We are now definitely into Winter, with thick frosts, de icing the car in the morning and no longer able to resist putting the heating on in the house! However, whisper it quietly but are we starting to see some thawing in the property market? Or is there still more pain to be endured by home sellers and buyers in 2024? There are numerous mixed messages out there and as always, we try to cut through the noise to give some clarity to the homeowners, landlords, buyers, and tenants of SK8 and SK3.

So, there were two sets of monthly stats announced this week, from the Nationwide Bank and the property portal Zoopla, and both were slightly more positive than most commentators expected.

UK house prices beat forecasts to rise again in November

According to the Nationwide, UK house prices unexpectedly rose again in November, with data that provides further evidence of stabilization in the property market as high mortgage rates ease.

House prices grew 0.2 per cent between October and November, mortgage provider Nationwide said on Friday. The increase follows a 0.9 per cent expansion in the previous month and a marginal rise in September.

After separate Bank of England figures this week showed mortgage approvals hit an unexpected three-month high in October, Yesterday’s data suggests an easing in the housing market after a slide in prices and sales since the summer of 2022.

Robert Gardner, Nationwide’s chief economist, said the data for November remained “weak” compared with this time last year. But he noted “a significant change” in market expectations for the future path of interest rates, “which, if sustained, could provide much-needed support for housing market activity”.

In the summer, financial markets were pricing in a peak BoE interest rate of 6 per cent. But they now widely expect borrowing costs to go no higher than the current level of 5.25 per cent and are pricing in rate cuts from next year.

This has helped reduce the rates on popular mortgage deals. BoE data on Wednesday showed that the two-year fixed mortgage rates with 60 per cent loan-to-value eased from 6.2 per cent in July to 5.5 per cent in October.

That was a smaller contraction than the 3.3 per cent in October, and the lowest annual drop in nine months, Nationwide said. The average house price was £258,600 in November, down from a peak of 273,500 in August last year.

Charles Breen, director at Montgomery Financial, an independent mortgage broker, said the data showed the market “has definitely reached the bottom now and it’s the ideal time to either buy or start getting ready to buy”.

Andrew Wishart, property economist at the consultancy Capital Economics, said he now expected only a 2 per cent annual fall in prices in the last three months of 2023, compared with the 7 per cent he forecast at the start of the year. He said he expected a modest price contraction in 2024 but acknowledged “that these data suggest that house prices may surprise forecasters to the upside again in 2024”.

Robert Gardner said that, while mortgage rates were unlikely to return to their lows in the wake of the pandemic, “modestly lower borrowing costs, together with solid rates of income growth and weak/negative house price growth, should help underpin a modest rise in activity in the quarters ahead”.

Perhaps, the one factor which may still limit buyer activity is the amount of real household disposable income, people wanting to move may have, as the latest figures from the office for budget responsibility show that people are going to be worse off in 2024 and 2025

Separately, the Office for National Statistics on Friday revised upwards the annual rate of UK rental prices in October from 6.1 per cent to 8.4 per cent, the highest since data collection began in 2016. The agency said a new methodology for calculating rental price growth showed it hit 10 per cent in London in the year to October, compared with a previous estimate of 6.8 per cent.

Rental demand and prices have been boosted by households not being able to afford mortgage payments and by landlords passing on higher borrowing costs to tenants.

Zoopla were striking a similarly “cautiously optimistic” outlook as according to Richard Donnell, Executive Director, the housing market continues to adjust to higher mortgage rates, shown in fewer sales and widespread (but modest) house price falls.

People selling their homes are steadily becoming more realistic and agreeing to larger discounts. There seems to be a growing acceptance that what a home was worth a year ago is now little more than a memory.

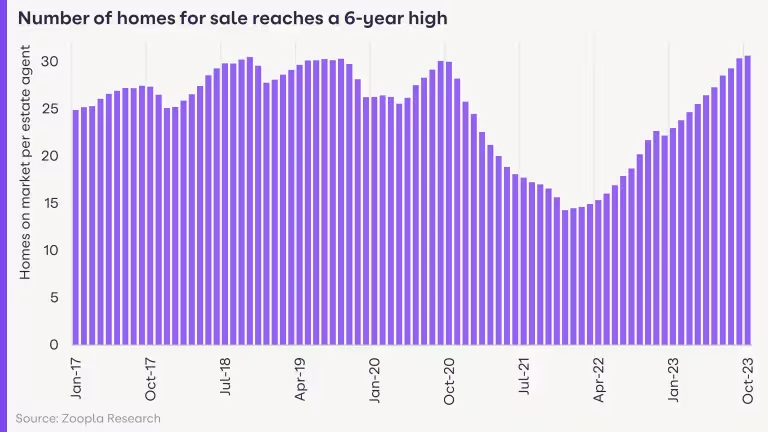

There are many more homes on the market than in recent years, putting more price pressure on those selling. This is felt mostly by 3 and 4+ bedroom homes which have had the greatest supply increase.

We expect a relatively strong number of residential property sales for 2024 and house prices will continue to fall slowly.

Property sales holding up despite weak demand for homes

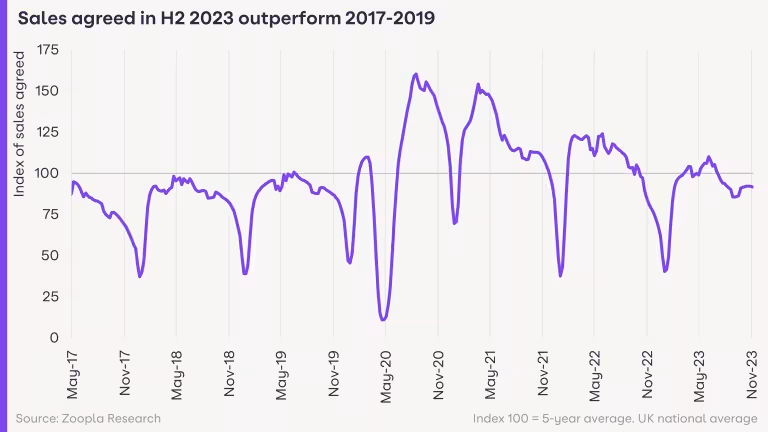

Zoopla measure buyer demand in the number of enquiries to estate agents for homes listed for sale on Zoopla. This dropped over the summer as mortgage rates increased, before picking up again in autumn.

Buyer demand is 10% higher than a year ago when the mini-budget hit. But it’s low compared to normal market conditions – sitting 13% lower than in 2019.

Meanwhile, there are 15% more agreed sales than a year ago and 5% more than in 2019. This suggests more realism from sellers. They’re dropping their price expectations to agree sales with buyers, who are in a strong negotiating position.

There’s also a sense amongst buyers that mortgage rates may have peaked. This is attracting those who delayed moving in the last year.

The pipeline of sales is the lowest for 4 years, but Zoopla still expects 1 million sale completions in 2023.

UK house prices fall 1.2% with most homeowners impacted

The average house price has fallen 1.2% in the last 12 months, with all price bands and locations in England and Wales impacted.

The largest price falls are in Southern England where demand is falling, and supply is growing. Many of these locations saw strong demand and price growth during the pandemic ‘race for space’.

It’s important to note that property prices remain well above what they were before the pandemic, even in the places with the biggest house price falls.

Highest number of homes for sale in 6 years

A chronic scarcity of residential property for sale during the pandemic – particularly for 3+ bedroom homes – was a key driver of house price growth between 2020 and 2022.

We’re now seeing completely the opposite, with the highest number of homes for sale per estate agent for 6 years.

Largest discounts to asking prices for more than 5 years

The average discount is at a 5-year high, with property sales being agreed at 5.5% lower than the asking price. This has increased from 3.4% in the first half of this year.

This 5.5% discount equals £18,000, which is even more than in 2018. That was the last time housing demand and price inflation weakened.

This shows more realism among people selling their home. Sellers are accepting ever-larger discounts as greater supply puts pressure on them to attract a buyer.

What has happened in SK8 and SK3 during the last month?

So, are the slight signs of positivity nationally reflected in our own local market? Now that we have reviewed the national picture, it is time to look closer to home and go into granular detail for the local market and see what has potentially changed over the last month.

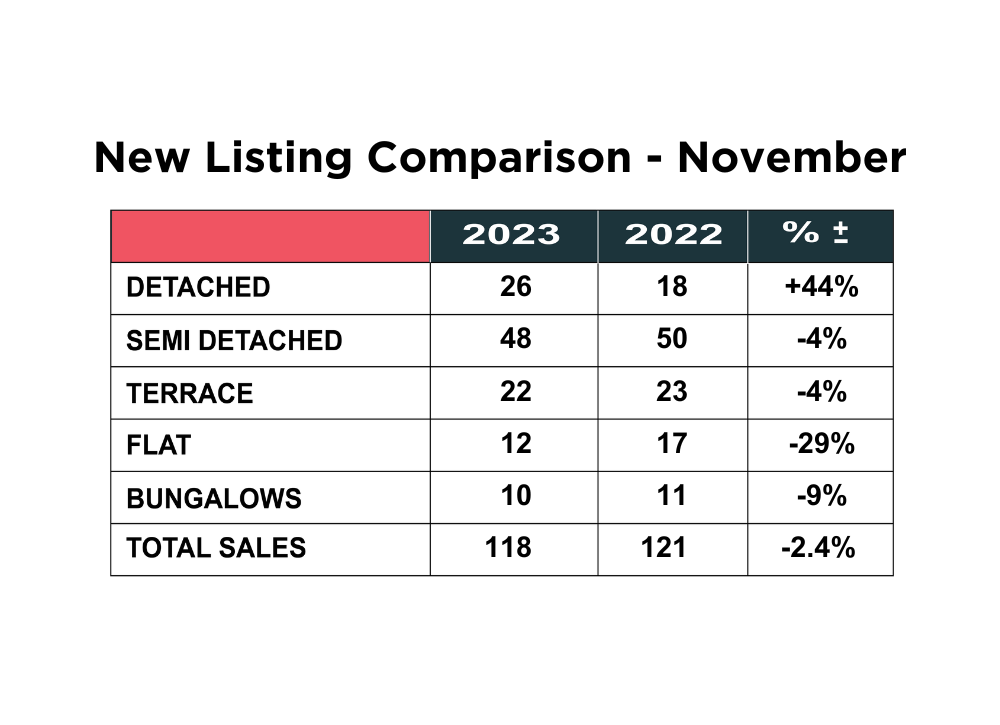

First of all, lets take a look at the number of new listings that came onto the market in November.

The number of new properties that came onto the market in November 2023 was 118, which was down from 152 in October, but comparable to the same period in 2022, when there were 121 new listings, so just a 2% drop. Obviously, this is likely to have some seasonal influence, with many sellers potentially holding back until the New Year now.

The most notable increase was in the percentage number of detached homes coming onto the market up from 18 last year, to 26 in 2023, a jump of 44%. This could be the sign that some sellers are now starting to look at downsizing to either free up some capital or reduce costs. There was a sharp decrease in the number of flats coming onto the market in 2023, with only 12 new listings, compared with 17 last year, a drop of 29%. There were also modestly reduced numbers of semi-detached homes, terraces and bungalows, down 4%, 4% and 9% respectively.

Stock levels higher, whilst buyer activity remains subdued.

The second set of figures continues to demonstrate the biggest challenge facing home sellers in SK8 and SK3.

The average available stock in November 2023 was 677 properties, which is 33% more houses to choose from than last November when there were 508 properties available! The positive way to look at this, is it is better than October, but a long way from where it was around 18 months ago. With more new listings anticipated in the new year , the downward pressure on prices is likely to continue.

The number of daily property views on Rightmove, remains subdued at just 68, although last November there were still only 82, so this year is only a drop off of 17% , but this demonstrates how buyers are still very uncertain about whether to stick or twist, we think it will be interesting to see how those numbers change in the New Year.

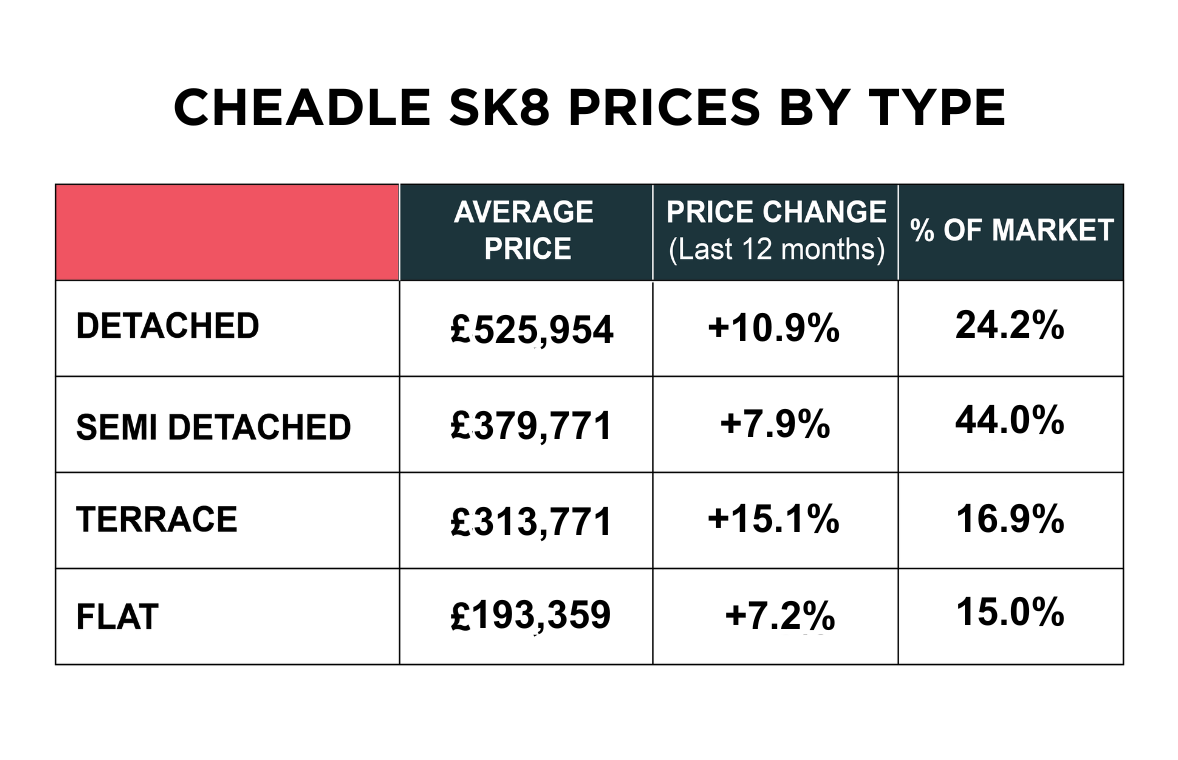

What is happening with individual house type prices in SK8?

The average price of a house across SK8 now stands at £372,655 down from £376,032 in October – a drop in real money terms of approximately £3500, but still a healthy 10% up on the previous year. As stated previously, most of the indexes run several months behind, in particular the Governments own data from the Land Registry, which shows actual sold prices and is our preferred indices of choice, so these figures might be slightly lower in reality and the general trend is definitely down, albeit the rate of reduction might be starting to slow.

When we break it down by property type, detached homes now stand at £528,954 which is up 10.9% on twelve months ago. Semi-detached homes are now an average of £379,771 up 7.9% on a year ago. Terraced houses now average £313,771 which is up 15% on the previous twelve months, and flats are up 7.2% to an average of £193,359

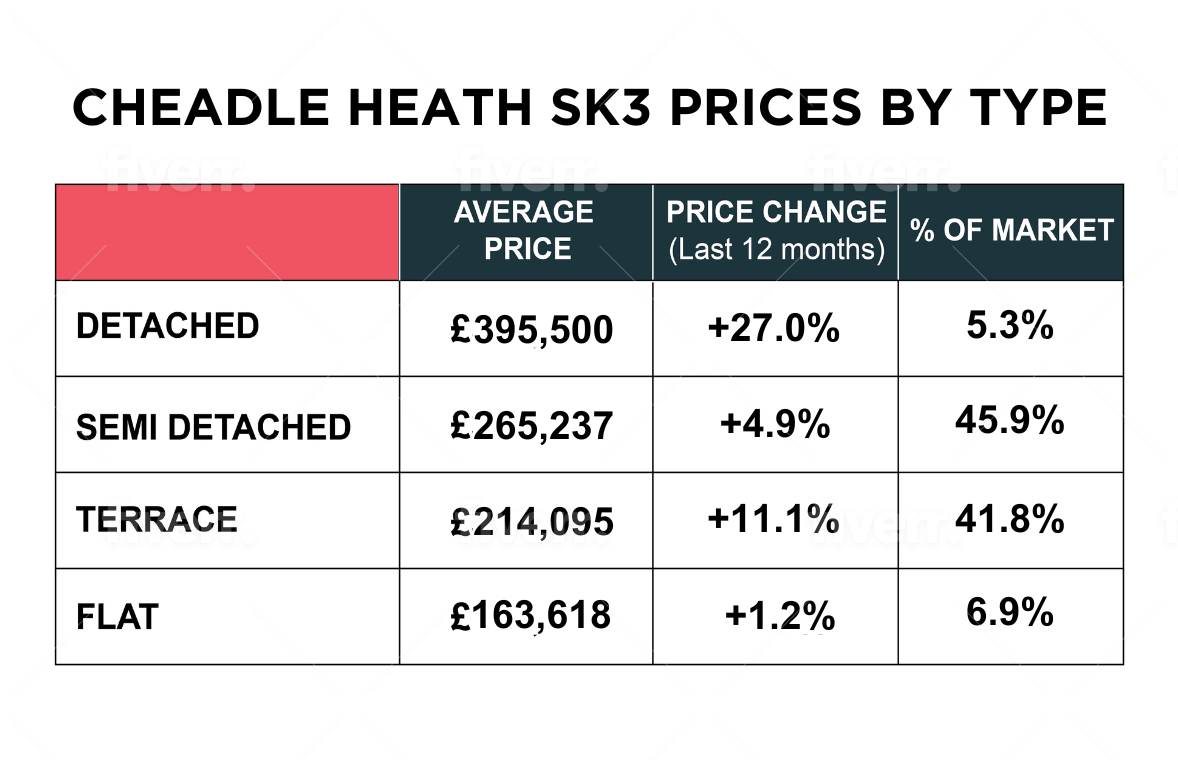

What changes have there been to individual house prices in SK3?

The average price of a property in SK3 is now £239, 614 which is up 8.1% year on year.

Detached homes now stand at an average of £395,000 and are up 27% year on year. Semi-detached homes now average £265,237, which is up 4.9% year on year. Terraced houses are now averaging £214,095, up 11.1% from last November and flats now average £163,618, which is up 1.2% on the same period in 2022.

It is always important to qualify these statistics, especially for the figures for detached homes in SK3, which is based on a very small sample size, and can therefore distort the averages somewhat.

Sales figures such dramatic increase in November

Perhaps the most encouraging set of statistics were the sales figures for November. There was a total of 121 sales across SK8 and SK3, compared with just 90 in November 2022 – that is an impressive 34% increase and should give some optimism to sellers who are realistic with their price expectations.

The biggest increase was the number of semi-detached homes sold, up from 32 last year to 62 in 2023 – a whopping 93.7% uplift! There was a 45% increase in the number of terraced homes sold, up from 20 to 29 and a 6.6% increase on the number of detached properties sold, up from 15 to 16. There was no change in the number of flats sold at 10, but a significant downturn in the number of bungalows sold, down 83.3% from 12 to just 2.

Renting in SK8 and SK3

The rental market is quite different to the sales market and remains very buoyant, with supply being the issue, whilst demand is high. Rents are contiuing to rise, although many experts expect them to peak in early 2024. In SK8, rents have increased 10% in the last twelve months and stand at an average of £1485 for a house and £894 for a flat with an annual yield of a healthy 5.09%. In SK3 the average rent stands at £1039 for a house and £807 for a flat, with an annual yield of 5.59%. Renting is still a good short to medium term option for some people who were thinking of selling. Talk to Patrick or Maurice about pro’s and con’s of renting and see if it is for you.

Summary

We are now hurtling towards the end of the year and what a turbulent year for the property market, both nationally and of course locally.

What is encouraging, is the Nationwide have reported house prices holding firm and even rising a little bit in the last three months, whilst Zoopla are only reporting modest house price drops, although they are still striking a cautionary note for 2024, however some of the forecasts which were suggesting house price falls of anything from 20% to 35% might have been a trifle over egged.

With the amount of disposable income people have available, interest rights unlikely to drop significantly – the governor of the Bank of England alluded to this last week and over 1.5m home owners with a fixed term mortgage coming to an end over the next two months, which will see their mortgage payments shoot up, there is every chance there will be an influx of new instructions hitting the market in the New year. It is essential therefore that potential sellers remain realistic in their expectations. If they do, they can achieve a sale. Get it wrong, they will be on the backfoot very quickly.

Our advice to sellers remains the same. Price your home to reflect the current market right from the outset. There is no mileage in the old “we aren’t in a hurry so happy just to stick it on the market and see” That is not a good strategy in the current climate and could ultimately cost you money. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £25,000 less than you hoped for, but pay £25,000 less for another property, it’s exactly the same? We appreciate nobody likes to take less for their house than they think it is worth, but holding out for some unrealistic and unachievable price will just cost you time and money in the long run.

As we say every month, it’s so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Agents now need to roll their sleeves up, dig deep, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency – a lot of the staff working in corporate agents aren’t old enough to remember the last difficult market in 2008!

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2023 ahead of a move in 2024 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.