There are now just 85 days until Christmas! Strictly is back on our TV’s and there is a definite Autumnal feel in the air, which I am sure you really wanted to know! and the good news keeps on coming for the local SK8 and SK3 and Northwest Property Market with interest rates now at their lowest for fifteen months, prices on the rise and more homes being sold.

But what has the picture been for the rest of the country? Let’s start our comprehensive monthly look at the National picture by sharing the view from the Nationwide Building Society and the property portal Zoopla.

Here are the headlines from the Nationwide September Property Index:

September records fastest annual house price growth in two years

UK house prices up 3.2% year-on-year in September

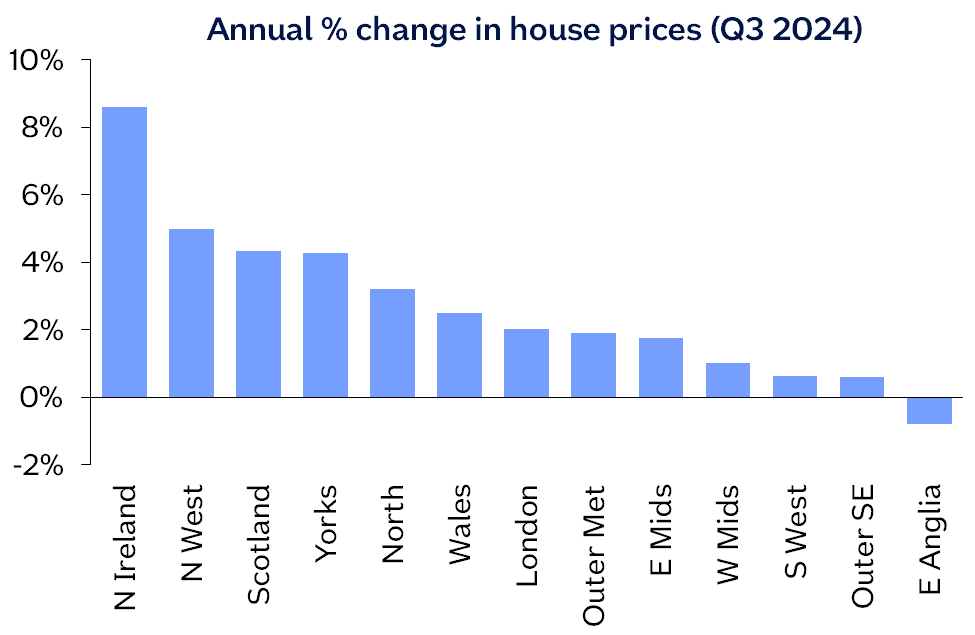

Northern Ireland best performer, with prices up 8.6% in Q3

East Anglia weakest performing region, with prices down 0.8% over the year

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“UK house prices increased by 0.7% in September, after taking account of seasonal effects. This resulted in the annual rate of growth rising from 2.4% in August to 3.2% in September, the fastest pace since November 2022 (4.4%). Average prices are now around 2% below the all-time highs recorded in summer 2022.

“Income growth has continued to outstrip house price growth in recent months while borrowing costs have edged lower amid expectations that the Bank of England will continue to lower interest rates in the coming quarters. These trends have helped to improve affordability for prospective buyers and underpinned a modest increase in activity and house prices, though both remain subdued by historic standards.

Most regions saw a pick-up in Q3 2024

“Our regional house price indices are produced quarterly, with data for Q3 (the three months to September) indicating that most regions saw a pickup in annual house price growth.

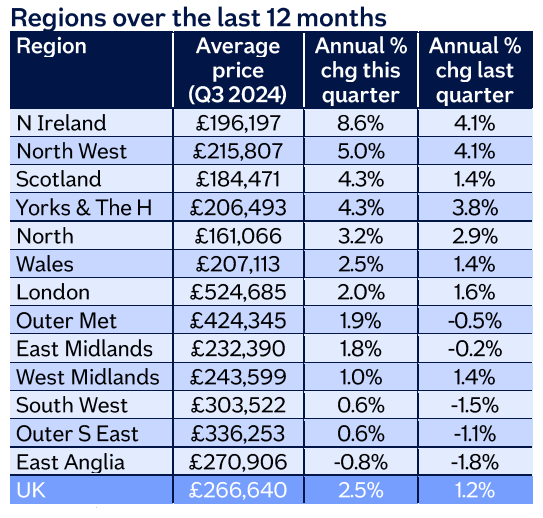

“Northern Ireland remained the best performer by some margin, with prices up 8.6% compared with Q3 2023. Scotland saw a noticeable acceleration in annual growth to 4.3% (from 1.4% in Q2), while Wales saw a more modest 2.5% year-on-year rise (from 1.4% the previous quarter).

“Across England overall, prices were up 1.9% compared with Q3 2023. Northern England (comprising North, Northwest, Yorkshire & The Humber, East Midlands and West Midlands), continued to outperform southern England, with prices up 3.1% year-on-year. The Northwest was the best performing English region, with prices up 5.0% year-on-year.

“Southern England (Southwest, Outer Southeast, Outer Metropolitan, London and East Anglia) saw a 1.3% year-on-year rise. London remained the best performing southern region with annual price growth of 2.0%. East Anglia was the only UK region to record an annual price fall, with prices down 0.8% year-on-year.

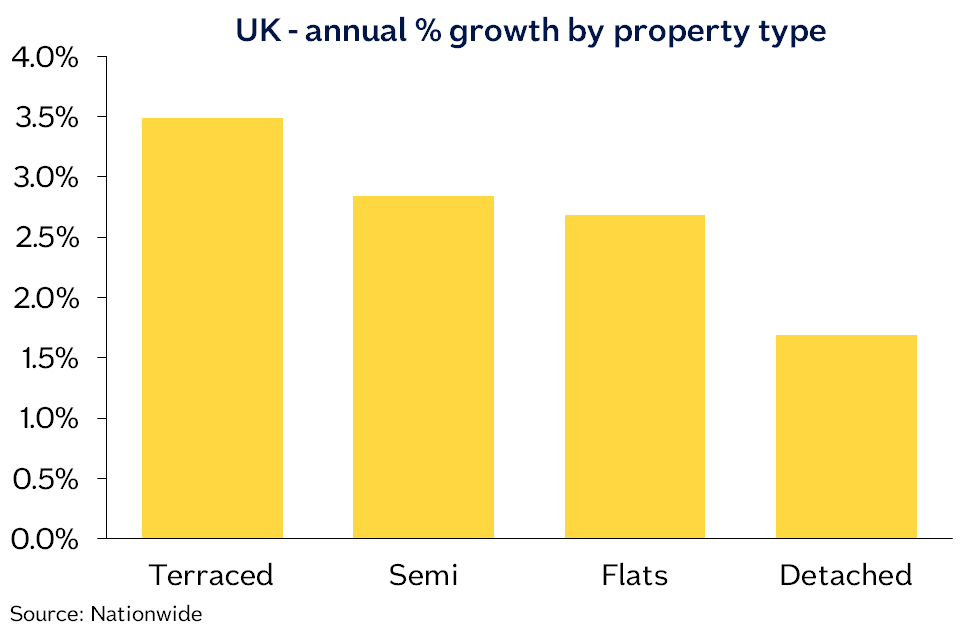

Flats still lagging

“Our most recent data by property type reveals that terraced houses have seen the biggest percentage rise in prices over the last 12 months, with average prices up 3.5%. Semi-detached and flats saw increases of 2.8% and 2.7% respectively. Whilst detached houses saw more modest growth of 1.7%.

“If we look over the longer term however, detached homes have continued to have a slight edge over other property types, most likely due to the ‘race for space’ seen during the pandemic. Indeed, since Q1 2020, the price of an average detached property increased by nearly 26%, while flats have only risen by c15% over the same period.”

Quarterly Regional House Price Statistics - Q3 2024

Please note that these figures are for the three months to September, therefore will show a different UK average price and annual percentage change to our monthly house price statistics.

Zoopla House Price Index: October 2024

Mortgage rates drop to lowest rates seen in 15 months as house prices rise and more homes are sold.

Key takeaways

Lowest mortgage rates for 15 months boost sales market activity

Buyer demand and sales agreed up 25% since 2023

Buyers remain price-sensitive, keeping price rises in check

Average UK house price rises almost 1% in a year

In affordable areas, house prices rise 2.5%

Almost a third of homes for sale are ‘chain-free’ as investors and second homeowners sell in the face of recent and possible tax changes

Some coastal and rural areas see supply of homes for sale up 40% on last year

The outlook is for modest price growth and steady growth in sales

Key figures

The average house price in the UK is £267,100 as of August 2024 (published in October 2024).

Property prices are now at 0.7% inflation compared to a year ago. However, the average UK house price is set to rise by 2.5% by the end of the year.

Average house price in June 2024 Average house price in July 2024 Average house price in August 2024 Year-on-year change (£) Year-on-year change (%)

The graph below shows how the UK’s average house price has changed in the last 10 years.

.avif)

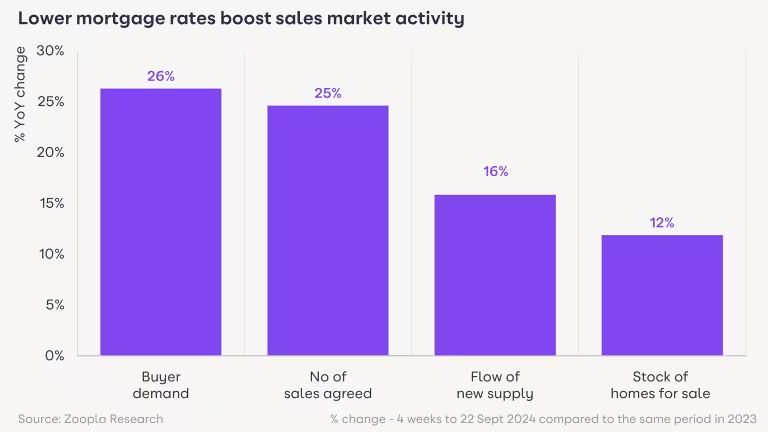

Double-digit growth in sales market activity

Home buyers are benefitting from the lowest average mortgage rates for 15 months, which is supporting double-digit growth in all key measures of sales market activity.

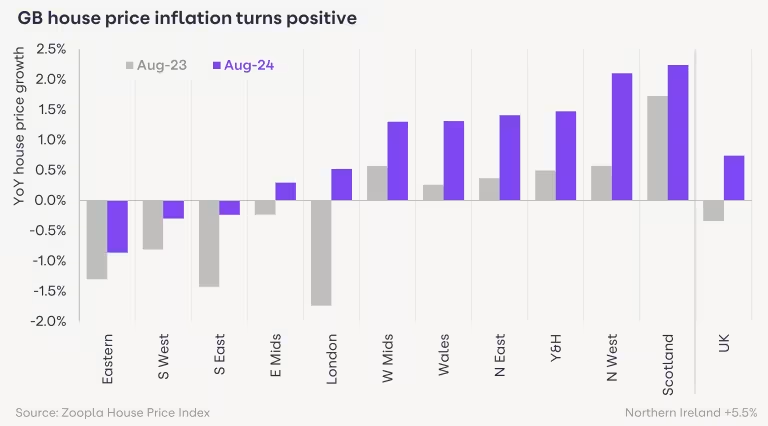

Annual house price inflation is positive but remains below 1%.

Nationally, home buyer demand is up 26% on this time last year, as more homes are listed for sale and sellers look for somewhere new to buy.

The average mortgage rate for a new 5-year 75% LTV loan is 4.3%, compared to 5.5% a year ago, the lowest since May 2023.

And intense competition among lenders is keeping rates attractive for buyers, especially for those with larger amounts of equity.

The number of sales agreed is now 25% higher than a year ago as households that have held off making moving decisions over the last 2 years return to the market.

Sales are up by over 10% across the UK, and more than 30% across the East Midlands and Northeast.

Increased sales activity is supporting modest price rises, rather than causing any acceleration in home values.

Affordability remains a constraint on house price growth, especially in southern England where home values are already high.

And house prices in the Southwest, Southeast and East of England are currently lower than they were a year ago.

However, across the UK as a whole, annual house price inflation is up +0.7% from -0.3% a year ago and will continue to improve slowly in the coming months.

Across all other areas of Great Britain, house price growth is higher than a year ago, with prices up to 2.5% higher.

Home values in Northern Ireland are up 5.5%, having under-performed the rest of the market in recent years.

Meanwhile London prices have registered the biggest turnaround over the last year, moving from annual price falls of -1.7% a year ago to modest price gains of +0.5% today.

More supply will keep price inflation in check

Rising sales volumes are being supported by more homes available for sale, up 12% on this time last year.

Many of these homes are new listings from homeowners looking to sell and buy another home.

However, not all homes are ‘brand new’ to the market and a fifth of homes currently for sale were previously on the market over the last two years.

While market conditions are improving, setting the right price is important to attract buyers. The same applies to the fifth of homes for sale that have been on the market for more than 6 months, still unsold.

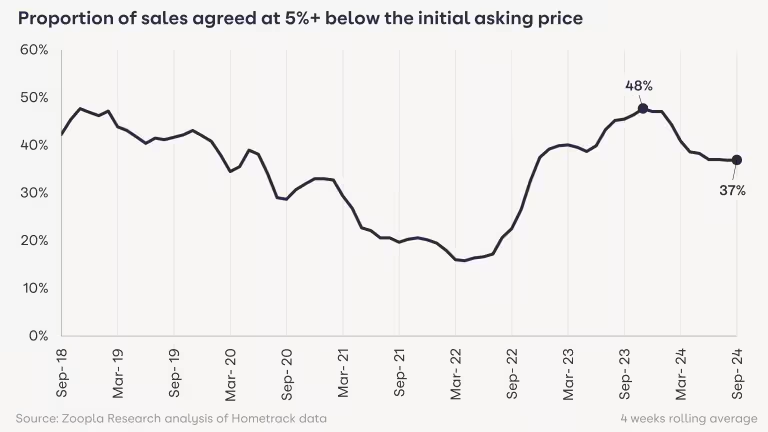

This explains why a similar proportion have had their asking price cut by 5% or more to attract buyers. These trends show buyers remain price sensitive as choice improves and sellers need to price sensibly to agree a sale.

Tax change speculation boosts supply

Speculation over possible tax changes in the Budget is likely to support the growth in supply with investors, second homeowners and others with multiple homes considering selling.

Nearly a third (32%) of homes for sale on Zoopla are ‘chain-free’. Outside London, 1 and 2-bed flats are most likely to be chain-free, while in London 2 and 3-bed houses are most likely to be chain-free.

Higher mortgage rates have forced some landlords into selling, with 13% of homes for sale being previously rented. Most of these (53%) are in London and the Southeast, where modest yields, higher mortgage rates and low house price growth impacted returns for investors over recent years.

Looking ahead, many English councils are planning to double council tax for second homes from next year. Coastal and rural postal areas including Truro, Torquay, Exeter, Bournemouth, Lincoln and Norwich have all seen available supply increase by over 40%, which is partly a result of tax changes. Annual house price growth is negative in these areas, with the rising supply keeping prices in check.

While sales prices have firmed, we find that almost 2 in 5 sales (37%) are agreed at more than 5% below the initial asking price.

This highlights how a high proportion of buyers continue to make offers below the asking price and while this proportion has improved from a year ago, it stays at a level which suggests single-digit house price growth lies ahead.

Housing market outlook

The housing market continues to adjust to higher borrowing costs through low house price growth and a steady recovery in sales.

Expectations of lower mortgage rates are a real attraction for would-be movers, with some lenders offering mortgage rates below 4%.

The outlook for interest rates is far from certain though, considering global events.

Today’s ‘fixed’ mortgage rates already reflect the extent to which financial markets expect UK interest rates to move lower in the next 2-5 years.

Our view is that mortgage rates will settle in the high 3% and low 4%s into 2025, meaning a modest improvement in borrowing costs over the coming months.

Together with rising household incomes, every little helps to improve affordability for home buyers and these will continue to support sales volumes and a steady recovery of prices.

The outlook is more positive than it was a year ago, but sellers need to manage their expectations on pricing if they are serious about agreeing a sale in a timely manner.

So, there is a very comprehensive look through the national picture. There appears to be what we would call cautious optimism from Nationwide and Zoopla and there is clearly some modest improvement in certain key metrics, however the global situation remains very unstable and this could indirectly effect interest rates and of course rising stock levels means it is important for sellers to remain sensible with their pricing.

Now let’s take a look at what has been happening in the SK8 and SK3 property market during the month of September and see if we are mirroring the national picture are exceeding it?

New listings hit a bump in the road in September

After three months where the number of new properties coming to the market rose at significant levels, September was a bit of a damp squib, with the number of new listings dropping 1.1% on the previous September, or if you want to put a positive spin on it – virtually the same as last year.

It was a very mixed bag across the various house types, with the number of flats coming onto the market up 50% from 12 in 2023 to 18 in 2024 and the number of detached homes up 33.3% from 30 to 40, but all the other house types were down. Terraces down from 40 to 25 – a drop of 37.5% was the most significant reduction, with Bungalows close behind, down 35.3% from 17 to 11. Semi detached homes were down 10% from 80 to 72. It will be interesting to see whether this was a blip or the start of an early seasonal downturn in market activity.

Stock levels still rising but much more slowly as daily property views increase

.png) It is now eight months in a row that stock levels have risen and now stand at a new record high of 779.

It is now eight months in a row that stock levels have risen and now stand at a new record high of 779.

The average number of daily property views dropped back from 91 in August to 89 in September, but this is still almost 22% more than a year ago, which is a positive sign, but a far cry from what we would usually see in a more buoyant market.

How are individual house type prices performing in SK8?

The average price of a house across SK8 is now £368,727, which is down almost £4,000 from the month before and for the first time in over a year down 1.0% year on year.

The average price of a house across SK8 is now £368,727, which is down almost £4,000 from the month before and for the first time in over a year down 1.0% year on year.

When we break it down by property type, detached homes now stand at £510,836, which is a £3,000 drop on the previous month and £7,000 down over the last two months and -1.2% over the last twelve months. Semi-detached homes now average £372,502, which is up 0.7% on the previous twelve months. Terraced houses now average £299,600, which is down £8,000 on last month and £15,000 over the last two months and -3.3% over the last year. Flats have actually gone up in value, up almost £7,000 since last month and now stand at an average of £190,375 or an increase of 7.8% on the year.

What is happening with SK3 house prices by individual type?

The average price of a property in SK3 currently stands at £239,753, which is up £4,000 on August, but is down 0.9% year on year. Average prices in SK3 have now been in decline for three months.

The average price of a property in SK3 currently stands at £239,753, which is up £4,000 on August, but is down 0.9% year on year. Average prices in SK3 have now been in decline for three months.

Detached homes now stand at an average value of £348,306 which is up from last month, and up 9.6% on the year before. Semi-detached homes now average £268,009 which up slightly from the previous month but down 0.6% over a twelve-month period. Terraced houses now average £214,687, up 3.2% on this time a year ago, and flats now average £170,833 which is actually up an impressive 15.7% year on year.

Sales continue to show an impressive upward curve

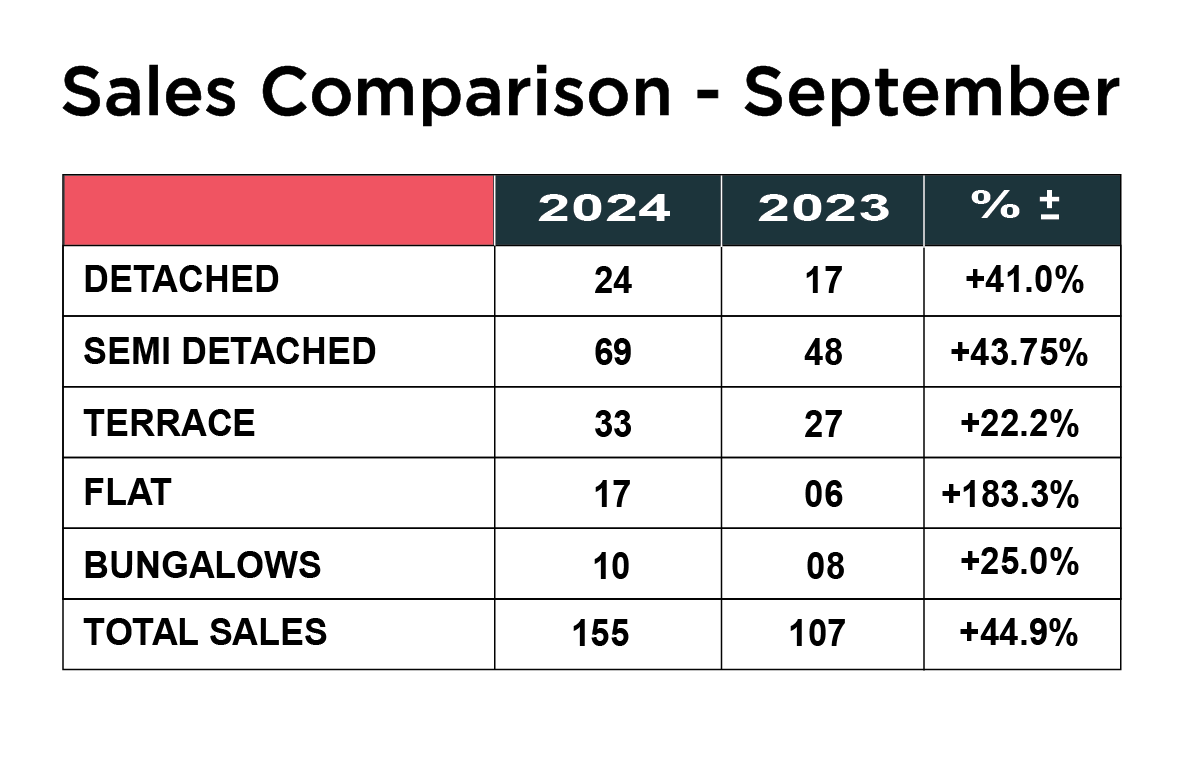

This is third consecutive month that we have seen a significant rise in the number of sales, which is encouraging news for home sellers after a pretty indifferent twelve months.

It would appear that it was a similar pattern across SK8 and SK3, as the number of properties sold increased 45% from the previous year, up from 107 last September to 155 in September 2024, following an 80% plus rise in August.

When we break down the number of sales by type, there was a large increase in the number of sales in every category of property. Most notable was the 183% increase in the number of flats sold, up from 6 to 17, although it is important to qualify these figures because of the relatively small sample size.

There was also a 44% increase in the number of semi-detached homes sold, up from 48 last year to 69 this year. The There was also a 41% rise in the number of detached homes sold, up from 17 in 2023 to 24 in 2024. Bungalows and Terraced houses were both up a healthy 25 and 22% respectively.

What about the SK8 and SK3 rental scene?

There remains a distinct imbalance between the supply of rental properties in SK8 and SK3 and demand, which remains good, although we did notice a slight cooling in interest during September in SK8. Rents have actually dropped modestly for the first time in the last twelve months by 1.0% on the same period last year, with the average rent for a house now standing at £1,613 and the average rent for a flat is £959. The annual yield in SK8 is a very healthy 6.22% for any potential landlords looking to invest in the area.

In SK3 rents are down 0.9% year on year. The average rent for a house in SK3 is now £1163 and a flat stands at £1030. The yield is also a very attractive 6.16%

If you are a landlord with a property to rent out, we would love to hear from you, as we have a pre-qualified database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website https://www.mkiea.co.uk/landlord-services

Summary

The national picture is definitely showing some green shoots off recovery with rising prices, lower mortgages and more property selling, but the recovery is fragile and there are a number of factors which could derail the improvement at any moment.

What we are seeing in our own business and across SK8 and SK3 is a slow down in the number of properties coming to the market, but definitely more buyer confidence after three months of increase in the number of property sales across the Stockport area.

It would be helpful if the Bank of England decided to cut interest rates before Christmas, which would give buyers and sellers more confidence heading into the New Year, but at the last meeting of the monetary committee, there didn’t seem any great appetite for cutting rates.

We say the same every month, but make no apology for re-enforcing this very important message - All the metrics show that the market is resilient but subdued and prices are dropping as you can see in the above data. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same.

We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and money in the long run – it is not only us saying this, but the property portal Rightmove recently put out some statistics that backed this up.

It is also important for sellers to choose a well-established, experienced local agent who has operated in challenging markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people.

Online agents and personal brand agents are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or good practice.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed ahead of a move in 2025 and to find out about our proven strategy to get you moving, please contact Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link Book a Free sales and marketing consultation

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.