February was another difficult month for most people with further strikes, the cost of living crisis biting harder and property buyers in many parts of the country becoming as hard to find as tomatoes on the supermarket shelves.

It would also appear that the long prophesied downturn in the property market is starting to rear its ugly head, as house prices are now falling at their fastest rate in more than decade latest figures show today.

The average cost of a home in the UK dropped 1.1% last month, the biggest annual fall since November 2012 and the first year on year decline since June 2020 at the start of the pandemic, according to lender Nationwide.

They are now 3.7% below the peak reached last August immediately before Kwasi Kwarteng’s disastrous mini-Budget, which sent mortgage rates soaring. The monthly decline of 0.5% was the sixth on the trot leaving the average price of a home across the UK at £257,406.

The building society’s chief economist Robert Gardner said “The recent run of weak house price data began with the financial market turbulence in response to the mini-Budget at the end of September last year. While financial market conditions normalized some time ago, housing market activity has generally remained subdued.

“This likely reflects the lingering impact on confidence as well as the cumulative impact of the financial pressures that have been weighing on households for some time. Indeed, inflation has continued to outpace wage growth and mortgage rates remain significantly higher than the lows recorded in 2021. Even though consumer sentiment has improved in recent months, it is still languishing at levels prevailing during the depths of the financial crisis.

“It will be hard for the market to regain much momentum in the near term since economic headwinds look set to remain relatively strong, with the labour market widely expected to weaken as the economy shrinks in the quarters ahead and mortgage rates remain well above the lows prevailing in 2021.

Saving to buy a first home remains a struggle

Robert Gardner continues “Indeed, despite the modest fall in house prices, for a prospective first-time buyer earning the average income looking to buy the typical home, mortgage payments remain well above the long run average as a share of take-home pay. In addition, deposit requirements remain prohibitively high for many and saving for a deposit remains a struggle given the rising cost of living, especially for those in the private rented sector, where rents have been rising strongly.

“However, conditions should gradually improve if inflation moderates in the coming months as expected, easing pressure on household budgets. Solid gains in nominal incomes together with weak or declining house prices will al-so support housing affordability, especially if mortgage rates edge lower in the coming months.”

Clearly the key to the breaking the stalemate is confidence returning and inflation starting to come down, but the government don’t seem to be getting this under control, which makes the Bank of England nervous. It is also important though to be clear that the property market is made up of hundreds of micro markets, that can all be performing differently at any one time, so whilst national statistics and trends are important, breaking down what is happening in SK8, SK3 and M22 is most relevant to local buyers and sellers.

Mortgage Approvals down

Before we do that, let’s look at the latest data on mortgage approvals from the Bank of England. This shows that the number of home loans approved for new purchases fell to its lowest level (again, excluding the pandemic) since 2009. Just 39,600 were approved in January, down from 40,500 in December.

The rough monthly average for mortgage approvals following the 2008 crash has been about 60,000. We would be surprised if approvals don’t start to recover a bit, given that the fourth-quarter crisis in the gilt market is still playing havoc with the figures. But you’d also expect it to take a while for numbers to get back up to where they’ve been historically — the longer there’s a stand-off between buyers and sellers, the longer that will continue.

What is clear from the latest local property market data, is that there is definitely more stock available on the market, but buyers are still being very cautious and we are basically now in this hiatus, where everybody is waiting for somebody to blink first.

Is it possible to get a good mortgage deal?

Much of the current uncertainty around the property market was sparked by lenders withdrawing hundreds of deals and mortgage rates rising in the wake of September’s mini budget.

This resulted in even the cheapest mortgage rates rising to above 5%, having been below 1% in 2021.

The best deals are now around the 4% mark and lenders have been lowering rates on a weekly basis, with some banks recently offering 3.99% deals.

But further uncertainty could be set to come, with the Bank of England having increased the base rate to 4% in February, and may raise it further still, we need a period of stability to restore the shaken confidence of buyers

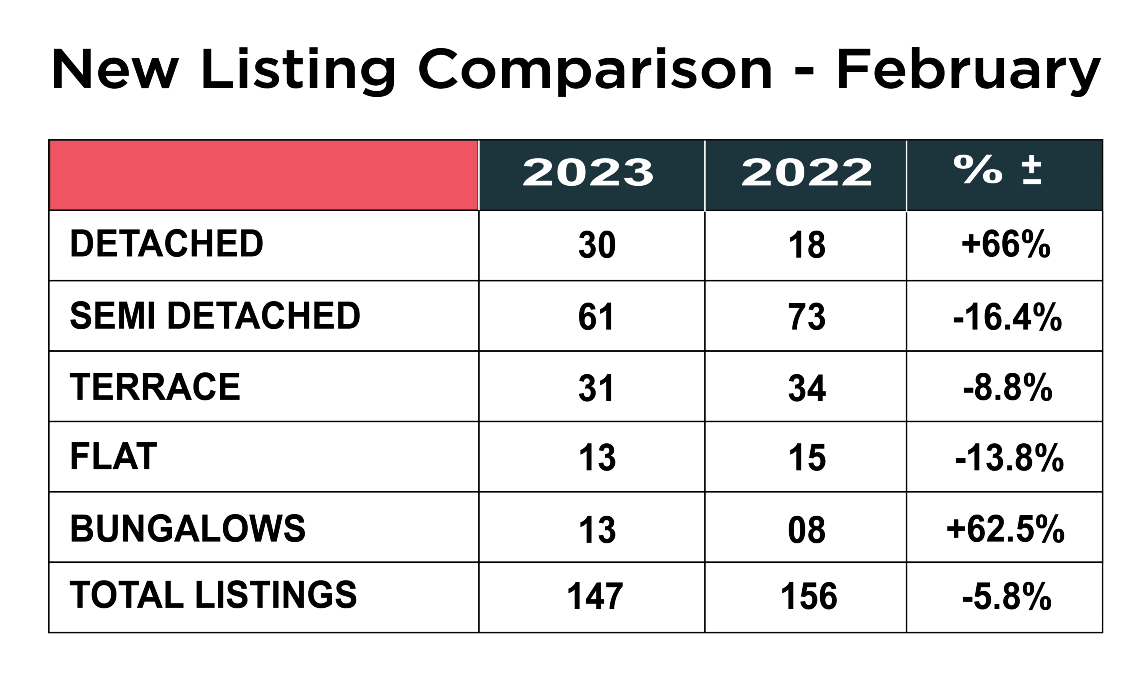

New listings picking up

When we look at the first graphic for Cheadle, it is evident the number of new properties coming onto or back onto the market is virtually on a par with the same time last year at 147 in 2023, compared with 156 in 2022, so just down 5.8%. When you break down the data further, what is interesting is the number of detached homes which came on the market in February 2023 was up 66% on last year, which might indicate that the pressure on people’s finances is causing some to look to downsize and reduce costs. Similarly, the number of bungalows is up 62% from 8 last year to 13 this year, which again might indicate some older people also looking to downsize and free up some cash. The number of semi-detached homes, terraces and flats are all down from 2022. Whereas previously the low register of available properties was probably helping keep upward pressure on prices, if stock levels continue to rise, sellers will need to ensure that the get the initial asking price right to attract interest from the fewer number of serious buyers, which we will come on to shortly.

Buyers remain very cautious

With the average available stock throughout February being 552, this is a 27% increase on the previous year. With the number of new listings still down on the previous year, this must mean an awful lot of properties that were sold/under offer have come back onto the market. The number of daily property views on Rightmove, which is a barometer for gauging buyer interest shows that there were 104 in February 2023, compared with 196 last February, a drop off of almost 47%. There has not been the traditional early new year spike in activity, despite there being more stock to choose from. We think that many buyers are being put off by the constant negative headlines in the press and media and some are now playing the long game and waiting to see how far prices will drop before committing. Many sellers are still refusing to accept that they need to correct their asking price in line with the more challenging market, so this could go on for some time.

Prices still rising in SK8 and SK3 – but for how much longer?

Very much against the national picture and even some of the over local stats prices in SK8 are actually still going up! How much of this is over optimistic sellers or poor advice from agents desperate for stock, it is difficult to tell, but with the number of buyer enquiries dropping off, price drops are surely in the offing. At least for now though detached homes in SK8 stand at an average value of £519,400, which is up 7.3% year on year. Semi detached homes are now worth an average of £385,700, up a very healthy 17% year on year, terraced homes are now averaging £293,100 up 10.1% and flats now stand at an average of £186,300, up 9.5% year on year.

In SK3 detached houses are now standing at an average of £428,375 up a massive 23% year on year. Semi detached homes are up a healthy 14.7% and stand at £265,058, terraced homes have now crept up to an average of £203,750 up 10.8% year on year and flats in the area are up 2.7% and now average out at £142,833. Interestingly, flat prices in SK3 are the only category where average prices have come down.

Sales down again in February

We suppose it makes sense that the number of sales will be seasonally down given the lower buyer interest we are seeing currently. Sales were down 16% in February over the previous year – but at least it was an improvement on the 21% drop in January. The rate of drop has slowed! When we micro analyse the individual stats for each home type, the number of detached homes sold is up 22% on the previous year, but if you remember the number of new listings, the number of detached homes that came onto the market was up 66%. The number of flats sold were also up an impressive 40%, whilst the number of semi detached homes, terraced and bungalow’s sold, were down 25%, 35% and 36% respectively, which are quite significant numbers.

Summary

The market started off at the start of the year better than many of us had expected, however the anticipated February upturn has simply not materialized and nationally the rate of prices dropping has gathered momentum. We have started to experience the first real signs of drop off in SK8, SK3 and M22 and it is now essential that sellers price their homes accurately to reflect the changing market. It is now clear that sellers are unlikely to achieve the level of pricing they did even just six months ago, yet many are still ignoring the signs.

On a positive note, there is still a reasonable number of buyers who are looking on a “need to move” basis, which is encouraging but as the number of properties coming onto the market rises, it strengthens the buyers hand and forces downward pressure on prices.

The continuing pressure on household budgets, rising interest rates and mortgage repayments are holding buyers back, but with the Bank of England softening their forecast on the outlook for the economy and a feeling that interest rates will reach a maximum of 4.5% before starting to drop back after the Summer, we still feel the local SK8 and SK3 market is well placed to avoid the price drops other areas around the country are suffering.

With most housing market commentators and forecasters predicting upwards of a 10% correction in house prices in 2023, some now suggesting it could hit 30% in some places, it is important to remember that if you are selling your home and you have to reflect this in your asking price, the properties you might be looking at are coming down too. It is all about the differential between what you sell for and what you pay for another property is what really matters.

What is also important for sellers is choosing a well-established, experienced agent who is used to operating in more challenging markets and is equipped with the widest marketing mix to reach the serious buyers looking at the moment. Simply listing a house on the property portals such as Rightmove and relying on those enquiries, when they are 50% down is not going to cut it. Agents now need good social media presence, an established database and groups of pre-qualified buyers ready and waiting for the right home to come on to the market, whom they are in contact with constantly.

If you are undecided on whether now is the right time to sell or you would like to know where you should position your asking price to sell in 2023, please contact Joe, Patrick or Maurice and arrange for a FREE market appraisal of your home on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.