May has been a seismic month. The football season is over with Manchester City crowned champions again for a record fourth time in a row, but the real big news for Cheadle home sellers and buyers, was just as the economy showed some signs of stabilizing, the surprise announcement of a snap general election on July 4th by prime minister Rishi Sunak, the political frenzy that has caused and of course the potential ramifications for the housing market, which we will look at in more detail in our monthly in depth look at the local property market nationally and of course in SK8 and SK3.

As always, we will look at the data from the Nationwide Building Society and the property portal Zoopla, to get an overview of the national picture, before breaking down the local data for SK8 and SK3 in granular detail to try and give our local home sellers, buyers, tenants and landlords, a sense of local perspective.

Modest rebound in house price growth in May as market shows resilience

UK house prices rose 0.4% month on month in May

Annual growth rate picked up to 1.3%, from 0.6% in April

Average Price £264,249 (not seasonally adjusted) £261,962

* Seasonally adjusted figure (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“UK house prices increased by 0.4% in May, after taking account of seasonal effects. This resulted in a slight pickup in the annual rate of house price growth to 1.3% in April, from 0.6% the previous month.

“The market appears to be showing signs of resilience in the face of ongoing affordability pressures following the rise in longer term interest rates in recent months. Consumer confidence has improved noticeably over the last few months, supported by solid wage gains and lower inflation.

Will the election impact the housing market?

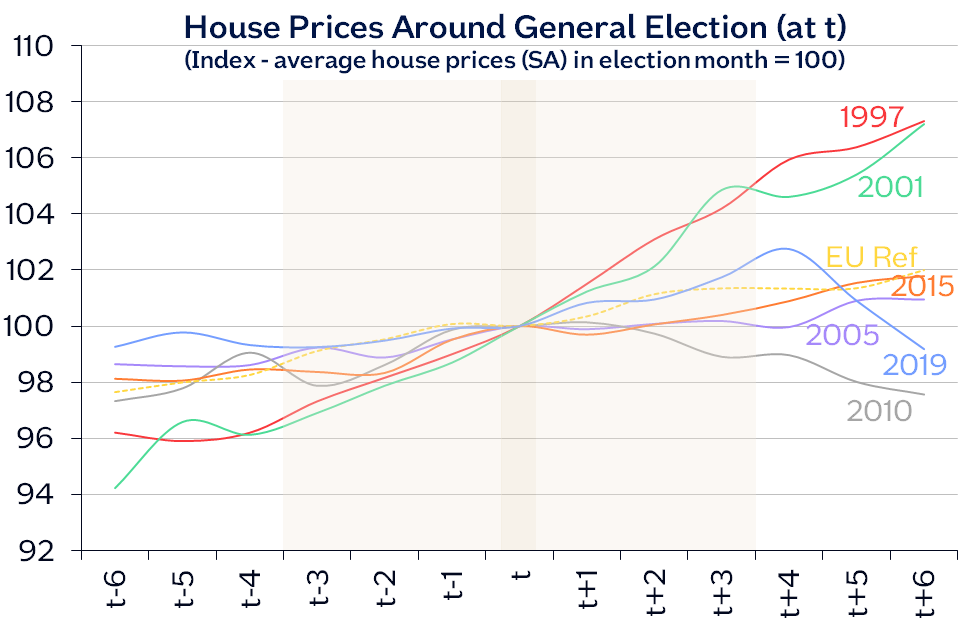

“With the recent announcement that the UK general election will take place on 4 July, we have analysed house price movements in the months around previous elections, and also the 2016 EU referendum.

“As the chart below illustrates, past general elections do not appear to have generated volatility in house prices or resulted in a significant change in house price trends.

“In the chart we have indexed average house prices, so they equal 100 in the election months in each of the years shown. We can then compare house price movements in the six months leading up to each election (t-6 to t-1) and following each vote (t+1 to t+6).

“On the whole, prevailing trends have been maintained just before, during and after UK general elections. Broader economic trends appear to dominate any immediate election-related impacts.

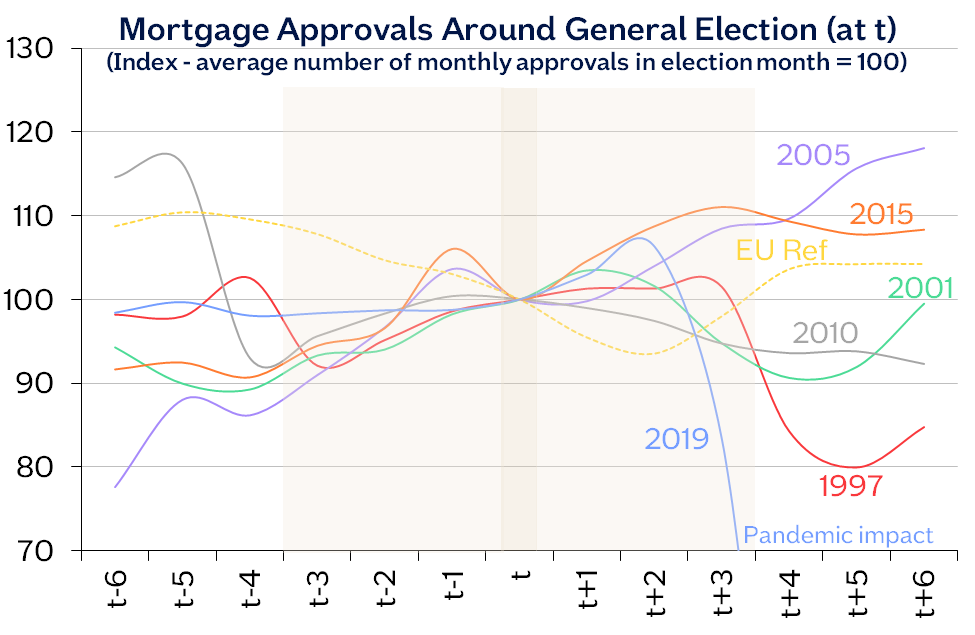

“We also examined how activity, in particular house purchase mortgage approvals, responded to past UK elections (see chart below). Here the picture is less clear but again there doesn’t seem to be any tangible impact in the three months either side of a general election.

“2019 is a notable exception, but this was due to the impact of the pandemic, with the initial lockdown in 2020 suppressing housing market activity. Activity subsequently bounced back once restrictions began to be lifted.

“It appears that housing market trends have not traditionally been impacted around the time of general elections. Rightly or wrongly, for most homebuyers, elections are not foremost in their minds while buying or selling property.”

One thing which may continue to dampen buyer demand is rising debt

A sharp rise in debt repayments was recorded in April as cost-of-living pressures continue to bite, Nationwide’s Spending Report shows.

Customers repaid unsecured debts of £735 million in April – a 25 per cent year-on-year rise, while the number of transactions to debt repayment increased by 14 per cent. Many consumers have been using credit to help them deal with rising costs. On average those with a credit card are repaying £391 per month, while repayments to car finance are £267 and personal loans £195. However, it isn’t all bad news, with inflationary pressures easing, meaning some may find themselves in a better position to further reduce outstanding debts.

Zoopla’s Property index for May is equally cautiously optimistic with a few caveats!

The average house price in the UK according to Zoopla is £264,300 as of April 2024 (published in May 2024).

Property prices have remained the same month on month and have fallen by 0.1% (£210) compared to a year ago.

Annual inflation rate helps keep house prices broadly unchanged over the last year

The pace of annual price inflation has improved modestly over the last 3 months, with our latest House Price Index showing that house prices remained mostly unchanged in the year to April 2024, falling by -0.1%. There remains a clear divide between continued small annual price falls across southern England and the rest of the UK, where house prices are posting modest gains.

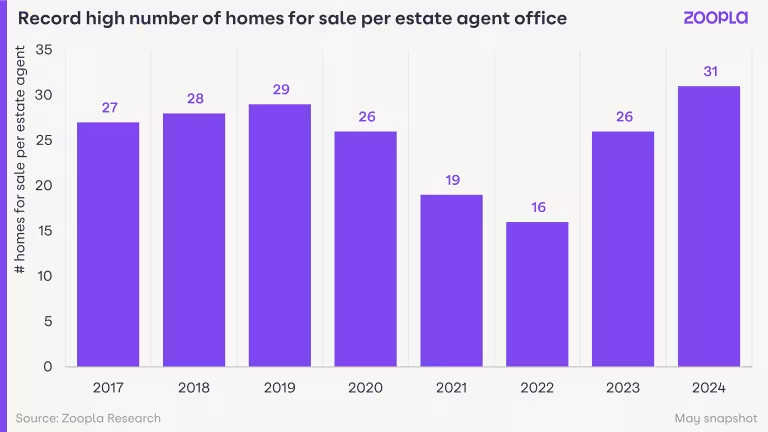

Highest numbers of homes for sale in last 8 years

As sellers return to the market in growing numbers, there are more homes for sale than at any point in the last eight years. The average agent has 31 homes for sale, up 20% on this time last year.

Following a shortage in the pandemic, the supply of 3 and 4-bed family homes has rapidly increased leading in turn to a large increase in the to the value of homes for sale. There are currently £230bn worth of housing on the market, 25% higher than a year ago.

Many existing homeowners delayed moving decisions in the second half of last year, due to concerns about the impact of higher borrowing costs on house prices and buyer demand. The recent decline in mortgage rates, together with rising sales volumes and firmer pricing, has brought more sellers back into the market, many of whom are also buyers.

Most homes currently for sale are new-to-market. But, as demand for homes fell over the second half of the year as mortgage rates jumped higher, it's important to note that 31% of homes currently available for sale were also listed in 2023 but failed to find a buyer.

Two-fifths (43%) of these homes have had their asking price cut by more than 5% to attract demand. This highlights the importance of correctly pricing your home from the outset, rather than aiming too high and not attracting buyers.

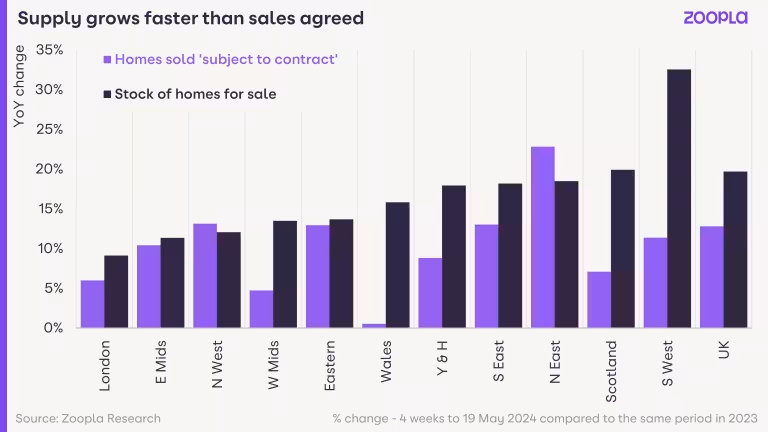

Sales are up but not as much as new supply

Sales volumes are continuing to recover back towards the long-run average., with the number of homes achieving a sale agreed 13% higher than this time last year. The other notable trend is that the number of homes for sale has generally grown faster than the increase in sales agreed. This replenishes the supply of homes for sale and means more choice for buyers.

Will the General Election have an impact?

The announcement of the general election on 4th July 2024 has come earlier than many expected. Elections normally lead to increased uncertainty and some stalling in market activity.

There are currently 392,000 homes in the sales pipeline working their way through to completion over 2024. This is 3% higher than this time last year and we don’t expect to see buyers already in the process of progressing to sales completions pulling out.

The desire to move remains for many households, first- time buyers in particular, who are looking to escape the rapid growth in rents in the private rented sector. Similar is true of up sizers, many of whom delayed moving last year when mortgage rates moved higher.

The election announcement is likely to stall the pace at which new sales are being agreed in the coming weeks, as we run up to the start of the summer slowdown.

Most buyers who are well into the home buying process close to agreeing a sale will ideally want to push through and agree sales now. Those who are earlier in the process may look to delay decisions until the autumn after the election is over.

Overall, Zoopla doesn’t see the election having as big an impact as in previous years, particularly as there is not a huge divide in policy between the two main parties.

There are also few specifics on housing, other than a focus on reforming the private rental sector and boosting housing supply. However, sales completions over 2024 may now fall slightly short of the 1.1m we expected for 2024.

What businesses and landlords will want to see from all political parties are concrete plans for how we can boost housing supply across all tenures, while getting the right reforms into the private rented sector to ensure we maintain supply while giving renters more protections.

Rising supply set to keep house price inflation in check

The growth in available supply is welcome news. After several years where lack of supply limited sales volumes and pushed up house prices, a return to greater availability will support the growth in sales.

However, Zoopla expects this expansion in supply to keep house price inflation in check over the remainder of 2024.

The latest index finds that annual UK house price inflation remains slightly negative at -0.1%. There has been an increase in house price inflation over the last quarter (+0.4%) in response to more sales and firmer pricing, but this quarterly growth rate has slowed over the last month, so Zoopla expect UK house price inflation to be flat over 2024 as a whole.

So, now that we have reviewed the National picture, what does this all mean for the local market in SK8 and SK3 market during May and let’s try to work out what is ahead for the property market as we close in on the General Election.

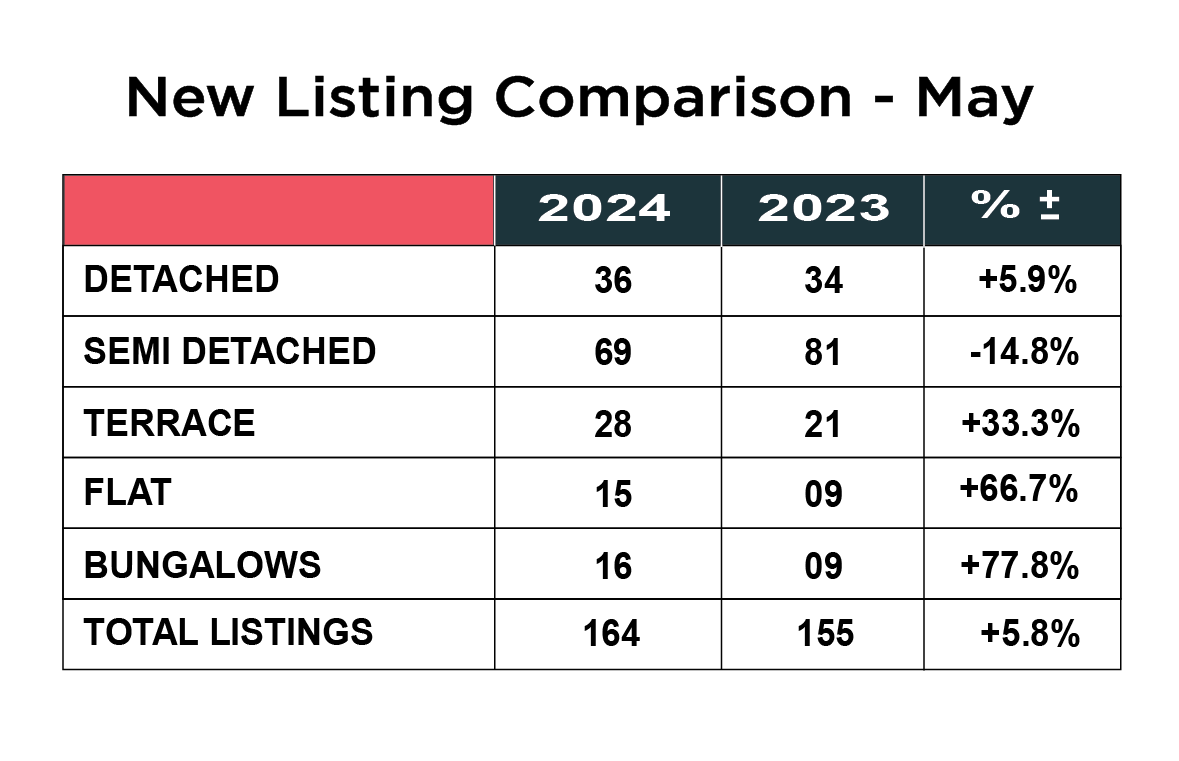

The number of new listings was very similar to April 2024, 164 in May and 165 in April, but up slightly on the previous May by 5.8% up from 155.

Taking a closer look at the individual breakdowns of properties coming onto the market, the biggest increase was in the number of bungalows, up 77.8% from 9 in 2023 to 16 in 2024, closely followed by the number of flats, up 66.7% from 9 in May 2023 to 15 in 2024 and also a significant increase in the number of terraced homes being sold, up 33.3% in 2023, from 21 to 28 in 2024. There was a more modest increase of just 5.8% detached homes coming to the market up from 34 to 36 and finally, the only blip was a reduction in the number of semi-detached homes coming onto the market down from 81 in 2023 to 69 in 2024, a drop of 14.8%.

Taking a closer look at the individual breakdowns of properties coming onto the market, the biggest increase was in the number of bungalows, up 77.8% from 9 in 2023 to 16 in 2024, closely followed by the number of flats, up 66.7% from 9 in May 2023 to 15 in 2024 and also a significant increase in the number of terraced homes being sold, up 33.3% in 2023, from 21 to 28 in 2024. There was a more modest increase of just 5.8% detached homes coming to the market up from 34 to 36 and finally, the only blip was a reduction in the number of semi-detached homes coming onto the market down from 81 in 2023 to 69 in 2024, a drop of 14.8%.

Local buyers remain nervous and reluctant to commit

Although both the Nationwide and Zoopla were painting a cautiously optimistic outlook nationally, both highlighted that buyer interest remained subdued for a number of reasons and that was certainly the case with buyers in SK8 and SK3 and it remains to be seen how they reacted to the general election news in June’s figures.

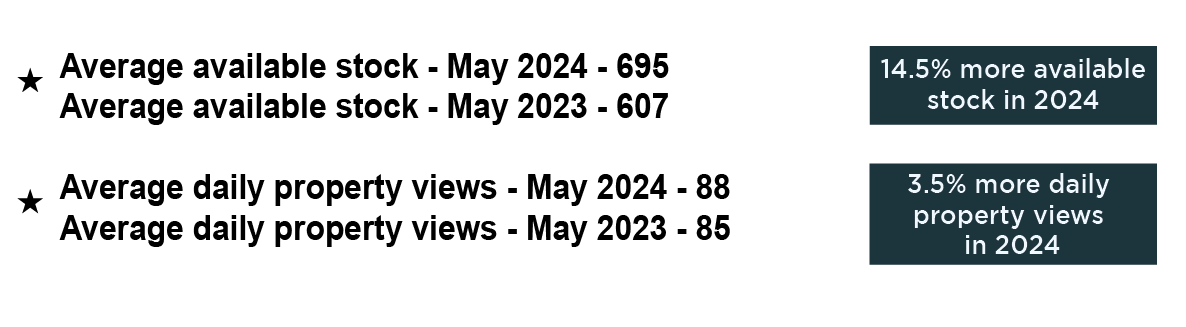

But, as the number of available homes stood at 695 at the end of May, which is 14.5% more homes available than a year ago at 607 - when you put this into context with the same time in 2022, there were only 395 properties available, so it shows how the ratio of buyers to properties has changed quite significantly in the last two years.

This is backed up by the number of daily property views on Rightmove, which have remained pretty consistent over the last twelve months, standing at just 88 in May 2024 against a similar number of 85 in May 2023. This compares with 172 in May 2022, which is a 49% drop in buyers looking at Rightmove on a daily basis.

This is compelling evidence that the local property market is still performing way below what it would normally, and the number of serious buyers is extremely low and impacting on the market.

What house price types are popular in SK8?

The average price of a house in SK8 now stands at £365,945, which is the first time that SK8 house prices have seen negative growth in almost 5 years, down 0.7% year on year.

When we break it down by property type, detached homes now stand at £516,592 which is up 4.6% on twelve months ago. Semi-detached homes are now an average of £367,342, down 1.5% on this time last year. Terraced houses now average £320,861, an uplift of almost £5,000 in just one month! which is up 9.2% on the previous twelve months, and flats now stand at £180,510, an increase of 3.3% on the previous year.

What is happening with SK3 house prices by type?

The average price of a property in SK3 currently stands at £235,981, which is down £3,500 from the previous month, which was also down 4,402 on March, so prices in SK3 have lost around £8,000 in value over the last two months, however they still remain in the black, up 1.8% year on year.

Detached homes now stand at an average value of £321,286, which is £5,000 down on last month and down 12.7% on a year ago. Semi-detached homes now average £267,676, which down 0.6% year on year and down three months running. Terraced houses are now an average of £208,792, almost £4,000 down from April but still up 1.7% this time a year ago, and flats now average £170,743 which is actually up almost £3,000 from last month and up 7.7% on the same period last year.

What is very clear is the prices in SK3 have started to drop in SK3, therefore if you were considering moving, it might be advisable to get a wriggle on!

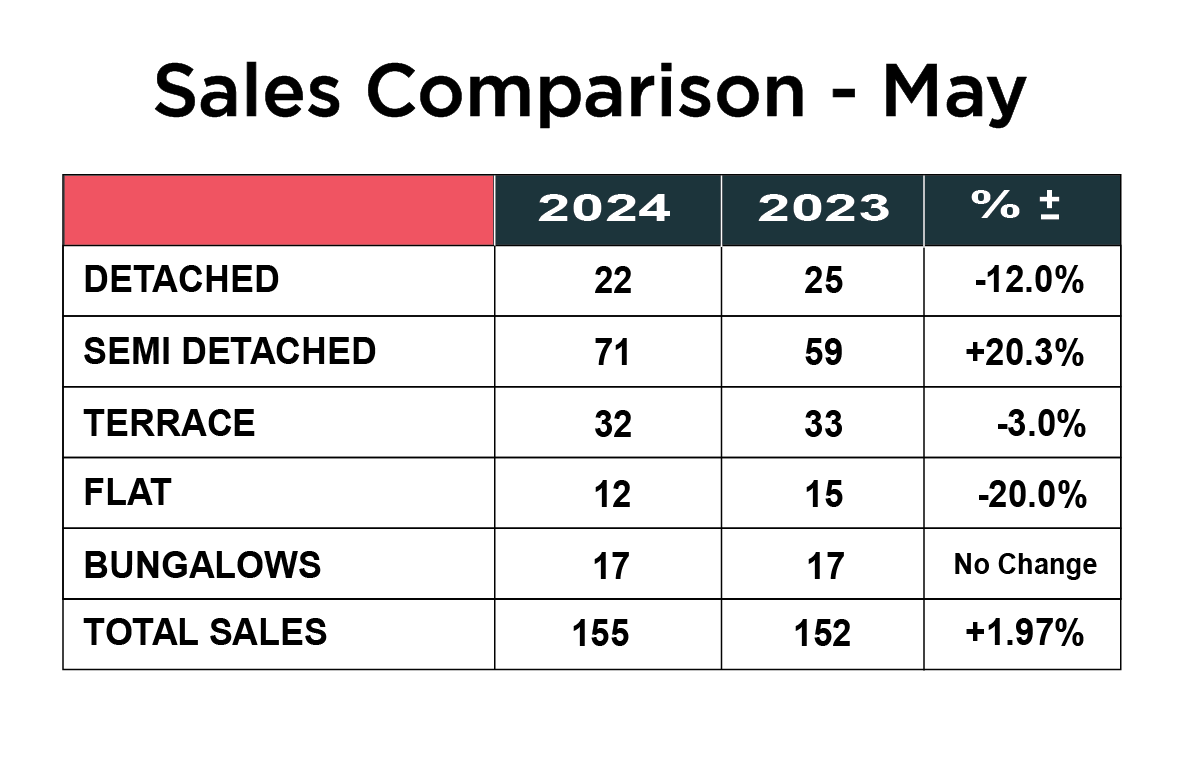

Sales up, but not significantly considering the level of available stock

The number of properties sold across SK8 and SK3 remained virtually the same year on year, 155 in 2024 verses 152 in 2023, a very modest improvement of 1.97%.

The number of properties sold across SK8 and SK3 remained virtually the same year on year, 155 in 2024 verses 152 in 2023, a very modest improvement of 1.97%.

When you consider that there were almost 15% more properties to choose from and in three of the five types of property we look at, there were a % drop, we think this gives a clear indication that the local market is demonstrating resilience but certainly not improving. The only type of property which was showing an improvement in the number of sales was semi detached homes up 20% from 59 last year, to 71 in 2024. The biggest drop off was in the number of flats sold, down from 15 to 12 or minus 20%. The number of detached home sales was down 12% from 25 to 22, and the number of terraces sold down a modest 3% from 33 to 32. The number of bungalows sold remained unchanged year on year at 17.

Renting in SK8 and SK3

The lack of rental stock in SK8 and SK3 remains the biggest issue and is helping to keep rents up.

In SK8 rents have actually dropped very slightly year on year, down 0.7%, but the average yield is a still a very healthy 5.27%. The average rent for a house is £1556 and for a flat it is £944 per calendar month.

In SK3 rents are up 1.8% year on year, they dropped back a little compared with April, but average yields are a healthy 5.75%. The average rent for a house in SK3 is £1094 and £887 per calendar month for a flat.

If you are a landlord with a property to rent out, we would love to hear from you, as we have a huge database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees.

Summary

Whilst both the Nationwide and Zoopla indices saw some green shots of optimism for the national property market, they also highlighted the significant issues of rising debt and more houses on the market, which are keeping a dampening effect on activity and prices.

What we are seeing in SK8/SK3 is the local picture beginning to mirror the national situation more. Buyer interest is not showing any signs of improvement and the stock levels in SK8 and SK3 keep rising. Interestingly Zoopla said that over 31% of the stock currently available, has been on the market since 2023, so a lot of the stock has been available for some time.

For those sellers who have been “testing the market” and aren’t in any hurry to sell they will need to review their strategy to remain competitive, along with the marketing strategy, to attract more eyeballs. If you want to talk to us about your options and how you can refresh your marketing without any obligation, please call 0161 428 3663.

At the risk of sounding like the proverbial gramophone record, I know our advice is the same every month, but we feel it is important to keep re-enforcing this very important message - price your home to reflect the current market from the outset. The longer a property sits there without selling, the more money it will cost you. All the metrics show that the market is resilient but subdued and prices are dropping as you can see in the above data. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same. We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and money in the long run.

It is also so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Online agents such as Strike and Purple Bricks are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or good practice.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has ahead of a move in 2024 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.