It has been quite a month for a variety of reasons, including the first Labour party budget for 14 years, which didn’t really offer much for home sellers and buyers, apart from increasing Stamp Duty on the purchase of second homes from 3% to 5%, which could impact on the investor market. There has been the US Presidential Election and in the last couple of days, following encouraging inflation figures, the Bank of England monetary committee reduced interest rates from 5% to 4.75%, which might help those on a tracker mortgage and first time buyers, at least a little bit!

So how has that impacted the local and National property market?

As always, we will take a look at the broad outlook across the country via the Nationwide Property Index and Zoopla, the property portal’s monthly index and then dig down in more granular detail to look at what is happening in the SK8 and SK3 property markets.

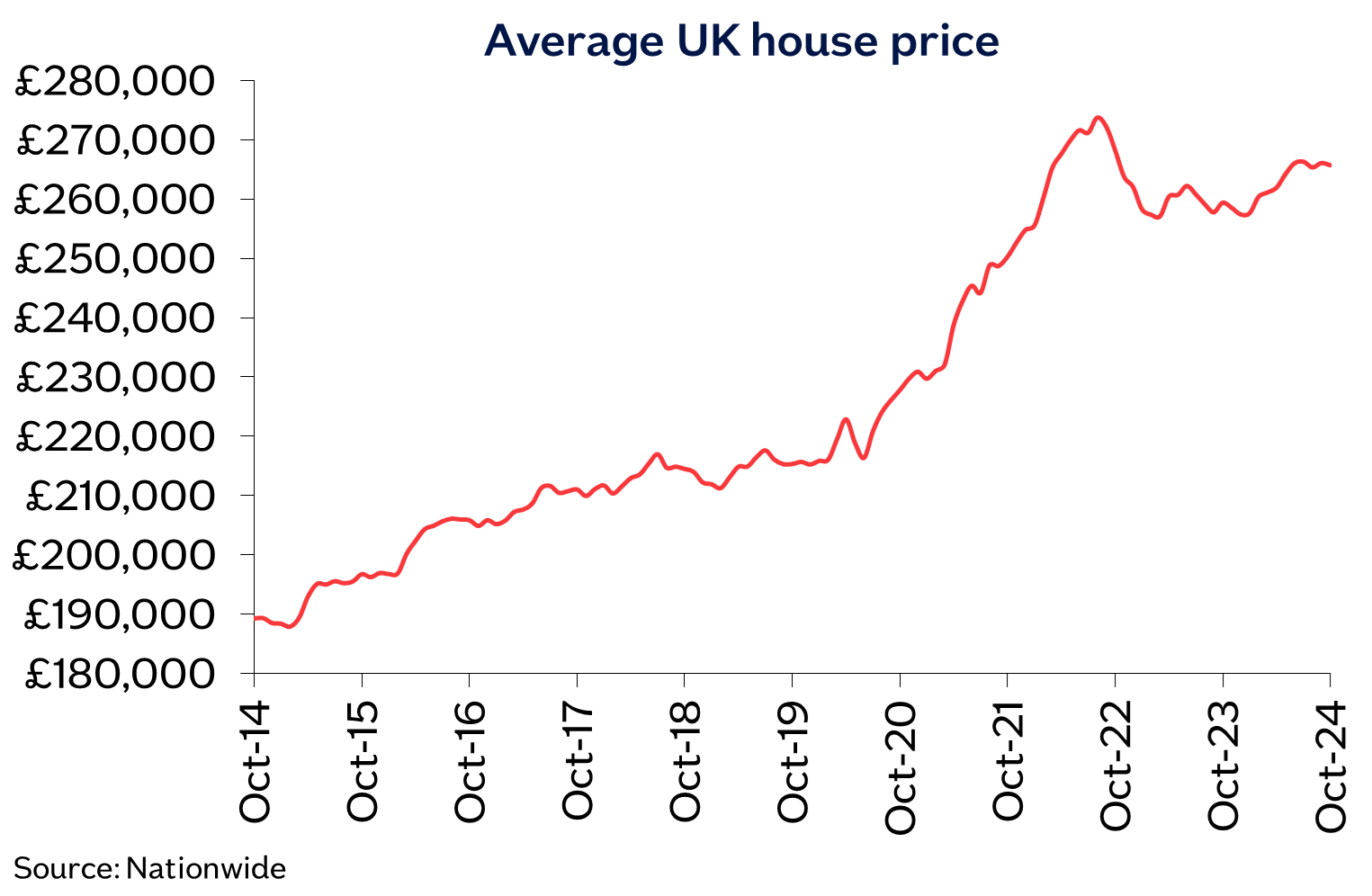

Let’s start with the headlines from the Nationwide October Property Index:

Annual house price growth slows in October

UK house prices rose 0.1% month on month in October

Annual growth rate slowed to 2.4%, from 3.2% in September

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “The price of a typical UK home increased by 2.4% year on year in October, though this represented a modest slowdown from the 3.2% pace recorded the previous month. House prices rose by 0.1% month on month in October, after taking account of seasonal effects.

“Housing market activity has remained relatively resilient in recent months, with the number of mortgage approvals approaching the levels seen pre-pandemic, despite the significantly higher interest rate environment.

“Solid labour market conditions, with low levels of unemployment and strong income gains, even after taking account of inflation, have helped underpin a steady rise in activity and house prices since the start of the year.

“Providing the economy continues to recover steadily, as we expect, housing market activity is likely to continue to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth".

How much of an impact will the expiry of the stamp duty holiday have on activity levels?

“The Chancellor confirmed that the temporary increase in the nil rate stamp duty thresholds (in England & Northern Ireland) would expire on 31 March 2025 and revert back to their previous levels, as had originally been set out by the previous government.

“From that point, for first time buyers purchasing a property of under £500,000, the nil rate band threshold will fall to £300,000 from £425,000 at present, while for other residential buyers, the nil rate band threshold will decline to £125,000, from £250,000.

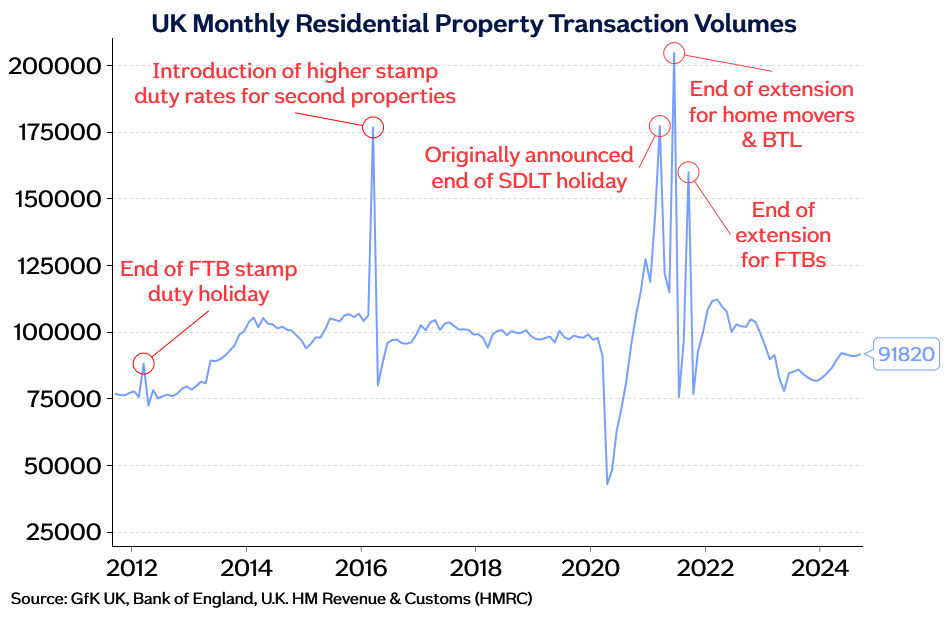

“The main impact of the stamp duty changes is likely to be on the timing of property transactions, as purchasers aim to ensure their house purchases complete before the tax change takes effect. This will lead to a jump in transactions in the first three months of 2025 (especially March), and a corresponding period of weakness in the following three to six months, as occurred in the wake of previous stamp duty changes (see chart below).

“However, the swings in activity are likely to be somewhat less pronounced, in this instance, given that the stamp duty reduction has been in place for some time and its planned expiry was well known. Affordability is also still relatively stretched at present as a result of the higher interest rate environment, which is acting to dampen housing market activity more generally. Nevertheless, determining the underlying strength of the market will become more challenging until this period of volatility passes.

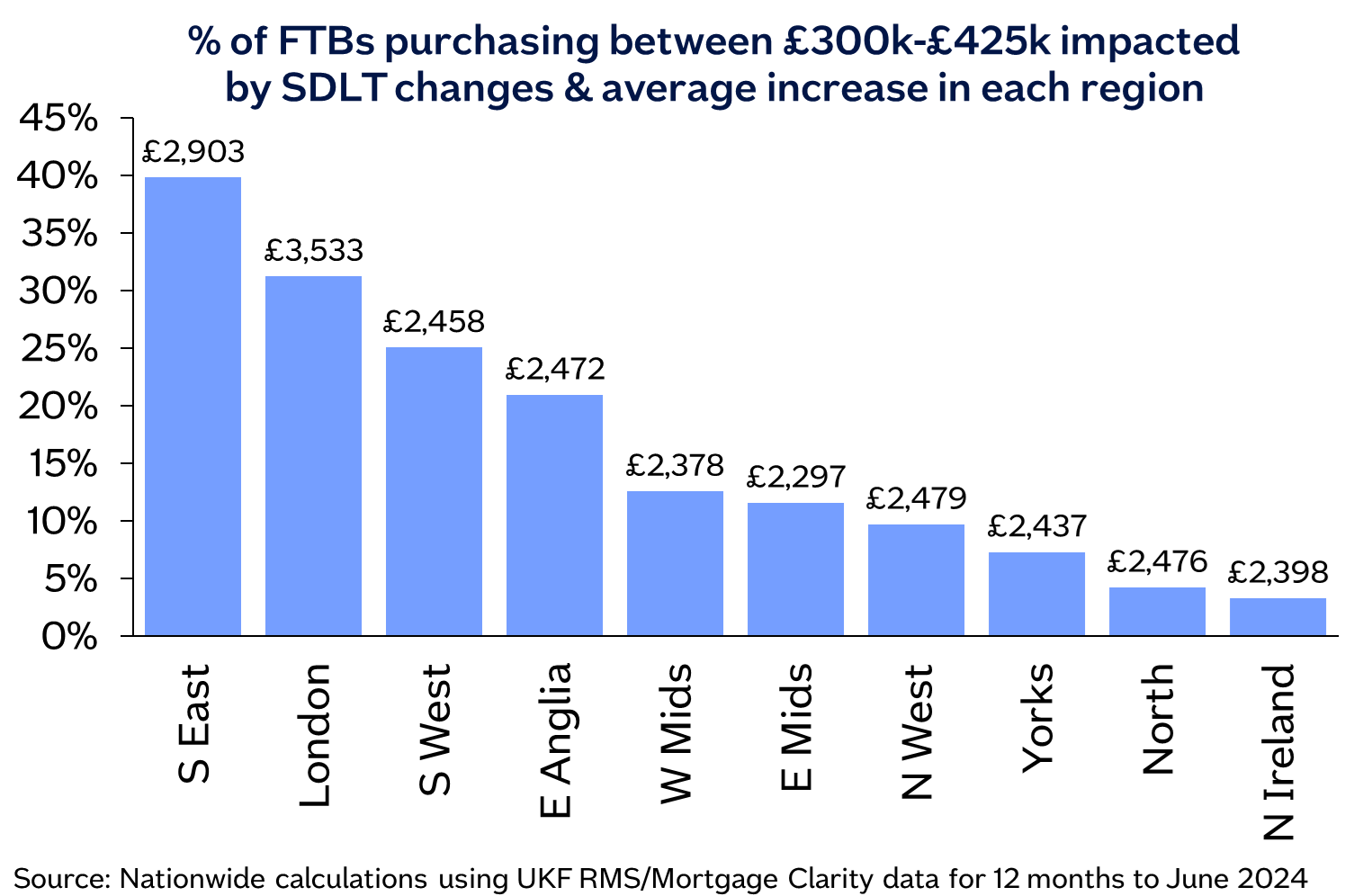

“Data for the year to June 2024 suggests that the stamp duty change will affect around one in five first time buyers, though the impact will vary significantly across the country, largely as a result of the difference in house prices across the UK (see chart above).

“The largest effects are likely to be in the Southeast of England, where 40% of first-time buyers paid between £300,000 and £425,000 for their homes, where the change will increase cost of moving for the affected first-time buyers by £2,900 on average. The areas least affected are Yorkshire & The Humber, the North of England and Northern Ireland, where less than 10% of first-time buyers paid between £325k and £425k for their homes. Moreover, as the chart shows, the additional tax paid by affected first time buyers in these regions will, on average, be lower than in London and the Southeast.

“The Chancellor also announced an increase in the higher rate of stamp duty for additional dwellings by 2 percentage points to 5%, which took effect on 31 October. Based on data for the year to June 2024, this would affect around 194,000 transactions, around one in five residential transactions in England & Northern Ireland. We estimate for a typical buy to let purchase, this would add approximately £4,000 to stamp duty costs. Consequently, this may dampen demand in this part of the housing market.”

Let’s now take a look at what the property portal Zoopla have had to say.

Key takeaways

UK house price inflation increases to +1%, up from -0.9% a year ago

Sales activity running at the highest level since the 2020 boom

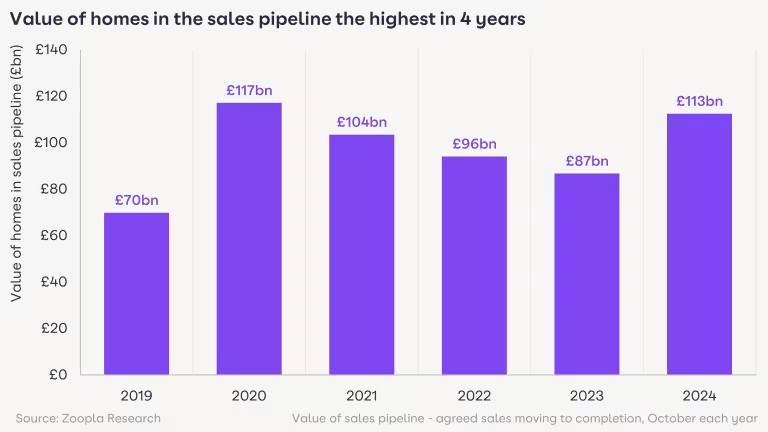

Pipeline of sales agreed is 30% higher than a year ago, at £113bn

High supply of homes for sale and affordability pressures are keeping house price inflation in check

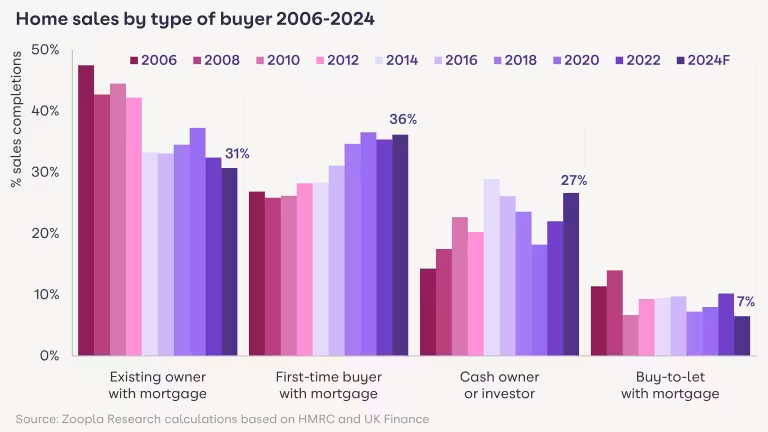

First-time buyers (FTBs) are the largest buyer group in 2024 (36% of sales)

Rapid growth in rents and decline in mortgage rates have shifted the renting vs buying dynamic and supported more FTBs

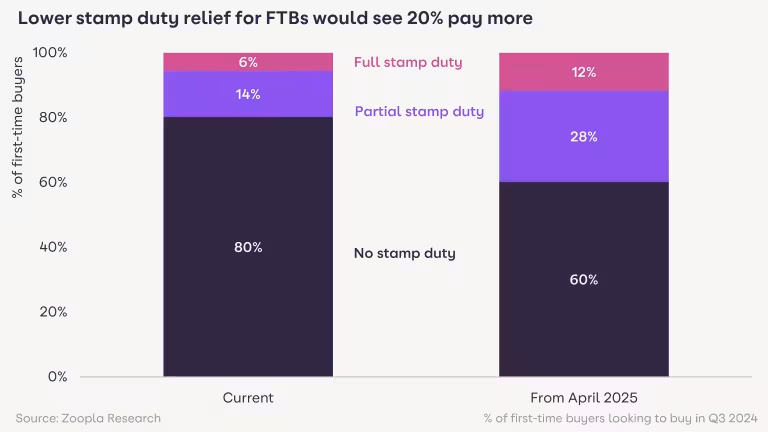

A reversal of stamp duty changes in the government budget could see 20% more FTBs paying this tax in England and Northern Ireland

Key figures

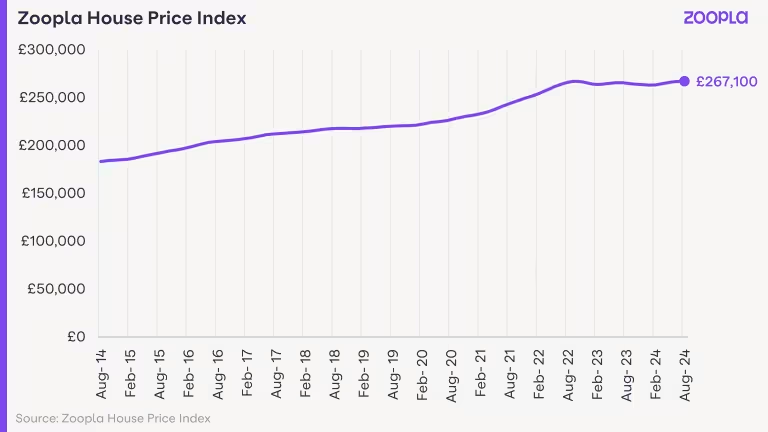

The average house price in the UK is £267,500 as of September 2024 (published in October 2024).

Property prices are now at +1% inflation compared to a year ago. However, the average UK house price is set to rise by 2% by the end of the year.

The graph below shows how the UK’s average house price has changed in the last 10 years.

2024: A bumper year for sales

2024 is turning into a bumper year for housing sales, as intense competition amongst lenders has seen average mortgage rates reach their lowest for two years. Together with rising incomes, this is supporting the highest level of new sales agreed since 2020’s boom in the wake of pandemic restrictions being lifted.

House prices are rising more slowly, up by just 1% over the last 12 months to September 2024, compared to -0.9% a year ago. Price inflation is being held back by a large choice of homes for sale, while buying power is being kept in check by affordability pressures.

House prices are rising at an above-average rate in areas with more affordable house prices, e.g. the Northeast (2.0%), Yorkshire & Humberside (2.0%), the Northwest (2.3%), Scotland (2.4%) and Northern Ireland (5.6%). House prices are posting small falls in the Eastern (-0.3%) and Southeast (-0.1%) regions. UK house prices remain on track to be 2% higher over 2024.

The sustained growth in new sales over the year has led to the largest sales pipeline for four years. We estimate that there are currently 306,000 homes with a sale agreed, which are working their way through the buying process towards completion. This works out at 62,000 (or 26%) more homes than a year ago.

The total sales value of homes in the pipeline is £113bn. This is 30% higher than this time last year, when a spike in mortgage rates hit buyer demand and reduced the number of sales agreed over the second half of 2023.

The momentum in new sales looks set to continue into December. And many recent sales will turn into completed sales over the first half of 2025.

First-time buyers: the largest buyer group in 2024

FTBs are on track to be the biggest buyer cohort in 2024, accounting for 36% of all sales. This is followed by existing homeowners buying with a mortgage (31%).

Cash buyers are on track to account for 27% of sales. These are a mix of homeowners who have paid off mortgages and some mortgage-free investors. Landlords buying homes with buy-to-let mortgages are set to account for 7% of purchases, with their volumes hit by higher mortgage rates.

The rapid growth in rents and the decline in mortgage rates have shifted the renting vs buying dynamics and supported more FTB purchases. The average mortgage repayments for a typical UK FTB home are 17% cheaper than renting, compared to a difference of just 2% a year ago, when mortgage rates were higher.

First-time buyers benefit from landlord sales

First-time buyer numbers are supported by landlords selling homes, as in these instances the average asking price tends to be lower. Out of homes listed for sale, 12% were previously rented, with an above-average concentration of landlord sales taking place in London.

The average asking price of a formerly rented home is £307,000, which is 16% lower than the average UK asking price of £365,000.

This is a positive development for the sales market and is the likely explanation of improved market performance in London. However, it’s less favourable for the rental market, where there is a chronic undersupply of homes. Landlords selling up creates scarcity which pushes rents higher, hitting lower-income renters the hardest.

Government Budget 2024: stamp duty tax

FTBs currently get relief from stamp duty land tax in England and Northern Ireland, paying no stamp duty on properties that cost up to £425,000 and only partial stamp duty on homes priced up to £625,000. Currently, 80% of FTBs pay no stamp duty and 14% pay partially.

These thresholds are set to return to previous, lower levels from April 2025. Without action in the upcoming Budget, 20% of FTBs would be set to pay stamp duty once again.

The impact of stamp duty changes will be the greatest in southern England, where an average FTB in London would face a stamp duty bill of £5,600 or £1,390 in the South East, compared to £0 today.

In parts of London with home values over £600,000, FTBs could pay an additional £15,000 in stamp duty. Faced with higher costs, FTBs will want to pay less for homes, which will keep future price rises in check.

Housing market outlook

The housing market is adjusting to the step change in mortgage rates over the last two years. It is positive to see more sales activity supported by rising incomes and mortgage rates in the lower 4% range. Additionally, this reflects growing confidence amongst buyers and sellers.

Our assumption remains that mortgage rates will remain close to current levels (4%-4.5%) over 2025. This means wage growth will have to do the hard work supporting affordability and buying power with house price growth likely to remain modest. The market remains on track for a modest 2% price increase in 2024, with sales of 1.1m.

The housing market is an extension of the economy, so we hope for a government budget that delivers economic growth and rising incomes alongside much needed investment to support the development of more homes.

So, that is the national picture covered, it seems that both Zoopla and the Nationwide seem to suggest there is growing confidence amongst buyers and sellers, but due to higher interest rates and the volume of available stock, price growth will remain modest in 2025. Obviously, a lot will depend on the wider economy and how that performs over the next twelve months.

Now let’s take a look at what has been happening in the SK8 and SK3 property market over the last month and see if the local market has been mirroring the national picture on performing in a different manner.

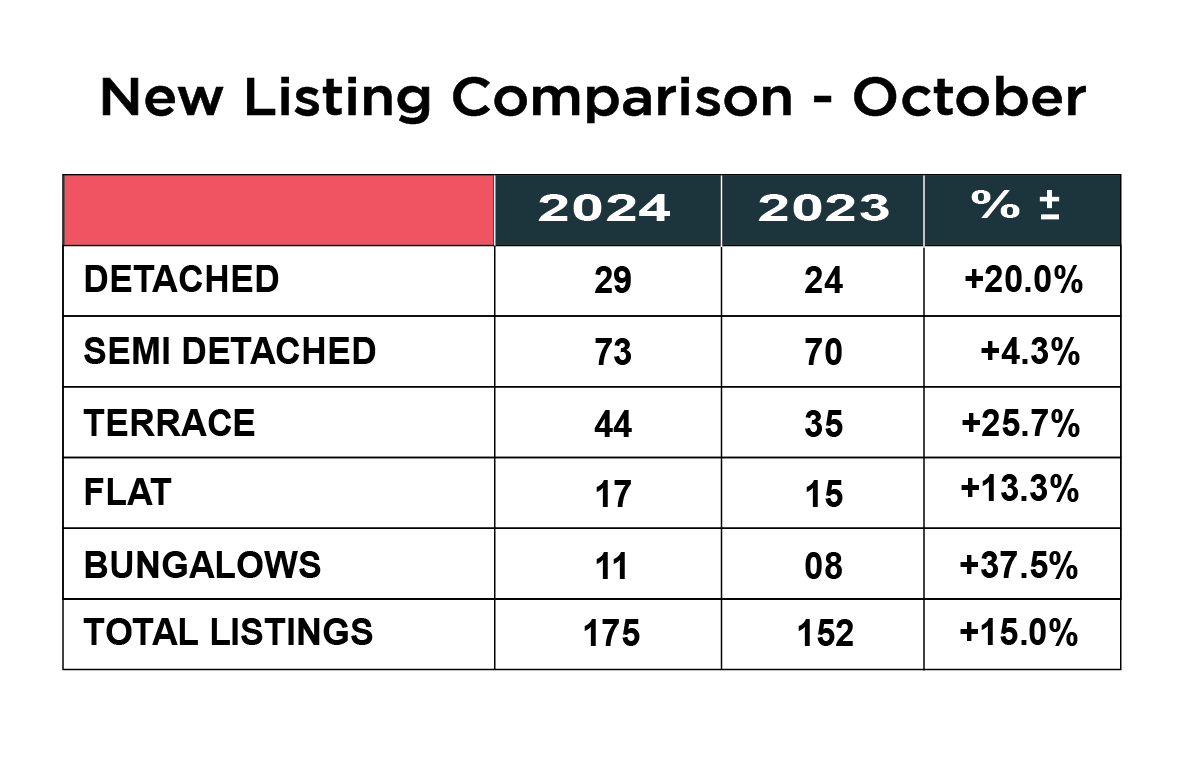

Number of new listings up 15% in October

After a temporary blip in September, following three months of more stock coming to the market, October bounced back with a bang, with the number of new instructions coming onto the market increasing from 152 in 2023 to 175 in 2024 – an increase of 15%

After a temporary blip in September, following three months of more stock coming to the market, October bounced back with a bang, with the number of new instructions coming onto the market increasing from 152 in 2023 to 175 in 2024 – an increase of 15%

Every category of property was up! with the number of Bungalows up the most, from 8 to 11, an increase of 37.5%. Next was the number of terraced homes, up 25.7% from 35 last year to 44 this year. The number of detached homes that came available was 29, up from 24 in 2023 – an increase of 20%. Flats were up 13% from 15 to 17 and the number of semi-detached homes rose 4.3% from 70 last year to 73 this year.

Stock levels drop as daily property views increase

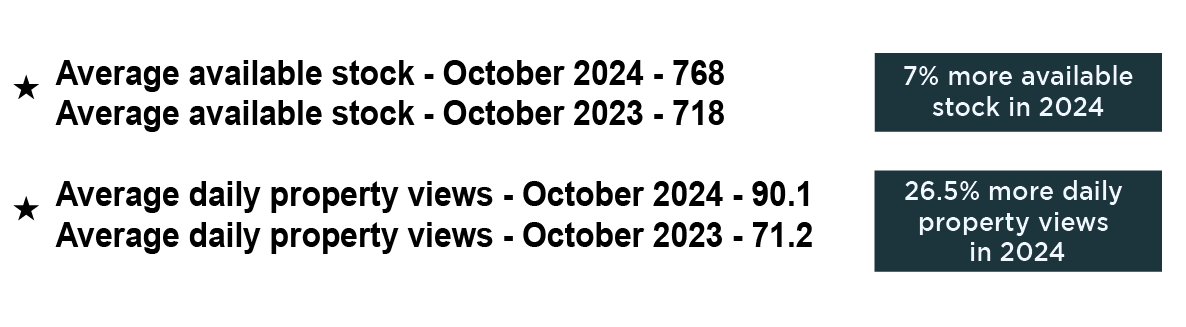

For the first time in nine months, the number of available homes fell slightly from the record high of 779 last month to 768 in October 2024, but this is still 7% higher than the same period last year.

The average number of daily property views has been pretty consistent over the last three months and is now 26.5% higher than the same period last year, which is quite significant.

How are individual house type prices performing in SK8?

The average price of a property in SK8 now stands at £364,888, which is down £4,000 from September and that follows another £4,000 drop in August, so prices are clearly coming down in the SK8 area. The drop is now 3% year on year.

The average price of a property in SK8 now stands at £364,888, which is down £4,000 from September and that follows another £4,000 drop in August, so prices are clearly coming down in the SK8 area. The drop is now 3% year on year.

When we break it down by property type, detached homes now stand at £508,151 which is a £2,500 drop on the previous month and almost £10,000 down over the last three months and -2.2% over the last twelve months. Semi-detached homes now average £371,708, which is down 0.3% on the previous twelve months. Terraced houses now average £297,823, which is down £2,000 on last month and £17,000 over the last three months and down 4.2% over the last year. Flats have actually gone up in value again and now stand at an average of £191,867, up almost £8,000 over the last quarter or an increase of 3.6% on the year.

What is happening with SK3 house prices by individual type?

Whilst house prices in SK8 have taken a bit of a hit over the last few months, prices in SK3 have remained very resilient.

Whilst house prices in SK8 have taken a bit of a hit over the last few months, prices in SK3 have remained very resilient.

The average price of a property in SK3 currently stands at £241,535 which is up £2,000 on September or almost £6,000 over the last three months and is up 2.1% year on year.

Detached homes now stand at an average value of £370,395 which is up £20,000 from last month, and up 8.0% on the year before. This probably means a few more expensive properties in the area sold last month, which has pulled the average price up and it will be interesting to see how it looks next month. Semi-detached homes now average £270,220 which up slightly from the previous month and 1.5% up over a twelve-month period. Terraced houses now average £214,166, which is virtually no monthly change but up 3.0% on this time a year ago, and flats now average £165,694 which is actually a drop of almost £5000 on last month, but still up a healthy 7.5% on the year.

Sales show a dramatic upward spike in October

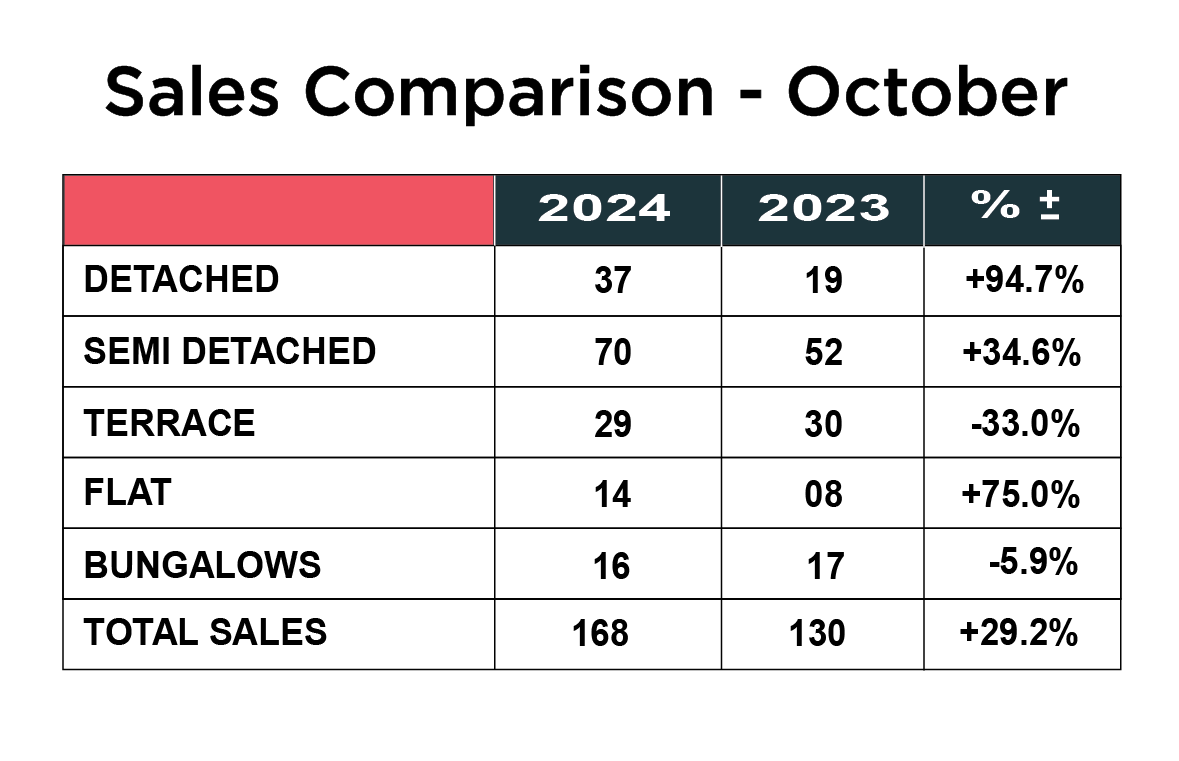

Sales have been on a steady incline for three months but showed a healthy spike in October up from 130 sales last year to 168 this year – a jump of 29%, which is very good news for home sellers, following an 80% increase in August.

When we break down the number of sales by type, there was a huge increase in the number of sales of detached homes – a jump of 94.7% from 19 in 2023 to 37 in 2024. Flat sales were up 75% from 8 last year to 14 this year and the sales of semi-detached homes are up almost 35% from 52 to 70. There was however a drop in the number of terraced homes that were sold down 3.3% from 30 to 29 and the number of bungalows was down 5.9% from 17 in 2023 to 16 in 2024.

What about renting in SK8 and SK3?

It definitely feels quieter in the rental sector, but there also remains a shortage of suitable properties. It might be that landlords are considering whether it is viable to continue renting their property out and we know some are seriously considering selling up, which of course will create a further stock imbalance.

In SK8 rents have actually dropped for the second month in succession and are now 3% lower than they were a year ago. The average rental price for a house is now £1619 and for a flat it is £960. The yield is still a very healthy 6.58%.

In SK3 rents are actually up 2.1% year on year. The average rent for a house in SK3 is now £1171 and a flat stands at £1035. The yield is also a very attractive 6.11%

If you are a landlord with a property to rent out, we would love to hear from you, as we have a pre-qualified database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website Landlord services and fees

Summary

There definitely seems a degree of optimism and positivity in the market and the latest interest rate drop can only help. However, it is important to qualify this, by stating it is still a tough market to sell and buy, with interest rates higher than they were pre-covid and the Liz Truss mini budget. There is a feeling that prices are still a little high. Those who are selling are the ones who are pricing their properties competitively.

What we are seeing in our own business and across SK8 and SK3 is a steady market, with a reasonable number of properties coming onto the market and a good number of sales, but it remains very price sensitive in Cheadle.

We say the same every month but make no apology for re-enforcing this very important message - All the metrics show that the market is resilient but subdued and prices are dropping as you can see in the above data. Facts are facts. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same, but that is how we get the market moving more briskly.

We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and ultimately money. There is no mileage in putting your house on the market with the mindset “ We aren’t in any hurry and happy to sit and wait to get our price” It is completely the wrong strategy.

It is also important for sellers to choose a well-established, experienced local agent who has operated in challenging markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people.

Online agents such as Strike and Purple Bricks and personal brand agents like EXP or Keller Williams are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or just plain good practice.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed ahead of a move in 2025 and to find out about our proven strategy to get you moving, please contact Josh, Patrick or Maurice to arrange for a FREE marketing advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.