What a last month it has been!

We have a new Labour government after fourteen years of a Conservative one, England’s football team disappointed once again in the Euro’s final, Jimmy Anderson retired, as one of England’s all time great cricketers and last night we saw Andy Murray bow out of Tennis at the Olympics in Paris. It’s all been change! Oh and we saw the first drop in interest rates for four years yesterday, as the Bank of England monetary committee decided to cut the base rate from 5.25% to 5% and we saw some significant moves in the local SK8 and SK3 property market, which we will cover further later, but first of all lets start with our monthly look at the National picture and the view from the Nationwide Building Society and the property portal Zoopla.

Here are the headlines from the Nationwide July Property Index:

House price growth edged up in July

• UK house prices rose 0.3% month on month in July

• Annual growth rate picked up to 2.1%, from 1.5% in June

• Marks fastest pace of growth since December 2022

• Average House Price £266,334 ( not seasonally adjusted )

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“UK house prices increased by 0.3% month on month in July, after taking account of seasonal effects. This resulted in a slight pickup in the annual rate of house price growth from 1.5% in June, to 2.1% in July - the fastest pace since December 2022. However, prices are still around 2.8% below the all-time highs recorded in the summer of 2022.

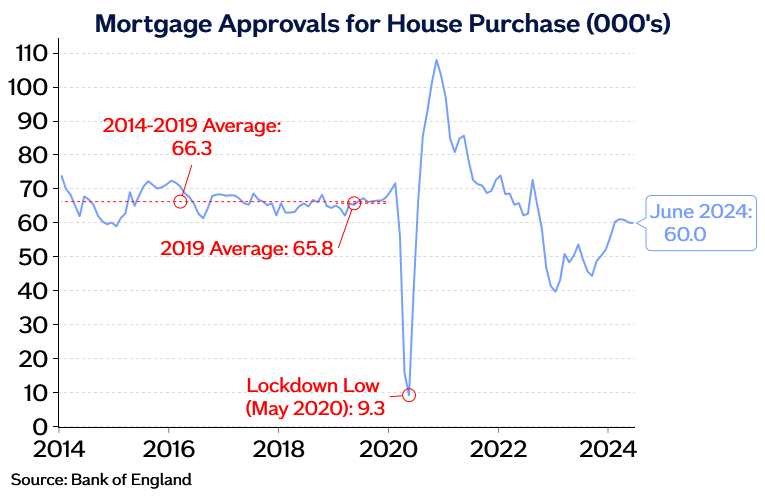

“Housing market activity has been holding relatively steady in recent months with the number of mortgages approved for house purchase at around 60,000 per month (see chart below). While this is still c.10% below the level prevailing before the pandemic struck, it is still a respectable pace given the higher interest rate environment.

“For example, for borrowers with a 25% deposit, the rate on a five-year fixed rate deal has been around 4.6% in recent months, more than double the 1.9% average recorded in 2019. As a result, affordability is still stretched for many prospective buyers. Indeed, for an average earner buying a typical first-time buyer property, the monthly mortgage payment is equivalent to around 37% of take-home pay, well above the 28% prevailing pre-Covid and the long-run average of c30%.

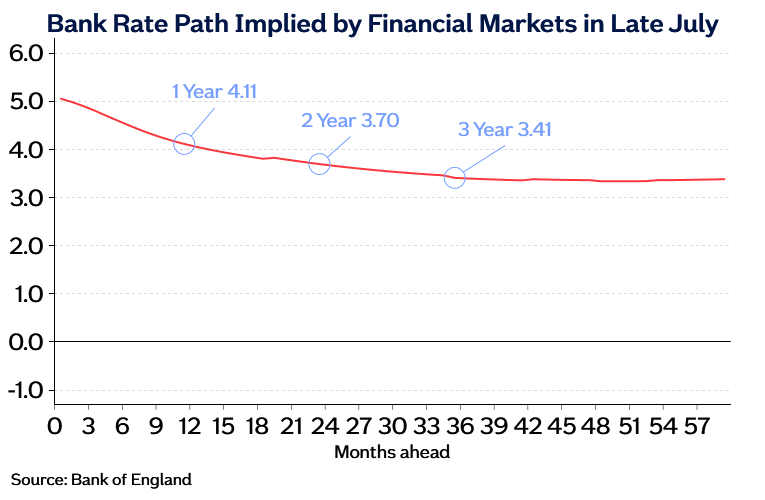

“Investors expect Bank Rate to be lowered modestly in the years ahead, which, if correct, will help to bring down borrowing costs. However, the impact is likely to be fairly modest as the swap rates which underpin fixed-rate mortgage pricing already embody expectations that interest rates will decline in the years ahead.

“As a result, affordability is likely to improve only gradually through a combination of wage growth outpacing house price growth (which is expected to remain fairly flat), with some support from modestly lower borrowing costs.”

So now let us take a look at the Zoopla Property Market Index for July and see what they are saying by comparison with the Nationwide.

Key takeaways

• The housing market continues to adjust to +4% mortgage rates with increased market activity rather than faster house price growth

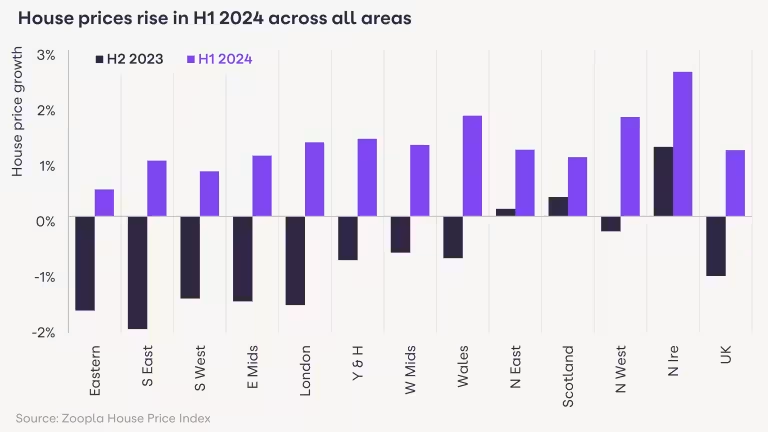

• House prices have been broadly flat over the last 12 months, but over the first half of 2024 they’ve been higher across the whole of the UK

• House prices are on track to be up to 2% higher by the end 2024

• The supply of homes for sale continues to grow and is 16% higher than a year ago – the average estate agent has 33 homes for sale

• More supply and choice is supporting sales growth and is also keeping price inflation in check

• Buyers are paying a greater proportion of the asking price (96.8%), which has recovered the most in London and the Southeast

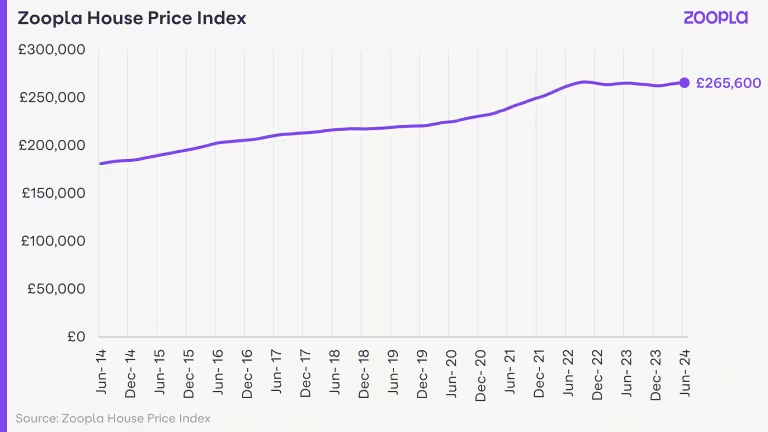

The average house price in the UK is £265,600 as of June 2024 (published in July 2024)

Property prices are now at 0.1% inflation compared to a year ago. However, the average UK house price is set to rise by 1.5% by the end of the year.

The graph below shows how the UK’s average house price has changed in the last 10 years.

Housing market is the most balanced it’s been in five years

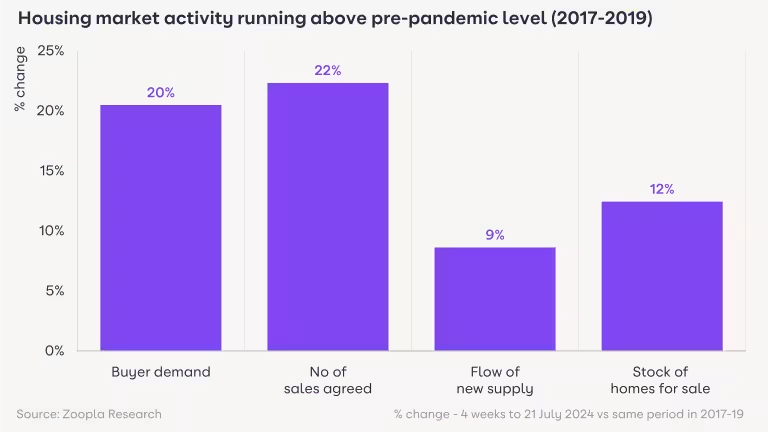

The housing market continues to adjust to +4% mortgage rates with positive signs of increased activity. More sellers continue to list homes for sale, and more sales are being agreed. Buyers are also paying a greater proportion of the asking price as confidence improves.

House prices have been rising slowly across the UK since January, reversing the price falls recorded over 2023. Market activity will continue to improve, but prices will be kept in check by greater supply and affordability constraints.

House price inflation remains static, but is still negative in south

UK house prices have edged 0.1% higher over the last 12 months, increasing by just £310 to £265,600. Annual price inflation ranges between -1.2% in the East of England to +3.9% in Northern Ireland.

We expect house prices to continue to increase slowly over the second half of 2024. This means the annual rate of UK house price inflation will increase towards +2% by the end of the year.

Modest price rises help motivate sellers to list their home for sale, but a return to faster house price inflation would be unwelcome. This is because affordability remains a major constraint on market activity, especially in southern England.

The housing market requires a 12–24-month window where incomes rise faster than house prices to help reset affordability. Incomes are set to rise by 4.5% in 2024, and we also expect incomes to continue to rise faster than house prices in 2025.

Supply of homes for sale continues to grow

One important feature of the current housing market is that there are more homes for sale than at any point in the last six years. This is improving choice for home buyers and supporting more sales.

The average estate agent has 33 homes for sale, which is 16% higher than a year ago. More supply means more sellers, most of whom are also buyers. Many would-be movers are upsizers who are looking further afield to get the home and features they are looking for, while also seeking value for money.

1 in 10 homes for sale are formerly rented homes

Over 1 in 10 (12%) homes for sale currently were previously rented - a proportion that has broadly held steady over the last 3 years. Tax changes introduced in 2016, higher mortgage rates and greater regulation of rented property have all led to more landlords selling.

However, not all these homes leave the rented market. We find that 40% remain as rentals as they’re either bought by a new landlord or let out by the current landlord who decides not to sell.

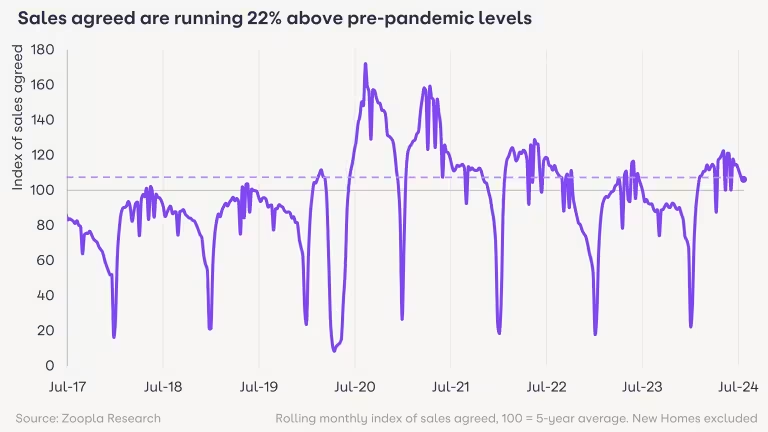

Sales agreed are up 16% year-on-year

A greater supply of homes for sale and more buyers has resulted in a 16% increase in the number of sales agreed since last year. A long-run index of weekly sales shows how sales in the first half of 2024 have been stronger than in 2023 and the pre-pandemic years.

This is positive and reveals a more balanced housing market: an increase in sales volume but with a greater stability in price inflation. Overall, sales are up across the whole of the UK.

Buyers paying a greater % of the asking price

Buyers are paying a greater proportion of the asking price than they were last year when higher mortgage rates hit demand.

UK buyers are currently paying 96.8% of the asking price, which is up from 95.6% last October. This is on par with the long-run average, and points to continued house price inflation. In value terms, this averages at £16,600 below the asking price for sales agreed in June 2024, compared to £23,000 below the asking price in October 2023.

Demand and buying power in southern England have been hit the hardest by higher mortgage rates, as prices here have larger falls. Buyers were paying less than 95% of the asking price last year, but this has recovered to 96.3%.

The impact of higher mortgage rates was less pronounced across the rest of the UK, which explains why the proportion of the asking price achieved declined by a smaller amount and has stabilized at 97.1%.

Outlook for the rest of 2024

For the rest of the year, we expect continued modest growth in house prices. This will be greater outside the south of England where affordability is less of a constraint on price inflation. Sales remain on track for 1.1m in 2024, which is still 10% lower than the 20-year average.

The timing of the first base rate cut is important. It will deliver a boost to consumer confidence and market activity rather than leading to any major reduction in mortgage rates for new home buyers.

Nothing in the King’s Speech or the new Government’s plans has any material impact on the outlook for the market in the next 12-18 months. Economic growth and increasing home building will benefit homebuyers and renters in the long run.

However, affordability as well as access to home ownership and rented housing remain challenges for a significant proportion of households on lower incomes.

That is the national outlook covered off. It is clear that there is a degree of stability returning to the market, although buyer interest remains fairly subdued, but it will be interesting to see what impact, if any, the interest rate drop yesterday has on buyers. It would also appear that many sellers are starting to take note of the prevailing selling conditions and marketing their properties more competitively to start with, with is reflected in the increased percentage of asking price, properties are selling for.

Let’s see if that is a similar pattern in SK8 and SK3.

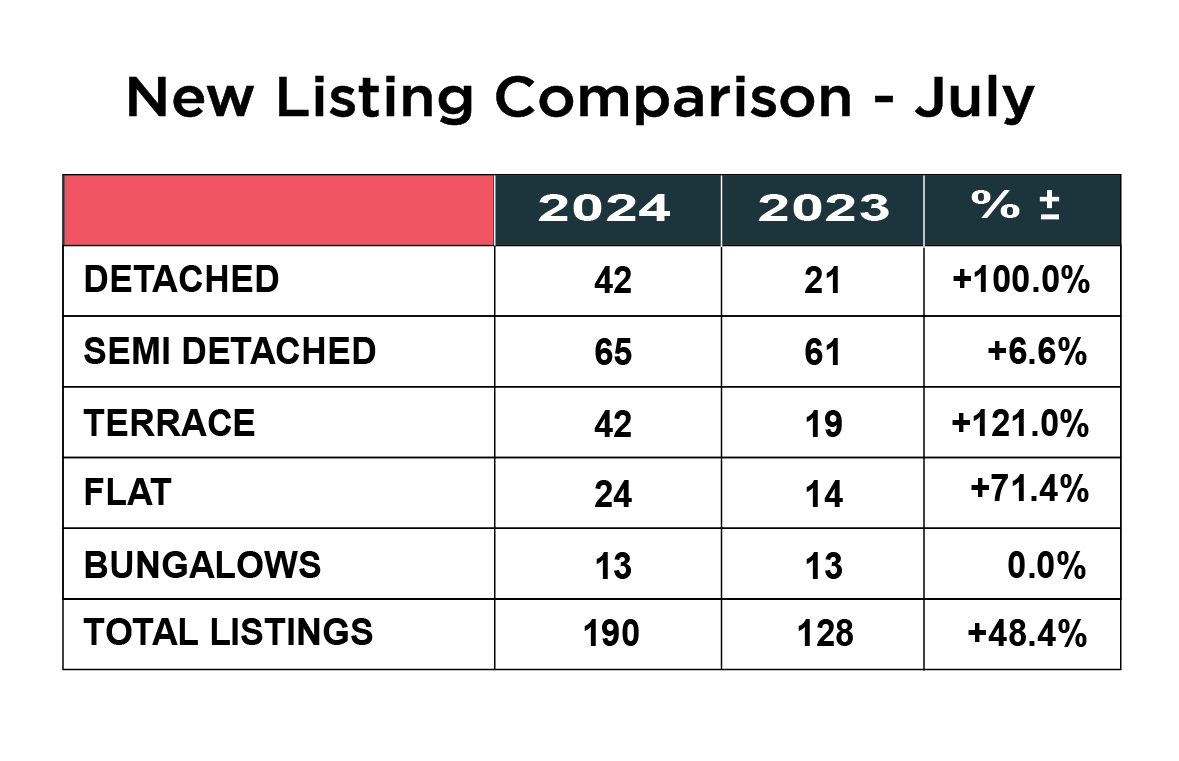

New instructions up a huge 48% across SK8 and SK3

Following a 28% increase in new properties coming to the market in June, there was an even bigger increase in July, up a massive 48% from 128 in July 2023 to 190 in July 2024.

Following a 28% increase in new properties coming to the market in June, there was an even bigger increase in July, up a massive 48% from 128 in July 2023 to 190 in July 2024.

Every individual type of property saw an increase, except Bungalows, which remained the same at 13 last year and this year. However, there were huge increases in the number of terraced homes coming to the market, up a whopping 121% from a year ago, up from 19 in 2023 to 42 in 2024. Not far behind was the uplift in detached homes, up 100% from 21 last year to 42 this year. Flats increased from 14 to 24, an increase of 71% and semi-detached homes were up a more modest 6.6% from 61 in 2023 to 65 in 2024. The significant increase in new properties coming onto the market is a little unusual for July, so this is something we will have to keep an eye on, as increases of this nature will continue to subdue prices.

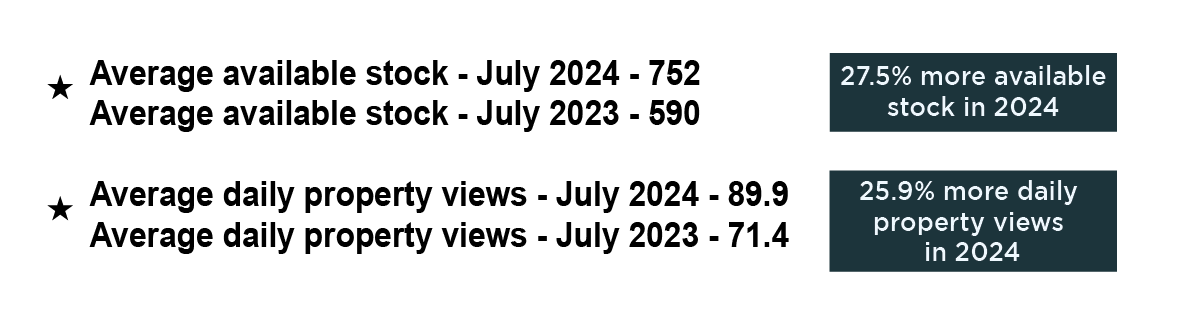

Over a quarter more stock available in July 2024 than in 2023

Unsurprisingly, with such an influx of new houses to the market, available stock levels rose 27.5%, from 590 a year ago to 752 in 2024 and up from 703 properties only a month ago.

On a positive note, the number of daily property views on Rightmove increased from 71.4 a year ago, to 89.9 this year – an increase of 26%. This is still significantly below the peak in 2022, but a step in the right direction and again we are waiting to see if this is the start of more buyers looking or just a reflection on the number of properties available? The next couple of months as we head towards the Autumn will be very interesting.

What is happening to individual house price types in SK8?

The average price of a house in SK8 now stands at £372,818 which is a modest uptick on the previous month and 2.1% year on year, although 27% up over the last five years.

The average price of a house in SK8 now stands at £372,818 which is a modest uptick on the previous month and 2.1% year on year, although 27% up over the last five years.

When we break it down by property type, detached homes now stand at £517,160 which is up 3.1% on twelve months ago and almost £4,000 on the last month alone. Semi-detached homes are now an average of £371,816, which means there has been no difference one way or the other in the last twelve months. Terraced houses now average £314,024, which is up 3.5% on the previous twelve months, but down £5,000 in a month.

Flats now stand at £180,469, an increase of 2.2% on the previous year.

What is happening with SK3 house prices by individual type?

The average price of a property in SK3 currently stands at £236,176, which is up 0.9% year on year on the same period 2023 and down £1,000 on the previous month.

Detached homes now stand at an average value of £329,571 down 7.9% year on year. Semi-detached homes now average £274,317, which is 1.8% up on a year ago. Terraced houses now average £211,105, up 2.4% on this time a year ago, and flats now average £169,579, which is actually up an impressive 9.5% year on year.

Sales up in line with increased stock levels

At Maurice Kilbride, we followed a record sales month in June, with another excellent month for sales in July, which is very encouraging.

At Maurice Kilbride, we followed a record sales month in June, with another excellent month for sales in July, which is very encouraging.

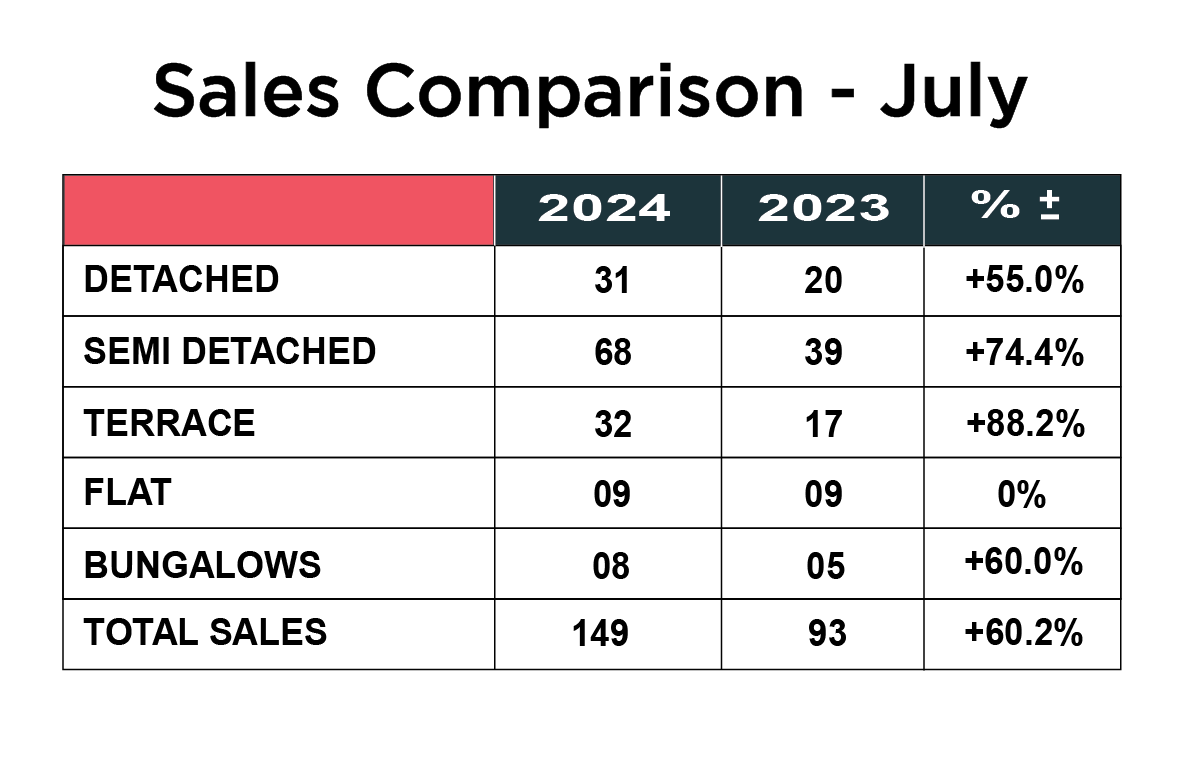

It would appear that it was a similar pattern across SK8 and SK3, as the number of properties sold increased 60% from the previous year, up from 93 in July 2023 to 149 in July 2024.

When we break down the number of sales by type, there was a huge increase in the number of detached, semi-detached, terraced homes and bungalows. Only the number of flats sold remained the same as last year.

The biggest increase was the number of terraces sold, up 88% from 17 to 32 year on year. Not far behind, were the number of semi-detached homes sold, up 74% from 39 last year to 68 in 2024. Bungalow sales were up 60% from 5 to 8 this year and detached home sales were up 55% from 20 in 2023 to 31 in 2024.

What’s happening in the SK8 and SK3 rental market?

There remains a distinct lack of rental supply across SK8 and SK3, however rents have actually dropped a little year on year according to the figures.

In SK8 rents have dropped back 0.9% year on year by 3% with the average yield still a very healthy 5.47%. The average rent for a house is £1573 and for a flat it is £931 per calendar month.

In SK3 rents are down 1.4% year on year, with an average yield of 5.88%. The average rent for a house in SK3 is £1133.

If you are a landlord with a property to rent, we would love to hear from you, as we have a huge database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website CHECK OUT OUR LANDLORD SERVICES AND FEES

Summary

There have been some encouraging signs for the property market during July and most importantly some stability returning, which is always positive. Both the Nationwide and Zoopla seem to be reflecting a cautious optimism in their monthly property indices; however, it is important to stress that we are not out of the woods by any means and the market is far from where we want or need it to be.

What we have noted in SK8 and SK3 is a significant increase in the number of properties coming onto the market, a big rise in sales and also the number of daily property views on Rightmove increasing too.

With the new Government now in situ and the Bank of England being bold and cutting interest rates, hopefully we will see more and more buyers slowly return to the market as hopefully affordability eases a little and there is a bigger pool of properties to choose from.

For those selling now, it remains imperative that you price your property correctly from the outset. There is more and more stock available to choose from, giving buyers more power and only those properties priced competitively will attract the serious buyers. Once a property has been on the market for 6-8 weeks without any serious interest, even reducing the price doesn’t necessarily have the desired effect and can be like setting fire to a bonfire of pound notes. It is not the time to be “testing the market” that strategy won’t work. If you want to talk to us about your options and how you can refresh your marketing without any obligation, please call 0161 428 3663.

I know our advice is the same every month, but we feel it is important to keep re-enforcing this very important message - All the metrics show that the market is resilient but subdued and prices are dropping as you can see in the above data. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same. We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and money in the long run.

It is also important for sellers to choose a well-established, experienced local agent who has operated in challenging markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Online agents such as Strike and Purple Bricks are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or good practice.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed ahead of a move in 2024 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.