As we prepare our in depth look at the local property market for July, we have had our three days of Summer, Wimbledon starts this week and England march or rather limp on in the Euro’s. We are also just a few days out from the General Election, and as we prepare for what is likely to be a change of Government, we will also look at the implications of this for the SK8 and SK3 property market.

As always, we will look at the data from the Nationwide Building Society and the property portal Zoopla, to get an overview of the national picture, before breaking down the local data for SK8 and SK3 in granular detail to try and give our local home sellers, buyers, tenants and landlords, a sense of local perspective. What appears evident is that the property market is showing a higher degree of resilience than many experts forecast.

House price growth broadly stable in June

• UK house prices up 1.5% in June compared with a year ago

• N. Ireland best performing region, with prices up 4.1% in Q2

• East Anglia weakest performing region, with prices down 1.8% over the year

|

Headlines |

Jun-24 |

May-24 |

|

Monthly Index* |

524.8 |

523.8 |

|

Monthly Change* |

0.2% |

0.4% |

|

Annual Change |

1.5% |

1.3% |

|

Average Price (not seasonally adjusted) |

£266,064 |

£264,249 |

* Seasonally adjusted figure (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “UK house prices edged up by 0.2% in June, after taking account of seasonal effects. This resulted in the annual rate of growth rising from 1.3% in May to 1.5% in June, leaving prices around 3% below the all-time high recorded in the summer of 2022"

Housing market activity remains fairly subdued

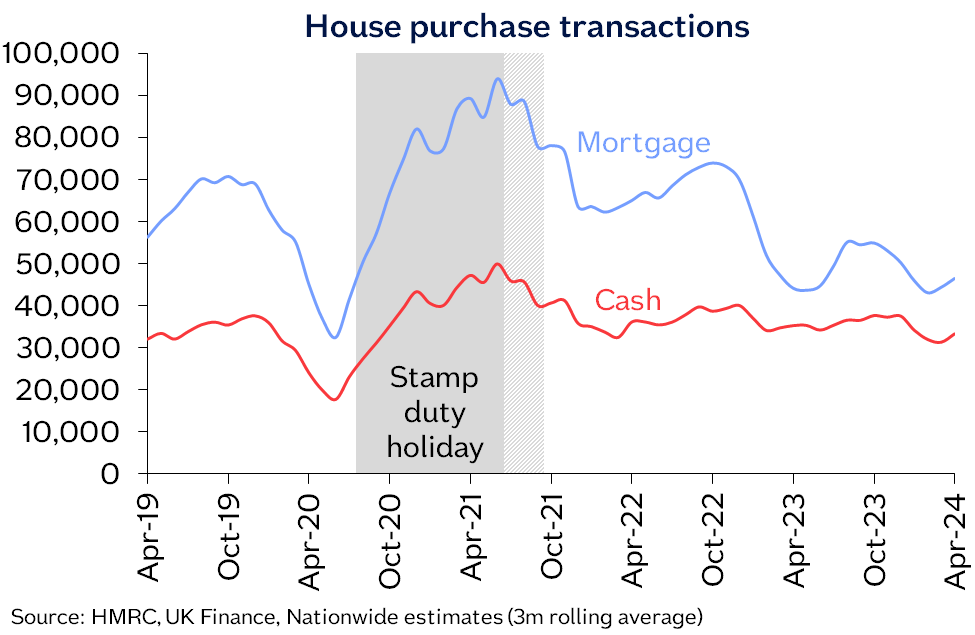

“Housing market activity has been broadly flat over the last year, with the total number of transactions down by around 15% compared with 2019 levels. Transactions involving a mortgage are down even more (nearly 25%), reflecting the impact of higher borrowing costs. By contrast, the volume of cash transactions is actually around 5% above pre-pandemic levels.

“While earnings growth has been much stronger than house price growth in recent years, this hasn’t been enough to offset the impact of higher mortgage rates, which are still well above the record lows prevailing in 2021 in the wake of the pandemic. For example, the interest rate on a five-year fixed rate mortgage for a borrower with a 25% deposit was 1.3% in late 2021, but in recent months this has been nearer to 4.7%.

“As a result, housing affordability is still stretched. Today, a borrower earning the average UK income buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 37% of take-home pay - well above the long run average of 30%.

Mixed picture amongst the regions in Q2 2024

“Our regional house price indices are produced quarterly, with data for Q2 (the three months to June) showing a mixed picture, with some regions seeing a modest pick-up in growth, but others still recording annual price declines (see full table on page 4).

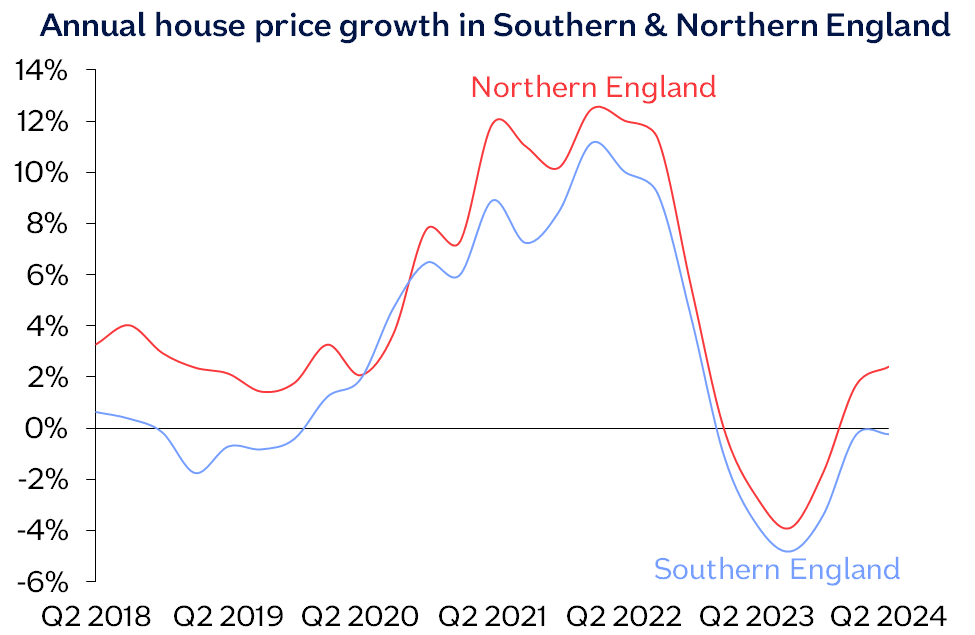

“Northern Ireland remained the best performing area, with prices up 4.1% compared with Q2 2023. Across England overall, prices were up 0.6% compared with Q2 2023, while Wales and Scotland both saw a 1.4% year-on-year rise. Northern England (comprising North, Northwest, Yorkshire & The Humber, East Midlands and West Midlands), continued to outperform southern England, with prices up 2.4% year-on-year.

“Meanwhile southern England (Southwest, Outer Southeast, Outer Metropolitan, London and East Anglia) saw a 0.3% year-on-year fall (the same as last quarter). London remained the best performing southern region with annual price growth maintained at 1.6%. East Anglia was the weakest performing region, with prices down 1.8% year-on-year.”

So, lets take a look at the Zoopla Property Market Index for June and see what they are saying by comparison with the Nationwide.

Key takeaways

• House price inflation was flat at 0% in May 2024, but UK house prices are on track to be 1.5% (£3,900) higher by the end of 2024

• UK house prices are currently 8% “overvalued” but will be “fairly valued” by the end of the year due to rising incomes

• House prices have risen across all regions over the last 3 months

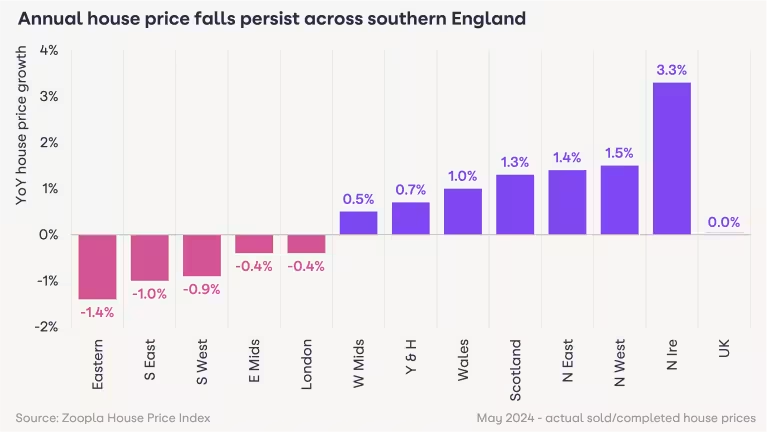

• Annual rate of house price growth remains negative across southern England but is rising elsewhere

• Home buyers and sellers largely undeterred by election campaign

• Demand (6%) and sales agreed (8%) are both higher than this time last year

• 75% of the 1.1 million sales projected for this year are either complete or in the sales pipeline

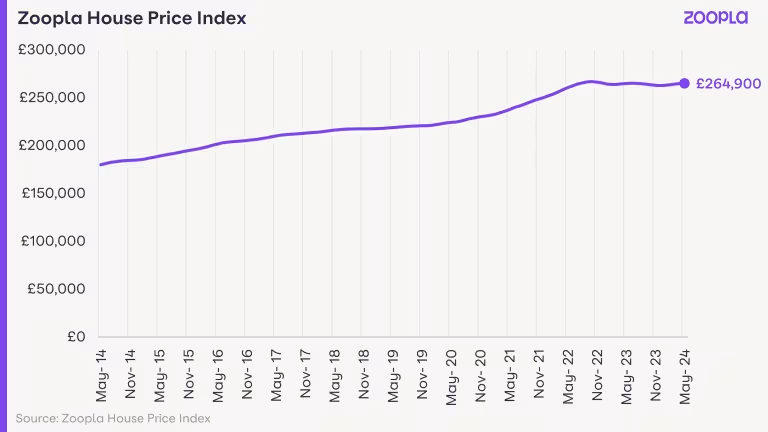

The average house price in the UK is £264,900 as of May 2024 (published in June 2024). Property prices are now at 0% inflation compared to a year ago. However, the average UK house price is set to rise by 1.5% by the end of the year.

The graph shows how the UK’s average house price has changed in the last 10 years.

Home buyers and sellers shrug off election

The recent pick up in sales market momentum has continued over June, albeit at a slightly slower pace than the previous 2–3 months. New sales agreed are still running 8% higher than a year ago, and other key measures of market activity are also higher year-on-year.

However, there are signs that market activity is starting to slow as we approach the quieter summer period. Buyers and sellers who were at the start of the home-buying process when the election was called are more likely to have delayed their buying decisions until after the election. And this is adding to the slowdown in activity.

Sales agreed are down slightly month-on-month across all regions, led by the Northeast (-6%) and West Midlands (-5%). The overall stock of homes for sale continues to grow across all regions, albeit at a slower rate than recorded over recent months. There are still almost a fifth more homes for sale than a year ago.

House price inflation is static, and is still negative in the South

Improving sales volumes over the first half of 2024 has led to a levelling in average house prices which is reflected in our house price index. All regions and countries of the UK have registered an increase in house prices on a month-on-month basis since January.

The annual rate of UK house price inflation is now static at 0% in May 2024, up from a low of -1.3% in November 2023, and +1.6% a year ago. House prices continue to register annual price falls across southern England at a slowing rate. But prices continue to increase across the rest of the UK by up to 3.3% in Northern Ireland.

We see no evidence that price rises will pick up speed in the coming months. However, UK house prices are on track to be 1.5% higher at the end of 2024.

75% of this year’s sales are completed or in progress

The 4–5 months between a sale being agreed and then completed means we have a good view into the sales pipeline for 2024. Our data shows the market is still on track for 1.1m sales this year.

Three quarters of these 1.1m expected sales have either been completed, or they’ve been agreed and are working their way toward completion. There are still over 250,000 sales yet to be agreed that we expect to complete by the end of 2024.

The 1.1m sales figure is 10% higher than 2023, but still below the 20-year average. It is positive that sales are rising despite higher borrowing costs, and it shows a more realistic view from sellers, as well as a renewed, cautious confidence amongst buyers.

The sales market has proved resilient

The sales market has proved resilient

The housing market has been very resilient over the last year given the rise in mortgage rates. These averaged below 2% in late 2021 and stand at 4.7% today, spiking well over 5% in October 2022 and again over the summer of 2023.

Higher borrowing costs have reduced the buying power of new buyers. Rather than sizable price falls, the main impact has been a sharp decline in the number of sales - 23% lower over 2023.

House prices haven’t fallen as there have been few forced sellers. Unemployment has stayed low by historic standards, and there are a relatively small number of people struggling to pay their mortgage - despite wider cost of living pressures.

House prices still look expensive on various measures of affordability. We expect house price inflation to remain muted, and likely to rise more slowly than household incomes over the next 1–2 years.

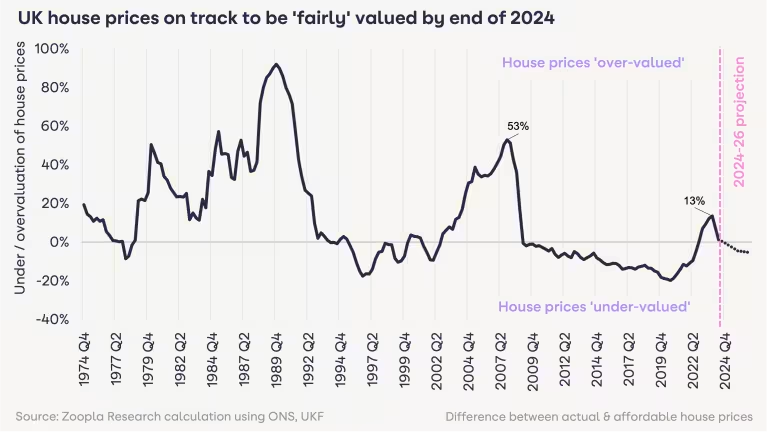

Housing remains overvalued but the trend is improving

One way we track affordability is to measure the extent to which actual house prices are higher or lower than an “affordable house price”. This is calculated from household incomes and mortgage rates.

The recent jump in mortgage rates led to house prices being overvalued by 13% at the end of 2023. This is less severe than in the run up to 2007 (the global financial crisis) and during the “house price bubble” of the late 1980s house. Double digit price falls followed both these periods of overvaluation. Price falls have been smaller more recently as the overvaluation was more modest and sales volumes have taken the hit.

Faster wage growth over the last 3 years has boosted household disposable incomes and helped offset some of the impact of higher mortgage rates. Mortgaged buyers have also been taking longer term mortgages to eke out that extra 5%+ of additional buying power.

We estimate that house prices were 8% overvalued at the end of March 2024, but by the end of the year this overvaluation will disappear. This assumes house prices rise 1.5% and mortgage rates remain at 4.5%.

Interest rates hold the key

Looking ahead, the short-term outlook for the sales market will depend on the outlook for mortgage rates, which is also dependent on the outlook for interest rates. Any reductions in the base rate over the summer and into the autumn will deliver a boost to market sentiment and sales activity, even though the impact on fixed rate mortgages will likely be more muted.

Based on city forecasts for base rates, mortgage rates are expected to remain in the 4-4.5% range. This is sufficient to support sales volumes and low, single-digit levels of house price growth. House prices in the south of England are expected to continue to under-perform the UK average as they realign with incomes. (Income growth is the key to supporting sales and demand into 2025.)

So that’s the National picture covered off and it would appear that two of the biggest players in the UK property market are expressing caution about the direction of travel of the market. It is clear that the General Election isn’t impacting seller sentiment, although buyer sentiment remains subdued in terms of numbers, but the quality of those looking is good, but the high cost of borrowing and the fact prices haven’t dropped as much as expected is impacting sales.

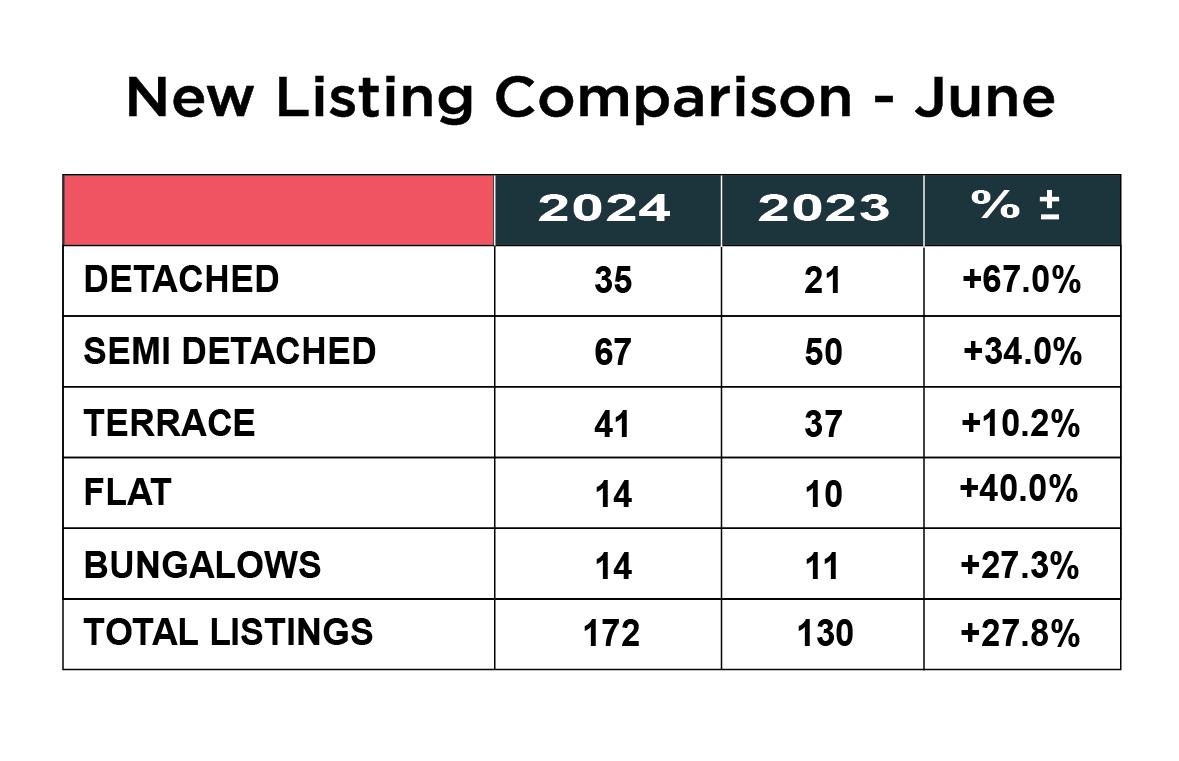

New instructions up almost 28% in SK8 and SK3

First of all, let’s take a look at the number of new instructions coming to the market in June, which has shown a significant increase from a year ago, up from 130 properties in 2023 to 172 in June 2024 – an increase of 27.8%

When we look at the individual breakdown by property type, every single category has shown an increase, with significant rises in the number of detached homes, up from 21 to 35 in 2024, an uplift of 67%. The number of flats listed was up from 10 to 14, an increase of 40% and the number of semi-detached homes that went on the market was up from 50 to 67, up 34%. The number of bungalows has risen year on year from 11 to 14 or 27.3% and the number of terraces is up 10.2% from 37 in 2023 to 41 in 2024.

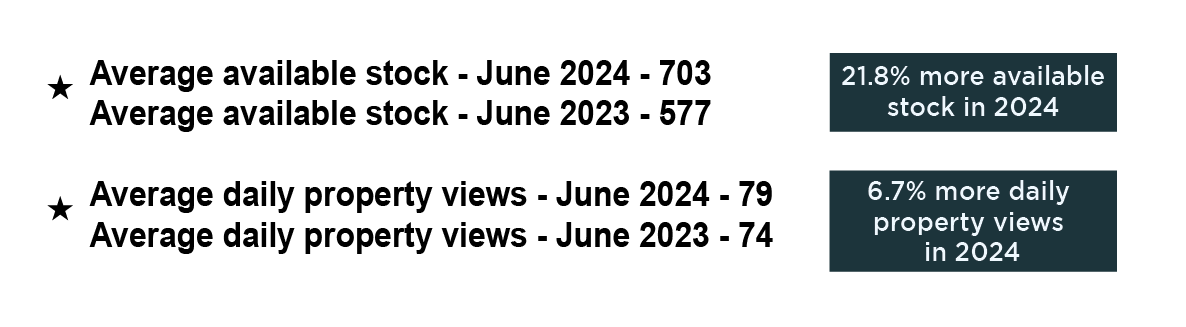

Stock levels up over 21% but buyer activity remains subdued

The level of available stock throughout the month rose again and now stands at 703 properties, whilst this was 577 properties a year ago, so an increase of 21.8%

The level of available stock throughout the month rose again and now stands at 703 properties, whilst this was 577 properties a year ago, so an increase of 21.8%

The flip side is there were still only 79 average daily property views on Rightmove, against 74 this time last year, a modest increase of just 6.7%, which demonstrates that many buyers are still not being tempted back into the market, despite the huge selection of property to choose from.

There are a number of factors affecting this including the cost of borrowing, the fact property is still considered to be generally overpriced and so many potential first time buyers being stuck in the rental cycle, with rents being so high impacting their ability to save towards a deposit.

We think many home buyers will have an eye on the policies being introduced by the next government and what happens with interest rates.

What house price types are popular in SK8?

The average price of a house in SK8 now stands at £372,468, which is up almost £7,000 on the previous month and 3% year on year.

When we break it down by property type, detached homes now stand at £513,343 which is up 3.9% on twelve months ago. Semi-detached homes are now an average of £371,072, down 0.5% on this time last year. Terraced houses now average £320,746, which is up 8.7% on the previous twelve months, and flats now stand at £180,651, an increase of 2.8% on the previous year.

What is happening with SK3 house prices by type?

The average price of a property in SK3 currently stands at £237,949, which is up 1.9% year on year on the same period 2023.

Detached homes now stand at an average value of £324,200, down just over 10% year on year. Semi-detached homes now average £274,951, which is almost £4,000 up on last month, and up 2.1% on a year ago. Terraced houses now average £210,952, up 2.8% on this time a year ago, and flats now average £168,285, which is actually up 8% year on year.

Sales up, but not significantly considering the level of available stock

Ironically, we had a record month for sales this year in June, despite activity levels being down, flew in the face of the national picture. This was due to listing some nice properties at sensible prices which reflect the current market.

Ironically, we had a record month for sales this year in June, despite activity levels being down, flew in the face of the national picture. This was due to listing some nice properties at sensible prices which reflect the current market.

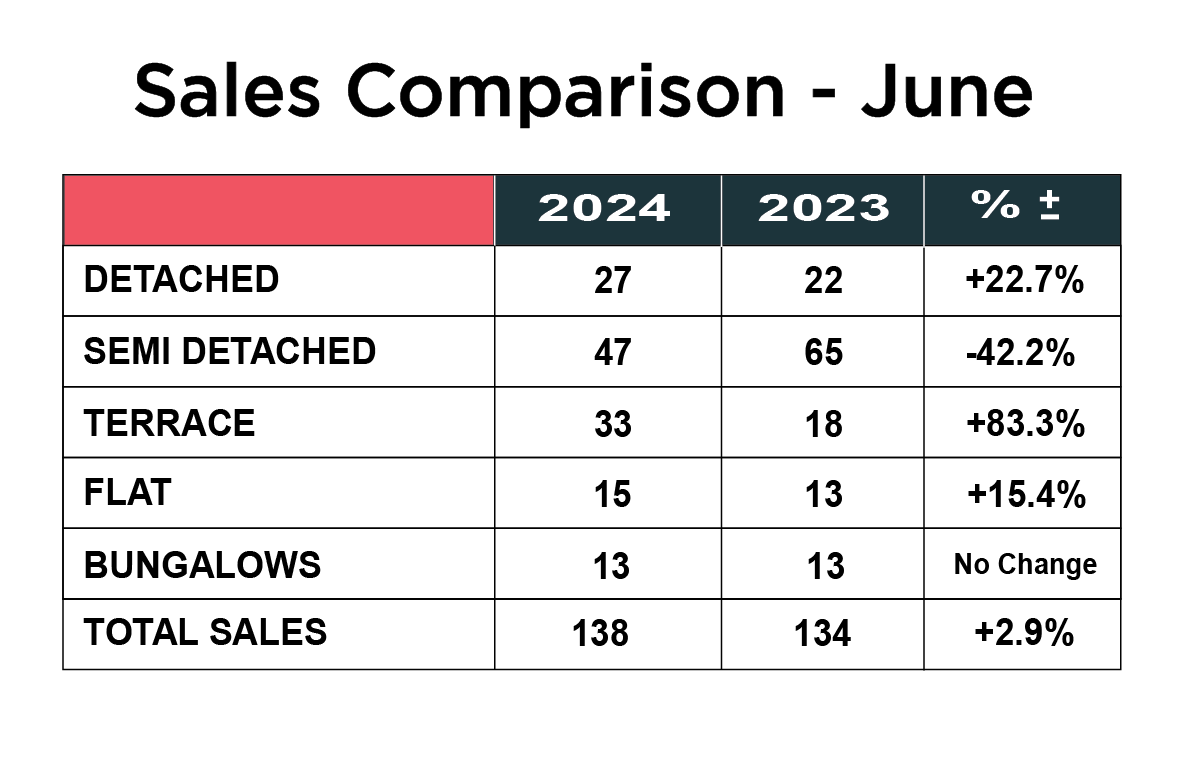

However, across SK8 and SK3, the number of properties sold in June was again very similar to June 2023, up just 2.9% from 134 to 138, but when you look at the number of available properties to choose from, it puts these figures into perspective.

When we break down the number of sales by type, there was a huge increase in the number of terraced houses sold, up from 18 in 2023 to 33 in 2024, a whopping increase of 83.3%. There was a 22.7% uplift on the number of detached homes sold at 27, up from 22 last year, a 15.4% increase on the number of flats sold 13 to 15 and the number of bungalows sold remained the same for the second year running. The one anomaly was the number of semi-detached properties sold dropped 42.2% from 65 to 47.

Renting in SK8 and SK3

The lack of rental stock in SK8 and SK3 continues to be the biggest issue and is keeping rents high and the reason there is often multiple applications for every rental property.

In SK8 rents have risen slightly year on year by 3% with the average yield a very healthy 5.28%. The average rent for a house is £1569 and for a flat it is £917 per calendar month.

In SK3 rents are up 1.9% year on year, with an average yield of 5.86%. The average rent for a house in SK3 is £1116 and £891 per calendar month for a flat.

If you are a landlord with a property to rent out, we would love to hear from you, as we have a huge database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website Landlord Services

Summary

With the Nationwide stating that affordability was still massively impacting prospective buyers and Zoopla saying that house prices are still too high, it is clear there are still many issues affecting the property market, both nationally and locally.

What we are seeing in SK8/SK3 is the local picture beginning to mirror the national situation more. Buyer interest is not showing any signs of improvement and the stock levels in SK8 and SK3 keep rising. We might have had a fantastic June, which is down to good marketing and correct pricing, it doesn’t feel particularly busy.

We think many buyers have decided to put their plans on hold until after the general election. There will be a period of uncertainty, with any new government and although inflation is down, the Bank of England will be waiting to see what the market reaction is before cutting interest rates, which will be very welcome to homeowners and buyers and may kick start more activity.

For those selling now, it is imperative that you price your property correctly from the outset. There is more stock available to choose from and applicants are still showing no real appetite for buying. Once a property has been on the market for 6-8 weeks without any serious interest, even reducing the price doesn’t necessarily have the desired effect and can be like setting fire to a bonfire of pound notes. It is not the time to be “testing the market” that strategy won’t work. If you want to talk to us about your options and how you can refresh your marketing without any obligation, please call 0161 428 3663.

I know our advice is the same every month, but we feel it is important to keep re-enforcing this very important message - All the metrics show that the market is resilient but subdued and prices are dropping as you can see in the above data. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same. We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and money in the long run.

It is also so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Online agents such as Strike and Purple Bricks are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or good practice.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has ahead of a move in 2024 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.