Welcome to the first Cheadle Property Market Update of 2025.

The start of a New Year usually comes with optimism and positivity, but there doesn’t seem to be a great deal of it about, especially in the UK economy and with Donald Trump back in the White House for a second term as US President, it remains to be seen what effect that will have on the UK and other economy’s around the world.

The property market has also started off a little slower than many experts expected and this is reflected in the first forecasts of 2025 from the Nationwide Bank and Zoopla, the UK’s second largest property portal. As always, we will take a look at the national picture in the first instance and the a more detailed look at the local property market in SK8 and SK3 and also take a look at the outlook for next twelve months.

Let’s start with our usual look at the headline from the Nationwide January Property Index.

House price growth softens at the start of 2025

Annual rate of house price growth slowed to 4.1% in January, compared with 4.7% in December

House prices up 0.1% month on month

Little change in overall rate of home ownership in recent years despite affordability pressures

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

The price of a typical UK home rose by 4.1% year on year in January, a modest slowing in the annual pace of growth compared with December. House prices increased by 0.1% month on month, after taking account of seasonal effects.

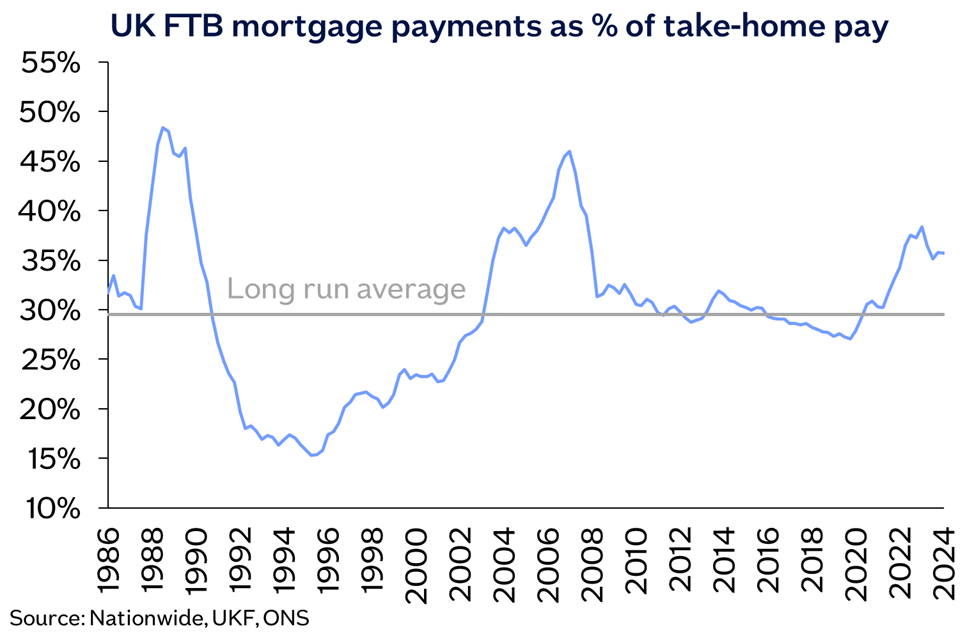

The housing market continues to show resilience despite ongoing affordability pressures. As we highlighted in our recent affordability report, while there has been a modest improvement over the last year, affordability remains stretched by historic standards. A prospective buyer earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 36% of their take-home pay – well above the long-run average of 30%.

Furthermore, house prices remain high relative to average earnings, with the first-time buyer house price to earnings ratio standing at 5.0 at the end of 2024, still well above the long run average of 3.9. Consequently, the deposit hurdle remains high. This is a challenge that has been made worse by the record increase in rents in recent years, which, together with the cost-of-living crisis more generally, has hampered the ability of many in the private rented sector to save.

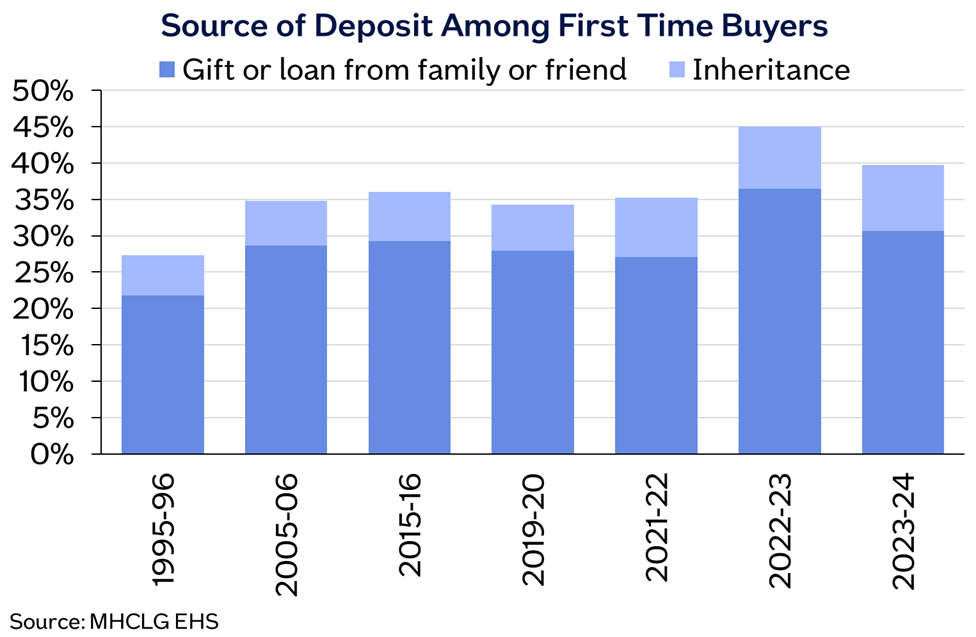

Therefore, it’s not surprising that a significant proportion of first-time buyers have to draw on help from friends and family to raise a deposit. In 2023/24, around 40% of first-time buyers had some assistance raising a deposit, either in the form of a gift or loan from family or friends, or through an inheritance.

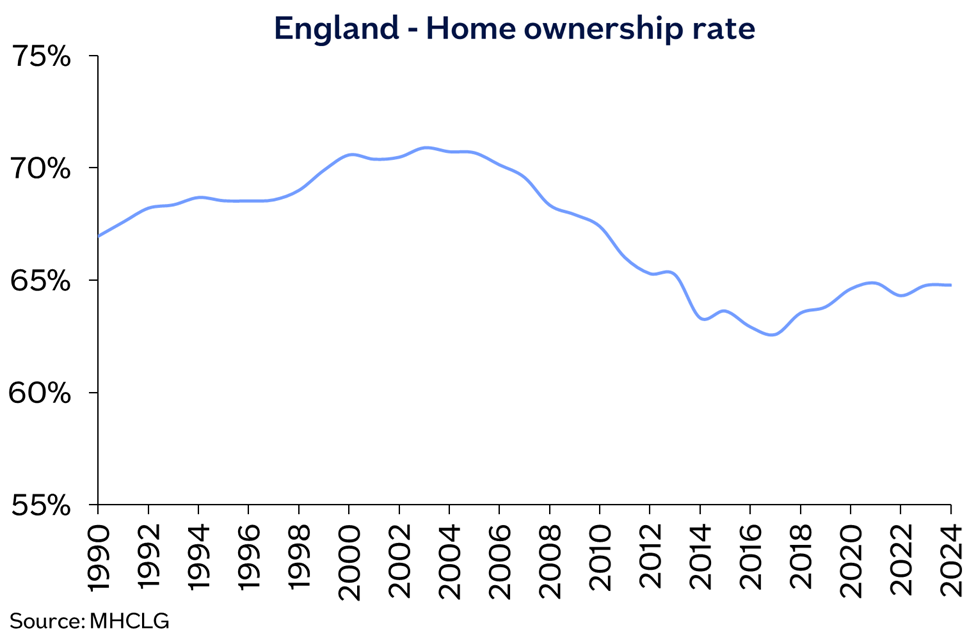

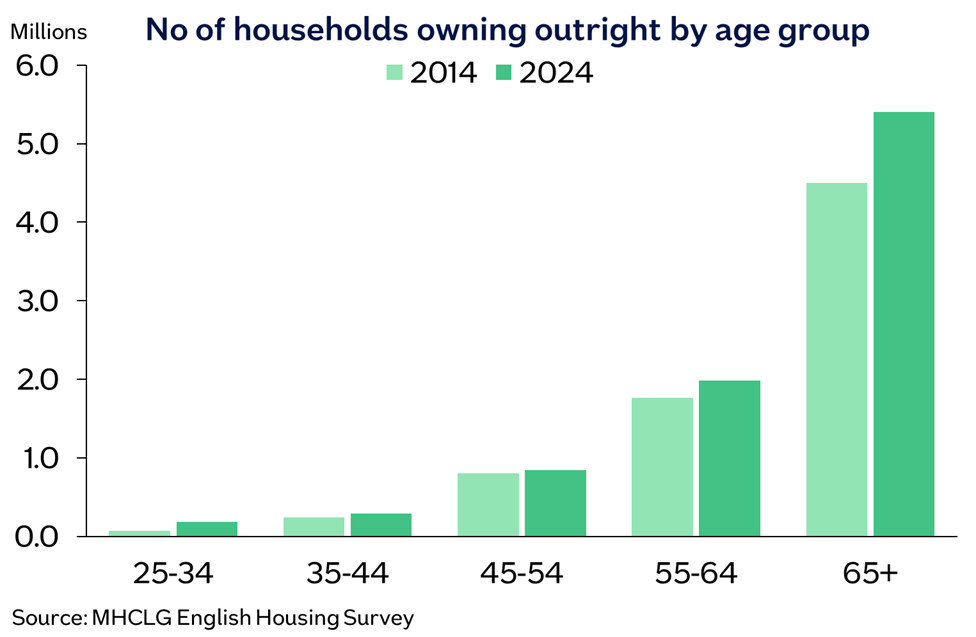

Despite these challenges, there has been relatively little change in overall levels of home ownership in recent years. The latest English Housing Survey produced by the Ministry of Housing; Communities & Local Government (MHCLG) showed homeownership rate remained stable in 2024 at 65%.

There was a slight increase in the number of people owning their home with a mortgage, although the majority of homeowners (around 55%) own outright, which is largely a reflection of demographic trends. The proportion of households in the private rented sector remained stable at 19%.

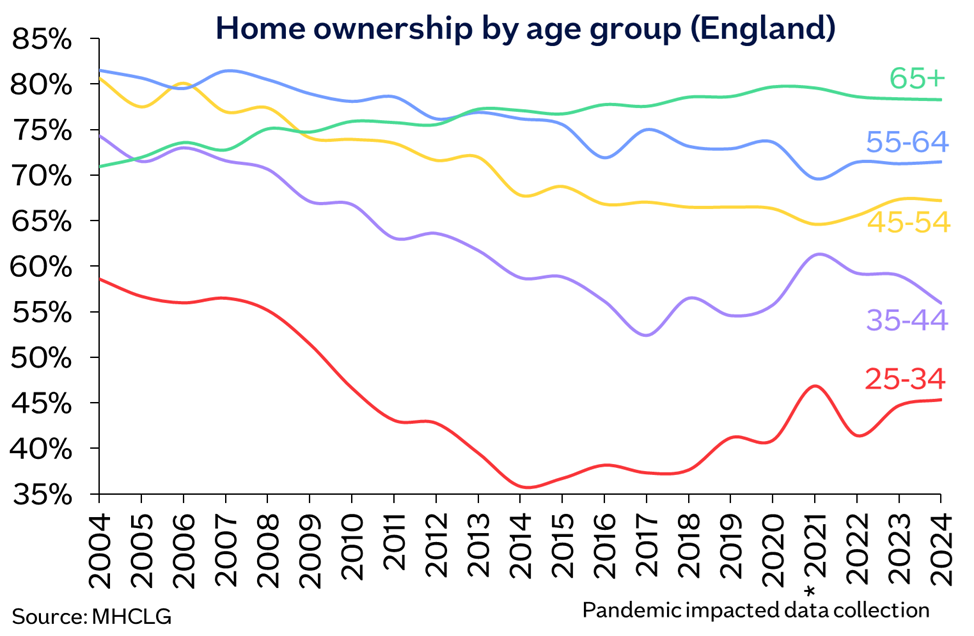

Looking at trends over the long term, homeownership rates among younger age groups, in particular those aged 25-34 and 35-44, remain well below their 2004 peaks. Homeownership amongst those aged 25-34 has been gradually improving over the last decade however and now stands at 45%, compared to 36% in 2014, though still below 2004 peak of 59%.

The number of households in England owning their homes outright has increased by 1.3 million over the past ten years to reach 8.7 million. This reflects demographic developments, in particular a rise in the number of older households (aged 65+), where the number owning outright has increased from 4.5 million to 5.4 million over the last decade.

So, now let’s take a look at the Zoopla January 2025 Property Index and see how their forecast and outlook compares with the Nationwide.

Key takeaways

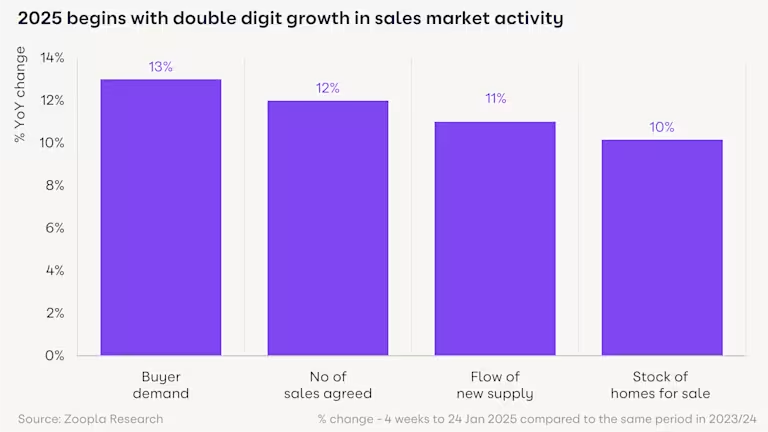

The 2025 sales market is off to a stronger start than in 2024 and 2023

Buyer demand is 13% higher than a year ago, with 10% more homes for sale and 12% more sales agreed

The removal of stamp duty relief from April has boosted first-time buyer demand in the price bands where there will be the steepest tax increases

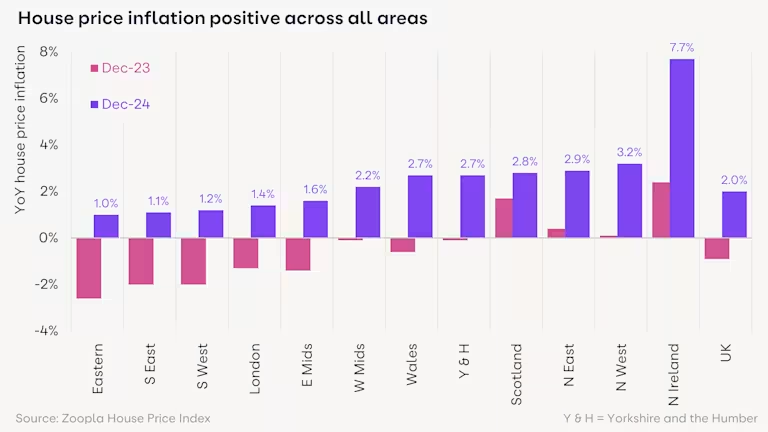

UK house price inflation is running at +2.0% versus -0.9% last year

Price inflation ranges from 7.7% in Northern Ireland and 3.2% in the North West to 1% in the East of England

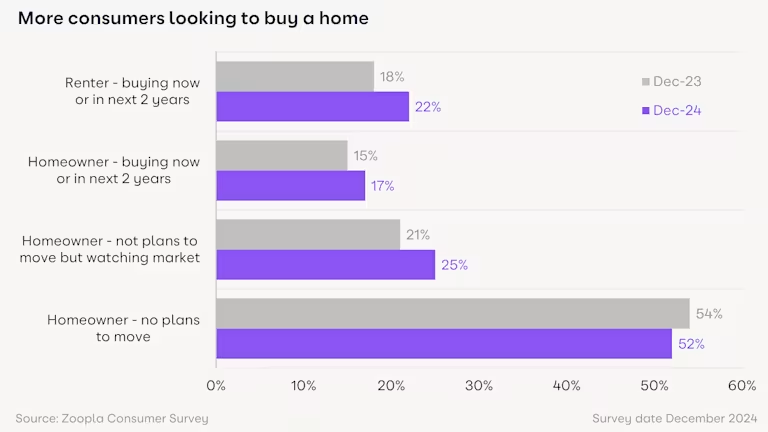

There has been an increase in the number of people looking to buy now or in the next 2 years

22% of renters are looking to become first-time buyers, while 17% of homeowners are now looking to move

Key figures

The average house price in the UK is £267,700 as of December 2024 (published in January 2025).

Property prices are now at +2% inflation compared to a year ago and the average UK house price is set to rise by 2.5% by the end of the year.

Sales market momentum from 2024 spills into 2025

The momentum in sales market activity over 2024 has spilled over into 2025 despite concerns over mortgage rates drifting higher and some softening in consumer confidence over the economic outlook.

The number of homes for sale is 10% higher than this time last year, with the average estate agent branch having 31 homes for sale - the highest January total for 7 years.

More sellers mean more buyers too, with demand 13% higher than this time last year and 26% higher than at the start of 2023.

New sales agreed are up 12% as some buyers attempt to beat the reduced stamp duty deadline at the end of March.

UK house price inflation stood at +2% at the end of December 2024, up from -0.9% a year ago and the fastest growth rate since April 2023.

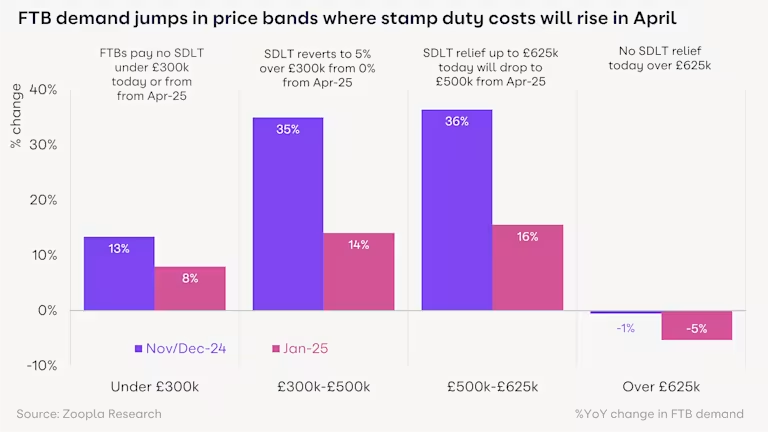

Higher stamp duty from April has boosted demand

The October 2024 Budget confirmed that more buyers would pay higher stamp duty in England and Northern Ireland from April 2025 - both existing owners and first-time buyers (FTBs).

FTB demand jumped by over a third in November and December 2024 in the price bands where stamp duty for FTBs will increase the most - between £300,000 and £625,000.

But buyer demand increased more slowly for homes below £300,000, where FTBs will continue to pay no stamp duty, and for homes over £625,000, where there remains no tax relief for FTBs.

It is now too late for buyers to agree and complete a property purchase before the end of March 2025 in order to pay lower stamp duty. We don’t see a cliff edge in demand coming as FTB interest remains higher year-on-year, in line with the wider market.

Homeowner demand has also increased since the Autumn Budget, but to a lesser degree, as the extra stamp duty from April (up to £2,500 per purchase) will be less impactful than the extra cost for FTBs buying in the £350,000 to £625,000 price range.

Earnings rising faster than house prices for 2 years

House price inflation remains in low single digits across most of the country. The average UK house price stands at £267,700, representing an increase of £5,200 or 2% over 2024.

Low house price growth is down to the ongoing impact of higher mortgage rates on buying power, and wider cost of living pressures. Housing affordability is slowly improving as mortgage rates stabilize in the 4-5% range and earnings rise faster than house prices - a trend that has been running since December 2022.

Annual earnings growth remains over 5%, a factor playing a key role in resetting housing affordability. This sets a scene for above-average house price inflation in areas with jobs growth and lower house prices.

House price inflation grows across all markets

The fastest growth in average house prices is in Northern Ireland (7.7%), where prices are rebounding off a low base, followed by North West England (3.2%).

The North West of England, Scotland and Northern Ireland have recorded faster employment growth over the last 2 years than the regions of southern England. Locally, prices are rising the fastest in Wigan in the North West (5.6%) and Motherwell in Scotland (4.9%).

Southern regions of England are recording the lowest rates of house price inflation, below 1.5%. The recent boost to FTB demand is more concentrated in London and South East England and we expect this to support near-term price inflation in these regions.

There are signs that the recent upturn in prices is starting to level out as mortgage rates drift higher and buyers have plenty of homes to choose from. This will keep price inflation in check over 2025, but the current north-south divide in house price inflation is expected to continue over the year ahead.

Increase in households looking to buy in 2025

While there is speculation that demand may cool after stamp duty costs rise from April 2025, we find that there is an increased appetite amongst consumers to move home in the next 2 years.

Zoopla’s Monthly Consumer Tracker shows there has been an increase in the proportion of renters and existing homeowners looking to buy compared to a year ago. This is down to households delaying decisions in the face of higher mortgage rates in recent years and expectations of base rates cuts in 2025.

Over a fifth of renters want to buy a home, having seen the cost of renting rise rapidly over the last 2 years. Renters buying homes are a driving force in the FTB market, which we expect to be the largest buyer group once again in 2025.

Just under a fifth of homeowners want to move in the next 2 years, while a quarter have no immediate plans to move but are keeping a close watch on the market should circumstances change.

Outlook for 2025

The first few weeks of each year tend to provide a clear indication of how the rest of the year will unfold. 2025 has started off better than both 2024 and 2023. This bodes well for market activity over the rest of the year, supported by evidence of more people looking to move.

While some are rushing to beat the new stamp duty levels by March, we don’t see this having a major impact on activity overall. Three in five FTBs will still pay no stamp duty from April and the extra costs on homeowner movers remain manageable.

A healthy stock of homes for sale will keep price rises in check and we are forecasting that average UK house prices will rise by 2.5% in 2025, with 5% more sales taking place than last year, a predicted total of 1.15m. Rising incomes and base rate cuts are set to continue improving housing affordability over 2025.

First-time buyers will remain an important buyer group, but existing homeowners looking to move need more support to help realise their ambitions, with more and more having to look further afield to find better value for money.

Slightly different outlooks from the Nationwide and Zoopla, but it is clear that more people are at least looking at properties, even if they are not committing to buying just yet.

So, lets now drill down into the local property market and see how the year has started out for SK8 and SK3 home sellers and buyers.

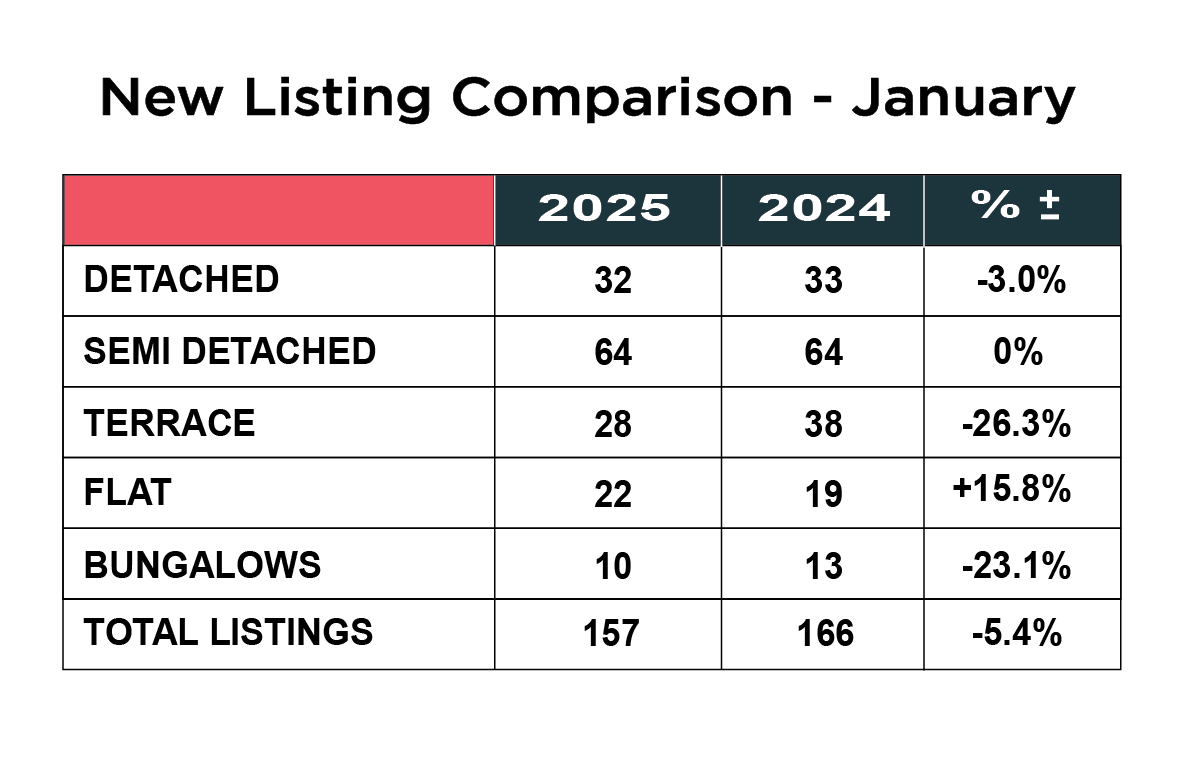

Listings consistent with 2024

The number of new properties which came to the market in January was remarkably similar to January 2024 with 157 new instructions in 2025 against 166 in 2024, a modest drop of just over 5%.

When we look at the breakdown of individual property types, there was a 15.8% increase in the number of flats for sale, up from 19 in 2024 to 22 in 2025. There was no change in the number of semi-detached properties – 64 in both 2025 and 2024, but significantly less terraced homes and bungalows, down 26% and 23% respectively. The number of detached homes fell very slightly from 33 last year to 32 this year. A drop of just 3%.

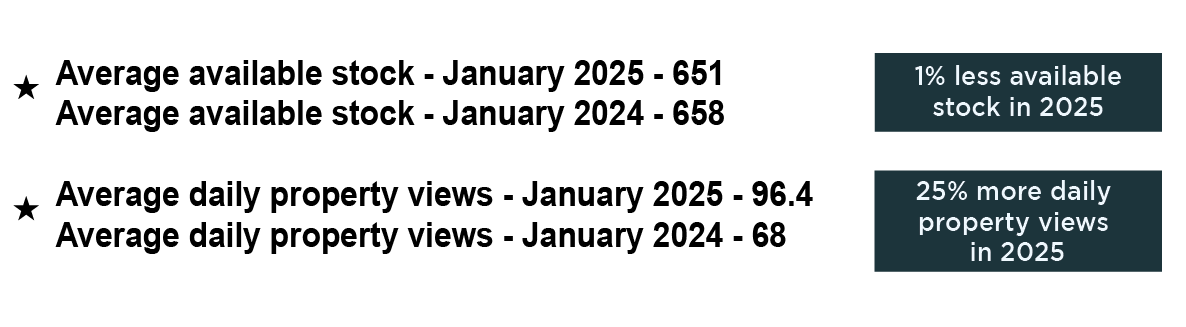

Stock levels drop but buyer views increase

For the first time in 14 months, the average available stock has reduced, from 658 last January to 651 in January 2025 – a modest drop of just 1%.

For the first time in 14 months, the average available stock has reduced, from 658 last January to 651 in January 2025 – a modest drop of just 1%.

Interestingly, the average number of daily property views rose from 68 in 2024, up to 96 in January 2025, which is an increase of 25%, which is an encouraging sign.

House prices by type in SK8

The average price of a property in SK8 now stands at £359,448, which is 3.7% lower than the same period in 2024.

The average price of a property in SK8 now stands at £359,448, which is 3.7% lower than the same period in 2024.

When we look a bit closer and break it down by property type, we can see that the average price of detached homes in SK8 now stands at £497,563 which represents a 4.0% drop year on year. The average price of a semi-detached home is now £371,204, which is actually up on the end of 2024, but down 0.6% over the last 12 months. Terraced homes have seen a drop of 7.0% over the last year and now stand at £288,960, which is £4,000 less than last month. Flats on the other hand have bucked the trend and shown a healthy growth of 12.5% over the last 12 months and now stand at an average of £194,419

SK3 house prices by type

The average price of a property in SK3 currently stands at £238,059 which is 0.2% down year on year, so prices generally in the area are holding firm.

The average price of a property in SK3 currently stands at £238,059 which is 0.2% down year on year, so prices generally in the area are holding firm.

Detached homes now stand at an average value of £381,600, which is down £20,000 over the last two months but still up 15.5% year on year. Semi-detached homes now average £263,795, which is down £5,000 from the end of 2024, but still up 0.1% over the last 12 months. Terraced houses now average £214,518, which is virtually no monthly change but up 1.4% on this time from a year ago, and flats now average £155,132 which is a drop of £5,000 from the end of last year and now stand at 6.8% less than January 2024.

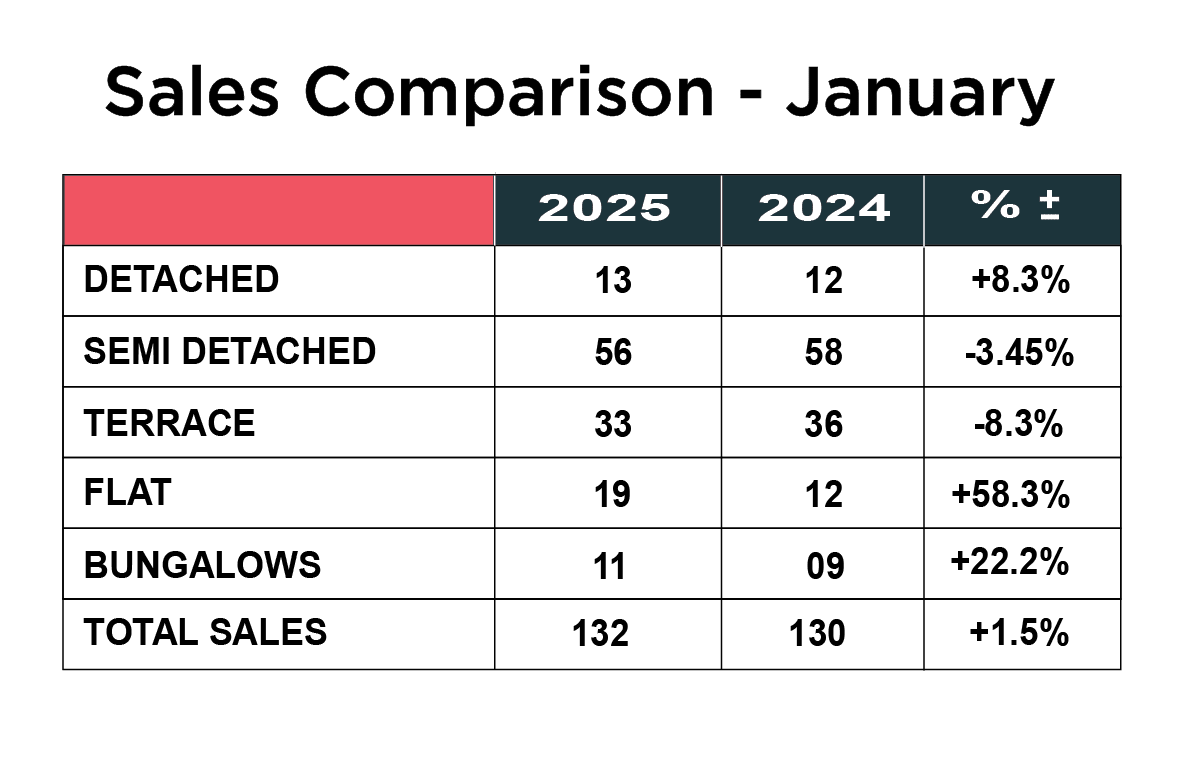

Sales consistent with January 2024

Sales were very similar to the same period last year but are still on an upward trajectory for the fifth month running.

The total number of sales across SK8 and SK3 was 132, which is up 1.5% from last year’s total of 130.

When we break it down by individual property types, there was a huge uplift in the number of sales – up from 12 in 2024 to 19 in 2025, which is an increase of 58%. There was also a rise of 22% in the number of bungalows sold and an 8% rise in the number of detached homes. On the flip side, the number of terraced homes sold was down 8.3% from 36 in 2024 to 33 in 2025 and the number of semi-detached homes sold was down 3% from 58 in 2024 to 56 in 2025.

The rental scene in SK8 and SK3

The new Renters Rights Bill is currently working its way through parliament and is likely to have a significant impact on the rental market across the SK region and the rest of the UK.

There are more landlords currently considering or actually selling their rental properties as a result of what they expect to see in the new legislation, which will of course have an effect on supply and therefore potentially to cause upward pressure on rents.

The average rental price for a house in SK8 is now £1641 and for a flat it is £1003. The yield is a very healthy 6.93%, which despite landlords fears about the new legislation, still make renting a property out financially attractive.

In SK3 rents are down 0.2% over a 12-month period. The yield is also a very healthy 5.85%

If you are a landlord with a property to rent out, we would love to hear from you, as we have a pre-qualified database of high calibre tenants waiting for the right home. Call Patrick, Josh or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website Landlord services and fees or if you have any questions about the Renters Rights Bill and how it might affect you.

Summary and 2025 forecast

Despite the economic uncertainty in the country at the moment, the housing market remains resilient. There are plenty of new properties coming to the market and there are definitely more people keeping an eye on the market. At the time of writing our blog, the Bank of England monetary committee will be meeting in the next 24 hours and there is a possibly that interest rates might be cut slightly to try and boost growth and may encourage more buyers to buy and stimulate the market.

We expect to see more sales completing over the next two months as buyers rush to try and complete their purchase before Stamp Duty increases to its previous levels at the end of March. We also expect to see similar tranasction levels to 2024, with just over 1m homes sold with an imbalance weighted to the first half of 2025.

We we will never make predictions on how much house prices may go up or down – we leave that to others who are prepared to make guesstimates educated or otherwise, as there are too many variables that can affect the market, such as affordability, mortgage rates, plus employment and wage rises. What we always hope for is stability and consistency, rather than highs and lows, but given the current economic uncertainty and volume of houses still available we can only envisage prices staying the same or coming down a little in the short term, whilst maybe starting to creep back up in the third quarter of 2025.

What will remain important for Cheadle home sellers is choosing the right estate agent to sell their home in a more difficult and competitive market.

A well-established, experienced local agent who has operated in challenging markets before and is equipped with the widest marketing mix both online and offline, to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Exclusively online or personal brand agents are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or just plain good practice.

We can demonstrate a successful strategy to help you move, that puts more money in your pocket at the end of the transaction.

Pricing your property correctly from the outset will remain incredibly important. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same, but that is how we get the market moving. We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and ultimately money. There is no mileage in putting your house on the market with the mindset “ We aren’t in any hurry and happy to sit and wait to get our price” It is completely the wrong strategy and proving time and again not to work in today’s market.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2025, please contact Josh, Patrick or Maurice to arrange for a FREE marketing advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.