The March merry go round has been in full swing and house prices have been front and centre of much debate, discussion and conjecture, as all and sundry try to interpret the data and trends, to predict what direction property values will be travelling for the rest of 2023 and beyond.

With no sign of things getting any better economically, in fact March saw an unexpected spike in inflation, which in turn led to a further base rate interest rate rise from the Bank of England to 4.25%, which of course impacts on mortgage rates. On top of this we saw an end to the Governments Help to Buy scheme for first time buyers and with the UK government energy bill relief scheme ending on the 1st April 2023, this is sure to place more pressure on household budgets.

House prices record seventh consecutive monthly decline in March

If that wasn’t depressing enough, house prices recorded their seventh consecutive monthly decline, down 3.1% year on year in March, the largest annual decline for 14 years since July 2009. Commenting on the figures, Robert Gardner, Nationwide’s Chief Economist, said “March saw a further decline in annual house price growth, with prices down 3.1% compared with the same month last year. March also saw a further monthly price fall, which leaves prices 4.6% below their August peak (after taking account of seasonal effects)”

“The housing market reached a turning point last year as a result of the financial market turbulence which followed the mini-Budget. Since then, activity has remained subdued – the number of mortgages approved for house purchase remained weak at 43,500 cases in February, almost 40% below the level prevailing a year ago.

“It will be hard for the market to regain much momentum in the near term since consumer confidence remains weak and household budgets remain under pressure from high inflation. Housing affordability also remains stretched, where mortgage rates remain well above the lows prevailing at this point last year.

House price growth slowed in all UK regions

“Our regional house price indices are produced quarterly with data for Q1 (the three months to March) showing a further slowdown in annual house price growth in all regions. Indeed, nine out of our 13 regions recorded annual house price declines in Q1.”

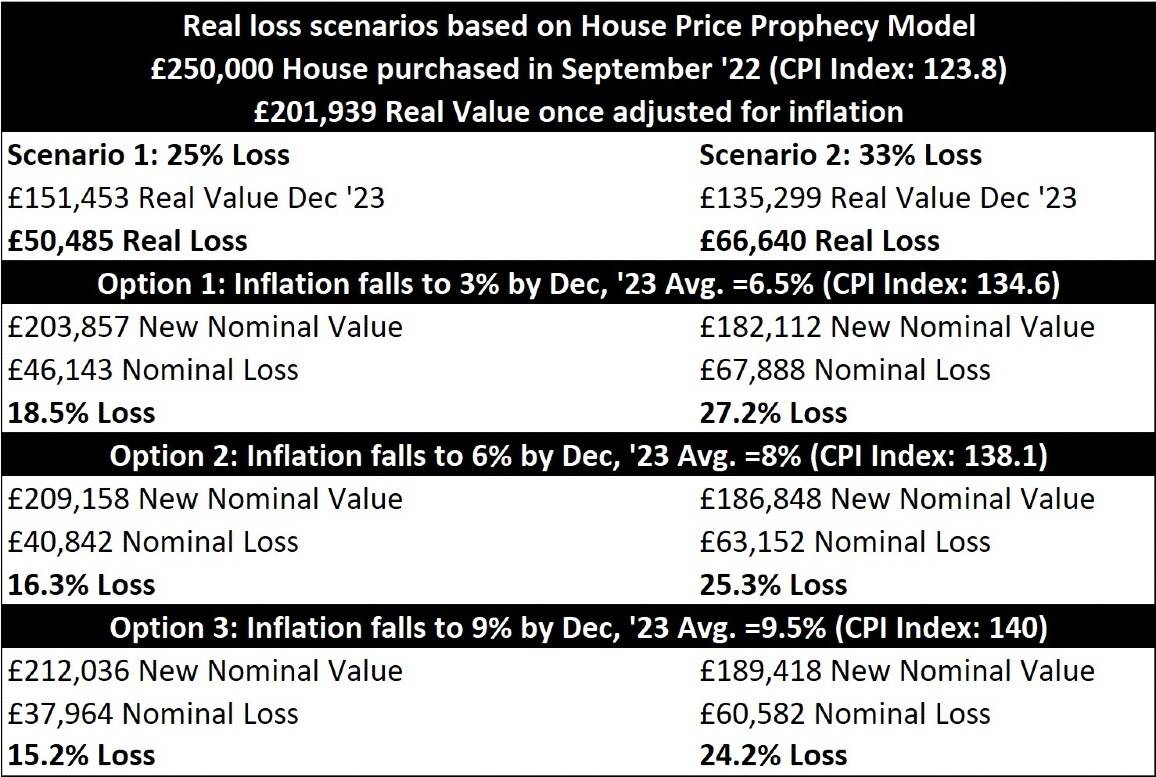

The Nationwide is one of our preferred indices, as they tend to be consistent and reflective of what we are seeing in our own market, however there have been a number of other wilder claims including from Richard Donnell, research Director at the property portal Zoopla who suggested he can house prices drifting sidewards for a decade! Another new study from the European Central Bank suggesting nominal house prices could fall back as much as 40% in 2024. We also had the chart below from the Housing Stig, with a number of scenarios that could play out, none of which were particularly good news for home owners and sellers.

Mortgage approvals on the increase

However, to counter all this negativity, net approvals for house purchases in the United Kingdom, often an indicator of future borrowing, increased to 43,500 in February 2023, up from 39,600 in January. This was the first monthly increase in mortgage approvals for house purchases since August 2022, despite the rising cost of living and higher borrowing costs. Meanwhile, approvals for remortgaging, which only include remortgages with a different lender rose to 28,100 in February from 25,400 in January. The effective interest rate or the actual interest rate paid on newly drawn mortgages was 4.24%, whilst the rate on the outstanding stock of mortgages rose to 2.64%

Trying to make some sense of the conflicting data, it is clear that despite the financial pressures, there are still a reasonable number of people wanting to move. What we are seeing is lower numbers, but the quality of those looking remains high. Obviously what happens with inflation over the coming months is hugely significant, as this impacts on affordability and disposable income. Wages are clearly not keeping pace with inflation and whilst unemployment, is running at around 3.7%, one of the lowest figures since 1974, we don’t envisage there will be the collapse in the local property market or the huge price drops some experts are predicting. However, the situation is extremely fluid and changing constantly, so making predictions is a little risky.

Is it a buyer or seller’s market?

The number of price reductions in the first 11 weeks of the year has more than doubled compared with a year ago, according to the housing market analysts TwentyCi.

The number of reductions is now, more or less, back to 2019 levels. Prices, though, are not — although they are heading that way.

Andrew Wishart, senior property economist at consultancy Capital Economics says: “In real terms, house prices have already fallen by 11.5 per cent, taking them back to the same level as in mid 2020. But with mortgage rates now higher, a further adjustment in prices is necessary.”

However, there is no guarantee that prices will fall in a straight line and, while the trend is down, in certain locations, homes are likely to hold their prices better than others, as we have seen locally.

Spring is traditionally the best time to sell a home and there are early signs that it could be a bright spot in the calendar for sellers, with buyer confidence seemingly slowly returning and fixed mortgage rates finally recovering from the so-called mini-budget. The next couple of months could end up being the best that estate agents and sellers get this year.

The fact is that each downturn has its own unique characteristics and this one is no exception. Homeowners don’t have as much debt as they did in 2009. Another myth is that buyers can time their purchase to the bottom of the market. History tells us that those who hold out for the bottom often miss it and end up buying as prices rise the other side of the trough.

What’s more, it makes no sense for buyers to wait for prices to come down further if rising rents are eating their deposits or waiting to buy low while holding out for a higher price for their own home.

Another myth is that there will be lots of sellers desperate to sell. There will be some, but equally there are plenty of homeowners with enough equity to be able to sit and wait out the downturn.

In 2021 some 37 per cent of properties were owned outright without a mortgage, according to the Office for National Statistics; meanwhile, many of those with loans are on low loan-to-value deals after a long period of sustained property price growth.

Of course, there will always be those driven by death, divorce and debt who will need to sell and there will sadly be some distressed sellers.

The bottom line is that if you want to move, you need to get real to do the deal. Price realistically to sell, bid reasonably to buy. Prices are falling but sellers aren’t giving houses away. Meanwhile, buyers’ budgets are squeezed. Neither side should play games to the extent they risk losing the sale they want.

So, after looking at the National picture, it’s now time to look in more granular detail at what is happening in the SK8 and SK3 property market.

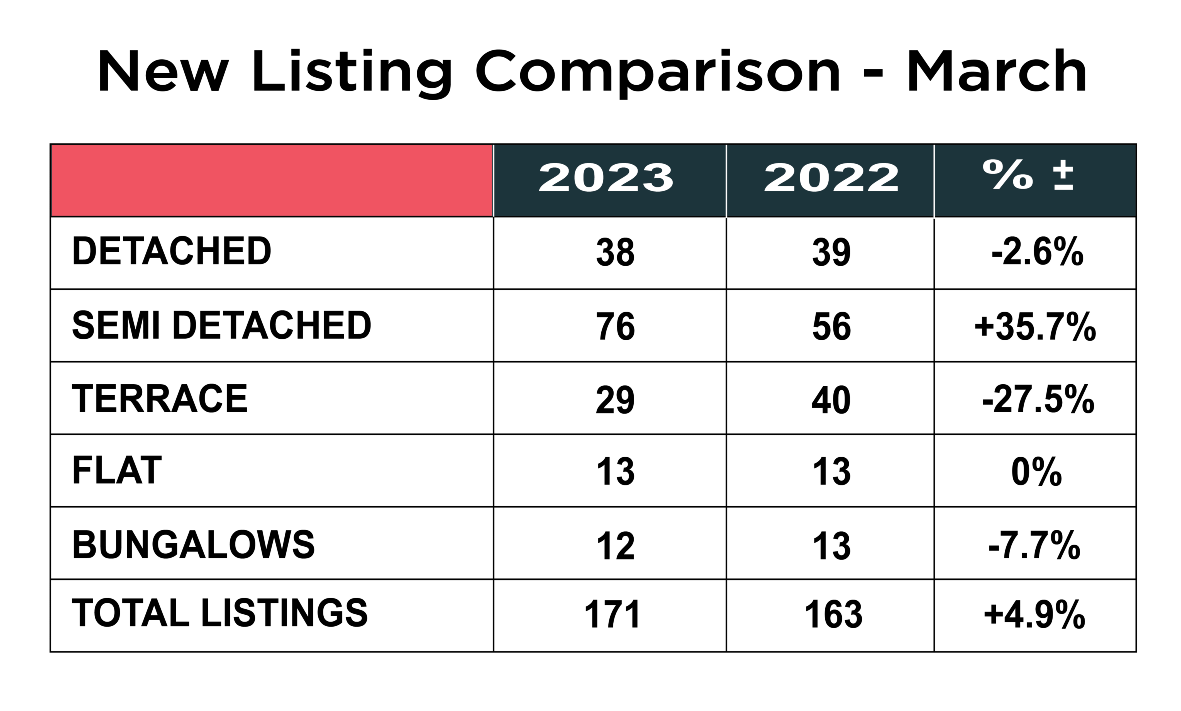

New listings continue to rise

Looking at our first graphic, after a drop in February on the previous year, in March listings were up almost 5% on the previous March from 163 in 2022 to 171 in 2023. The biggest increase was in the number of semi detached homes coming onto the market, up 35.7% on last year, whilst the biggest drop was in the number of terraced homes, which were down 27.5%. There was little change in the number of detached homes, flats or bungalows.

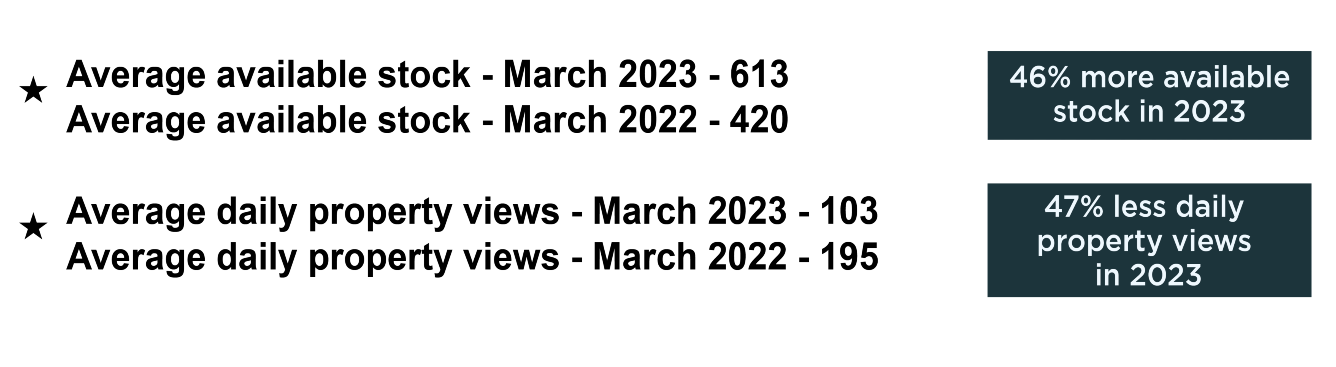

Buyer interest remains subdued

Our second graphic perhaps is the most telling. The average available stock throughout March was 613, up a whopping 46% from 420 in 2022. With the number of new listings on the rise as well, this will create much more choice for buyers and sellers will need to be competitive with their asking prices or may struggle to sell. The number of daily property views on Rightmove, which is a barometer for gauging buyer interest remains very subdued, shows that there were only 103 in March 2023, compared with 197 last March, a drop off 47%. The stand off mentioned earlier in the piece seems to be continuing!

House prices drop back slightly in March

Although house prices are still holding firm in SK8, March showed the first slow down with the rate of increase dropping for the first time in many months. The average price of a home in the SK8 postcode now stands at £371,548 up a healthy 12% year on year. Detached homes are now an average of £506,191, whilst semi detached homes are worth an average of £378,908 up 17% year on year which is quite something considering where things are! Terraced homes are an average of £297,459 and flats £193, 973 both showing double digit year on year increases.

Prices in SK3 are also holding firm with the average price of a home now standing at £232,924 up 9% year on year. Detached homes have seen the biggest rise up almost 25% and now standing at an average of £424,111, whilst semi detached homes average out at £266,370, terraced homes at £205,380 and flats £145,739.

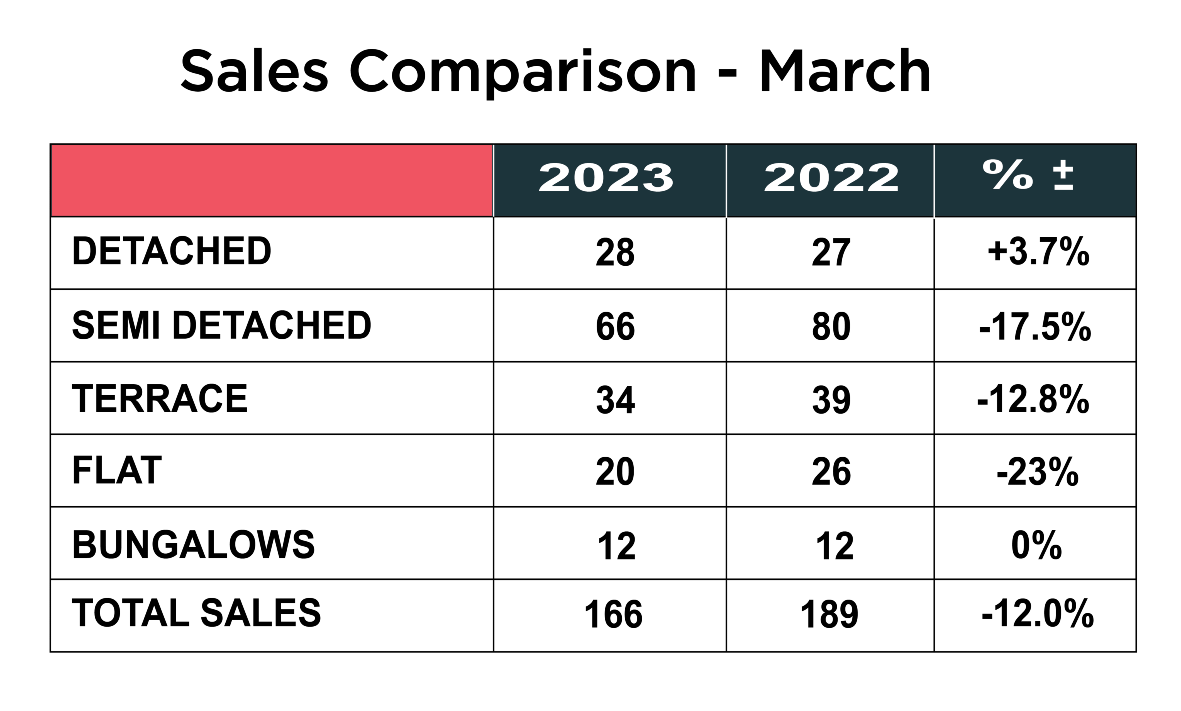

Sales down in March

The number of sales across SK8 and SK3 were down 12% overall from the previous March, down from 189 to 166. Interestingly, there was a modest increase in the number of detached homes sold, up 3.7%, but the number of semi detached homes, terraces and flats were all well down on March 2022.

Summary

As we reach the end of Q1 we find ourselves in a strange position. The national picture seems to be getting worse, with price drops accelerating, as buyers continue to remain unimpressed and the numbers looking well down on what could be expected for the time of year.

With the volume of available stock increasing, whilst the number of sales is dropping, we feel Q2 will be tougher for those sellers who refuse to acknowledge the shift in the market and continue to hold out with unreasonable expectations. It is important for agents to also be honest with sellers and manage those expectations, rather than pander to them just to get the listing in the first place.

Inflation and affordability remain the biggest problem and pressure on household budgets and rents, whilst wages stagnate and buyers finding it harder to save for a deposit and meet rising mortgage repayments.

Despite all the negative aspects in the press to buying a home right now, we get the feeling that there is a will and intent to buy and the increasing number of mortgage approvals is testament to this. Hopefully the recent rise in inflation was a blip and if that starts to come down in the next quarter and interest rates stabilize, we think we will see a lot more buyers tempted back into the market sooner rather than later.

What is also important for sellers is choosing a well-established, experienced agent who is used to operating in more challenging markets and is equipped with the widest marketing mix to reach the serious buyers looking at the moment. Simply listing a house on the property portals such as Rightmove and relying on those enquiries, when they are 50% down is not going to cut it. Agents now need good social media presence, an established database, and groups of pre-qualified buyers ready and waiting for the right home to come on to the market, whom they are in contact with constantly.

If you are undecided on whether now is the right time to sell or you would like to know where you should position your asking price to sell in 2023, please contact Joe, Patrick or Maurice and arrange for a FREE market appraisal of your home on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.