July was the hottest month on record around Europe, however we don’t think Great Britain got the memo, as it seemed more like the wettest month on record!

And it was certainly a rather damp squib for the housing market nationally and even our local SK8 and SK3 market saw some significant shifts, which will affect the market moving forward. In fact, as we write this, the Bank of England monetary committee have just met and raised interest rates for the fourteenth consecutive month by a further 0.25%, up to 5.25%

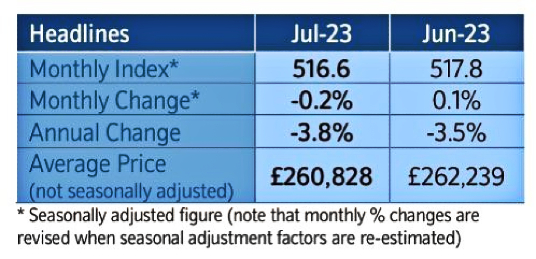

Annual UK house prices decline continues at fastest rate for 14 years

The general consensus amongst many property market observers is house prices will likely fall further in the coming months after a closely watched index reported the biggest drop in 14 years.

It comes after Nationwide reported that annual property values declined by 3.8% in July – the sharpest fall since July 2009. The average home is now worth £260,828 – a fall of 0.2% compared to the previous month but down 4.5% on the peak recorded in August 2022, the building society said on Tuesday.

Nationwide’s chief economist Robert Gardner blamed the high cost of mortgages. “As a result, housing affordability remains stretched for those looking to buy a home with a mortgage,” he said.

To illustrate the pressure on prospective first-time buyers, Nationwide said a person earning an average wage – who has a typical first-time deposit of 20% and a mortgage with a 6% rate – would see 43% of their take-home pay gobbled up by mortgage payments. This is on top of the cost of living, higher than wanted inflation and wages not keeping pace. This is up from 32% a year ago and well above the long-term average of 29%.

“This challenging affordability picture helps to explain why housing market activity has been subdued in recent months,” Gardner said. There were 86,000 completed housing transactions in June, 15% below the levels at the same time last year and about 10% below pre-pandemic levels.

Mortgage approval data showed an increase in activity in June, but most of these applications will predate the more recent rise in longer term interest rates, he said. BoE data on Monday showed mortgage approvals in the UK rose to their highest level since October as people scrambled to secure home loan deals before interest rates rose further.

Nationwide believes a housing crash is unlikely, assuming unemployment – currently 4% in the UK – remains below 5%, and most borrowers should be able to cope with higher interest rates.

Gardner concluded: “While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank rate peaks.”

Will falling prices accelerate?

Experts said they expected the trend of falling prices to continue – and even accelerate – in the short term, because many remain reluctant to lock themselves into mortgages with high rates – even as rents soar.

Imogen Pattison, an assistant economist at Capital Economics, said: “The slight fall in house prices in July is the first sign of the surge in mortgage rates since mid-May taking its toll.

“As we expect mortgage rates to remain around their current level for the next 12 months, we expect further falls in house prices over the coming months.” She added: “House price falls are likely to gather pace over the coming months.”

Gabriella Dickens, a senior economist at Pantheon Macroeconomics, said rising mortgage rates were to blame and “a further drop seems likely”.

She said: “Consumers’ confidence remains well below its long-run average, and expectations that house prices will fall further are well-entrenched. “Accordingly, we think that house prices will have to fall by about 8% from their peak before demand and supply come back into balance.”

However, the bigger than expected drop in inflation to 7.9% has led some to believe that price declines may not be as severe as previously predicted.

Nicola Schutrups, managing director at Southampton-based broker The Mortgage Hut, said: “Further falls in house prices are likely for the rest of 2023, but if inflation continues to come down and the jobs market remains strong, there’s still a chance for a soft landing.”

Tom Bill, head of UK residential research at Knight Frank, added: “While we expect UK prices to fall by 5% this year, demand should prove more resilient than expected between now and the general election given the cushioning effect of wage growth, high levels of housing equity, lockdown savings, the availability of longer mortgage terms, forbearance from lenders and the popularity of fixed-rate deals in recent years.”

The signs of change in SK8 and SK3

So, now that we have a feel for the national picture, it’s time to look at what’s happened in SK8 and SK3 during July and there are a couple of significant shifts, in particular the drop in sales and the fact that stock levels are continuing to rise, whilst home hunters are showing very little sign of changing their apathy and indifference to buying.

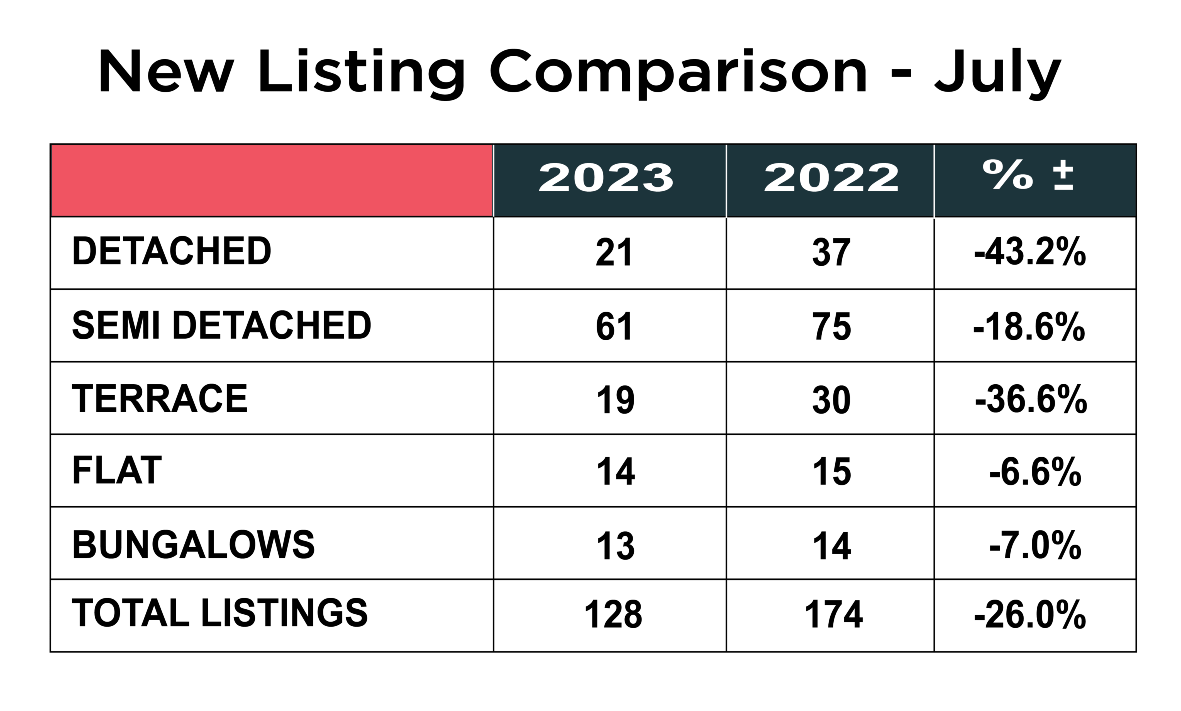

So, let’s start as always with the number of new listings in the area.

July followed the trend we saw in June with another significant drop in the number of new properties coming onto the market, with just 128 new listings, compared with 174 in July 2022 – a drop of 26%. As this is now the second month in a row, we need to dig a bit deeper to try and establish what’s happening. We suspect that with so much negative press and potential sellers seeing other properties sticking on the market or reducing in price, many are now playing the same waiting game as buyers, unless of course they need to sell for a specific reason, and it might be a question of who blinks first.

July followed the trend we saw in June with another significant drop in the number of new properties coming onto the market, with just 128 new listings, compared with 174 in July 2022 – a drop of 26%. As this is now the second month in a row, we need to dig a bit deeper to try and establish what’s happening. We suspect that with so much negative press and potential sellers seeing other properties sticking on the market or reducing in price, many are now playing the same waiting game as buyers, unless of course they need to sell for a specific reason, and it might be a question of who blinks first.

We said last month that reduced availability could help prices stabilize, unless the perfect storm of buyers not doing anything continued as well – and that very much seems to be the case at the moment.

The biggest drop was in the number of detached homes coming to the market, which was down 43% from 37 last July to only 21 in 2023. The number of terraces was also down significantly 37% from 30 to 19, next was semi detached properties down 19% from 75 to 61 and there were more drops in both the number of bungalows and flats, both down around 7%

More available stock but less buyer interest

Our second image shows that for the 7th month in succession, the average number of daily property views on Rightmove is less than 50% of what it was the year before. Last month was a record low of 74 daily views, this month it has dropped again to just 71! This time last year there were 163 average daily property views. The drop off is 56%. This will of course impact the number of viewings and supports the claim theory that buyer sentiment remains extremely subdued and todays confirmation of another rise in interest rates is unlikely to stimulate enthusiasm.

The average available stock in July 2023 was 590 properties, which was up 34% on the previous July from 440, but whilst we look for any crumb of comfort from the statistics, stock levels remain consistent from last month. Since this isn’t new listings, there must be quite a lot of sales falling through and filtering back onto the market.

What are individual property types doing in SK8?

The average price of a house across SK8 now stands at £372,361 which despite the negativity and the declining performance stats is still up a healthy 11.2% year on year and in monetary figures, up £3,000 on the previous month. This could of course be sellers having unrealistic expectations or agents giving poor advice on pricing. Detached homes leapt back up after a blip in June and now stand at £523,477, which is up 10.7% up on twelve months ago or £9,000 higher than June. Semi-detached homes are now an average of £380, 050 up 13% on a year ago, but down from 15.4% in June and are now approximately £2,000 cheaper than last month – something to keep an eye on maybe? Terraced houses now average £310,368, which is up 19% over the previous twelve months and are now worth an extra £10,000 in the last month and flats are up 2.3% to an average of £187,055, which shows a drop from last month of 3% or £1000.

With sales showing quite a dramatic fall off, we cannot see how these prices can be sustained at such high levels for the remainder of 2023 and there is clearly alot of uncompetitive over priced stock on the market.

The average price of a property in SK3 is now £239,901, which shows tremendous resilience and is 10.8% up year on year, albeit, very slightly lower than in June but negligible . Detached homes stayed very consistent with June at £423,658, which is up 39% year on year. Semi-detached homes now average at £272,333, which is up 14% year on year but down from 17% in June and that represents a £2,000 drop in monetary value. Terraced houses are now averaging £208,606, up 11% from July 2022 and a monetary increase of around £1,000 and flats now average at £141,246 down from last month, but still up 3.4% year on year, but £5,000 lower than last month, which is the most significant drop of all.

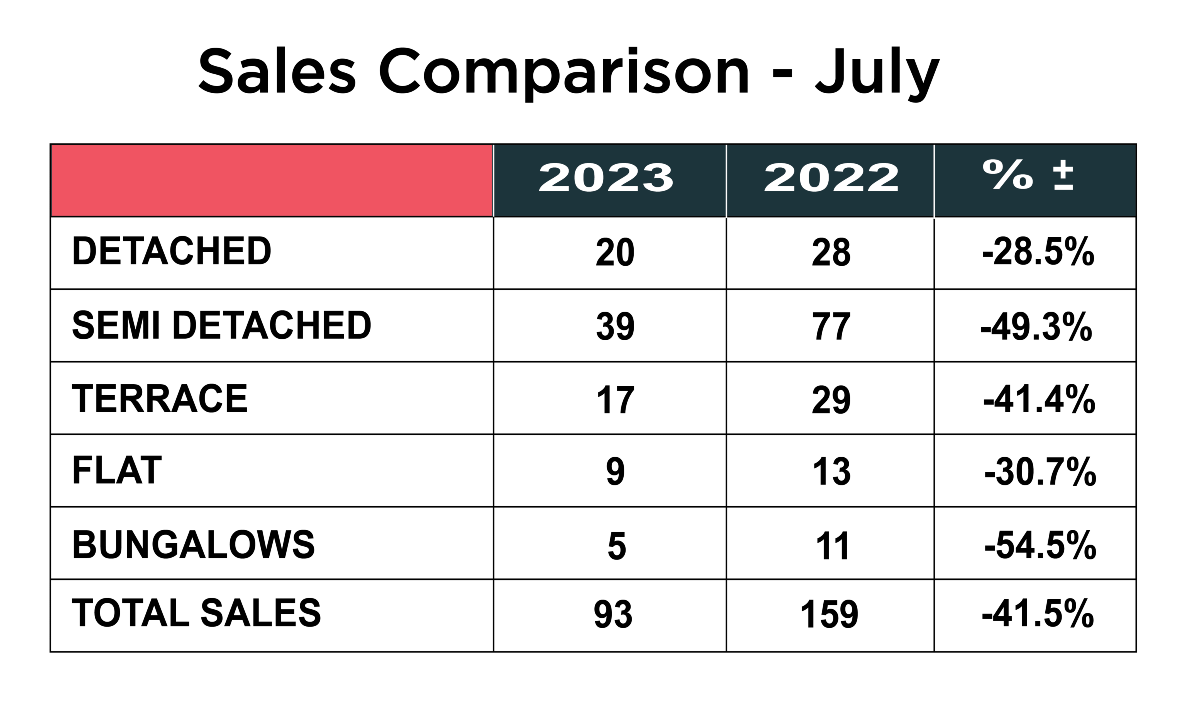

Sales take a tumble in July

Perhaps the most worrying set of statistics from July are the sales figures for the month. Just 93 properties were sold across SK8 and SK3, compared to 159 in July 2022, which is dramatic drop of almost 42% and a huge drop compared with June. Some of this can be attributed to seasonal fluctuation, but not to that level and this is definitely a result of there being less buyers looking online for property and the lower number of physical viewings.

The number of sales across the board are down significantly with bungalows showing the biggest drop from 11 to 5 – a drop of 55%, semi detached homes are down 49% from 77 to 39, terraced homes down 41% from 29 to 17, flats down 31% from 13 to 9 and detached homes down 28.5% from 28 to 20. Obviously, we hope this is just a blip, but if August shows a similar trend, there would be more cause for concern.

Summary

Q3 has started to finally show the resilience that the property market in SK8 and SK3 has shown to date is finally starting to wane.

Of course, we don’t want to be negative, but it is our duty as a good and ethical agent to provide home sellers and buyers with the facts, although we would remind everybody that interest rates at around 4 or 5% were the accepted norm for many years, we have just enjoyed ten years or so of unprecedented low rates, that were never going to remain so low forever.

Even if prices drop 10%, this will still leave them higher than before the pandemic, when they became artificially propped up by government policy, so now is more important than ever that motivated sellers, market their properties at the right price from the outset to have a realistic chance of selling.

If you are expecting to get the price the property might have fetched in July 2022, you will be very disappointed. What we are seeing is a property that is priced correctly from the outset is getting interest, if you get it wrong and over price it, it will simply sit there, and even reducing the price will not have the same effect. Don’t listen to agents who are simply trying to get you to list with them by overvaluing your home, they are not doing you any favours. You need honesty and a defined strategy that is proven to work.

Get the price right and make up the difference on your purchase. Just because you might have to take £10/15,000 less than you wanted, if you pay £10/15,000 less for your next home, it equates to the same!

Reducing inflation remains the key and the Bank of England expects it to start coming down and be under control by 2025, but there will be a period of pain before we get there.

As we have said many times now, it is more important than ever for sellers to choose a well-established, experienced local agent who is has operated in more challenging markets and is equipped with the widest marketing mix to reach the serious buyers looking now. Simply listing a house on the property portals such as Rightmove and relying on those enquiries, when they are 60% down, is not going to expose the property to enough people. Agents now need to roll their sleeves up, dig deep, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. Proper estate agency!

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2023 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice and arrange for a FREE market appraisal on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.