The year seems to be flying by and we are already almost into Spring with lighter mornings and evenings when you head home from work. And there have been a few green shoots for the property market in SK8 and SK3, although there remain considerable challenges and conflicting opinions and data as to where the market is heading.

So, without further ado, let take a look at what the major players nationally are saying, before we break down the local data in more granular detail.

UK House Prices rose year on year for the first time in more than a year according to the Nationwide

|

Headlines |

Feb-24 |

Jan-24 |

|

Monthly Index* |

525.6 |

521.9 |

|

Monthly Change* |

0.7% |

0.7% |

|

Annual Change |

1.2% |

-0.2% |

|

Average Price (not seasonally adjusted) |

£260,420 |

£257,656 |

UK house prices rose year-on-year for the first time in more than a year in February, according to Nationwide.

The building society’s latest house price index showed prices were up 1.2% on the year last month, marking the first return to positive territory since January 2023.

Month-on-month, prices rose 0.7% to an average price of £260,420. House prices are now around 3% below the all-time highs recorded in the summer of 2022.

Robert Gardner, Nationwide’s chief economist, said the decline in borrowing costs around the turn of the year appeared to have prompted an uptick in the market.

“Indeed, industry data sources point to a noticeable increase in mortgage applications at the start of the year, while surveyors also reported a rise in new buyer enquiries,” he said.

However, Gardner warned that near-term prospects were nonetheless “uncertain” due to a lack of clarity about the future path of interest rates.

“Borrowing costs remain well below the highs recorded last summer but, if the recent upward trend is sustained, it threatens to restrain the pace of any housing market recovery,” he said.

“While the squeeze on household budgets is easing, with wage growth now outstripping inflation by a healthy margin, it will take time to make up for the ground lost over the past few years, especially given consumer confidence remains fragile.”

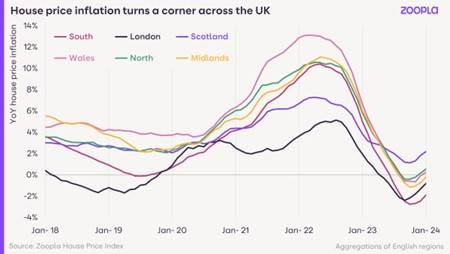

Housing Market recovery continues says Zoopla

Housing market activity continues to improve at the start of 2024

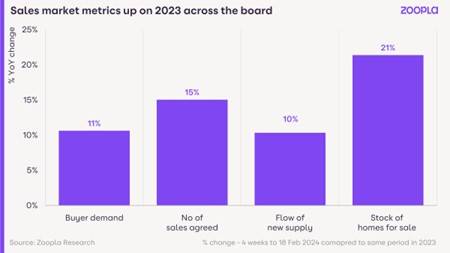

All measures of sales market activity are improving as pent-up demand returns to the market.

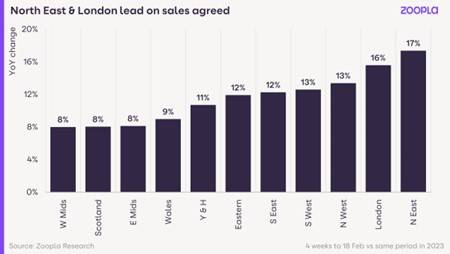

15% more property sales agreed

The number of sales agreed - one of the most reliable indicators of housing market health - is 15% higher than a year ago.

This uplift shows greater confidence to move house and more realistic pricing from sellers.

The chart shows the year-on-year percentage change in agreed property sales in UK regions.

11% uplift in buyer demand

Meanwhile, buyer demand is 11% higher than a year ago as buyers return to the housing market in 2024.

21% more homes for sale

Growing confidence among sellers is boosting the number of homes for sale, now 21% higher than a year ago.

This is increasing choice for would-be buyers and supporting the uplift in completed sale numbers but will keep pressure on prices.

Fewer asking price reductions, but they remain above average

A proportion of sellers are reducing their asking price as a way to attract more buyer interest.

These reductions are less common than a year ago but still above average, showing that buyers continue to be price sensitive in the face of high mortgage rates.

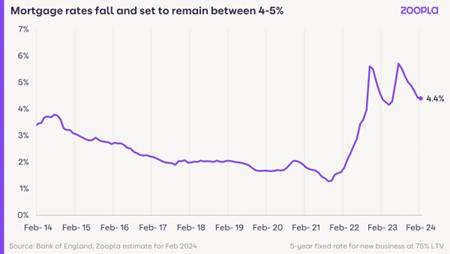

Mortgage rates fall but remain above 4%

Mortgage rates falling back to where they were a year ago has been instrumental in improving housing market sentiment and activity in recent weeks.

Faster earnings growth and rising incomes are also starting to offset higher borrowing costs, albeit slowly.

Zoopla expects mortgage rates to stay between 4% and 5% for much of 2024. Lenders have been taking any deals below 4% off the market most recently, due to a modestly increased cost of finance for them. This signals that house price rises will remain between 0% and low single-digit rises.

Zoopla’s consistently held view is that 5% mortgage rates are the tipping point to create annual house price falls, while rates over 6% for a sustained period would lead to double-digit falls.

What to expect in the housing market in 2024

There’s clear demand from homeowners and first-time buyers looking to move or buy their first home in 2024. This will support higher sales volumes but don’t expect house price growth to be any greater than it is now.

The housing market is still adjusting to higher mortgage rates and reduced buying power, the impact of which has varied across the country.

If you’re planning to sell your home this year, remain realistic on pricing and celebrate the fact that your home is likely to attract more buyer interest now than last year. This increases the likelihood of a successful sale.

If you’re planning to buy a home, expect mortgage rates to remain within the 4% to 5% range. They could move a little lower over the year, but this hinges on the Bank Rate and if (and when) it’s cut later in the year.

Momentum in the sales market has been building over the last five months. Zoopla believes the housing market is on track for 10% more sales in 2024 than in 2023.

So, it would appear that two of the major players in the property industry and striking a cautiously optimistic outlook for the market in 2024

What has happened in SK8 and SK3 during the last month?

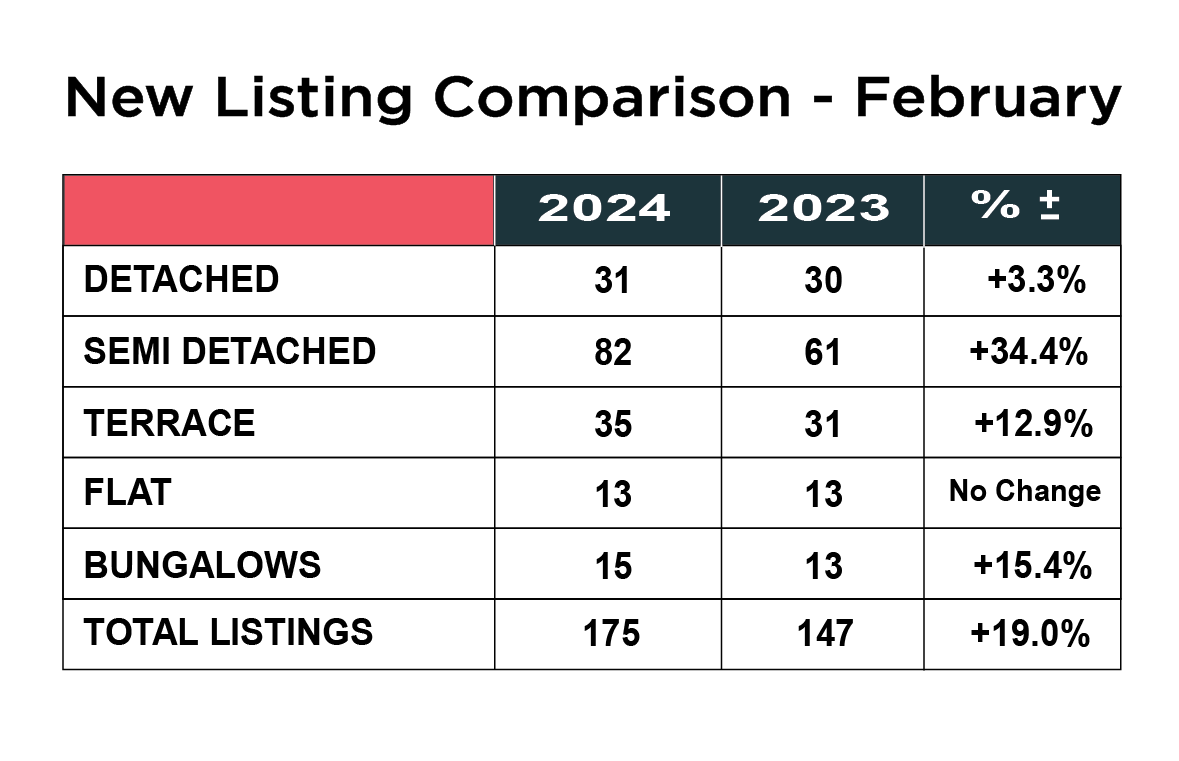

February has been a good month for new listings in the SK8 and SK3 for us personally and it would appear that this has been replicated across other agents looking at the monthly performance figures.

As we have seen nationally, the number of new properties coming onto the market continues to rise. The rate of increase slowed in February, compared with the 45% increase in new stock in January, but still up a very healthy 19% at 175 properties, compared with 147 in February 2023.

Breaking the figures down by property type, the biggest increase was in the number of semi-detached homes, which increased from 61 last year to 82 this February – an uplift of 34%. The number of new bungalows coming onto the market was up 15% from 12 to 15 and the number of terraced homes up 13% from 31 to 35. The number of detached homes was up just 3.3% from 30 to 31 and there was no change in the number of flats, which remained constant at 13.

Whilst the number of new instructions is always welcome, it does of course increase choice for the fewer buyers who are currently looking and that means it will be important for sellers to remain realistic in their pricing expectations.

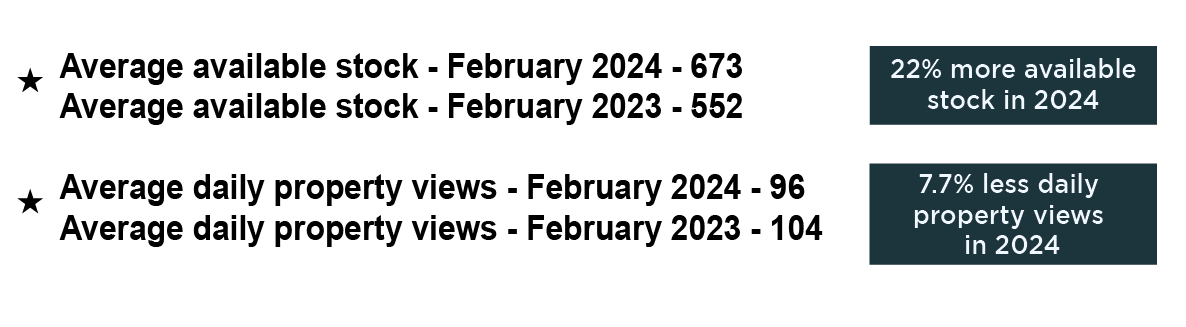

Stock levels rise again, but buyer interest remains muted

The second set of figures are very telling and remain the biggest challenge for home sellers in 2024.

The average available stock in February 2024 was 673 up from 658 in January and against 552 this time last year. The is a 22% uplift on last year. To put some context on this – that is almost 25% more homes available in 2024 and the problem is for those sellers who have had their homes on the market for a few months without attracting a buyer, it is only going to get harder, as those listing now are usually at prices below the existing stock to reflect current market conditions.

The number of daily property views on Rightmove rose in January for the first time in over a year, however with a number of lenders pushing up their mortgage rates in the last month, this seems to have affected buyer confidence and the number of daily property views on Rightmove has dropped back down to 96 from 104 last February – a drop of 7.7%. This is evidence that the local property market is still in a precarious position and could go either way depending on economic factors, especially interest rates.

What is happening with individual house type prices in SK8?

The average price of a house in SK8 is now £363,265 which is almost £4,000 down on last month, and 1.3% up year to date.

As we state every month, all of the indexes run several months behind, in particular the Governments own data from the Land Registry, which shows actual sold prices and is our preferred indices of choice, so these figures might be slightly lower in reality and the general trend is definitely down, albeit the rate of decease has started to slow.

When we break it down by property type, detached homes now stand at £515,035 which is up 3.8% on twelve months ago. Semi-detached homes are now an average of £367,687, up 0.3% on a year ago. Terraced houses now average £316,075, which is up 9% on the previous twelve months. Flats are actually down 4.6% year on year and now stand at an average of £178,614. This is clear evidence that prices are dropping slowly.

What changes have there been to individual house prices in SK3?

It is a similar pattern in SK3. Prices are down in every different category of property. The average price of a property is now £241,799, which is up 6.2% year on year, but down from 6.9% last month.

Detached homes now stand at an average value of £373,062, which is still up 6.2% year on year, however, is a substantial £11,000 down from the previous month. Semi-detached homes now average £267,138, which is up 2.5% year on year. Terraced houses are now an average of £216,163, up 7.2% from this time in February 2023 and flats now average £168,698, which is up 2.2% on the same period last year.

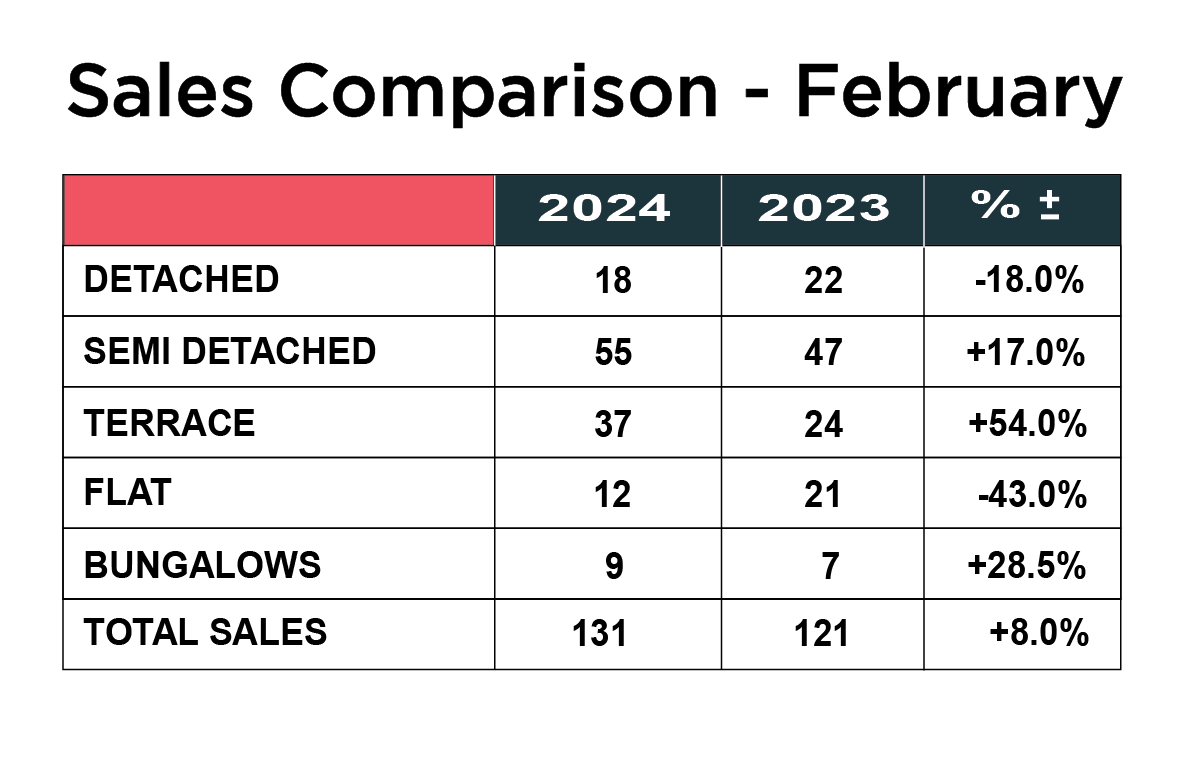

New sales up in February – but rate of increase falls significantly

Following the 35% increase in the number of sales in January 2024 over the same period last year, February was a bit of a damp squib by comparison, although in fairness the number of sales was still up on the year before, rising a modest 8% from 121 to 131.

When we look at the individual breakdown of property types, the biggest increase was in the number of terraced properties sold, up from 24 last year to 37in 2024 – a big increase of 54%. There was also a healthy 29% increase in the number of bungalows sold, up from 7 to 9. There was a 17% increase in the number of semi-detached homes sold from 47 last year to 55 in 2024, but there was also a significant drop off in the number of flats sold, dropping 43% from 21 in 2023 to just 12 in 2024 and an 18% drop in the number of detached homes which were sold, down from 22 to 18.

Despite the number of new homes coming onto the market, the sales figures are a little disappointing and a reflection on a still weak buyer sentiment and a nervousness to commit, whilst interest rates remain higher than for a number of years.

Renting in SK8 and SK3

Renting remains extremely difficult in SK8 and SK3, with a chronic lack of supply being the biggest issue.

In SK8 rents have flat lined year on year in overall increases, but the average yield is a healthy 5.05%. The average rent for a house is £1506 and for a flat it is £946 per calendar month. In SK3 rents are up 0.6% and average yields are a healthy 5.57%. The average rent for a house in SK3 is £1083 and £829 per calendar month for a flat.

If you are a landlord with a property to rent out, we would love to hear from you, as we have a huge database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees.

Summary

Despite the positive start to the year in January and many property market commentators talking the market up, February failed to hit the heights, so we will watch what happens in March very closely.

The Chancellor will set out his budget today, so it will be interesting to see if there is anything in there to help house buyers, but it seems his idea of 99% mortgages is of the table, after it received a very lukewarm reception from many, especially lenders who dismissed the idea completely. Let’s see if Mr Hunt has any other rabbits to pull out of his hat!

Whilst major stakeholders such as the Nationwide, Halifax, Zoopla and Rightmove are quite bullish about the national picture, our view of the local market is quite clear.

The number of serious buyers remains low. The number of available houses to buy remains high and is increasing month on month. That is not a recipe for a better market, and it is imperative that sellers ensure their properties are competitively priced when they go on the market, or if they have been on for some time, are brought down in line with current conditions. Our experience over the last month is quite a few of the properties that have come on the market and attracted good interest and been sold in a matter of days. Those that have come on at over optimistic prices are just sitting there and not getting the views. Those that have been on the market 6-8 weeks or longer, without any positive interest, need to review the price, to ensure the property remains competitive, along with the marketing strategy, to attract more eyeballs.

At the risk of sounding like a gramophone record, our advice to home sellers remains the same. Price your home to reflect the current market from the outset. There is no mileage in the old “we aren’t in a hurry so happy just to stick it on the market and see” That is not a good strategy in the current climate and could ultimately cost you money. All the metrics show that the market is remaining resilient, but prices are coming down. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same? We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and money in the long run.

It is also so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Online agents such as Strike and Purple Bricks are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or good practice.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has ahead of a move in 2024 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street? You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.