What a Summer it has been and sadly not in a good way! It has been the wettest Summer on record, the country continues to limp along in an economic malaise with escalating costs making things tough for most people, but at least the football season is back, which may or not be a positive depending on whether you are a football fan or not!

The Summer has certainly not been a ray of sunshine for the property market either, with prices continuing to drop, sales plummeting and mortgage rates still rising and resulting in higher mortgage payments for many.

In recent days there have been a number of things happen, which suggest we haven’t seen the end of the bad news for the housing market, which we will analysis in more detail.

Firstly, UK house prices have fallen at the fastest rate since 2009, says the Nationwide.

UK house prices fell 5.3% in August compared with the same month last year, the fastest annual drop in 14 years, according to the Nationwide Building Society.

The lender said the fall, which was the biggest since July 2009, when the global economy was in the depths of the financial crisis, was driven by soaring mortgage costs, which are putting off potential buyers. Average house prices are more than £14,500 lower than they were a year ago and mortgage approvals have plummeted by a fifth compared with pre-pandemic levels.

Prices fell 0.8% in August compared with July, dragging down the typical price of a UK home to £259,153.

“The softening is not surprising given the extent of the rise in borrowing costs in recent months, which has resulted in activity in the housing market running well below pre-pandemic levels,” said Robert Gardner, the chief economist at Nationwide. Mortgage rates have risen sharply over recent months in response to the Bank of England, which has raised interest rates 14 times since December 2021, from 0.1% to 5.25%.

Nationwide said the number of completions of house sales was down 20% in the first half of the year compared with 2019, and about 40% down on 2021, when the UK experienced a housing sales boom because of factors including low interest rates and the implementation of a stamp duty holiday by the government.

While the proportion of people buying with cash has remained strong, the number of completions by those requiring a mortgage has plummeted.

“Home mover completions with a mortgage in the first half of 2023 were 33% lower than 2019 levels, while first-time buyer numbers were about 25% lower,” Gardner said. “By contrast, cash purchases were actually up 2%. The relative weakness of mortgage activity reflects mounting affordability pressures as the result of the sharp rise in mortgage rates since last autumn.”

“Constant interest rate rises are making affordability difficult for buyers who are trying to move, with many having little option but to wait until rates settle,” said Tomer Aboody, a director of the property lender MT Finance. “With some better news on inflation recently, it would be useful if the Bank of England postponed the next rate rise, giving the market some breathing space to adjust.”

Interest rate rises on mortgages are weakening demand, property website

Earlier this week, a report by the property portal Zoopla also predicted that the number of UK homes sold this year would fall to the lowest number in over a decade with the soaring cost of borrowing putting off many homebuyers.

House sales reaching completion are expected to fall 21% year on year to about 1m in 2023, the lowest level since 2012.

The number of house sales completed securing a mortgage is forecast to fall by 28% this year, while cash sales will remain relatively resilient, falling just 1% in 2023, according to the report.

A typical two-year fixed mortgage was 6.73% earlier this week, and the average five-year fix was 6.21%, according to Moneyfacts. Some lenders have cut rates in recent weeks, however, as competition returns.

Zoopla said: “Mortgage rates have started to fall slowly but rates need to fall below 5% before we see an increased appetite to move home in the second half of 2023.”

It also said that over the last four weeks, demand for homes had been 34% lower than the average for the same period over the last five years.

The report estimates that the cost of renting is on average 10% cheaper than making mortgage payments, despite high growth in rental rates in recent years.

Lack of affordability is affecting the housing market the most in southern England, where average house prices are highest, meaning buyers need larger mortgages, bigger deposits, and higher incomes to buy. Levels of market activity are holding up better in more affordable parts of the UK, including the North-West, however, as we will show later when we break down the stats for SK8 and SK3 – that doesn’t look sustainable for long.

“These trends will continue over the rest of 2023 and into 2024,” said Zoopla. The report found, however, that affordability was improving relative to earnings, with wages up 7% over the last year. The report forecasts that the UK house price-to-earnings ratio will fall back into line with the 20-year average by the end of this year, at 6.3%

UK mortgage approvals fall to five-month low as rate hikes hit demand.

The other stat which hit us and will no doubt reflect in house sale figures is the number of mortgage approvals fell to its lowest level in five months, amid fresh evidence of the impact of the sharp increase in borrowing costs on the housing market and the wider economy.

Bank of England figures showed the number of new loans approved but not yet completed decreased from 54,600 in June to 49,400 in July – a drop of 10%.

The Summer is traditionally a busy time for home buying but last month approvals were running 20% below the average for 2022.

Andrew Wishart, a property analyst at the consultancy Capital Economics said the renewed surge in mortgage rates since April had begun to “take its toll. But given the lag between quoted mortgage rates and approvals, the full impact is unlikely to become clear until September.” We disagree, the full impact won’t be seen until towards the end of the year.

Despite the increase in mortgage rates, the monthly bulletins of house prices from both the Halifax and Nationwide building society have detected only modest falls over the past year. Again, it is important to note that their figures are selective and based on a relatively small sample size.

Myron Jobson, a personal finance analyst at the investment platform Interactive Investor, said: “Buyers should proceed with caution. With home prices and mortgage rates remaining elevated, buyers should be careful to avoid biting off more than they can chew.”

The warning signs for SK8 and SK3 are clear.

Now that we have set the scene with the national picture, it is time to delve into what’s happening in the local market in granular detail and there a couple of significant changes that are concerning and need looking at in closer detail.

As always, we start off by looking at the what has come onto the market in the last month.

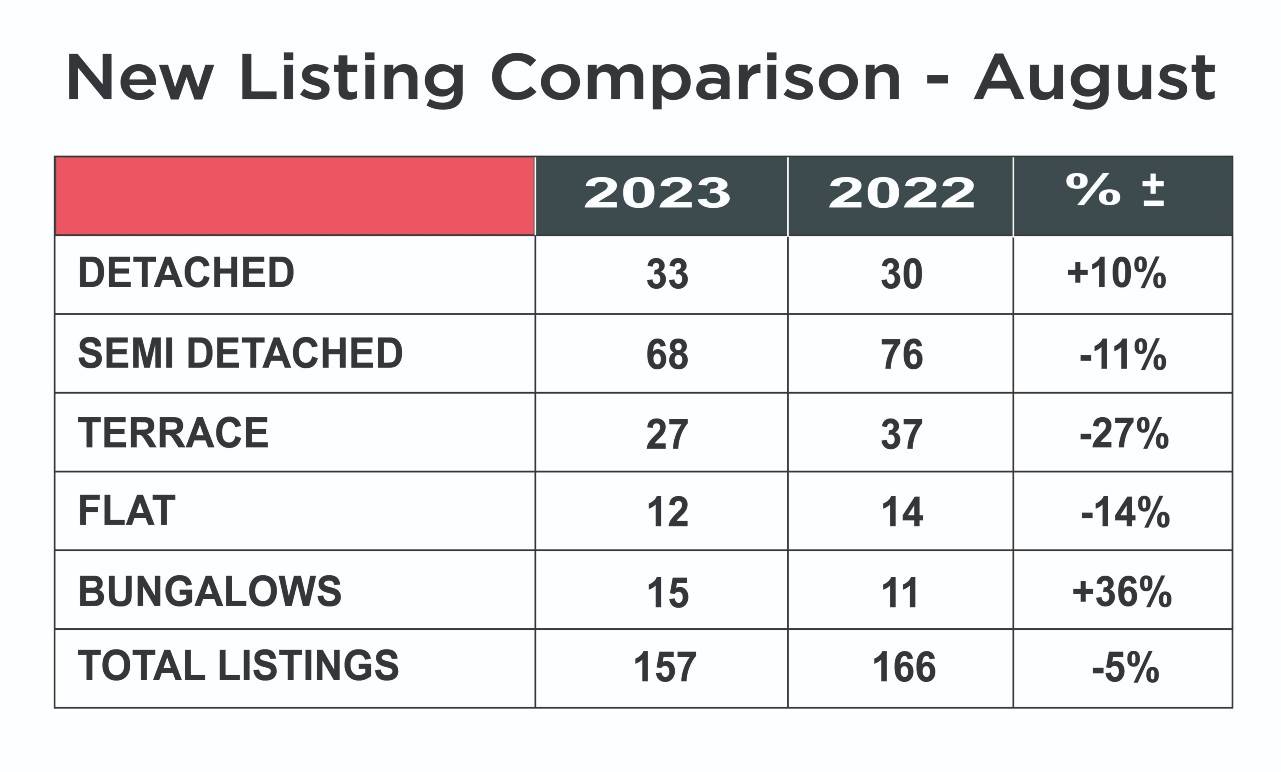

It would appear the drop in new properties coming onto the market in July was just a blip, as August returned to something like the seasonal norm and very similar to the same period last year, just 5% down from 166 to 157.

The negative press and headlines continue to have an impact on peoples thinking, so we can only assume from these figures that more people are beginning to have to sell for financial reasons or are deciding to take the equity they have in their properties out now, before it gets eroded any further.

We said last month that reduced availability could help prices stabilize, unless the perfect storm of buyers not doing anything continued as well – Sadly it seems to be the latter and prices are starting to come down in SK8 and SK3 too, mirroring the national picture.

The biggest drop was in the number of terraced homes coming to the market, which is interesting, as these have mainly been bought by first time buyers in recent years, down 27% from 37 last August to 27 in 2023. The number of semi-detached homes and flats were also down 11% and 14% respectively. The trend was somewhat bucked as the number of detached homes coming onto the market was up 10% from 30 to 33 and bungalows up 36% from 11 to 15.

Stock levels up but buyer interest continues to be subdued.

The second set of stats really starts to show buyer interest is becoming increasingly problematic and following a similar pattern as other parts of the country.

We thought last months record low number of daily property views on Rightmove might be as low as it gets – unfortunately not! In August the number dropped to just 63, compared with 131 last August, a drop of 52%. This will of course clearly impact on the number of viewings and sales.

The average available stock in August was 593 properties, which was up 28% on the previous August from 464. Increasing stock levels and less enquiries can only lead to one thing, which you will see shortly!

What is hot and what’s not in SK8

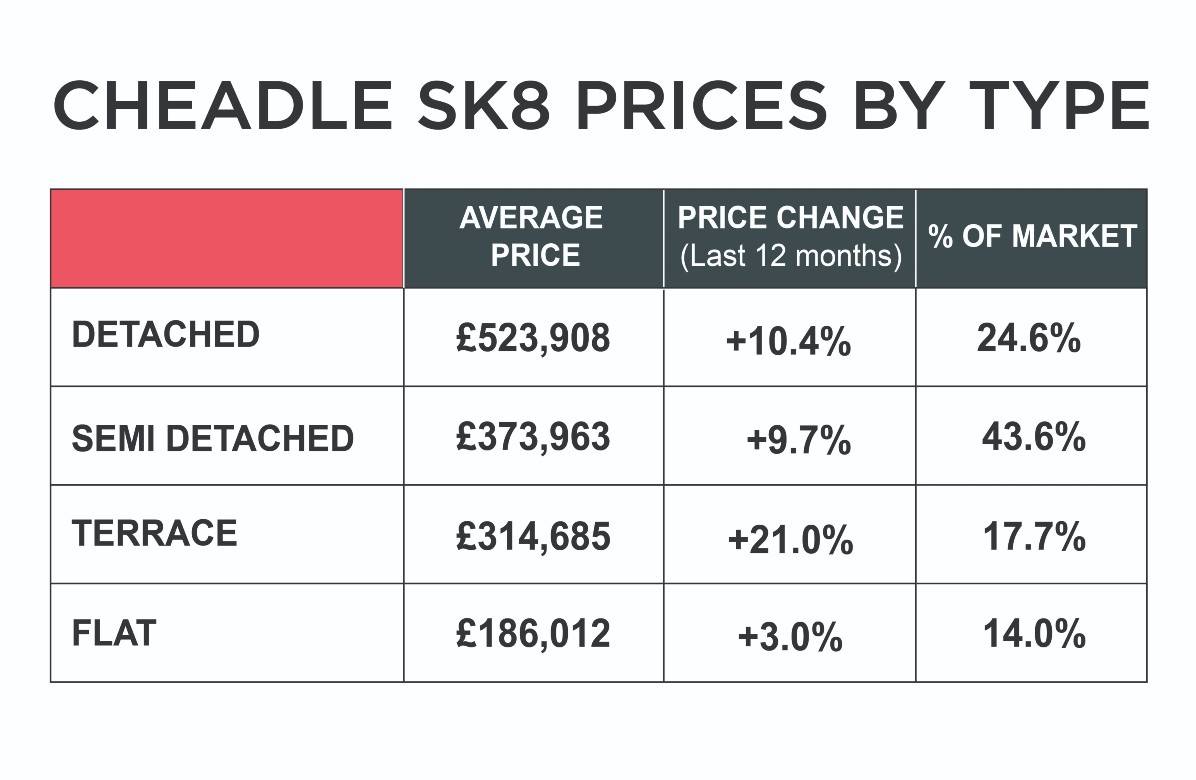

The average price of a house across SK8 now stands at £371,571 which despite everything is still up a healthy 11.5% year on year – although it is very important to remember all of the indices are several months behind and the reality is, the figures won’t be as good as they are showing, but we won’t see what is truly happening in August until at least the end of the year. The worry we have and see regularly, is many sellers still have unrealistic expectations and think they can achieve prices comparable with this time last year and sadly this is fueled by agents desperate for stock and quite happy to give sellers duff information to obtain the listing.

When we look at the breakdown of each type of property, detached homes now stand at £523,908 which is up 10.4% on twelve months ago. Semi-detached homes are now an average of £373,963, up 9.7% on a year ago, but down almost £7,000 in real terms from a month ago – something to keep an eye on if it continues? Terraced houses now average £314,685 which is up 21% on the previous twelve months and are now worth an extra £4,000 in the last month alone and flats are up 3.0% to an average of £186,012.

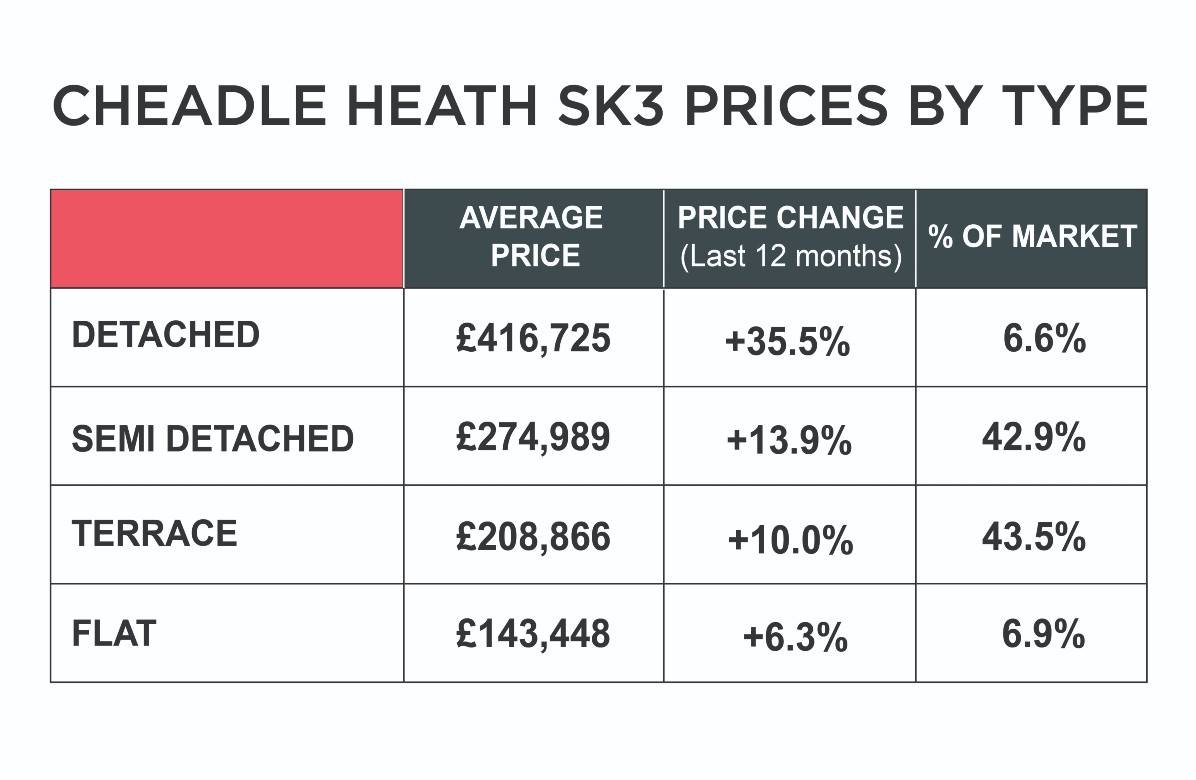

The average price of a property in SK3 is now £241,775, which is 11.4% up year on year.

The average price of a property in SK3 is now £241,775, which is 11.4% up year on year.

Detached homes are up 36% year on year and now stand at an average of £416,725. Semi-detached homes now average £274,989, which is up 14% year on year and remains consistent with July. Terraced houses are now averaging £208,866, up 10% from last August and flats now average £143,448 up 6.3% year on year.

If you thought July’s sales figures were bad, August was dire!

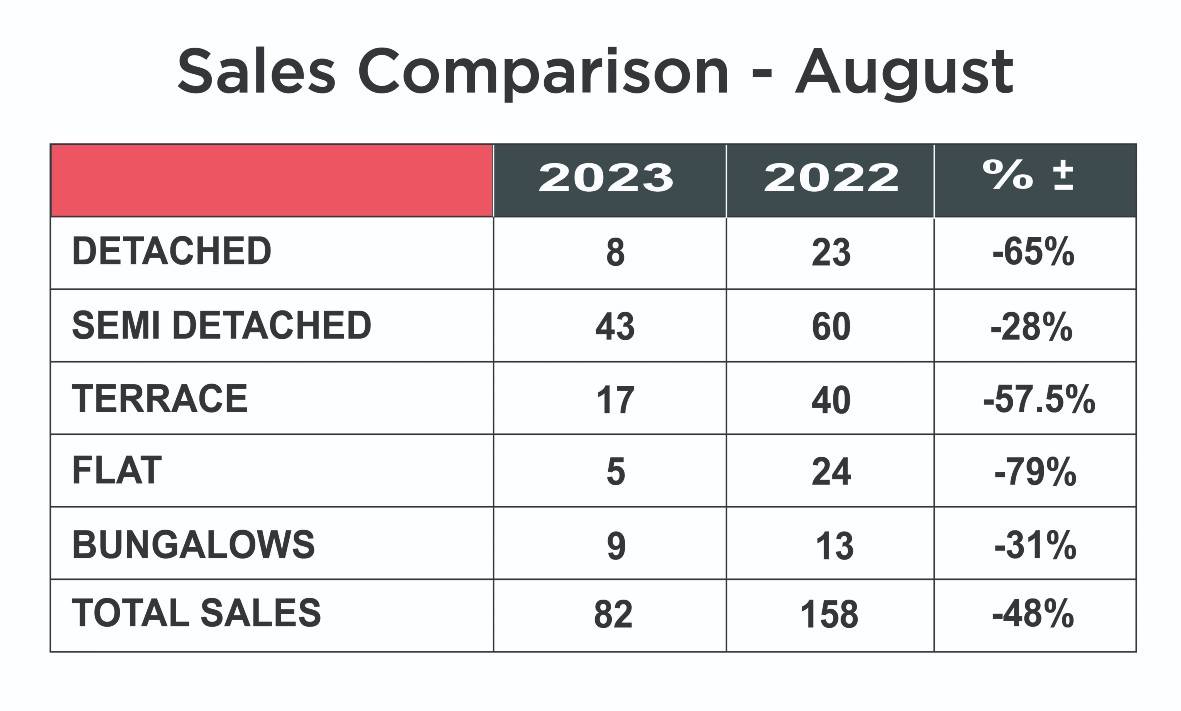

Just 82 properties were sold across SK8 and SK3, compared to 158 in August 2022, which is seismic drop of almost 48% and followed another steep drop in July. The number of buyers looking has dropped significantly, as those buying with a mortgage continue to battle with rising repayment costs and clearly many have shelved their buying plans until they see where prices drop too.

The number of sales across the board are down massively with the number of detached homes showing the biggest drop from 23 to 8 last year – a drop of 65%, semi-detached homes are down 28% from 60 to 43, terraced homes down 58% from 40 to just 17, flats down 79% from 25 to 5 and bungalows down 31% from 13 to 9. This is no longer a blip but a trend.

Summary

We think that Q3 of 2023 is the time that the local SK8 and SK3 property market is starting to mirror the rest of country and the slow down in activity, sales and prices is accelerating. It looks like we are heading for a bumpy Autumn and Winter.

Home sellers who are keen to move need to act now and ensure that they market their homes competitively and that is not to have an expectation of achieving prices from last year.

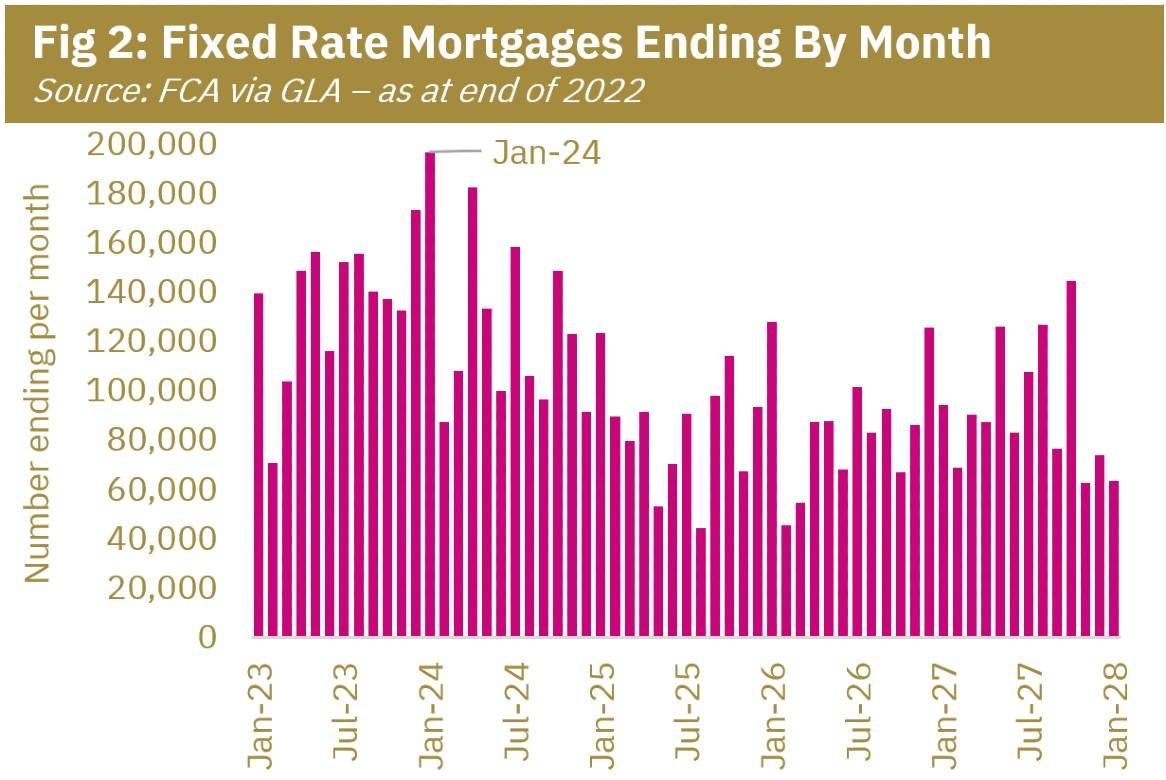

Another factor which needs to be considered, with interest rates rising to their highest levels in decades and January 2024 will have the highest number of fixed rate mortgages coming to an end, there is expected to be an increased supply of property coming onto the market, placing further pressure on prices.

It is clear that buyers have been put off by the rise in the cost of borrowing. There are still a number of cash buyers looking to take advantage of weakening prices, but the vast majority of buyers seem to be waiting to see whether rates stabilize, and prices drop further. With many “property experts” and media outlets still suggesting prices haven’t bottomed out, buyers seem to be hedging their bets.

It is important for sellers to remain calm and focused. As we have said before, even if prices drop 10%, this will still leave them higher than before the pandemic, when they became artificially propped up by government policy. This was never sustainable.

What we are seeing now is a property that is priced correctly from the outset is getting interest, if you get it wrong and over price it, it will simply sit there, and even reducing the price will not have the same effect. Don’t listen to agents who are simply trying to get you to list with them by overvaluing your home, they are not doing you any favours. You need honesty and a defined strategy that is proven to work and navigate these challenging times. Get the price right and make up the difference on your purchase. Just because you might have to take £10/15,000 less than you wanted, if you pay £10/15,000 less for your next home, it equates to the same! Too many sellers remain fixated on the price they are going to get, rather than look at the overall differential.

Reducing inflation remains the key for the government and there have been one or two green shoots recently, but it is not moving quickly enough. What would be good is if the Bank of England saw enough encouraging signs to suspend next months rate rise to give the market and borrowers some breathing space.

As we say every month and make no apologies for ramming home the message! it is so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking now. Simply listing a house on the property portals such as Rightmove and relying on those enquiries, when they are 50% down, is not going to expose the property to enough people. Agents now need to roll their sleeves up, dig deep, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this proper estate agency!

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2023 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice and arrange for a FREE market appraisal, on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.