As we reach the end of May (where has the year gone?) we had three bank holidays, the coronation of a new king, and the football season is over, with congratulations to Manchester City for winning the title for the third season running, which seems considerably more predictable than the housing market, as after some green shoots and dare we say positivity in April, the national picture has taken a step back in May, although interestingly, here in SK8 and SK3 we have enjoyed our best two months – April and May since September 2022.

The news coming from various quarters has been very mixed, with the emphasis on caution and signs that the market has gone backwards with prices dropping back a little, transaction levels shown to have dropped and in the last few days lenders pulling a number of mortgage deals and issuing new products at higher rates as the fear is the Bank of England will need to increase base rates, as inflation remains out of control.

So, lets start with our go to guys, the Nationwide and their monthly house price index.

Annual house price growth slips back in May

May saw a 0.1% month-on-month fall in house prices, after a 0.4% increase in April, whilst the annual rate of house price growth slipped back to -3.4% from -2.7% in April.

Commenting on the figures, Robert Gardner, Nationwide’s Chief Economist, said:

“Following tentative signs of improvement in April, annual house price growth softened again in May, falling back to -3.4% (from -2.7% in April). However, this largely reflects base effects with prices broadly flat over the month after taking account of seasonal effects. Average prices remain 4% below their August 2022 peak.

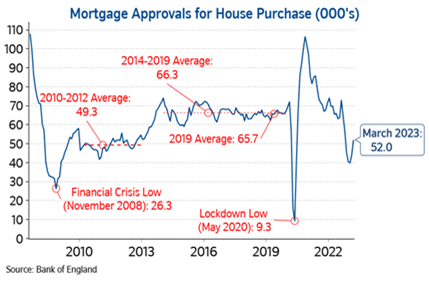

“Recent Bank of England data had shown some signs of recovery in housing market activity, although the number of mortgages approved for house purchase in March was still around 20% below pre-pandemic levels.

“Moreover, headwinds to the housing market look set to strengthen in the near term. While consumer price inflation did slow in April, it was a much smaller decline than most analysts had expected. As a result, investors’ expectations for the future path of Bank Rate increased noticeably in late May, suggesting it could peak at c5.5%, well above the c4.5% peak that was priced in around late March. Furthermore, rates are also projected to remain higher for longer”

“If maintained, this is likely to exert renewed upward pressure on mortgage rates, which had been trending down after spiking in the wake of the mini-Budget in September last year”

“Nevertheless, in our view a relatively soft landing remains the most likely outcome since labour market conditions remain solid and household balance sheets appear in relatively good shape”

“While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank Rate peaks.”

Government data reveals the average UK house price £285,000

Last week the government published it’s latest figures from HMRC. These are for March, as their figures always run a little behind, which does make some indices a little irrelevant as the real data is always running a little behind. This showed that the average house price in the UK stands at £285,000, which is £11,000 higher than a year ago, but more significantly £8,000 down from the peak in November 2022.

UK house sales also returned to a downward trend in April after their early Spring spike. HMRC confirmed just 67,220 sales completed in the month, 29% down on March and 32% down on April 2022.

Between January and March, residential market activity had been relatively strong and close to pre pandemic levels, with 270,000 total transactions compared with 283,540 in the same period in 2020.

Landlord sales will add to the oversupply of available property

Hometrack, the leading property market analysists also issued their latest report and are saying that UK prices have seen a 1.3% decline over the last six months. They say that annual house price inflation now stands at 1.9% down from 9.6% a year ago. However, they strike a cautionary note on short to medium term house price rises, as there has been an 16% uplift on available stock, which is only going to get worse, as following the recent announcement of the Government Renters Reform Bill, many landlords are expected to jump ship and sell up, giving prospective buyers even greater choice.

So, what does all this mean for the property market?

The increase in housing market activity this year has been very welcome, but is it likely to be sustainable?

Interest rates have been starting to stabilize, falling back to around 4%, however lenders are putting up the rates as we write this, as the latest set of inflation numbers has increased the likelihood of further intervention from the Bank of England to try and cool inflation, which will have a knock-on effect on mortgage rates.

Obviously if mortgage rates start creeping up above 5%, the greater the impact on buying power and the more house prices will come under downward pressure. Banks increasing their affordability stress tests will compound the pressure.

Banks have a supply of mortgage funding at current rates, but some lenders have also been chasing business with very competitive deals, but these are going to have to rise. How much higher rates are set to go in the coming months depends on the financial markets and their assessment of the short to medium term outlook for interest rates.

The net result is that the build up of market momentum this Spring is likely to weaken in the second half of the year with the scale of the impact depending on hoe much borrowing costs increase.

What’s happening locally in SK8 and SK3

As mentioned at the beginning of the article, after a slow first quarter of 2023, we have seen much higher levels of activity in terms of listings and sales, despite the number of eyeballs on Rightmove remaining well below the norm. This suggests that perhaps the speculative buyers and sellers have shelved their plans for now, but those who seriously need to move are pressing on with their plans.

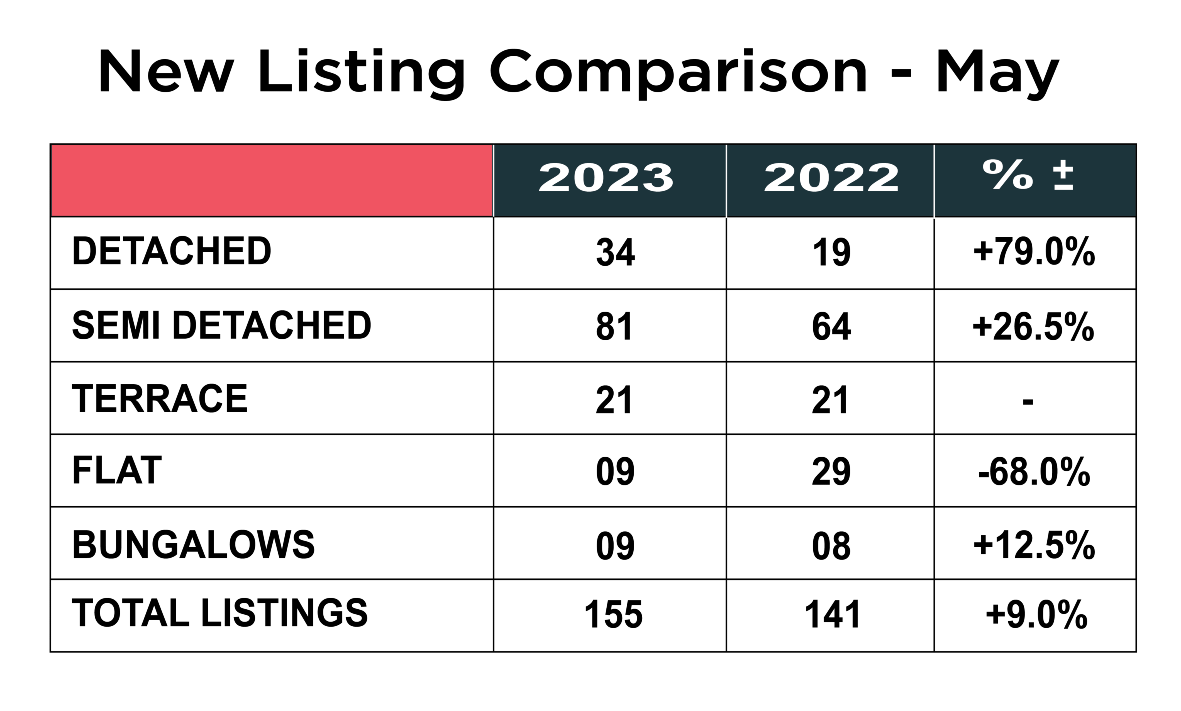

So, let’s start by looking at the number of new listings that have come to the market in the month of May.  Last month, we saw an uplift of 12% in the total number of listings and the upward trend continued into May with a 9% increase from 141 to 155. There was a huge increase in the number of detached homes being sold, which increased 79% from 19 in 2022 to 34 in 2023. This could be an increase in the number of sellers looking to downsize to save costs – it is a trend we will be keeping a close eye on. The number of semi-detached homes coming to the market increased 26.5% on the same period in 2022 and bungalows were up 12.5%. The number of terraced houses for sale stayed the time, but the number of flat showed a significant drop, down 68% from 29 in 2022 to just 9 in 2023.

Last month, we saw an uplift of 12% in the total number of listings and the upward trend continued into May with a 9% increase from 141 to 155. There was a huge increase in the number of detached homes being sold, which increased 79% from 19 in 2022 to 34 in 2023. This could be an increase in the number of sellers looking to downsize to save costs – it is a trend we will be keeping a close eye on. The number of semi-detached homes coming to the market increased 26.5% on the same period in 2022 and bungalows were up 12.5%. The number of terraced houses for sale stayed the time, but the number of flat showed a significant drop, down 68% from 29 in 2022 to just 9 in 2023.

Buyer interest remains cool

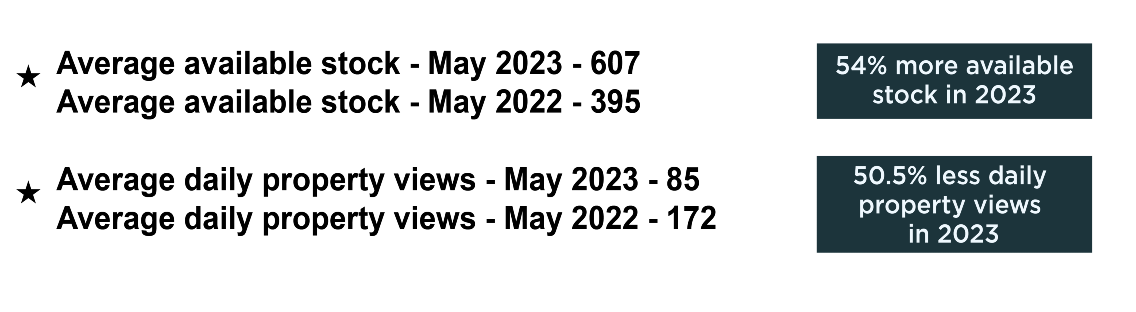

Our second graphic is following a trend we have seen since the start of the year. The average available stock during May was 607, which was slightly up on April but a huge 54% up on May 2022. With so much stock now available, this is giving buyers considerably more choice and means that sellers will need to be keeping it real with asking prices if they want to sell their home amongst significantly increased competition. This becomes even more pertinent when you see that the average number of daily property views on Rightmove was down to just 85! Down from 104 in April 2023, and down 50% on May 2022. Whilst economics isn’t our specialty, we do understand the basic premise of supply and demand, and after 2/3 years where demand was far outstripping supply, it has now turned full circle.

Our second graphic is following a trend we have seen since the start of the year. The average available stock during May was 607, which was slightly up on April but a huge 54% up on May 2022. With so much stock now available, this is giving buyers considerably more choice and means that sellers will need to be keeping it real with asking prices if they want to sell their home amongst significantly increased competition. This becomes even more pertinent when you see that the average number of daily property views on Rightmove was down to just 85! Down from 104 in April 2023, and down 50% on May 2022. Whilst economics isn’t our specialty, we do understand the basic premise of supply and demand, and after 2/3 years where demand was far outstripping supply, it has now turned full circle.

For the first time in a number of months, we saw the price of some times of property drop back a little in May. Detached homes dropped from an average of £511,728, almost £4000 to £507,749, however year on year they are still up around 7%. Semi detached homes have remained very consistent and now average £381,952, which is up a very healthy 16.6% over the last twelve months. Terraced homes are now worth an average of £298,137, up 12.7% year on year and actually very slightly up on April, and flats are now worth an average of £189,869, which is 5% up on the same period last year and down around £3000 from April. Our concern remains that the number of sales hasn’t really picked up, so whilst it would appear that values are holding firm, properties are not moving that easily and with the increasing number of properties available, sellers are going to need to reduce their prices to appeal to the genuine buyers currently looking.

Prices in SK3 continue to do well and buck the national trend with the average price of a home now £236,789 up 10.6% year on year and a massive 33% over the last five years. Detached homes have seen the biggest increase up almost 54% and now stand at an average of £471,237 – we would add the caveat that this is based on a very small sample size of detached homes, whilst semi-detached homes average out at £269,591, up 16% year on year. Terraced homes are now fetching an average price of £206,838, up 10% and flats are up 9.4% to an average of £145,848. Despite the points looking negative, this hasn’t yet shown in the SK3 prices, but that is not to say we won’t start to see some drop off, remember there is a lag in the stats that are produced.

Sales down from May 2022

The number of sales across SK8 and SK3 in May remained sluggish and were down 8.5% overall from the previous May down from 166 to 152, which were up slightly on April, but when you think of the massive influx of stock and therefore choice for buyers, these figures are a little disappointing. The only figures which showed an upturn on the previous year were the number of bungalows sold, up 21.5% from 14 to 17, which could support our theory that older sellers in big homes are starting to downsize a little more. The number of detached and semi-detached homes sold were down 19% and 13% respectively, terraced house sales were down 11% and flats down 6.25%

Summary

After a weak start to the year in Q1, optimism nationally seems to have dropped off further as we approach the end of Q2. It is important though to have some context here and remember that the figures are returning to pre pandemic levels, which became artificially propped up during Covid.

However, we can see the signs with mortgage approvals dropping, interest rates continuing to creep up, the cost of living continuing to be a problem for many families and the government and the Bank of England seemingly unable to get a firm grip on inflation, things are likely to get worse for the housing market over the second half of 2023.

The huge increase in available stock and 50% less buyers looking for a property will also continue to impact house prices and sellers need to be realistic in their expectations from the outset. We are seeing some really nice houses, at what would appear to be ok prices, simply not getting any interest. However, where the asking price is correct from the start, we are still seeing multiple viewings, offers and quick sales. Sadly, we are still seeing agents, who are clearly struggling for stock, listing property at any price, which is not helping the market and certainly not the client, by creating unrealistic expectations. It is important for agents to be honest with potential sellers.

The written press and TV news in particular continue to spew negativity and doom and gloom, but as we have stated before, the housing market is made up of thousands of micro markets around the country, that can all be performing differently at any one time. We are fortunate here in SK8 and SK3, that the area is reasonably affluent, with high employment and whilst the market has undoubtably dropped a little, we have not been affected to the same extent as other parts of the country, however the warning signs are there and it looks likely that there will be a further period of difficulty before things start to get better.

As we have said many times now, it is more important than ever for sellers to choose a well-established, experienced agent who is has operated in more challenging markets and is equipped with the widest marketing mix to reach the serious buyers looking now. Simply listing a house on the property portals such as Rightmove and relying on those enquiries, when they are 50% down, is not going to expose the property to the necessary audience. Agents now need to dig deep, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing.

If you are undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2023, please contact Joe, Patrick or Maurice and arrange for a FREE market appraisal, on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.