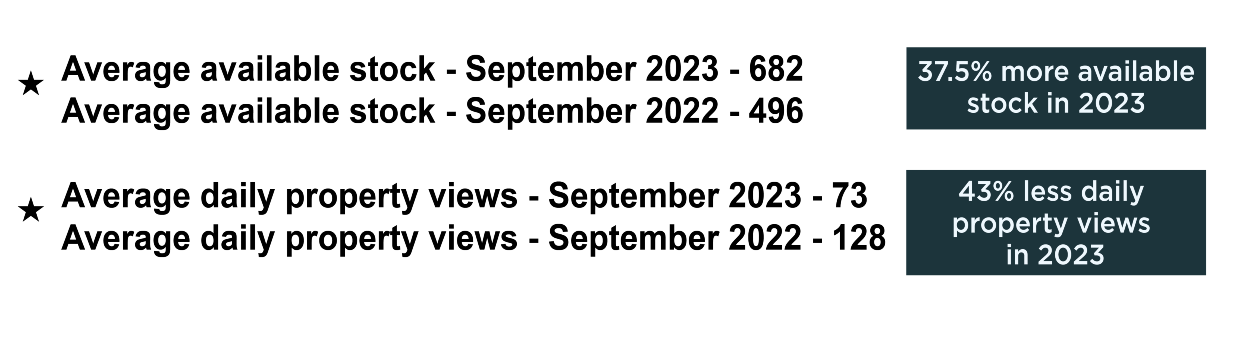

Stock levels up but not by as much – buyers remain unimpressed. The second set of figures demonstrates the biggest problem home sellers face in SK8 and SK3 – buyer interest remains very subdued. Whether that is affordability, there will clearly be an element of that, or buyers remaining patient in the belief that prices haven’t reached the bottom yet, it is difficult to tell.

The second set of figures demonstrates the biggest problem home sellers face in SK8 and SK3 – buyer interest remains very subdued. Whether that is affordability, there will clearly be an element of that, or buyers remaining patient in the belief that prices haven’t reached the bottom yet, it is difficult to tell.

We guess after last month’s record low of 63 average daily property views on Rightmove, any improve is welcome and September saw the first modest increase, up to 73, which is an uplift of almost 16%. However, for context, last September saw 128 daily property views, so the current levels are still 43% down.

The average available stock in September 2023 was a massive 682 properties, which was up 37.5% on the previous September from 496! Given that new stock was only up 1.7% suggest that there have been a significant number of sales fallen through, bringing back more stock to the market and giving the limited number of buyers looking more choice and this will of course force downward pressure on prices.

What is happening with individual house type prices in SK8?

The average price of a house across SK8 now stands at £375,290 which despite everything is still up a healthy 14.9% year on year – although it is very important to remember all of the indices are several months behind and the reality is, the figures won’t be as good as they are showing, but we won’t see what is truly happening in September 2023 until early 2024. The worry remains, that many sellers still have unrealistic expectations and think they can achieve prices comparable with this time last year and sadly this is fueled by agents desperate for stock and quite happy to give sellers poor and misleading information to obtain the home sellers instruction.

When we break it down by property type, detached homes now stand at £528,867 which is up 14.1% on twelve months ago. Semi-detached homes are now an average of £377,927 up 9.1% on a year ago. Terraced houses now average £317,873, which is up 23.8% on the previous twelve months, and flats are up 7.8% to an average of £191,530.

What is SK3 saying?

The average price of a property in SK3 is now £241,436, which is up an impressive 12.8% year on year.

Detached homes are up 42% year on year and now stand at an average of £413,575. Semi-detached homes now average £270,388, which is up 11.4% year on year, but down slightly from August and at almost £4000 less in monetary terms. Terraced houses are now averaging £211,463, up 11.5% from last September and flats now average £140,390, up 0.1% on this time last year, but down from August, wiping almost £3000 of property values.

It is important to qualify these statistics, especially for the figures for detached homes in SK3, which is based on a very small sample size, and can therefore distort the averages somewhat, if that makes sense!?

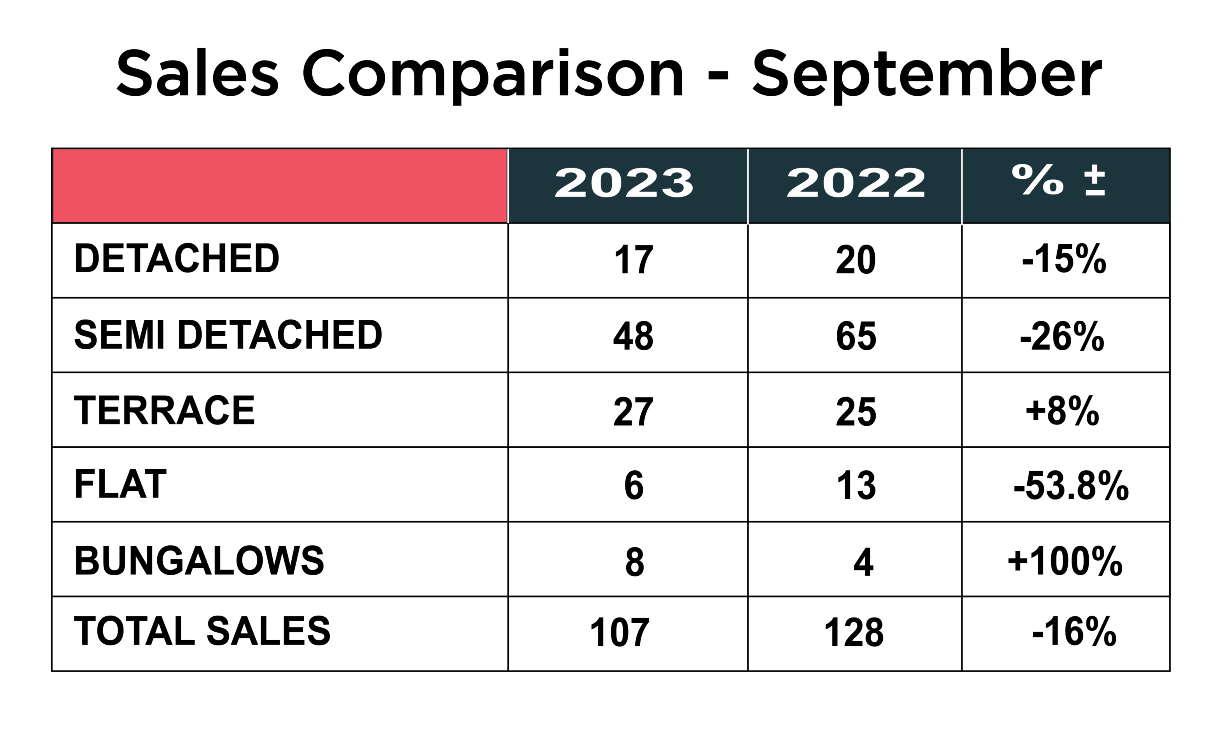

Sales figures show resilience in September.

After the awful sales figures in August, it was pleasing to see the number of sales across SK8 and SK3 bounce back to something like what you would expect for September.

107 properties were sold across SK8 and SK3 in September 2023, compared to 128 in September 2022, which was just 16% down from last September, but a 30% uplift from August 2023, which is probably a reflection of better priced stock tempting those who are still seriously looking to buy.

When we look at the individual breakdown of property types, what stands out is the number of bungalows sold increased 100% from 4 to 8 and terraced house sales rose 8% from 25 last year to 27 in 2023. However, the number of detached houses sold dropped 15% from 20 to 17, semi-detached sales dropped 26% from 65 to 48 and flat sales dropped significantly from 13 to 6 – a drop of almost 54%.

Summary

As we head into Q4 OF 2023, the local property market in SK8 and SK3 has slowed down considerably, but September showed some green shoots and reasons perhaps to be more positive than we have been in recent months.

For those of a cynical nature and also many economic observers are suggesting that as there is likely to be a general election in 2024, the current government will not want to see the property go into freefall and therefore interest rates might have peaked and things will start to improve, as the government battles to get inflation down to a satisfactory level next year.

This doesn’t mean home sellers can be complacent. Far from it! Yet many sellers are stuck in the mindset that their home can buck the trend when it comes to falling prices.

There’s also the inflation factor. Selling quickly for a reasonable price saves the property effectively losing value if it remains unsold for several months during a time when inflation is still running at 6.7 per cent according to the latest government data.

The biggest issue is still the sheer number of buyers is much lower than at any time in recent years. We have consistently seen around 50% less buyers looking on Rightmove all year. Against this backdrop, an over-ambitious asking price won’t cut the mustard, it’ that simple.

Over 800,000 homeowners who are on fixed rates now will have their deals expire before Christmas. Some of those will be potential buyers for your home and they will be faced with hundreds of pounds more per month on a new deal. New mortgages, especially for first time buyers, will be pricey. The average two-year fixed mortgage rate has jumped from around 2.3 per cent in 2021 to 6.56 per cent today.

Realistically priced homes will still sell. Agents have an obligation to help sellers keep it real, yet many serving our local community are overvaluing or going along with owners assessments of their property values to gain an instruction, which is not helping the market at all. Get the price right and make up the difference on your purchase. Just because you might have to take £10/15,000 less than you wanted, if you pay £10/15,000 less for your next home, it equates to the same! Too many sellers remain fixated on the price they are going to get, rather than look at the overall differential.

As we say every month and make no apologies for repeating the message! It is so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking now.

Simply listing a house on the property portals such as Rightmove and relying on those enquiries is not going to expose the property to enough people. Agents now need to roll their sleeves up, dig deep, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this proper estate agency!

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2023 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice and arrange for a FREE market appraisal, on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.