June has been one of the hottest on record weather-wise, but the same cannot be said for the property market, as a further 0.5% rise in interest rates from the Bank of England put a dampener on any feelings of positivity. There were a number of notable factors in the local SK8 and SK3 market that suggest despite us previously not being affected quite the same as other areas of the country, the market here may also be starting to slow down, and home sellers will need to think carefully about their pricing strategy moving forward – but more on that later!

Annual UK house prices decline by most since 2009

Even our normally positive go to guys, the Nationwide were talking the market down a little this week, as a sharp increase in mortgage costs is expected to trigger a “significant drag” on the housing market, they warned, as house prices slumped in June.

Property prices fell 3.5% in June on an annual basis but surprisingly edged up by 0.1% compared with a month earlier from £260,736 in May, to £262,239 at the end of June, the data showed.

It comes after more lenders raised mortgage rates on two and five-year fixed deals, following the Bank of England’s increase to the base rate last week.

Robert Gardner, Nationwide’s chief economist, said: “The sharp increase in borrowing costs is likely to exert a significant drag on housing market activity in the near term.”

“House prices remain high relative to earnings, and as a result, deposit requirements are still a significant barrier for those looking to enter the market.”

Nationwide said the average first-time buyer borrowing against a typical property with a 20pc deposit would be spending significantly more of their take-home pay on their mortgage than the long-term average.

Mr Gardner added: “A 10pc deposit on a typical first-time buyer home is equal to around 55pc of gross annual income – this is down from the all-time highs of 59pc prevailing in late 2022, but still marginally above the levels prevailing before the financial crisis struck in 2007/8.

“Despite the higher interest rates available to savers, the sharp rise in rents, together with continued high rates of inflation more generally is continuing to make it difficult for many prospective buyers to save for a deposit.”

Gardner added “A combination of healthy rates of income growth and modest price declines should improve affordability over time, especially if mortgage rates moderate.”

Mr Gardner said that for people coming off two-year fixed-rate mortgage deals, a new two-year deal could equate to an increase of £385 per month for a typical borrower.

Those coming off five-year deals face an increase equating to around £315 per month for a typical mortgage borrower, he said.

He said lenders will work with borrowers to provide assistance wherever possible.

Home sales plummet 27% in May

All this comes as home sales plummeted 27% in May compared with the same month last year.

HM Revenue and Customs (HMRC) figures said the large fall was partly due to the higher number of bank holidays in May 2023, but also represents “the decline in general market conditions in recent months”.

Robert Gardner, Nationwide’s chief economist, said of the annual price fall: “Longer term interest rates, which underpin mortgage pricing, have increased sharply in recent months, in response to data indicating that underlying inflation in the UK economy is not moderating as fast as expected.

“This has prompted investors to expect the Bank of England to increase its policy rate further and for it to remain higher for longer.

“Longer term borrowing costs have risen to levels similar to those prevailing in the wake of the mini-budget last year, but this has yet to have the same negative impact on sentiment.

“For example, the number of mortgage applications has not yet declined, and indicators of consumer confidence have continued to improve, though they remain below long run averages.

Investor Market remains positive

Whilst the domestic market has struggled in the last month, the investment market remains strong as rents continue to rise. Despite house prices dropping, annual rental prices in the UK increased by 5% in May, the highest rate for 7 years.

House prices dropping is to be expected after the extensive growth in the last few years as the market stabilizes to a more sustainable level, but the increase in rents is extremely promising for investors, having been spurred by a combination of factors including rising mortgage rates making it harder for those renting to enter the market, as well as a continuing imbalance between rental stock and demand.

How far will house prices fall in 2023?

There are many so-called experts with wildly differing views and claims about where the market is heading, but we take the view it is nigh on impossible to predict anything where property is concerned.

However, the property portal Zoopla suggests that UK house prices will fall by up to 5% in 2023 now mortgage rates are sitting at between 5% and 6%.

If mortgage rates were to come back to 4-5%, house prices would change by +/- 2% over the course of the year as it’s much more manageable for home buyers.

But the more mortgage rates edge towards and remain at 6%, the bigger the impact on sale numbers and house prices. What’s more, any further boost in the number of homes for sale could signal bigger house price falls are to come in 2023.

What’s happening in SK8 and SK3

So, now we’ve studied the national picture, lets look in more detail at what has been happening in SK8 and SK3 during June. For us at Maurice Kilbride, it has been a reasonable month, it was only after the latest interest rate rise that it started to go a little quieter, before that we were still seeing a good level of listings and sales, with multiple offers on well-priced properties, this despite the number of people looking at houses on Rightmove has dropped off significantly over the last six months and is not showing any sign of improving in the short to medium turn. It is very much a case of quality over quantity, that’s for sure.

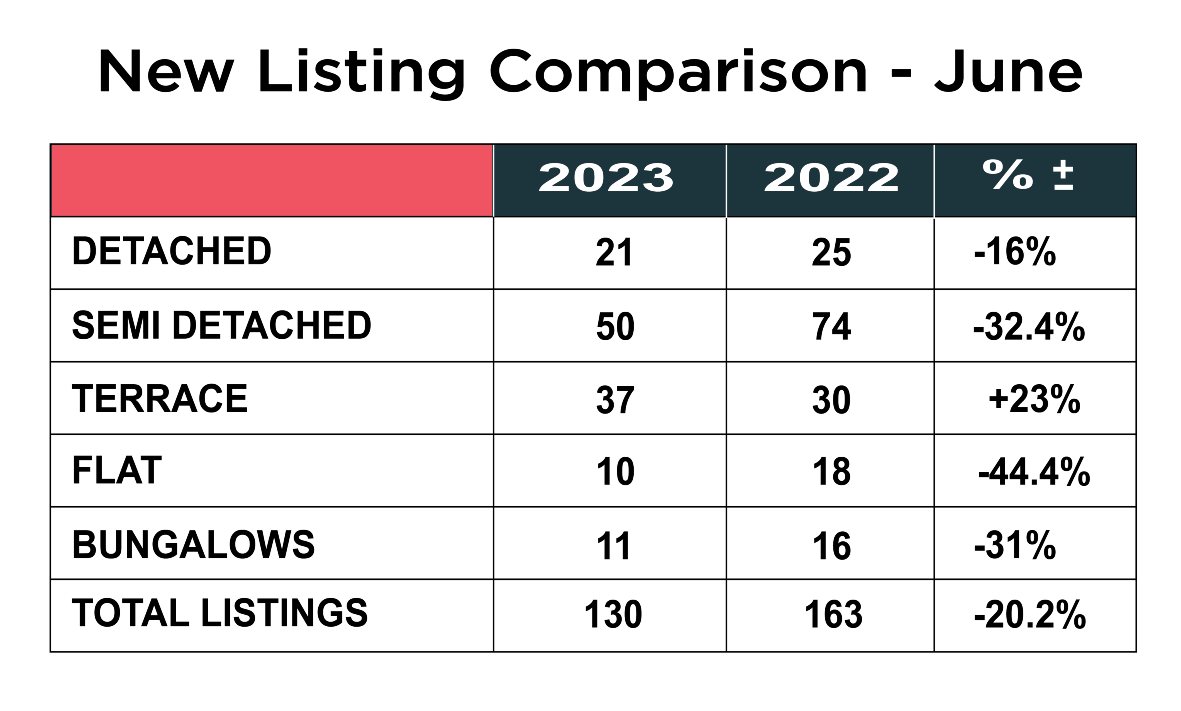

So, let’s kick off with the number of new listings that came onto the market in June.

June saw a significant drop in the number of properties coming onto the market, with just 130 new listings, against 166 in June 2022, which is a 20% drop. At this stage, we cannot be sure if this is a trend or a blip, it could be just all the uncertainty in the market making people nervous, we will have to see how Q3 of the year plays out. Obviously, if stock levels become an issue, it could of course help to keep prices propped up, but if demand drops off as well, then we could be heading for a problem!

There was a drop in the number of detached homes ( -16% ) semi detached homes ( -32% ) flats ( -44% ) and bungalows ( -31% ) on the previous year. Only the number of terraced homes coming onto the market increased ( +23% )

Buyers not motivated or priced out of market?

Our second image shows what is now becoming a worrying graphic as the number of average daily property views hits an all time low of just 74! This time last year there were 189 average daily property views, so the drop off is a massive 61%. This clearly indicates that the increased cost of borrowing, the ongoing cost of living crisis and the constant media speculation about the direction of house prices is having a significant effect on buyer sentiment.

The average available stock in June 2023 was 577 properties, which was up 34% on the previous June 430, but there was 54% more available stock in May, so that would tie in with a lesser number of new properties coming onto the market and a rise in the number of withdrawals and people reconsidering their options.

Changing values by type in SK8 and SK3

The average price of a house across SK8 now stands at £369,576 which despite everything is up 12% on a year ago. We have still not seen any drop in average prices yet. Detached homes dropped back a little last month but came bouncing back in June and now stand at £514,517, which is up £7000 from May. Semi detached homes are now an average of £382,623 up 15% on a year ago, terraced houses average at £299,780, which is up 13% on June last year and flats are up 5.5% to an average of £188,856. With sales picking up a little and stock levels dipping, it remains to be seen what impact this will have on property values for the duration of Q3.

The average price of a house across SK8 now stands at £369,576 which despite everything is up 12% on a year ago. We have still not seen any drop in average prices yet. Detached homes dropped back a little last month but came bouncing back in June and now stand at £514,517, which is up £7000 from May. Semi detached homes are now an average of £382,623 up 15% on a year ago, terraced houses average at £299,780, which is up 13% on June last year and flats are up 5.5% to an average of £188,856. With sales picking up a little and stock levels dipping, it remains to be seen what impact this will have on property values for the duration of Q3.

The average price of a property in SK3 is now £239,039, which is up a very healthy 11.4% from June 2022. Detached homes dropped back somewhat from May 2023 to £423,658, which is still up 39% year on year. Semi-detached homes now average at £274,291 which is up 17% year on year. Terraced houses are now averaging £207,738, up 11% from June 2022 and flats average at £146,545 up 7.2% from last year.

Sales up on previous June, but down from May

Despite many of the other figures across SK8 and SK3 looking a little gloomy, the number of sales remained comparative with June 2022 – 134 sales in 2023, compared with 133 in June last year ( +0.75% ). This is quite an achievement when you consider how few eyeballs there are on Rightmove, but what it does show is that those who are in the marketplace to buy are serious. What appears to have been weeded out are the speculative browsers. Basically, if you don’t have to move, many have appeared to shelve their plans for now.

The number of detached home sales were down ( -12% ) terraced house sales down ( -18% ) with there being no change in the number of flats sold. On the positive side the number of semi-detached homes sold was up ( +4.8% ) and Bungalows up ( +44% )

Summary

Q3 promises to be pivotal for the housing market in SK8 and SK3, which has remained pretty resolute in the first half of the year.

Again, though, we would ask to have some context here and remember that the figures are returning to pre pandemic levels, which were the norm. The pandemic years were artificially propped up by the government, so even a modest correction in house prices should not upset the market.

The elephant in the room remains inflation, which is stubbornly not coming down and keeping the pressure on interest rates, but with employment remaining high, consumer confidence not dipping as much as many are predicting and the number of mortgage approvals still relatively high, there is still reasons to remain positive and optimistic.

What is absolutely non-negotiable for motivated sellers is you must price your property to reflect the market today. You are simply not going to get 2022 prices. What we are seeing is a property that is priced well from the outset is getting good interest, if you get it wrong and over price it, it will simply sit there, and you are immediately on the backfoot. Even reducing the price will not have the same effect. Don’t listen to agents who are simply trying to get you to list with them but over valuing your home, it will backfire big time! You need honesty and a defined strategy that is proven to work.

As we have said many times now, it is more important than ever for sellers to choose a well-established, experienced agent who is has operated in more challenging markets and is equipped with the widest marketing mix to reach the serious buyers looking now. Simply listing a house on the property portals such as Rightmove and relying on those enquiries, when they are 60% down, is not going to expose the property to enough people. Agents now need to dig deep, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2023 and our proven strategy to get you moving, please contact Joe, Patrick or Maurice and arrange for a FREE market appraisal, on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.