April was another Month of conflicting data and opinions surrounding the UK property market, but it remains clear buyers are very undecided on whether to stick or twist and that is not necessarily good news for sellers, as more and more available stock hits the market. The governor of the Bank of England again poured cold water on the prospect of any imminent rate cuts as the economic outlook remains uncertain, in fact several lenders have even raised their rates recently. It will be interesting to see what happens when the Bank of England Monetary committee meets this week, but we are not expecting a cut, at least for now anyway.

So, what does all this mean for the property market nationally and more importantly in SK8 and SK3?

As always, we will look at the data from the Nationwide Building Society and the property portal Zoopla, to get an overview of the national picture, before breaking down the local data for SK8 and SK3 in granular details and see what we can glean and try to make some sense of it all for local homeowners and buyers. Here are the Nationwide headlines:

April sees slowing in annual house price growth

• UK house prices fell 0.4% month on month in April

• Annual rate of change slowed to 0.6%, from 1.6% in March

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“UK house prices fell by 0.4% in April, after taking account of seasonal effects. This resulted in a slowing in the annual rate of house price growth to 0.6% in April, from 1.6% the previous month, with the average non seasonally adjusted average price now £261,962"

“The slowdown likely reflects ongoing affordability pressures, with longer term interest rates rising in recent months, reversing the steep fall seen around the turn of the year. House prices are now around 4% below the all-time highs recorded in the summer of 2022, after taking account of seasonal effects.

Cost of living pressures and higher rates hold back would-be first-time buyers

“Recent research carried out by Censuswide on behalf of Nationwide found that nearly half (49%) of prospective first-time buyers (those looking to buy in the next five years) have delayed their plans over the past year.

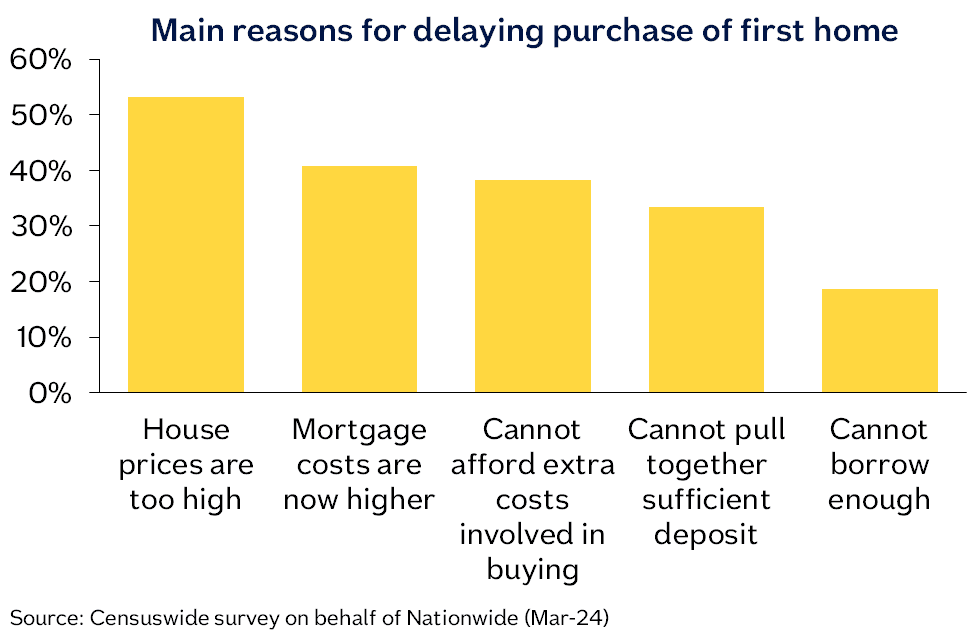

“Among this group, the most commonly cited reason for delaying their purchase is that house prices are too high (53%), but it is also notable that 41% said that higher mortgage costs were preventing them from buying (see chart below).

“Coupled with this, 84% of prospective first-time buyers said that the cost of living has affected their plans to buy, for example through having less money each month to save for a deposit. Around two thirds (67%) of respondents currently have between £0 and £10,000 saved towards a deposit. With a 10% deposit on a typical first-time buyer property currently around £22,000, it is not surprising to find that almost 60% of prospective buyers have yet to save more than a quarter of their target deposit.

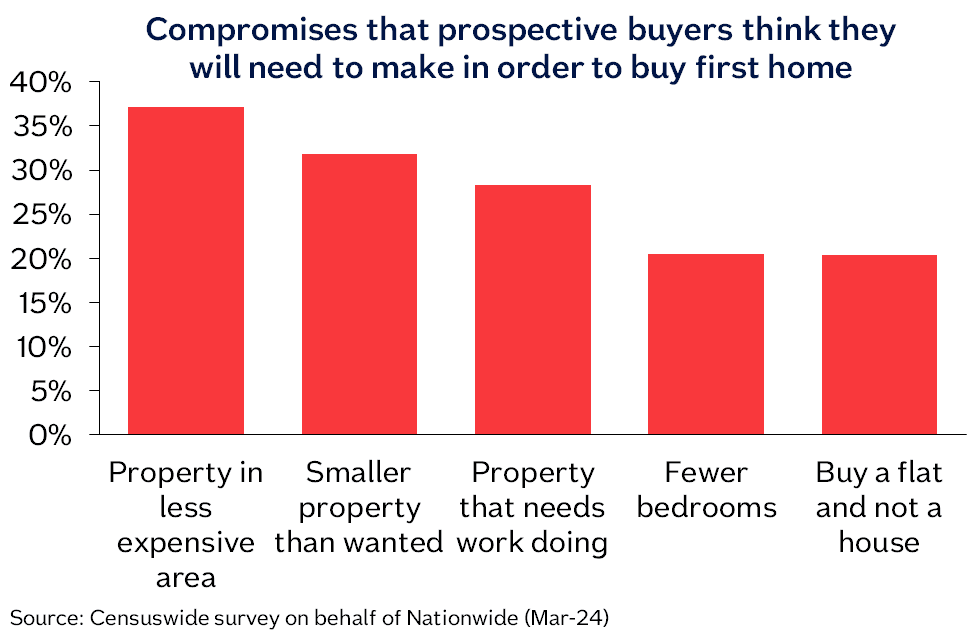

“Interestingly, 55% of respondents said they would be willing to buy in another part of the country where house prices are cheaper, or where they could buy a bigger property. Inevitably, there is a lot of variation in how far people would be willing to move, but half said they would move more than 30 miles from their current location.

“Buying a property in a less expensive area appears to be the most common compromise that prospective buyers will make. Around a third (32%) said they would consider a smaller property than they wanted, while 28% would go for a property that needed work doing.

“Amongst recent first-time buyers (those who have bought their first home in the last five years), 38% said they ended up compromising on the property they purchased. Among this group, nearly 40% bought a property to do up (rather than ‘turn-key’ ready) while 34% bought in a different area.”

Zoopla - House prices largely unchanged over the last year

The average house price in the UK is £264,500 as of March 2024 (published in April 2024).

Property prices have risen by +0.1% compared to the previous month and fallen by -0.2% (£410) compared to a year ago.

The latest Zoopla House Price Index shows that house prices are largely unchanged in the year to March 2024, falling by -0.2%.

House prices are continuing to fall across southern England and the East Midlands

although now at a slower pace. The East of England has seen the biggest annual drop at -1.7%.

Market conditions have been improving across the North of England, West Midlands, Wales, Scotland and Northern Ireland, leading to a return of annual house price growth in these regions.

6 in 10 homes are in markets seeing annual house price falls

64% of UK homes are in local authority areas where house prices are falling on an annual basis.

But this is lower than the 82% recorded in October 2023, and the scale of price falls is relatively modest. In most cases, house prices in these markets have fallen between -0.1% and -3.0% on average over the year.

Housing market continues to balance

The housing market is more balanced than at any time since before the pandemic. This is likely to give more people the chance to move home in 2024, so long as those selling remain realistic on pricing.

With house price inflation remaining broadly static, affordability for those buying a home is not worsening.

A rebound in sales volumes

The housing market is seeing a sustained uplift in new property sales, with 12% more agreed sales than a year ago.

The number of agreed sales has now been higher than the same time last year for 4 months running, but it is worth adding the caveat here, that the number of properties for sale is at its highest level for years, so you would expect more sales.

Sales pipeline rebuilding

The sales pipeline, where we track the number of homes moving through the sale process, is also rebuilding. This comes after a period of fewer sales when mortgage rates jumped in 2022 and 2023.

Our data shows that the housing market is on track for 1.1 million sales completions in 2024, a 10% increase on last year.

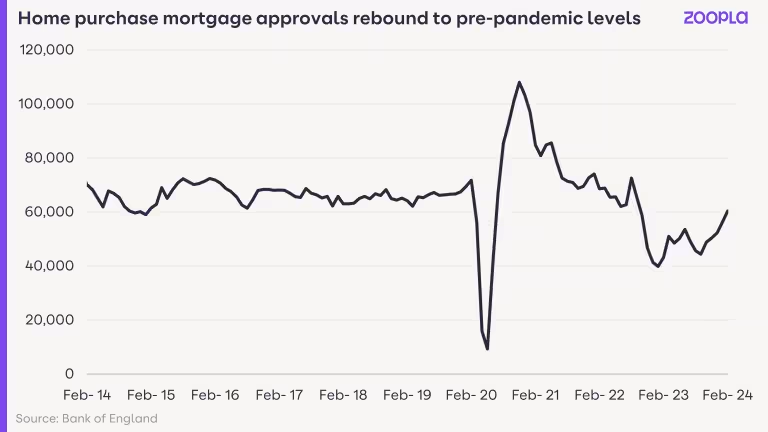

Mortgage approvals reach pre-pandemic levels

The recovery in sales numbers is starting to be reflected in other housing data, such as the number of mortgage applications being approved.

According to the Bank of England, there were 32% more mortgage approvals in February 2024 than a year earlier. This is a return to pre-pandemic levels, as the graph below shows.

The 4 to 6+ month time lag between agreeing a sale ‘subject to contract’ and moving in means sales completion data is yet to register an upturn. This will emerge in the coming months.

Mortgage rates remain twice as high as 2 years ago

The housing market is continuing to adjust to the end of ultra-low mortgage rates.

Mortgage rates spiked twice in the last 2 years - at the end of 2022 and in the summer of 2023 - as interest rates were increased to combat inflation.

The primary impact on the housing market was a -23% drop in sales in 2023, along with modest house price falls. These falls were so small they did very little to improve housing affordability.

Average mortgage rates have started to drift higher in the last few weeks as expectations for interest rate cuts later this year have shifted.

It comes after average mortgage rates for a 5-year fix at 75% loan-to-value fell back to 4.5% over recent months.

Richard Donnell from Zoopla says “I expect mortgage rates to remain around 4.5% throughout 2024, which in my view is consistent with +/-1% house price growth”

Monthly mortgage costs 60% higher than in 2021

When mortgage rates first started to rise, we reported that the shift from 2% to 5% rates would mean a 30% drop in buying power for the average person.

By ‘buying power’, we mean the price of the property you can afford to buy with a mortgage, assuming you keep your monthly repayments the same.

Buyers withdrew from the market as they faced even higher borrowing costs. Alongside general economic uncertainty, this led to fewer transactions in 2023 and a big slowdown in house price growth.

The housing market is still adjusting to the impact of higher mortgage rates, mainly through static house prices.

Today, when you compare a sub-2% mortgage rate from March 2021 to the current 4.5% average, the annual mortgage cost jumps from £7,100 to £11,400 - a 61% increase.

(This assumes you buy an average priced home with a 70% loan-to-value ratio on a 30-year term.)

Two thirds of this increase in annual housing costs is a result of higher mortgage rates. One third is down to the fact that house prices are still 13% higher than in March 2021.

While it seems that base rates have peaked and consumer confidence is on the up, mortgage costs for typical buyers are clearly still much higher than 3 years ago.

No signs of an uptick in house price inflation

Richard Donnell says “I expect UK house prices to continue to firm over 2024 rather than seeing any acceleration in house price inflation.

The current divergence between the south and the rest of the UK will also continue over the coming months.

With fixed rate mortgages today already reflecting expectations for interest rate reductions later in the year, I don’t expect any major changes in average mortgage rates in 2024.

What the housing market needs most is continued price stability which will create the right environment for continued growth in sales. I believe sales numbers rather than price growth will be the key indicator of housing market health for the foreseeable future”

So, now that we have reviewed the National picture, lets take a look closer at what has been happening in the local SK8 and SK3 market during April and see if it mirrors the national picture or whether we are bucking the trend!

April showed an overall reduction in the number of new listings, compared to the previous April of 1.2%

Looking at the individual types of properties coming onto the market, what stood out was a 35% uplift in the number of detached homes, up from 31 in 2023 to 42 in 2024. Flats were also up 10% from 10 to 11 and there was a modest 3.2% rise in the number of terraced homes coming onto the market. On the flip side, the number of bungalows was significantly reduced from 17 to 12 – a 29% drop and the number of semi-detached homes remained pretty much the same as last year.

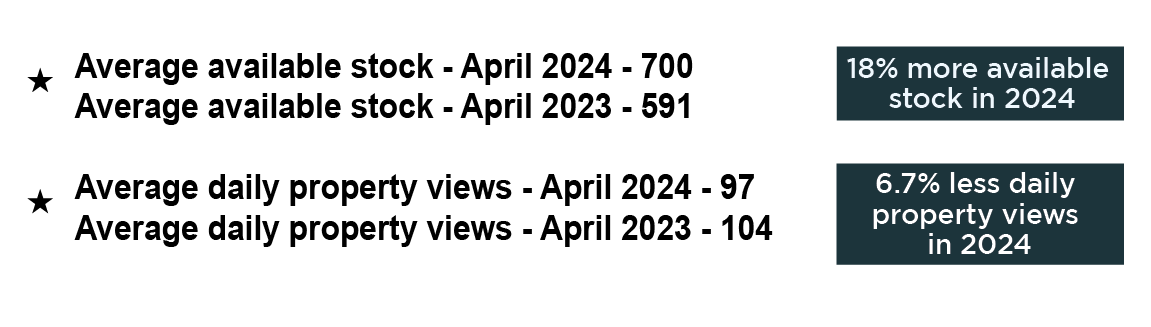

Buyer interest remains subdued in line with national picture

As was mentioned by both Nationwide and Zoopla, they have also picked up buyer apathy across the country for a number of reasons – not least they feel prices are still too high or the cost of borrowing is too expensive.

The number of available properties in SK8 and SK3 rose from 681 last month, to a record 700 homes in April.

The number of daily property views on Rightmove remains low, only 97 in April, down from 104 last April, but more significantly down 53% from April 2022 when there 206 daily property views, so you can see the difference.

This is compelling evidence that the local property market is still performing way below it would normally, and the number of serious buyers is extremely low and impacting on the market.

What house price types are popular in SK8?

The average price of a house in SK8 now stands at £364,336, which is actually up £2,464 on March’s figure.

The average price of a house in SK8 now stands at £364,336, which is actually up £2,464 on March’s figure.

When we break it down by property type, detached homes now stand at £515,356 which is up 4.3% on twelve months ago. Semi-detached homes are now an average of £366,618, down 1.3% on twelve months ago. Terraced houses now average £315,666, which is up 6.4% on the previous twelve months, and flats now stand at £178,472, an increase of 0.4 on the previous year.

What is happening with SK3 house prices by type?

The average price of a property in SK3 currently stands at £239,449, which is down £4,402 on the previous month, but still 3.6% up year on year.

The average price of a property in SK3 currently stands at £239,449, which is down £4,402 on the previous month, but still 3.6% up year on year.

Detached homes now stand at an average value of £326,286, which is down a significant 11.8% on a year ago. Semi-detached homes now average £268,749, which is up 1.5% year on year but again down from March. Terraced houses are now an average of £212,522, up 3.9% from this time in March 2024, and flats now average £167,316, which is up 3.5% on the same period last year, but interestingly, a drop of almost £7,000 on the previous month.

What is very clear is the prices in SK3 have started to drop further and quicker than SK8 and it will a trend to keep an eye on over the coming months.

Sales up across SK8 and SK3 mirroring national picture

After a blip in March, where the number of sales dropped after a solid start to the year, April was better with sales increasing from 134 in April 2023 to 149 in April 2024, an increase of 11.2%

After a blip in March, where the number of sales dropped after a solid start to the year, April was better with sales increasing from 134 in April 2023 to 149 in April 2024, an increase of 11.2%

When we look at the individual breakdown of property types, it was mainly positive across the board, with a huge uplift in the number of sales of flats and terraced homes, up 66.6% and 41.6% from a year ago. Bungalow sales were also up 10% from 10 to 11 in 2024, whilst the number of detached home sales stayed the same at 26 and the number of semi-detached homes dropped by 6.2% from 65 in 2023 to 61 in 2024.

It is difficult to know whether the increase in sales is just based on the number of homes available or a sign that whilst there are less buyers in the market, those who are there are seriously looking to buy?

Renting in SK8 and SK3

The lack of rental stock in SK8 and SK3 remains the biggest issue.

In SK8 rents have actually dropped very slightly year on year, down 0.6%, but the average yield is a still a very healthy 5.10%. The average rent for a house is £1566 and for a flat it is £941 per calendar month.

In SK3 rents are up 3.6% year on year and average yields are a healthy 5.60%. The average rent for a house in SK3 is £1082 and £875 per calendar month for a flat.

If you are a landlord with a property to rent out, we would love to hear from you, as we have a huge database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees.

Summary

As has been made clear from the recent Nationwide survey, many buyers are still holding back from committing to buying, as they feel prices are still too high and the cost of borrowing very expensive. This continues to have a subdued effect on the market.

What we are seeing in SK8/SK3 is an increased number of sales, which bucks the national trend, but this could just be down the large number of available properties. Either way, it is very welcome. We are seeing plenty of viewings, but not as many offers, so it remains very important that sellers keep their asking prices keen.

For those sellers who have been “testing the market” and aren’t in any hurry to sell they will need to review their strategy if they are not receiving any offers. Those that have been on the market 6-8 weeks or longer, without any positive interest, need to review the price, to ensure the property remains competitive, along with the marketing strategy, to attract more eyeballs. If you want to talk to us about your options and how you can change up your marketing without any obligation, please call 0161 428 3663.

At the risk of sounding like the proverbial gramophone record, our advice to home sellers remains the same. Price your home to reflect the current market from the outset. The longer a property sits there without selling, the more money it will cost you. All the metrics show that the market is resilient but subdued and prices are certainly not going up. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same. We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and money in the long run.

It is also so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Online agents such as Strike and Purple Bricks are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or good practice.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has ahead of a move in 2024 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.