We are certainly into Autumn with some awful storms recently, the leaves on the trees are changing colour rapidly and dropping and the clocks going back last weekend meaning we are getting up and going home in the dark for the next few months.

The storm clouds over the housing market have also been gathering, although the Nationwide reported yesterday, that house prices had risen 0.9% in October, which was something nobody saw coming, but we will try to explain this and put some context to it, later in the blog.

Perhaps this was influenced by the interest rate freeze in September and a number of mortgage rates coming down a little and it was interesting to see that when the Bank of England Monetary Committee met today, despite inflation stubbornly holding at around 6.7%, they decided not to raise interest rates, for the second consecutive month – so a collective sigh from many within the property sector, borrowers and those considering buying a home.

House prices had the biggest monthly rise in October for more than a year, according to the Nationwide.

However, they were still down sharply on a year ago, the UK’s biggest building society said.

The 0.9% rise in prices was most likely due to there not being enough properties to meet demand, it said, which is certainly not the case in SK8 and SK3 as you will see in our localized graphics.

Activity in the housing market is still “extremely weak”, it added, as buyers grapple with higher mortgage rates. “This is not surprising as affordability remains stretched,” said Robert Gardner, Nationwide’s chief economist.

“Market interest rates, which underpin mortgage pricing, have moderated somewhat but they are still well above the lows prevailing in 2021.”

On an annual basis the price of an average home fell 3.3% in October to £259,423 – down from £268,282 a year earlier.

However, prices are still much higher than before the Covid pandemic, which sparked a mini-housing boom as people working from home sought more space, enjoyed historically low mortgage rates, and took advantage of the temporary stamp duty holiday.

The average cost of a UK home in October 2019 was £215,368, according to Nationwide.

Although it is difficult for many first-time buyers to secure a mortgage at the moment, they will welcome the correction in prices. Sky-high borrowing costs and the continued squeeze on household incomes forces some to delay buying plans because they are unable to secure a mortgage.

Mr Gardner said that borrowing costs were likely to remain relatively high compared with the last decade, but affordability would eventually improve.

“It appears likely that a combination of solid income growth, together with modestly lower house prices and mortgage rates, will gradually improve affordability over time, with housing market activity remaining fairly subdued in the interim,” he said.

Last week Lloyds Banking Group, which owns the Halifax – the UK’s biggest mortgage lender – said UK house prices were likely to drop by 4.7% this year and by a further 2.4% in 2024, before starting to rise again in 2025.

Nationwide bases its survey data on its own mortgage lending, so the survey does not include those who purchase homes with cash or buy-to-let deals. According to the latest available official data, cash buyers currently account for more than a third of housing sales.

Surging mortgage rates hampering the market

To tackle soaring inflation, the Bank of England put up interest rates 14 times in a row before holding them steady at 5.25% in September. The theory is that by raising rates it becomes more expensive to borrow money, people have less to spend, and demand falls – meaning businesses put up their prices less quickly.

But mortgage rates tend to rise in line with official interest rates, so house buyers, people on tracker mortgages and those re-mortgaging have seen their costs surge. In the UK, the rate on an average five-year fixed residential mortgage was 5.87% as of 31 October, down slightly from levels seen earlier in 2023 but still high compared with a few years ago.

Whatever data or indices you choose to believe, according to the latest Government figures the provisional non-seasonally adjusted estimate of the number of UK residential transactions in September 2023 was 92,600, 19% lower than September 2022 and 2% lower than August 2023 and that perhaps is the biggest indicator of the current direction of travel for the housing market across the country, although it is important to stress as always, that the property market is made up of hundreds of micro markets and each area can be performing differently at any one time.

Zoopla’s Outlook

Zoopla, the UK’s second largest property portal, published its own figures last week and they showed that house price inflation had dropped from plus 9.6% a year ago, to a minus 1.1% today, but also house prices are falling in 4 out of 5 local housing markets and will continue to drop throughout 2024, by a further 2%, before potentially starting to increase into 2025. Zoopla also predicts there will be 1 million house sales in 2024, but this could be a little higher, if interest rates start to fall back towards 4%.

House price falls extend across the country

Higher mortgage rates and the ongoing cost-of-living squeeze have hit buyer demand. There was a rebound in the first half of 2023 as mortgage rates fell towards 4%, but rising rates over the summer stalled buyer demand yet again.

Buyer demand is now a fifth lower than this time last year and 25% below the five-year average for October.

What has happened in SK8 and SK3 during the last month?

Now that we have reviewed the national picture, it is time to look closer to home and go into granular detail for the local market and see what has happened over the last month, that might have impacted local sellers, buyers, landlords and tenants.

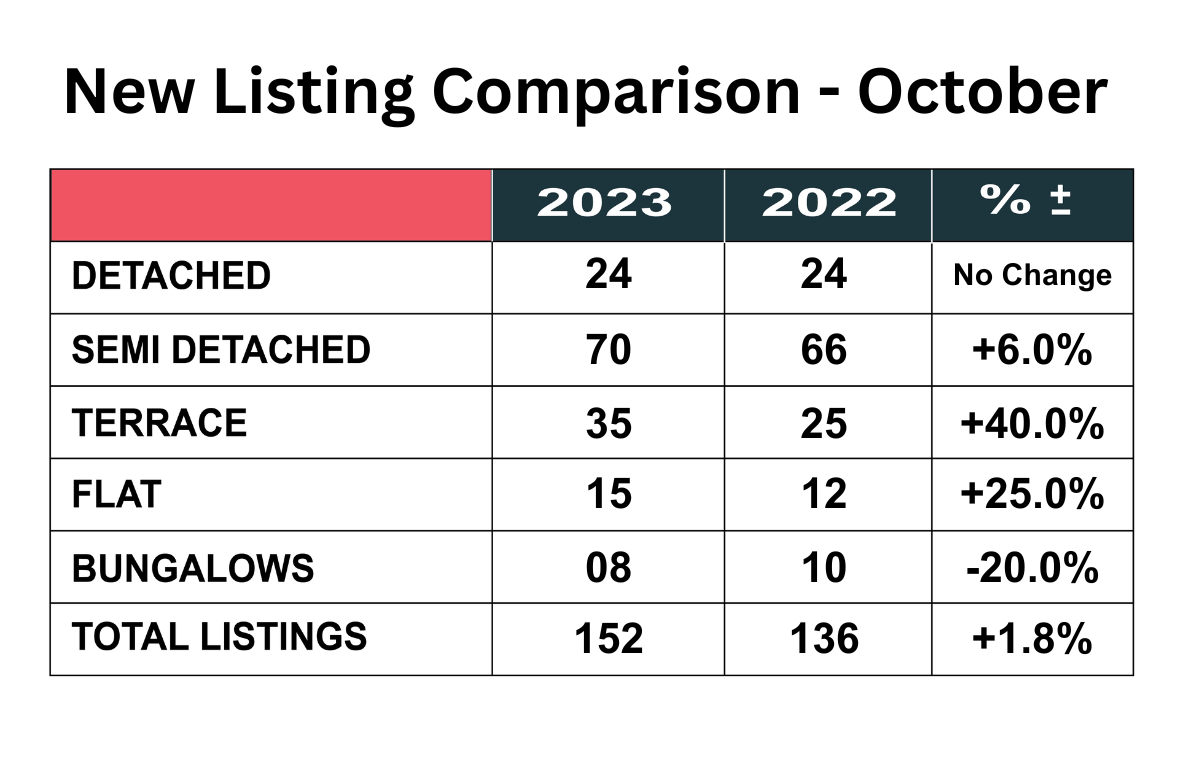

As always, we start with the number of new listings that have come to the market in total and by individual property type.

The number of new properties that came onto the market in October 2023 was 152 which was up from 136 last October. This is an increase of 11.8%. At this stage it is difficult to sell what has caused the increase, but it could be people struggling to afford their current property and looking to downsize or relocate to a cheaper area, or just sellers looking ahead and seeing an uncertain time ahead with prices potentially coming down further, so better to do it now than wait.

The most notable increase was in the percentage number of terraced homes coming onto the market up from 25 last year, to 35 in 2023, a jump of 40%. The number of detached homes coming for sale remained exactly the same at 24, whilst the number of semi-detached homes going on the market increased a modest 6% from 66 to 70 and flats up 25% from 12 to 15. The only decrease was in the number of bungalows coming on the market, down 20% from 10 last year to 8 this October.

Stock levels continue to rise, whilst buyers hold back

The second set of figures demonstrates the biggest problem home sellers continue to face in SK8 and SK3 – available stock levels rising, whilst buyer interest remains very subdued. What we are hearing from conversations with prospective buyers, many are waiting for some stability to return to interest rates or even to see them coming down again. Others are worried about the general instability of the economy and market in general, whilst others aren’t convinced prices have finished coming down and are just sitting and watching to see where the market is heading.

The second set of figures demonstrates the biggest problem home sellers continue to face in SK8 and SK3 – available stock levels rising, whilst buyer interest remains very subdued. What we are hearing from conversations with prospective buyers, many are waiting for some stability to return to interest rates or even to see them coming down again. Others are worried about the general instability of the economy and market in general, whilst others aren’t convinced prices have finished coming down and are just sitting and watching to see where the market is heading.

The average available stock in October 2023 continues to rise and stands at 718 properties, which is 39% more houses to choose from than last October when there were 515 properties available! With more new listings coming to the market and an increasing number of sales falling though, this figure could get even higher, although there is traditionally a seasonal drop-off in November and December.

The number of daily property views on Rightmove, remained subdued at 71.2, but last October was the start of the change in the property market, as there were only 86.8 daily views, a difference on just 18% year on year and down from 128 in September, but this of course was a result of the ill-fated Kwasi Kwarteng and Liz Truss mini budget at the end of September 2022, which contributed massively to the collapse of the money markets and upward pressure on interest rates. It virtually called the buyer market overnight.

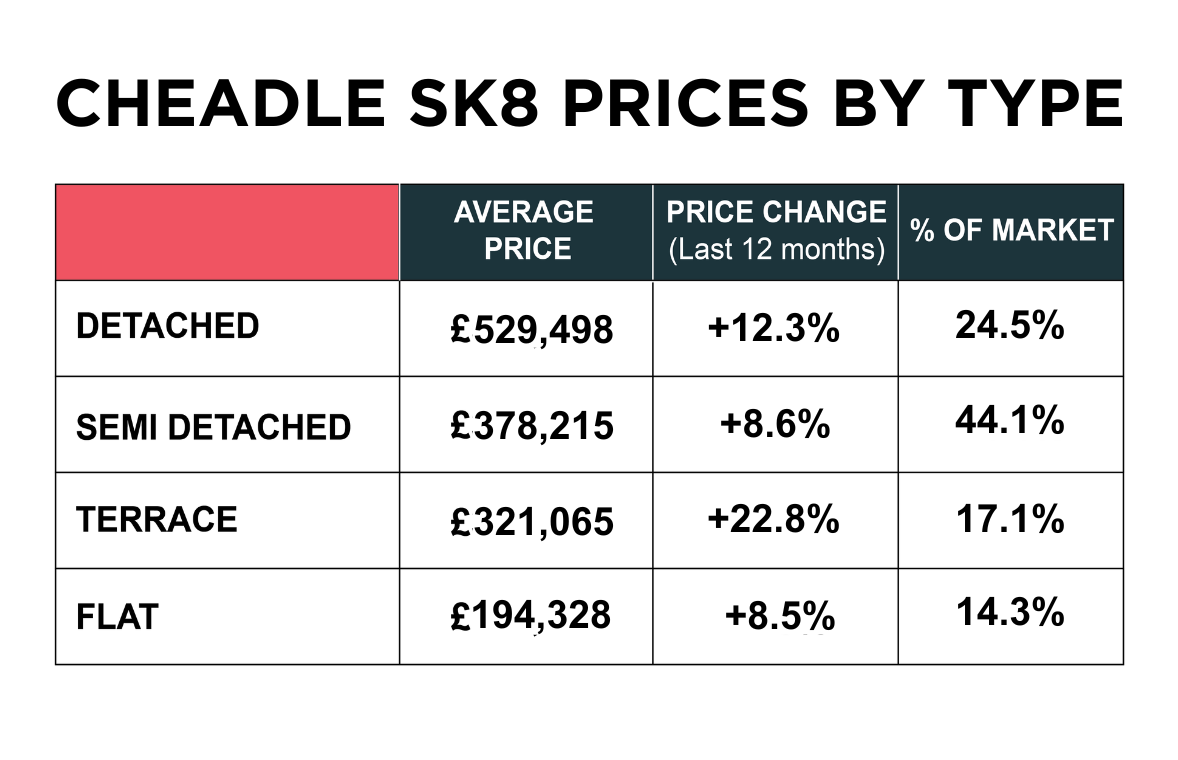

What is happening with individual house type prices in SK8?

The average price of a house across SK8 now stands at £376,032 which despite the national picture, is up 13% on the previous year. As previously mentioned, most of the indexes run several months behind, in particular the Governments own data from the Land Registry, which shows actual sold prices and is our preferred indices of choice, so these figures might be slightly lower in reality and the general trend is definitely down from what we are seeing and experiencing.

The worry remains, that many sellers are still being slow to react to the changing dynamics of the market and some still have very unrealistic expectations, which is sadly fueled by agents desperate for stock and quite happy to pander to sellers, rather than being honest with them, managing expectations and creating a strategy to market the property and sell for the best price possible.

When we break it down by property type, detached homes now stand at £529,498 which is up 12.3% on twelve months ago. Semi-detached homes are now an average of £378,215 up 8.6% on a year ago. Terraced houses now average £321,065 which is up 22.8% on the previous twelve months, and flats are up 8.5% to an average of £194,328

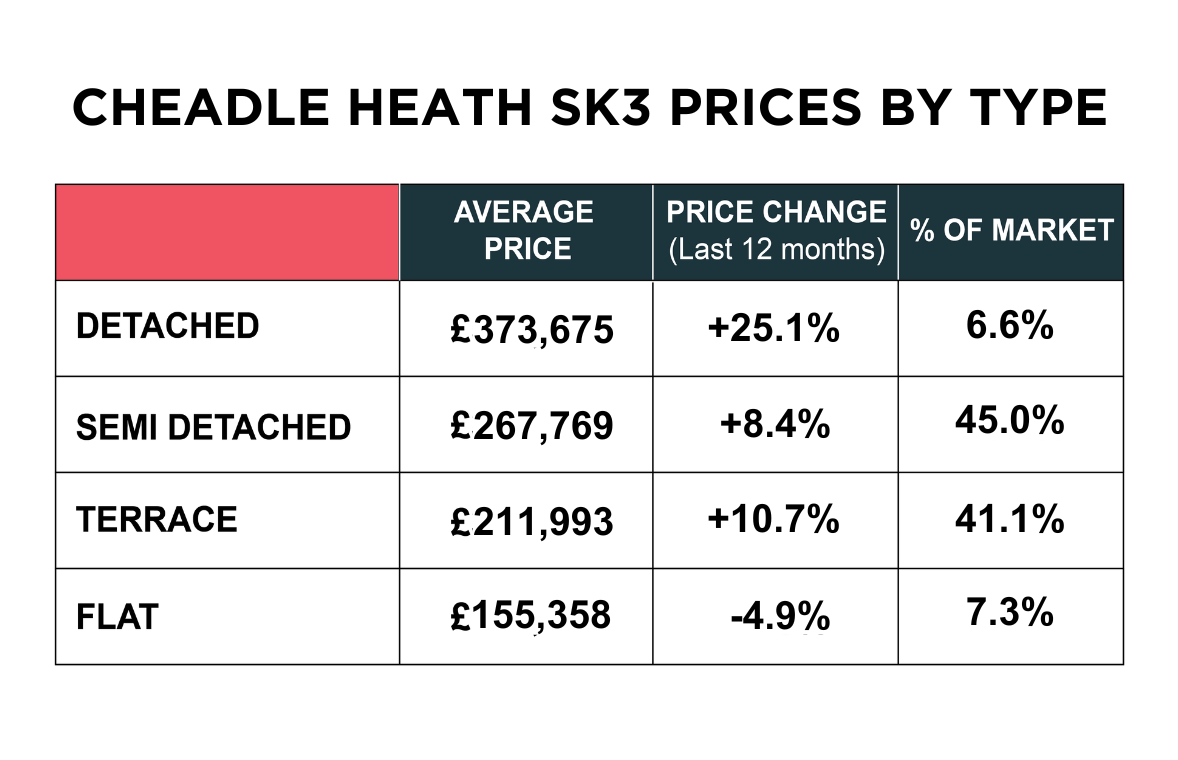

What is happening in SK3?

The average price of a property in SK3 is now £241,082, which is up 10.2% year on year.

The average price of a property in SK3 is now £241,082, which is up 10.2% year on year.

Detached homes are up 25% year on year and now stand at an average of £373,675. Semi-detached homes now average £267,769, which is up 8.4% year on year. Terraced houses are now averaging £211,993, up 10.7% from last October and flats now average £155,358, down 4.9% on the same period last year.

It is important to qualify these statistics, especially for the figures for detached homes in SK3, which is based on a very small sample size, and can therefore distort the averages somewhat.

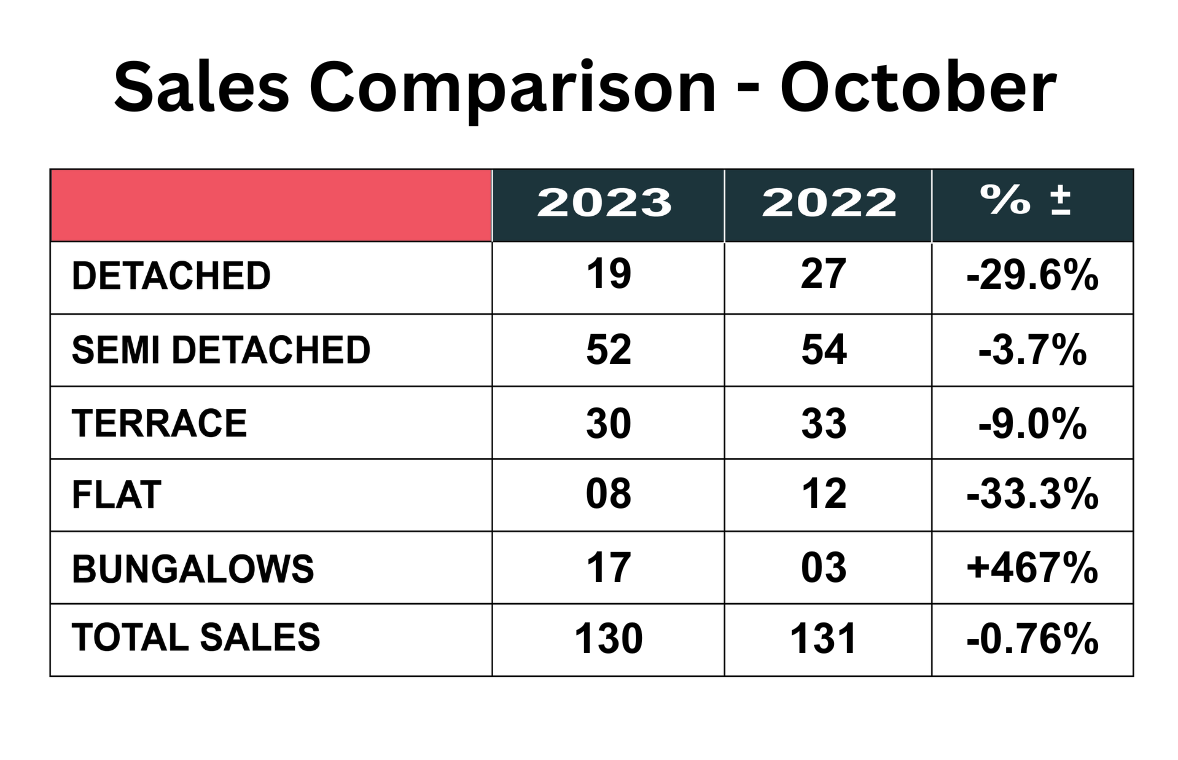

Sales figures continue to be resilient in October

After the huge drop in sales in August, the figures improved in September and rose again in October, to be on a par with what was sold last October, although was slightly distorted by the huge increase in the number of bungalows sold, which we will see in the individual breakdown by type.

130 properties were sold across SK8 and SK3 in October 2023, compared to 131 in October 2022.

When we look at the individual breakdown of property types, what stands out is the number of bungalows sold increased 467% from 3 to 17 but all other types of property sales were down. Detached homes dropped from 27 in 2022 to 19 in 2023, almost 30%. There wasn’t much change in the number of semi-detached homes sold, 52 this year against 54 last year, a modest drop of 3.7%. Terraced home sales dropped from 33 to 30 in 2023, that’s 9% and flats dropped from 12 to 8, that’s a reduction of 33.3%.

Renting in SK8 and SK3

The rental market is quite different to the sales market and remains very buoyant, with supply being the issue, whilst demand is high. Only last week the Government announced that rents were rising nationally at the quickest rate ever. In SK8, rents have increased 13% and stand at an average of £1443 for a house and £884 for a flat with an annual yield of around 5.14%. In SK3 the average rent stands at £1015 for a house and £815 for a flat, with an annual yield of 5.51%. Renting might be a good short to medium term option for some people who were thinking of selling. Talk to Patrick or Maurice about the pro’s and con’s of renting and see if it is for you.

Summary

We are now well into Q4 of 2023 and it is abundantly clear that the general levels of market activity vary quite considerably around the country.

As for the local SK8 and SK3 market, we have seen sales figures resilient, listings going up, available stock levels rising significantly, but viewing activity from buyers remains very subdued.

The rise in house prices nationally, reported by the Nationwide comes with a caveat in our opinion. This is just one month’s data, and so maybe it’s a fluke — these things happen. There is also an element of base effect in there — remember that October last year was unusually bad because of the mini-budget chaos.

More importantly, the collapse in housing transactions plays havoc with all of the indexes. Why’s that? It’s not easy creating a house price index to measure nationwide changes in the price of the average house, even at the best of times.

What If the Figures Aren’t wrong?

We are aware that it’s all too easy to make excuses for data that doesn’t fit a certain narrative, but looking ahead, we genuinely do not think we have reached the bottom with house price drops. But let’s also take this data at face value and see what might explain it.

One key point is that mortgage rates have improved. If you’re getting a mortgage, you’re not going to opt for the “average” – you’re going to bag the best rate you can. So, the “best buys” are a much better indicator of the interest rate that people are actually paying, and they have certainly been creeping lower in the past few months. For example, if you’re remortgaging, you can now easily get a five-year fix below 5%. A two-year is hovering around the “just over” 5% level as opposed to “just under” 6%.

This is happening partly because of hopes that interest rates have peaked, but also simply because the UK consumer banking sector is highly competitive, and with few transactions being done, banks are fighting each other for business even harder than usual.

All of this said, rates are still much higher than they were two years ago, which is the main reason why deals have collapsed. But things have undoubtedly improved, and as we always say here, it’s the price of borrowing that ultimately matters for house prices.

The other key point is that wages are – in theory — rising in real terms (after inflation). Consumers are still struggling with prices being much higher than we’re used to. That’s on top of the stealth tax increases that are whipping a big chunk out of every pay rise. But even so, the wage data is going in the right direction.

So, at the margins at least, the main factors that affect housing affordability (wages and access to credit) are getting better, rather than worse, but we are most definitely not out of the woods and potential home buyers remain to be convinced.

Our advice to sellers remains the same. Price your home to reflect the current market right from the outset. There is no mileage in the old “we aren’t in a hurry so happy just to stick it on the market and see” That is not a good strategy, totally counterproductive in the current climate and will ultimately cost you money. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £25,000 less than you hoped for, but pay £25,000 less for another property, what’s the problem? We appreciate nobody likes to take less for their house than they think it is worth, but holding out for some unrealistic and unachievable price will just cost you time and money in the long run.

As we say every month and make no apologies for repeating the message time and again! It is so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking now. Simply listing a house on the property portals such as Rightmove and relying on those enquiries is not going to expose the property to enough people. Agents now need to roll their sleeves up, dig deep, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2023 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also use this link to book an appointment online BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.