The clocks went forward at the beginning of April and Spring was in the air, although there remains a distinct chill in the economy with inflation remaining out of control and making the Bank of England very nervous, to the point where the BoE monetary committee who meet again later this month are likely to put up interest rates again.

There also remains a lot of differing opinions about the direction of the housing market and house prices across the country, with many commentators still predicting further drops in house prices during the second half of 2023 and beyond, whilst others are taking a more positive view and actually believe we are seeing some green shoots of recovery, which we will look at very shortly and also drill down into the SK8 and SK3 markets in much more detail.

But let’s start with our old friends from the Nationwide Building Society and their annual house price index for April.

While annual house price growth remained negative in April at -2.7%, there were tentative signs of a recovery with prices rising by 0.5% during the month. April’s monthly increase follows seven consecutive declines and leaves prices 4% below their August 2022 peak.

Recent Bank of England data suggests that housing market activity remained subdued in the opening months of 2023, with the number of mortgages approved for house purchase in February nearly 40% below the level prevailing a year ago, and around a third lower than pre-pandemic levels.

However, in recent months industry data on mortgage applications point to signs of a pickup.

A shift in consumer sentiment?

This also chimes with the recent shifts in consumer sentiment.

While confidence remains subdued by historic standards, people’s views of their own financial position over the next twelve months, and general economic conditions in the year ahead, have both improved somewhat in recent months.

If inflation falls sharply in the second half of the year – and this is the crux of any sustainable improvement, as many analysts expect, this would likely further bolster sentiment, especially if labour market conditions remain strong, comments Robert Gardner, Nationwide’s Chief Economist.

Gardner continued, this, in turn, would also be likely to support a modest recovery in housing market activity. But any upturn is likely to remain fairly pedestrian, as it will take time for household finances to recover, since average earnings have been failing to keep pace with inflation, and by a wide margin over the last few years.

Mortgage interest rates are also likely to act as a headwind.

While they are well below the highs seen in the wake of the mini-Budget last year, rates are still more than double the level prevailing a year ago.

Nevertheless, if gains in nominal incomes remain solid (wage growth has been running at above 7% in the private sector), this, together with weak or declining house prices, will help improve housing affordability over time, especially if

However, lenders continue to reduce their fixed rates, albeit at a slower pace than before, with bigger reductions seen on higher loan-to-value mortgages as they try to attract first-time buyers.”

The Property Portal, Zoopla, have also just completed their latest house price index, which is very comprehensive, but we have condensed it down to the following.

Key takeaways

Demand continues to recover as the number of new sales rises

Annual house price growth slows to 3% from 4.1% last month – but the worst of the month-on-month price falls are now behind us

First-time buyers were the largest buyer group in 2022 and look set to be a strong source of new sales again in 2023

The income first-time buyers need to buy a three-bedroom home has increased by £7,350 since 2020 – but this varies by location

The housing market is more balanced than for some years and there could be more than 1 million sales in 2023 if current trends continue.

What we have taken from Zoopla’s more positive outlook is that despite the affordability issues, many first-time buyers are ploughing on with their plans to purchase a property and the housing market is looking more balanced than it has for some years and there could be more than 1 million sales in 2023 if the current trend continues.

At this point it is important to strike a slightly cautionary note, as all the indices use a different point in time for its data source, which can skewer the figures a little, but there is no doubt, from our own experience and small sample size in Cheadle, things have definitely settled down and activity is rising again.

So, lets dive into the figures for the local Cheadle market and see what we can ascertain from them.

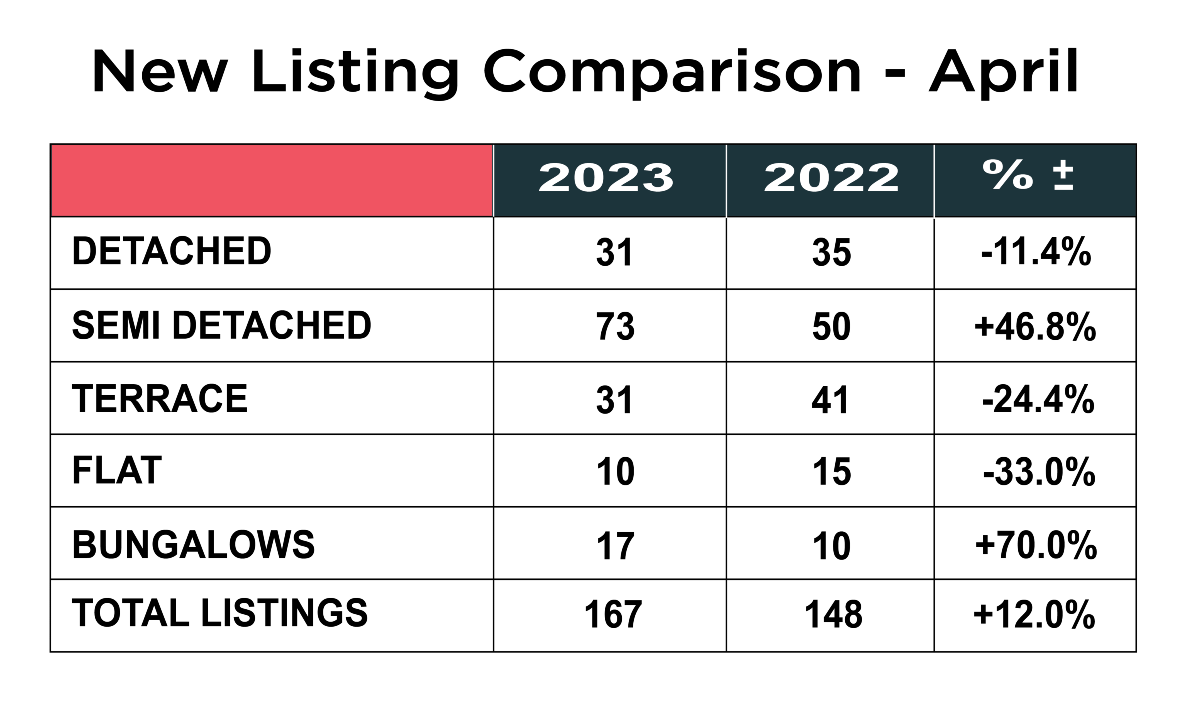

Looking at the initial graphic for the number of new instructions coming onto the market, we can see that there was a 12% increase on the previous year. This follows on from a 5% increase in March, so there are more people selling. The most noticeable increase was in the number of semi-detached homes on the market, up 47% on last April from 50 to 73 and a huge uplift in the number of bungalows from 10 to 17 – an increase of 70%. At the same time, there was a reduction in the number of detached homes coming to the market, down 11%, terraced homes down 24% and flats down 33%.

Buyers still not being tempted

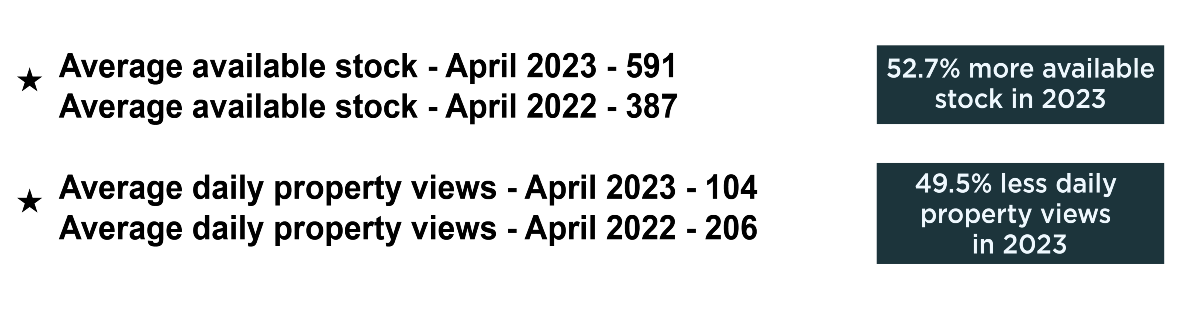

Our second graphic is perhaps the most interesting and telling. The average available stock during April was 591 down from 613 in March, but still up a massive 53% from April 2022. With so much stock now available, this is giving buyers considerably more choice and means that sellers will need to be keeping it real with asking prices if they want to stand out in the crowd. This becomes even more pertinent when you see that the average number of daily property views on Rightmove is just 104, down pretty much 50% on the same period in 2022. It has remained pretty much at this level since the start of 2023. We will be curious to see if there has been any change to this at the end of May.

Despite the much lower buyer activity than in previous years, Cheadle house prices have remained extremely resilient. The average house price across SK8 is currently £371,764, up 13% on 2022 prices. Detached homes now stand at an average price of £511,728, which is 9.3% up over the last twelve months. Semi detached homes are now an average of £381,077, which is up a healthy 17%. Terraced homes are now worth an average of £297,894, up 12.5% year on year, and flats are now worth an average of £193,304, which is 10% up on the same period last year. Our concern here would be that the number of sales hasn’t really picked up, so whilst it would appear that values are holding firm, properties are not moving that easily and sellers are going to need to reduce their prices to appeal to the genuine buyers currently looking.

Prices in SK3 are also doing well with the average price of a home now £236,026 up 10% year on year. Detached homes have seen the biggest increase up almost 36% and now stand at an average of £441,088 whilst semi-detached homes average out at £269,778, up 17%. Terraced homes are now an average price of £206,415, up 10% and flats are up 8% to an average of £144, 978.

Sales remain below average for the time of year but rate of drop slows down

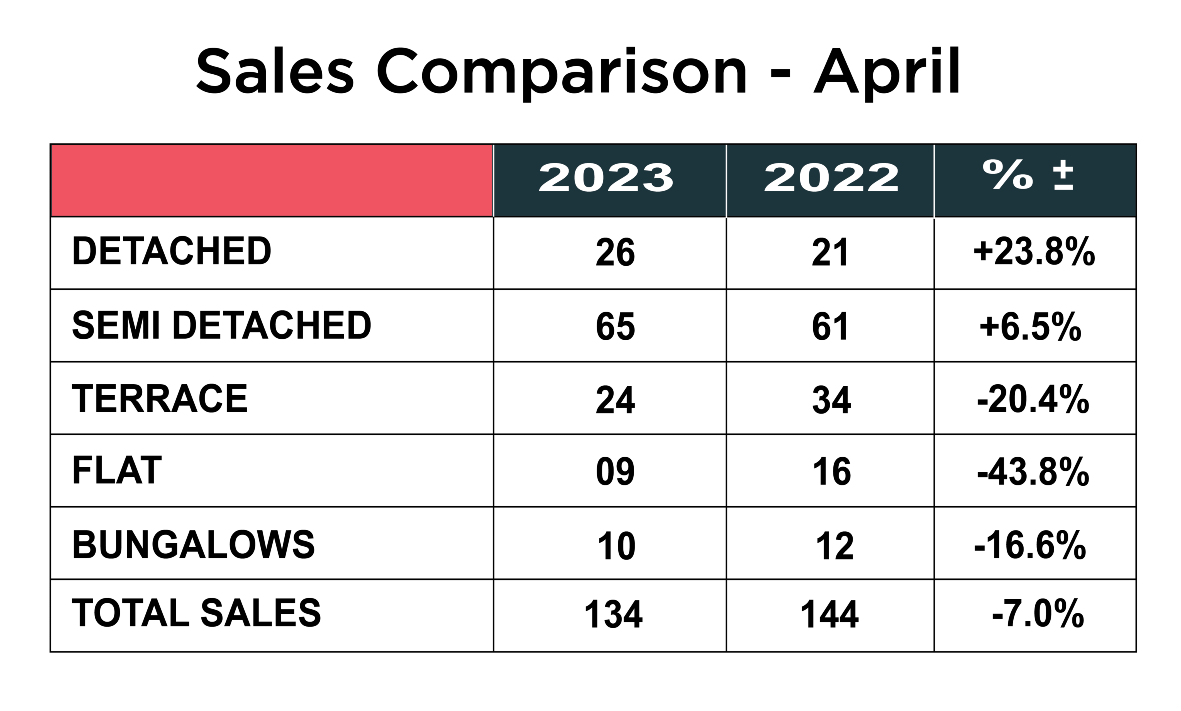

The number of sales across SK8 and SK3 combined were down 7% overall from the previous April, down from 144 to 134, however in March, sales were down 12%, so the rate of decrease is coming down. The number of detached properties being sold remains very good and is up 24% on the previous April. The number of semi-detached homes sold was also up from 61 to 65 – up 6.5%, but the number of terraces, flats and bungalows were all down 20%, 43% and 17% respectively.

Summary

As we head into Q2 of 2023 we are feeling cautiously optimistic that things are settling down a little. The national picture seems to be steadying too, with the figures starting to return to pre pandemic levels. It is important not to view the market just as it has been over the last 2/3 years, which was artificially inflated, but now prices and the number of sales are returning to what we would normally expect.

With the volume of available stock increasing, whilst the number of sales is dropping, we still feel Q2 will be tougher for those sellers who refuse to acknowledge the shift in the market and continue to hold out with unreasonable expectations. It is important for agents to also be honest with sellers and manage those expectations, rather than pander to them just to get the listing in the first place.

Inflation and affordability remain the biggest problem and pressure on household budgets and rents, whilst wages stagnate, and buyers find it harder to save for a deposit and meet rising mortgage repayments. The government must get a firm grip on inflation and start to drive it down, which would certainly increase buyer confidence.

Despite all the negative aspects in the press to buying a home right now, we have been busier in the last month, with more viewings and offers, so we are feeling encouraged, but mindful there are still some incredibly choppy waters to navigate economically. We will be keen to review activity levels at the end of May to see if the tide is really turning.

What is also important for sellers is choosing a well-established, experienced agent who is used to operating in more challenging markets and is equipped with the widest marketing mix to reach the serious buyers looking now. Simply listing a house on the property portals such as Rightmove and relying on those enquiries, when they are 50% down, is not going to expose the property to the necessary audience. Agents now need good social media presence, an established database, and groups of pre-qualified buyers ready and waiting for the right home to come on to the market, whom they are in contact with constantly.

If you are undecided on whether now is the right time to sell or you would like to know how the value of your home has changed in 2023, please contact Joe, Patrick or Maurice and arrange for a FREE market appraisal, on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat. You can also book an appointment online by clicking on this link https://mkiea.co.uk/valuation/

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.